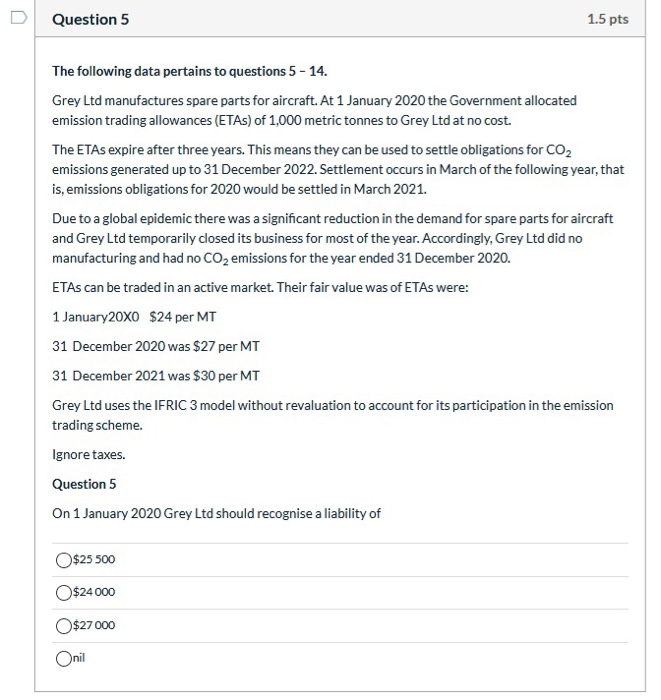

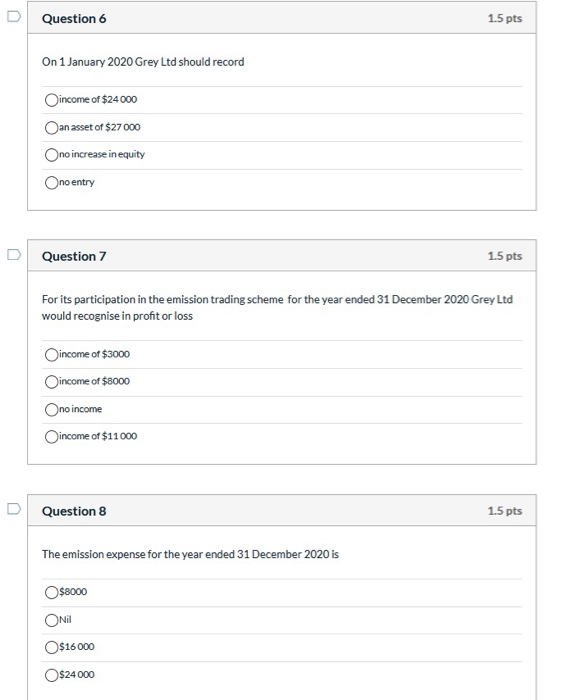

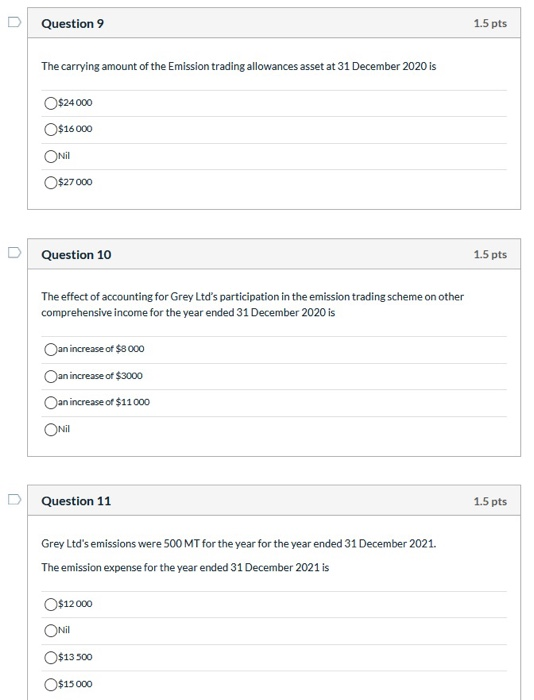

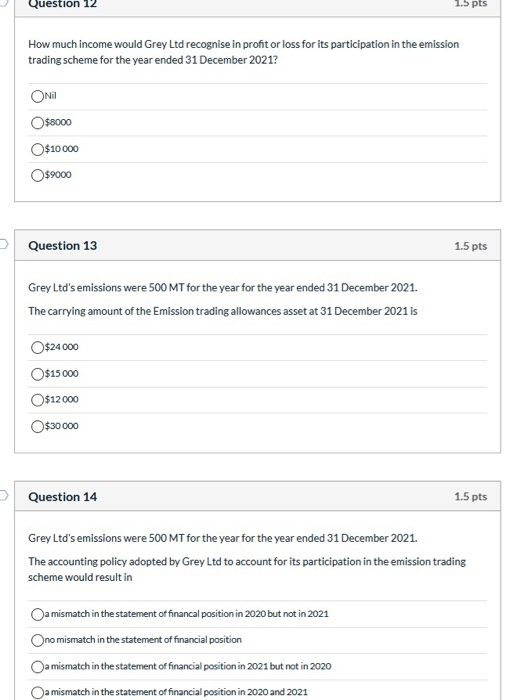

Question 5 1.5 pts The following data pertains to questions 5 - 14. Grey Ltd manufactures spare parts for aircraft. At 1 January 2020 the Government allocated emission trading allowances (ETA) of 1,000 metric tonnes to Grey Ltd at no cost. The ETAs expire after three years. This means they can be used to settle obligations for CO2 emissions generated up to 31 December 2022. Settlement occurs in March of the following year, that is, emissions obligations for 2020 would be settled in March 2021. Due to a global epidemic there was a significant reduction in the demand for spare parts for aircraft and Grey Ltd temporarily closed its business for most of the year. Accordingly, Grey Ltd did no manufacturing and had no CO2 emissions for the year ended 31 December 2020. ETAs can be traded in an active market. Their fair value was of ETAs were: 1 January20x0 $24 per MT 31 December 2020 was $27 per MT 31 December 2021 was $30 per MT Grey Ltd uses the IFRIC 3 model without revaluation to account for its participation in the emission trading scheme. Ignore taxes. Question 5 On 1 January 2020 Grey Ltd should recognise a liability of $25 500 $24000 O$27 000 Onil Question 6 1.5 pts On 1 January 2020 Grey Ltd should record income of $24 000 an asset of $27000 no increase in equity no entry Question 7 1.5 pts For its participation in the emission trading scheme for the year ended 31 December 2020 Grey Ltd would recognise in profit or loss income of $3000 income of $8000 no income income of $11000 Question 8 1.5 pts The emission expense for the year ended 31 December 2020 is $8000 Nil $16000 $24000 D Question 9 1.5 pts The carrying amount of the Emission trading allowances asset at 31 December 2020 is $24000 $16000 Nil $27000 Question 10 1.5 pts The effect of accounting for Grey Ltd's participation in the emission trading scheme on other comprehensive income for the year ended 31 December 2020 is an increase of $8 000 an increase of $3000 an increase of $11000 ON Question 11 1.5 pts Grey Ltd's emissions were 500 MT for the year for the year ended 31 December 2021. The emission expense for the year ended 31 December 2021 is O$12000 ONI O$13 500 $15 000 Question 12 1.5 pts How much income would Grey Ltd recognise in profit or loss for its participation in the emission trading scheme for the year ended 31 December 2021? Nil $8000 O$10000 $9000 Question 13 1.5 pts Grey Ltd's emissions were 500 MT for the year for the year ended 31 December 2021. The carrying amount of the Emission trading allowances asset at 31 December 2021 is $24000 $15 000 O$12000 $30 000 Question 14 1.5 pts Grey Ltd's emissions were 500 MT for the year for the year ended 31 December 2021. The accounting policy adopted by Grey Ltd to account for its participation in the emission trading scheme would result in a mismatch in the statement of financal position in 2020 but not in 2021 Ono mismatch in the statement of financial position a mismatch in the statement of financial position in 2021 but not in 2020 Oa mismatch in the statement of financial position in 2020 and 2021 Question 5 1.5 pts The following data pertains to questions 5 - 14. Grey Ltd manufactures spare parts for aircraft. At 1 January 2020 the Government allocated emission trading allowances (ETA) of 1,000 metric tonnes to Grey Ltd at no cost. The ETAs expire after three years. This means they can be used to settle obligations for CO2 emissions generated up to 31 December 2022. Settlement occurs in March of the following year, that is, emissions obligations for 2020 would be settled in March 2021. Due to a global epidemic there was a significant reduction in the demand for spare parts for aircraft and Grey Ltd temporarily closed its business for most of the year. Accordingly, Grey Ltd did no manufacturing and had no CO2 emissions for the year ended 31 December 2020. ETAs can be traded in an active market. Their fair value was of ETAs were: 1 January20x0 $24 per MT 31 December 2020 was $27 per MT 31 December 2021 was $30 per MT Grey Ltd uses the IFRIC 3 model without revaluation to account for its participation in the emission trading scheme. Ignore taxes. Question 5 On 1 January 2020 Grey Ltd should recognise a liability of $25 500 $24000 O$27 000 Onil Question 6 1.5 pts On 1 January 2020 Grey Ltd should record income of $24 000 an asset of $27000 no increase in equity no entry Question 7 1.5 pts For its participation in the emission trading scheme for the year ended 31 December 2020 Grey Ltd would recognise in profit or loss income of $3000 income of $8000 no income income of $11000 Question 8 1.5 pts The emission expense for the year ended 31 December 2020 is $8000 Nil $16000 $24000 D Question 9 1.5 pts The carrying amount of the Emission trading allowances asset at 31 December 2020 is $24000 $16000 Nil $27000 Question 10 1.5 pts The effect of accounting for Grey Ltd's participation in the emission trading scheme on other comprehensive income for the year ended 31 December 2020 is an increase of $8 000 an increase of $3000 an increase of $11000 ON Question 11 1.5 pts Grey Ltd's emissions were 500 MT for the year for the year ended 31 December 2021. The emission expense for the year ended 31 December 2021 is O$12000 ONI O$13 500 $15 000 Question 12 1.5 pts How much income would Grey Ltd recognise in profit or loss for its participation in the emission trading scheme for the year ended 31 December 2021? Nil $8000 O$10000 $9000 Question 13 1.5 pts Grey Ltd's emissions were 500 MT for the year for the year ended 31 December 2021. The carrying amount of the Emission trading allowances asset at 31 December 2021 is $24000 $15 000 O$12000 $30 000 Question 14 1.5 pts Grey Ltd's emissions were 500 MT for the year for the year ended 31 December 2021. The accounting policy adopted by Grey Ltd to account for its participation in the emission trading scheme would result in a mismatch in the statement of financal position in 2020 but not in 2021 Ono mismatch in the statement of financial position a mismatch in the statement of financial position in 2021 but not in 2020 Oa mismatch in the statement of financial position in 2020 and 2021