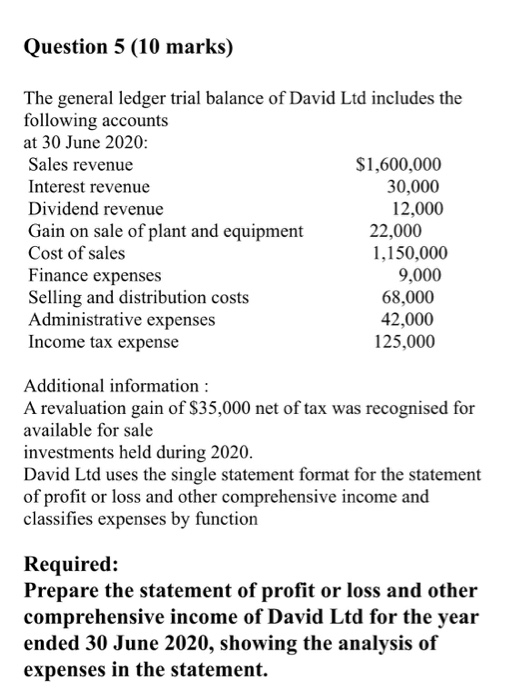

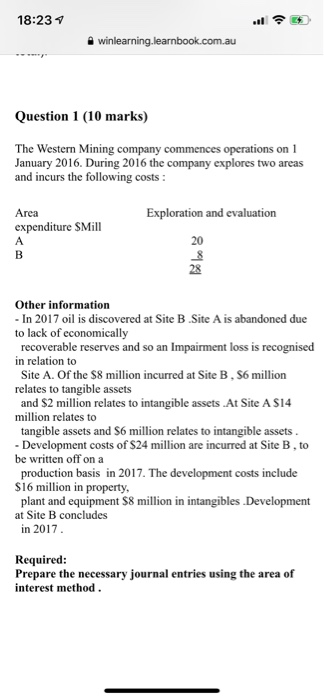

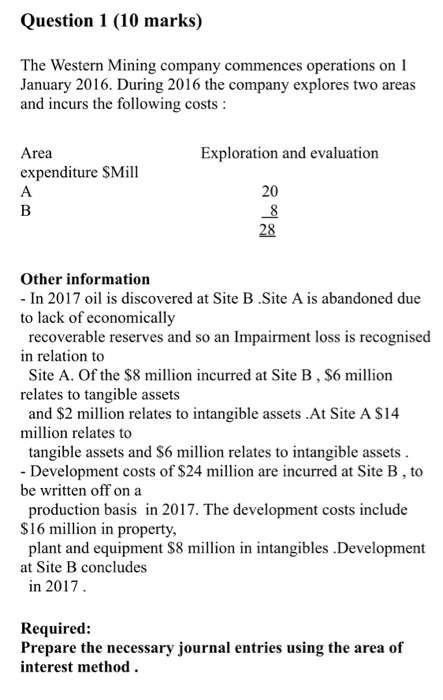

Question 5 (10 marks) The general ledger trial balance of David Ltd includes the following accounts at 30 June 2020: Sales revenue $1,600,000 Interest revenue 30,000 Dividend revenue 12,000 Gain on sale of plant and equipment 22,000 Cost of sales 1,150,000 Finance expenses 9,000 Selling and distribution costs 68,000 Administrative expenses 42,000 Income tax expense 125,000 Additional information: A revaluation gain of $35,000 net of tax was recognised for available for sale investments held during 2020. David Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function Required: Prepare the statement of profit or loss and other comprehensive income of David Ltd for the year ended 30 June 2020, showing the analysis of expenses in the statement. 18:23 7 winlearning.learnbook.com.au Question 1 (10 marks) The Western Mining company commences operations on 1 January 2016. During 2016 the company explores two areas and incurs the following costs : Exploration and evaluation Area expenditure SMill B 20 28 Other information - In 2017 oil is discovered at Site B Site A is abandoned due to lack of economically recoverable reserves and so an Impairment loss is recognised in relation to Site A. Of the $8 million incurred at Site B, S6 million relates to tangible assets and $2 million relates to intangible assets At Site A $14 million relates to tangible assets and S6 million relates to intangible assets. - Development costs of $24 million are incurred at Site B, to be written off on a production basis in 2017. The development costs include $16 million in property, plant and equipment $8 million in intangibles. Development at Site B concludes in 2017. Required: Prepare the necessary journal entries using the area of interest method. Question 1 (10 marks) The Western Mining company commences operations on 1 January 2016. During 2016 the company explores two areas and incurs the following costs : Exploration and evaluation Area expenditure SMill A B 20 8 28 Other information - In 2017 oil is discovered at Site B.Site A is abandoned due to lack of economically recoverable reserves and so an Impairment loss is recognised in relation to Site A. Of the $8 million incurred at Site B, $6 million relates to tangible assets and $2 million relates to intangible assets .At Site A $14 million relates to tangible assets and $6 million relates to intangible assets. - Development costs of $24 million are incurred at Site B, to be written off on a production basis in 2017. The development costs include $16 million in property, plant and equipment $8 million in intangibles Development at Site B concludes in 2017. Required: Prepare the necessary journal entries using the area of interest method