Answered step by step

Verified Expert Solution

Question

1 Approved Answer

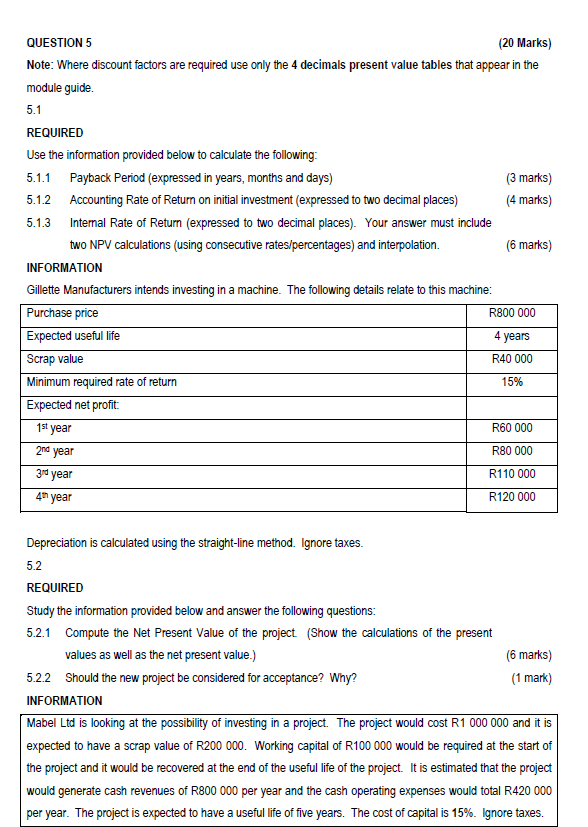

QUESTION 5 ( 2 0 Marks ) Note: Where discount factors are required use only the 4 decimals present value tables that appear in the

QUESTION

Marks

Note: Where discount factors are required use only the decimals present value tables that appear in the module guide.

REQUIRED

Use the information provided below to calculate the following:

Payback Period expressed in years, months and days

marks

Accounting Rate of Return on initial investment expressed to two decimal places

marks

Internal Rate of Return expressed to two decimal places Your answer must include two NPV calculations using consecutive ratespercentages and interpolation.

marks

INFORMATION

Gillette Manufacturers intends investing in a machine. The following details relate to this machine:

Depreciation is calculated using the straightline method. Ignore taxes.

REQUIRED

Study the information provided below and answer the following questions:

Compute the Net Present Value of the project. Show the calculations of the present values as well as the net present value.

marks

Should the new project be considered for acceptance? Why?

mark

INFORMATION

Mabel Ltd is looking at the possibility of investing in a project. The project would cost R and it is expected to have a scrap value of R Working capital of R would be required at the start of the project and it would be recovered at the end of the useful life of the project. It is estimated that the project would generate cash revenues of R per year and the cash operating expenses would total R per year. The project is expected to have a useful life of five years. The cost of capital is Ignore taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started