Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 (13pt) SuperMed has been running a R&D project on a disease and finally found the medicine for the disease. To conduct the

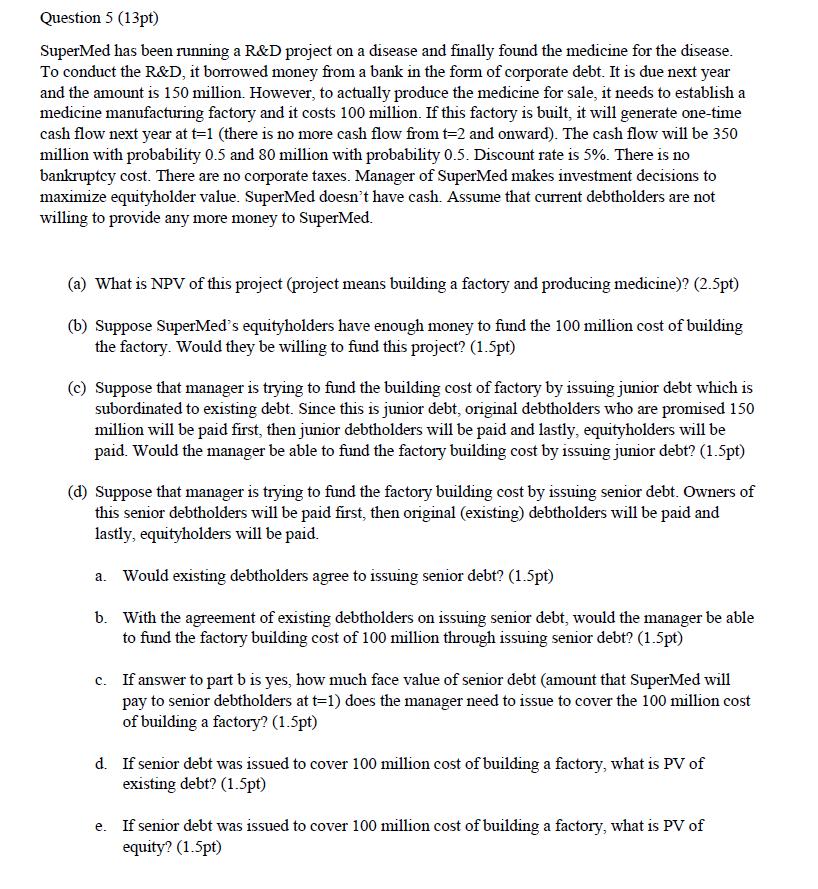

Question 5 (13pt) SuperMed has been running a R&D project on a disease and finally found the medicine for the disease. To conduct the R&D, it borrowed money from a bank in the form of corporate debt. It is due next year and the amount is 150 million. However, to actually produce the medicine for sale, it needs to establish a medicine manufacturing factory and it costs 100 million. If this factory is built, it will generate one-time cash flow next year at t=1 (there is no more cash flow from t=2 and onward). The cash flow will be 350 million with probability 0.5 and 80 million with probability 0.5. Discount rate is 5%. There is no bankruptcy cost. There are no corporate taxes. Manager of SuperMed makes investment decisions to maximize equityholder value. SuperMed doesn't have cash. Assume that current debtholders are not willing to provide any more money to SuperMed. (a) What is NPV of this project (project means building a factory and producing medicine)? (2.5pt) (b) Suppose SuperMed's equityholders have enough money to fund the 100 million cost of building the factory. Would they be willing to fund this project? (1.5pt) (c) Suppose that manager is trying to fund the building cost of factory by issuing junior debt which is subordinated to existing debt. Since this is junior debt, original debtholders who are promised 150 million will be paid first, then junior debtholders will be paid and lastly, equityholders will be paid. Would the manager be able to fund the factory building cost by issuing junior debt? (1.5pt) (d) Suppose that manager is trying to fund the factory building cost by issuing senior debt. Owners of this senior debtholders will be paid first, then original (existing) debtholders will be paid and lastly, equityholders will be paid. a. Would existing debtholders agree to issuing senior debt? (1.5pt) b. With the agreement of existing debtholders on issuing senior debt, would the manager be able to fund the factory building cost of 100 million through issuing senior debt? (1.5pt) c. If answer to part b is yes, how much face value of senior debt (amount that SuperMed will pay to senior debtholders at t=1) does the manager need to issue to cover the 100 million cost of building a factory? (1.5pt) d. If senior debt was issued to cover 100 million cost of building a factory, what is PV of existing debt? (1.5pt) e. If senior debt was issued to cover 100 million cost of building a factory, what is PV of equity? (1.5pt)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a The NPV of the project is 50 million b No the equityholders would not be willi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started