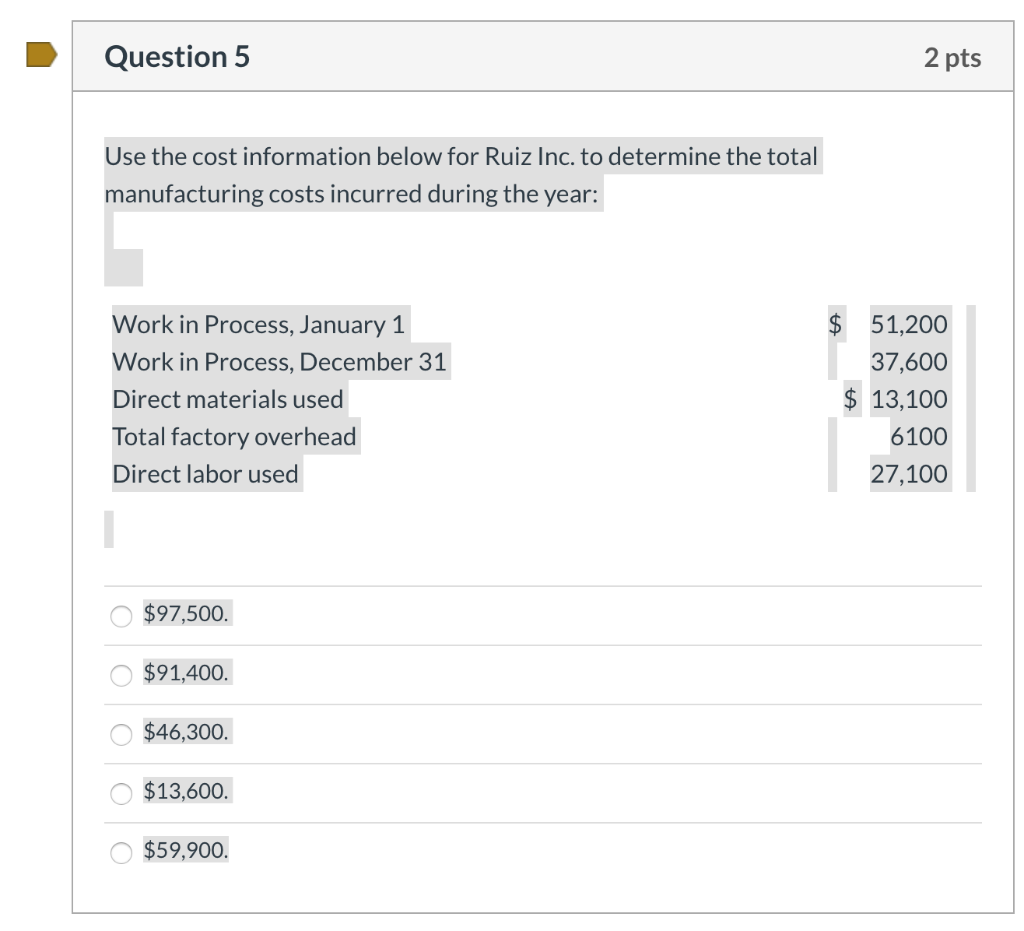

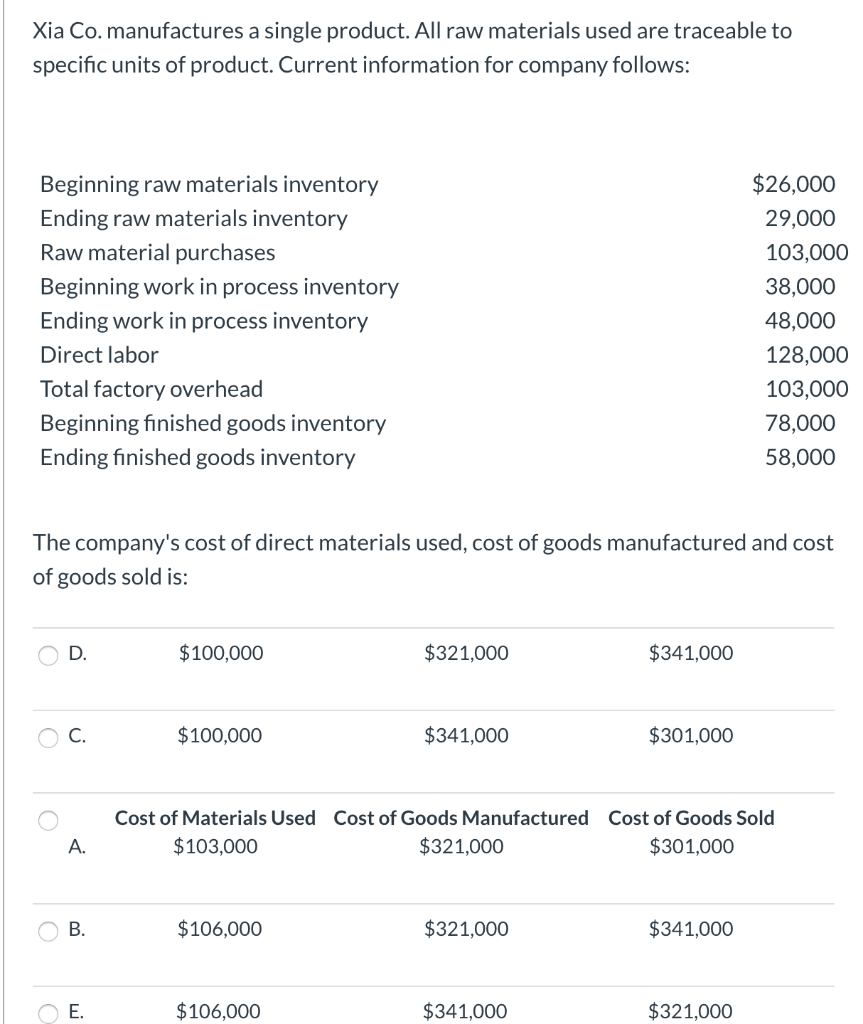

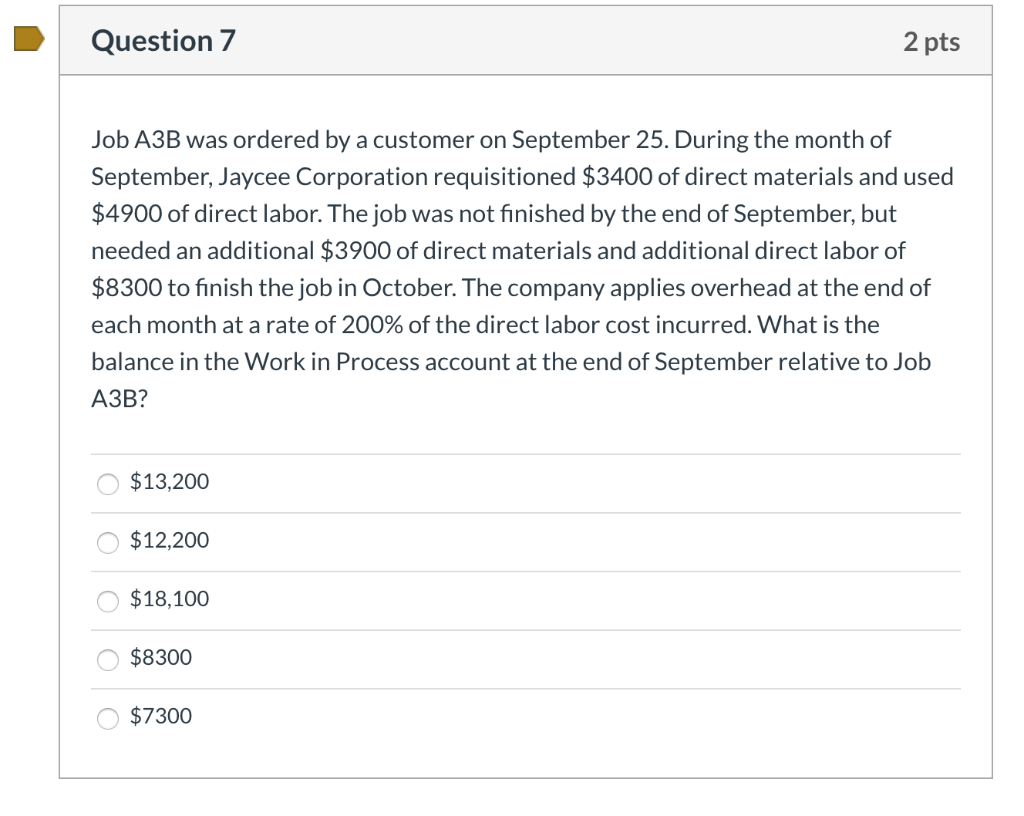

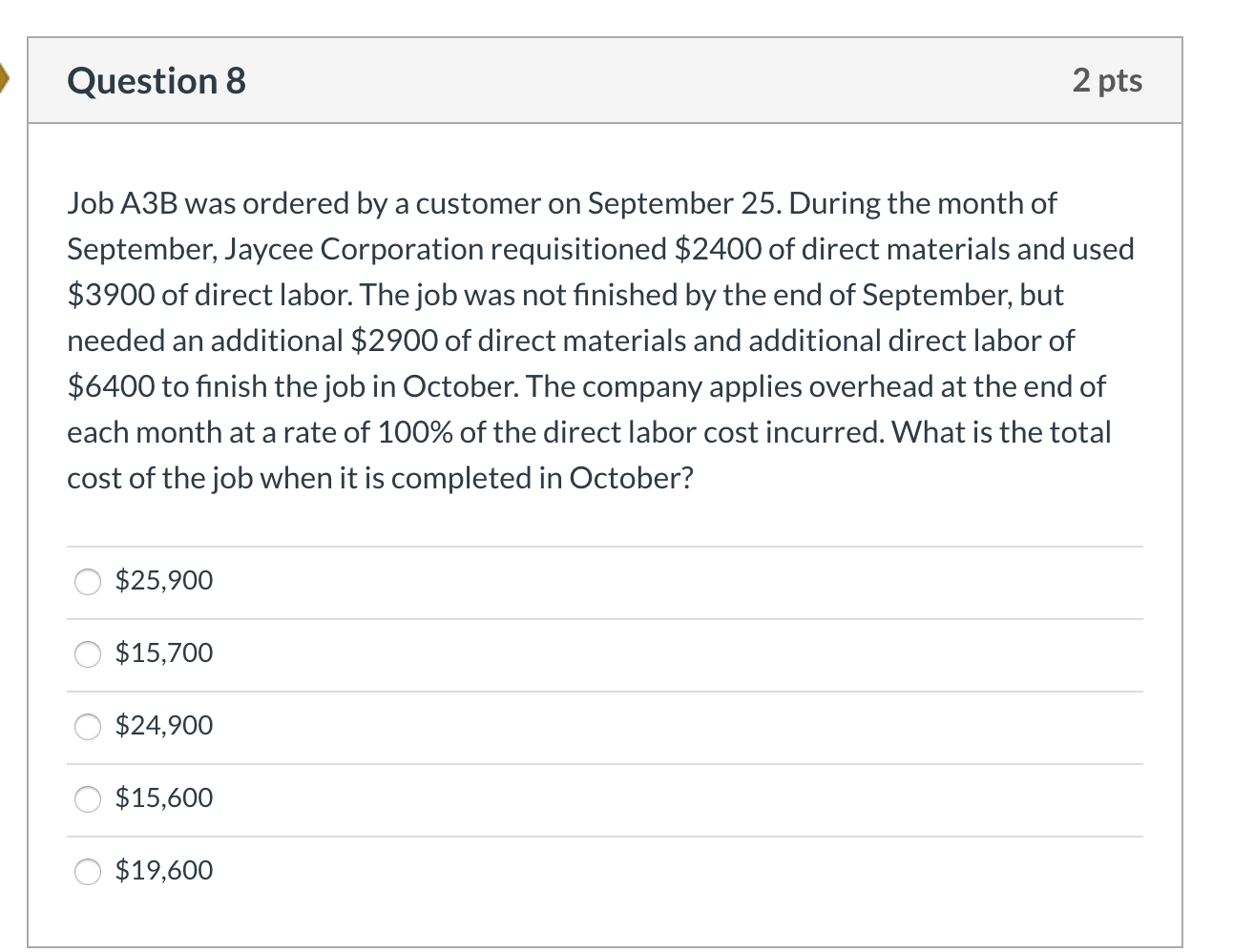

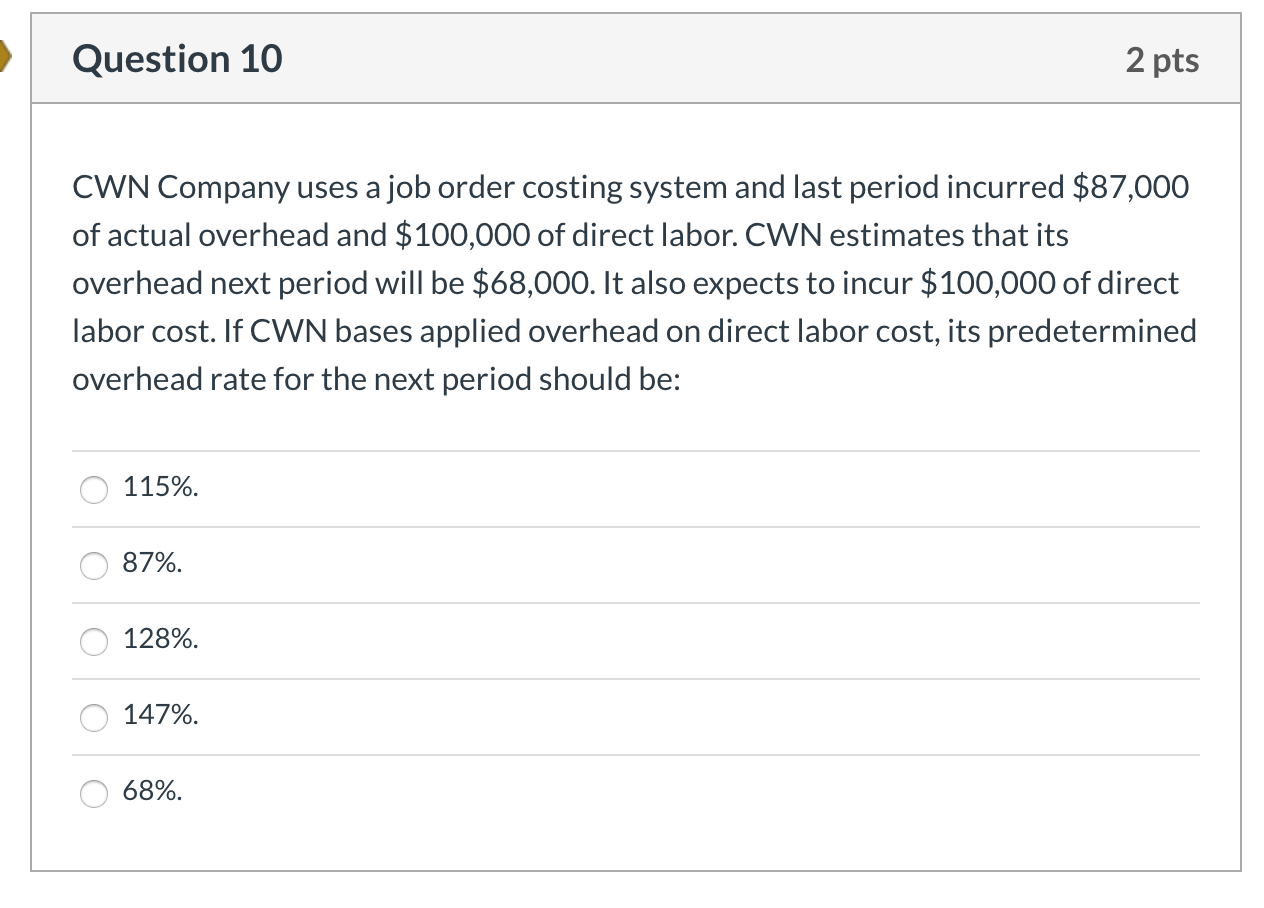

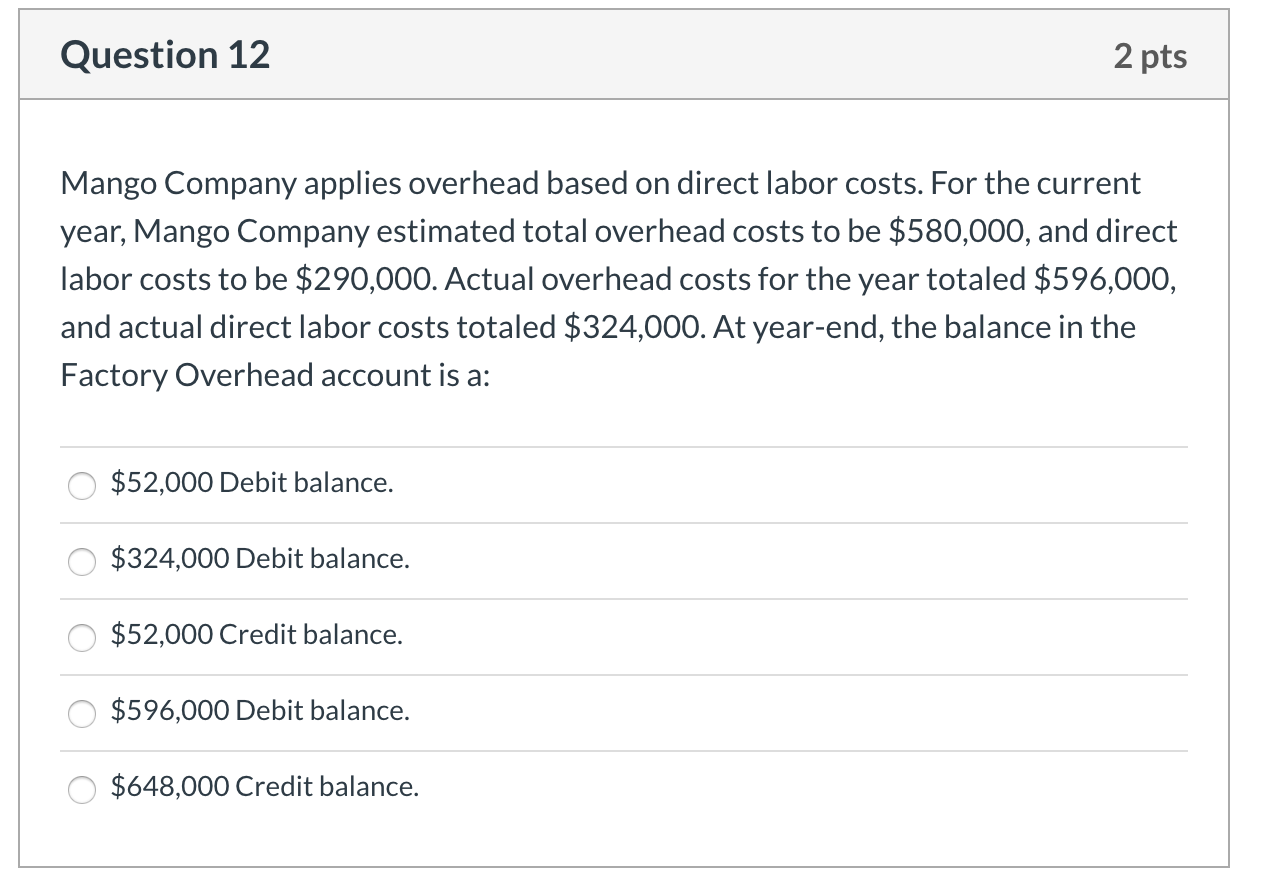

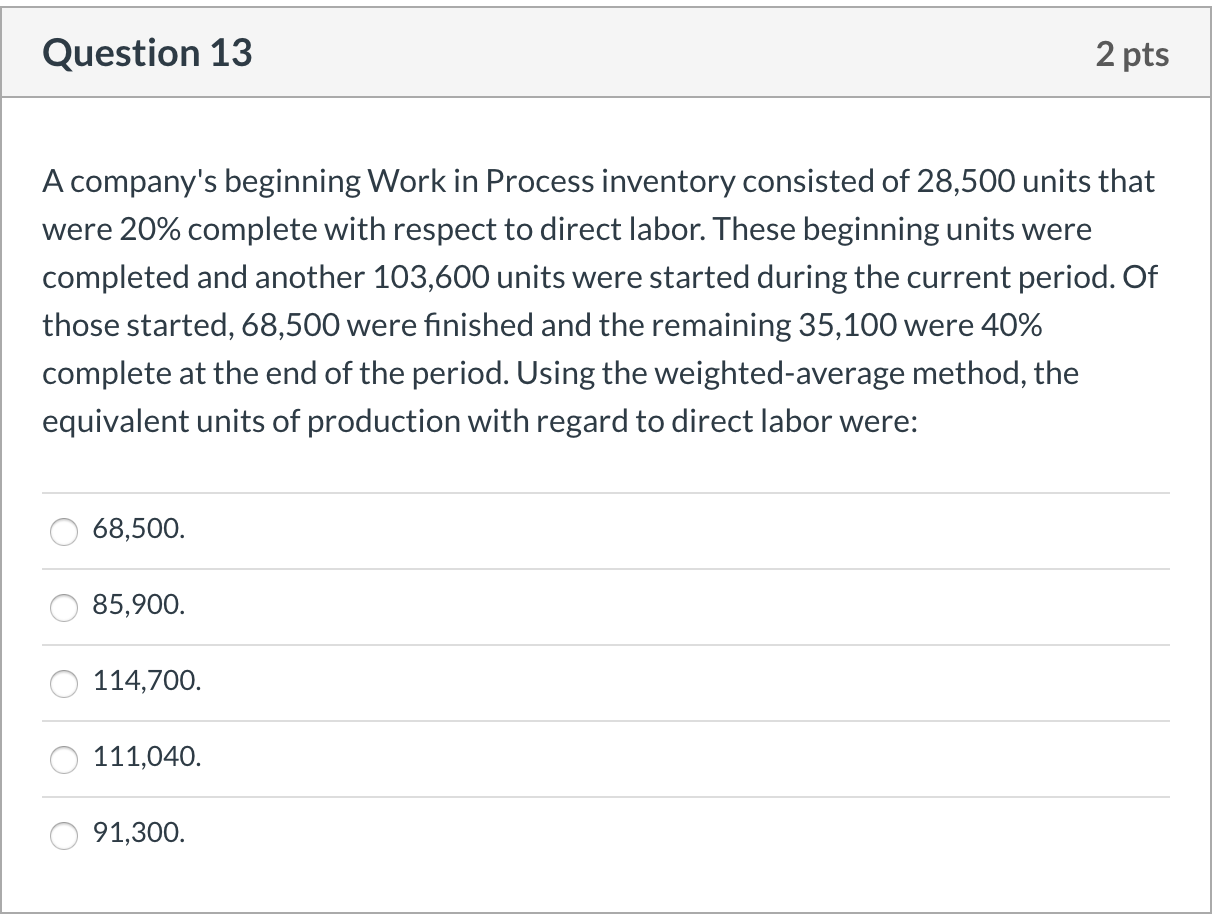

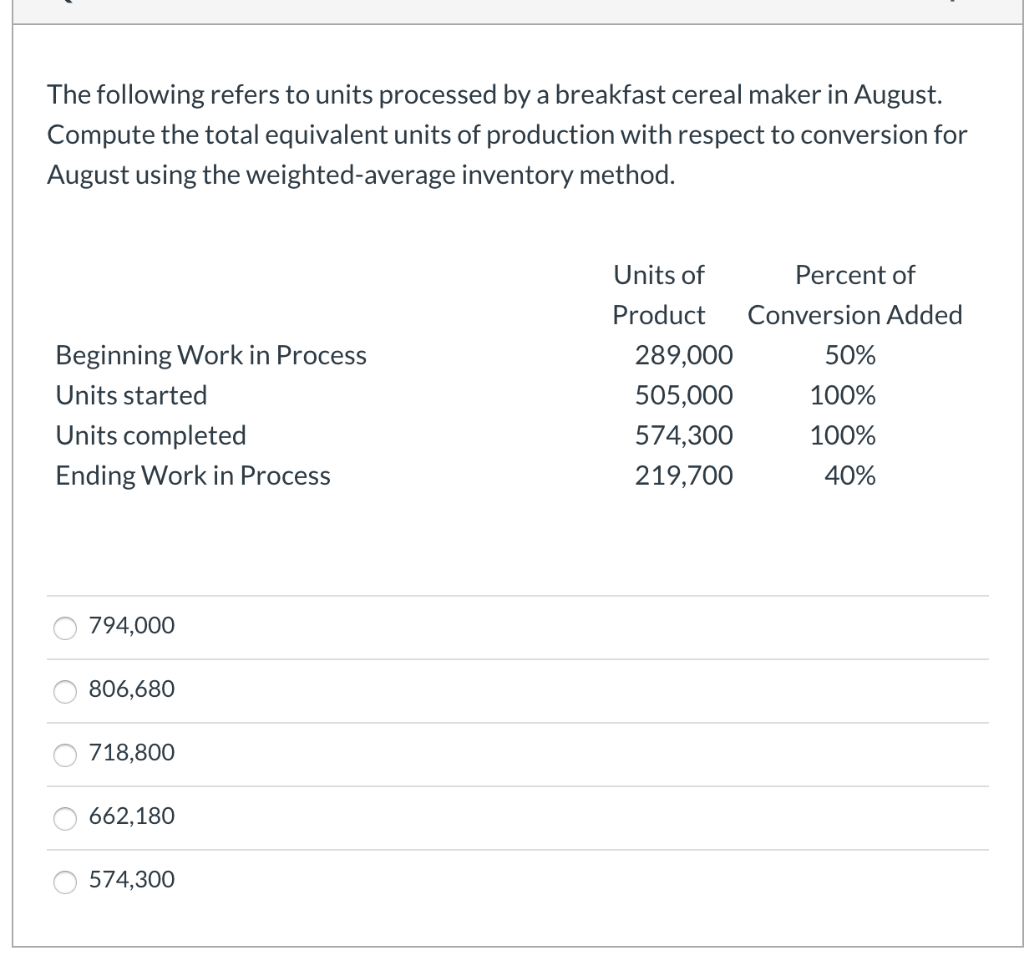

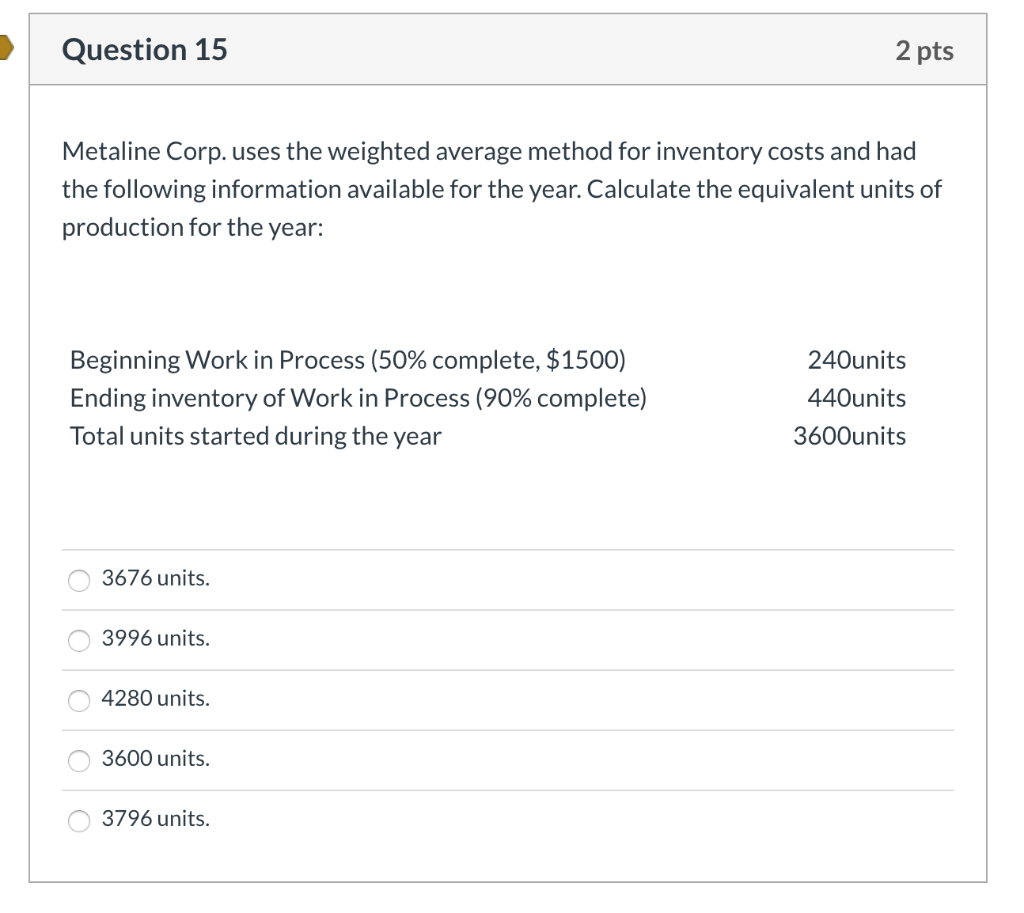

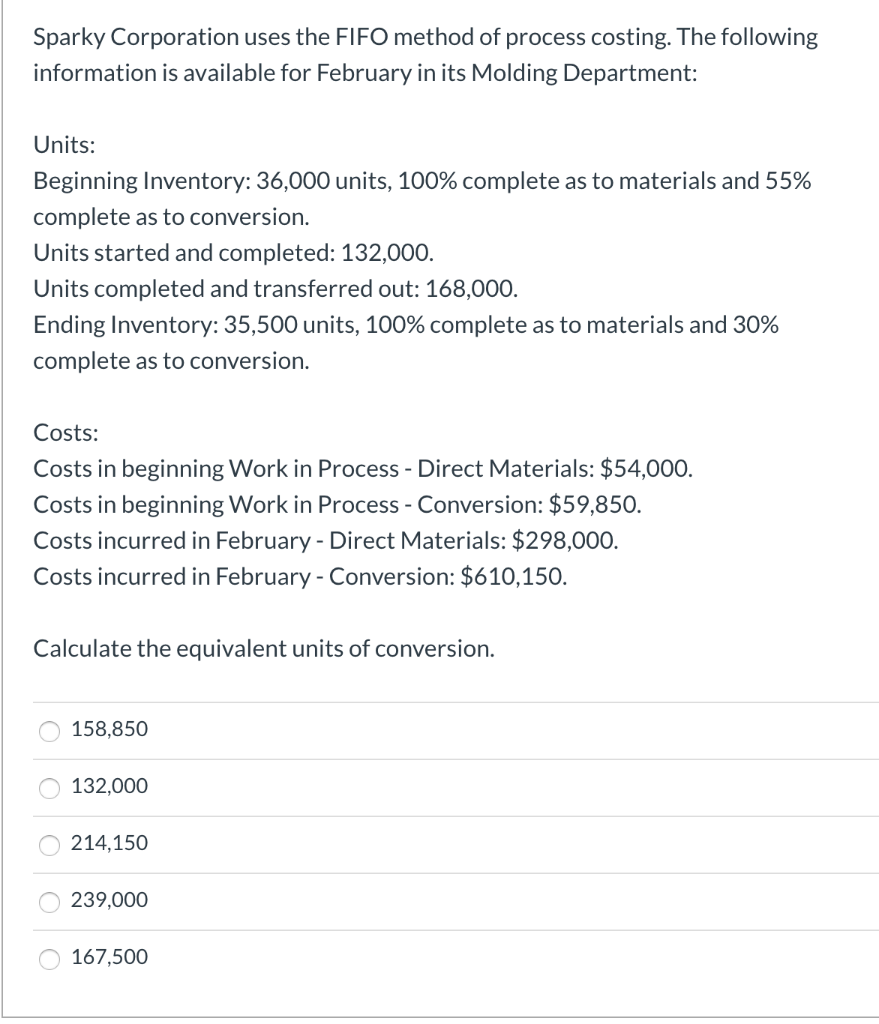

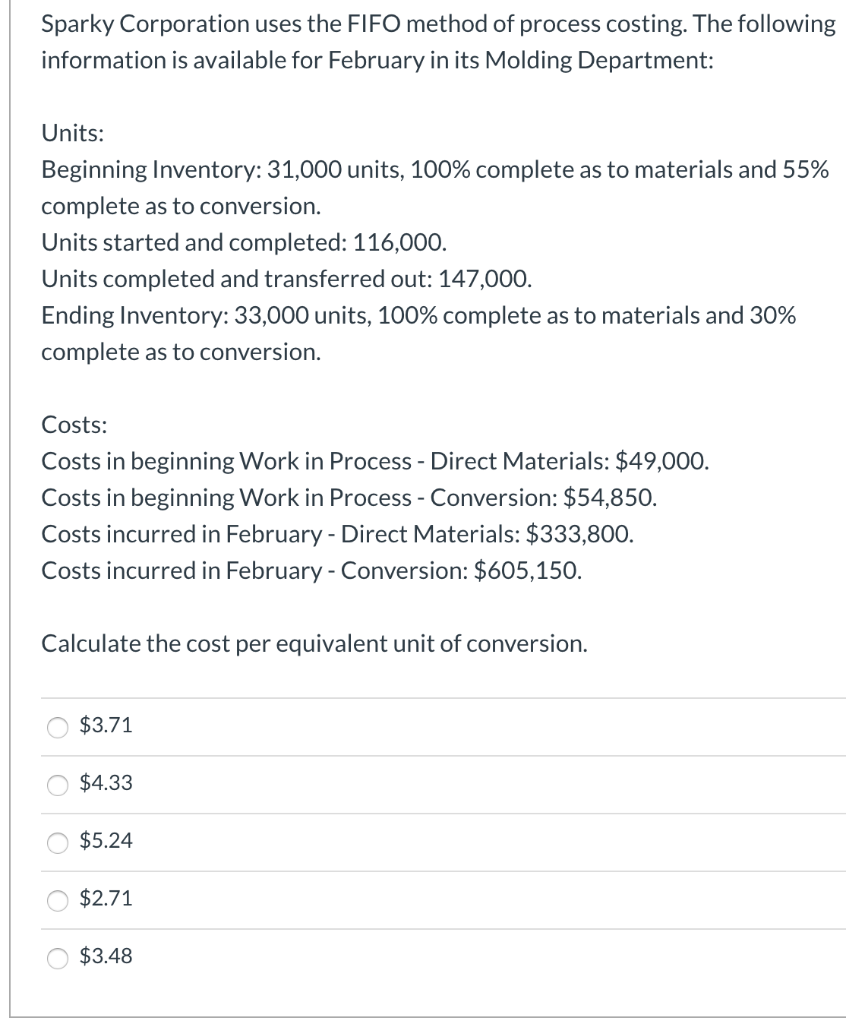

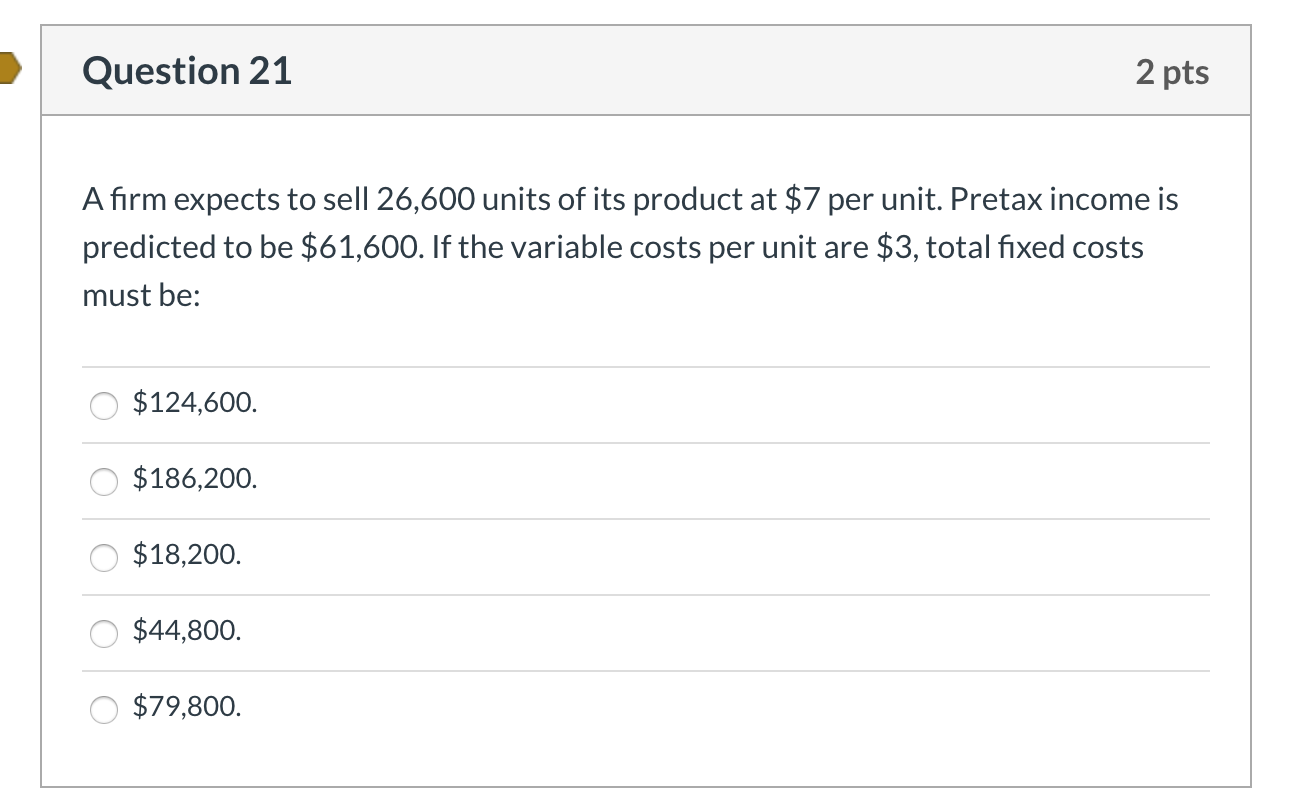

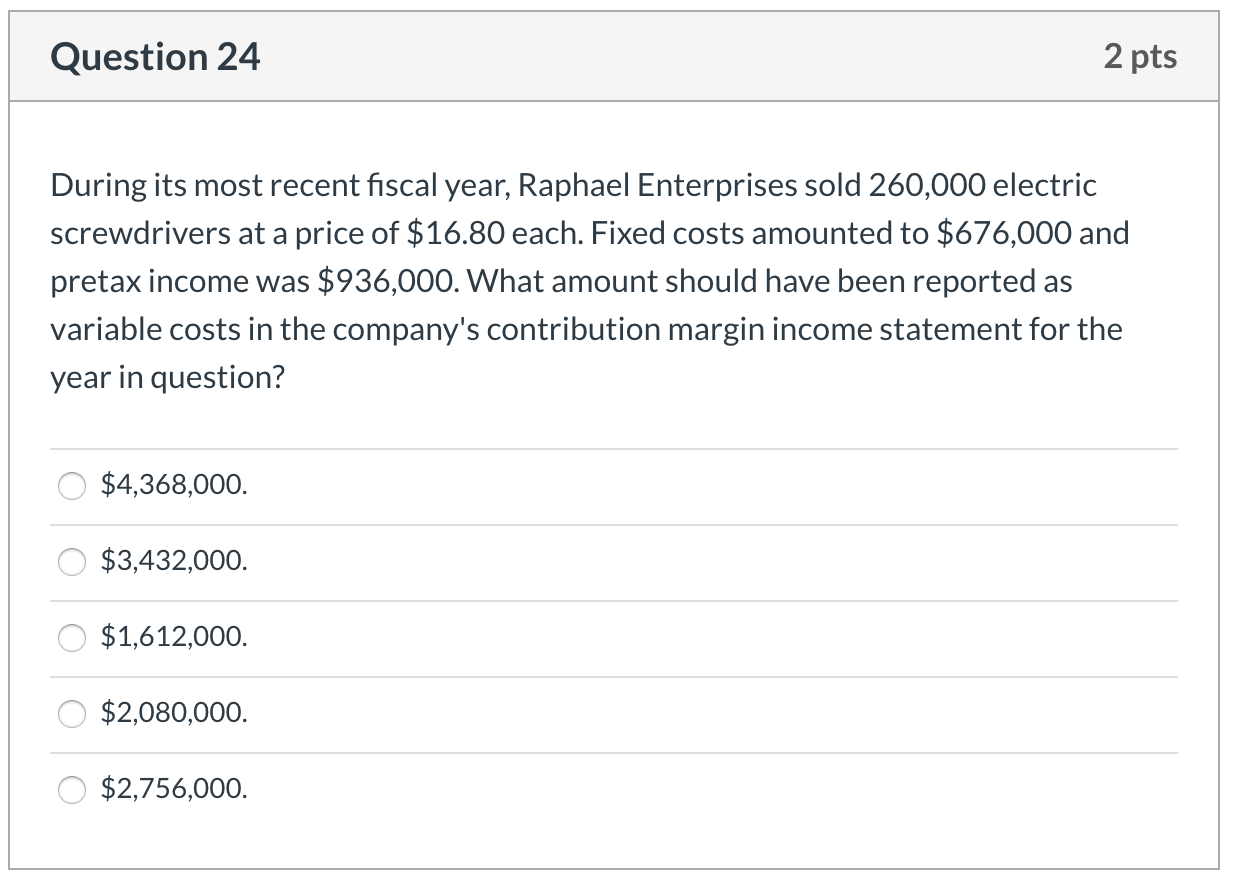

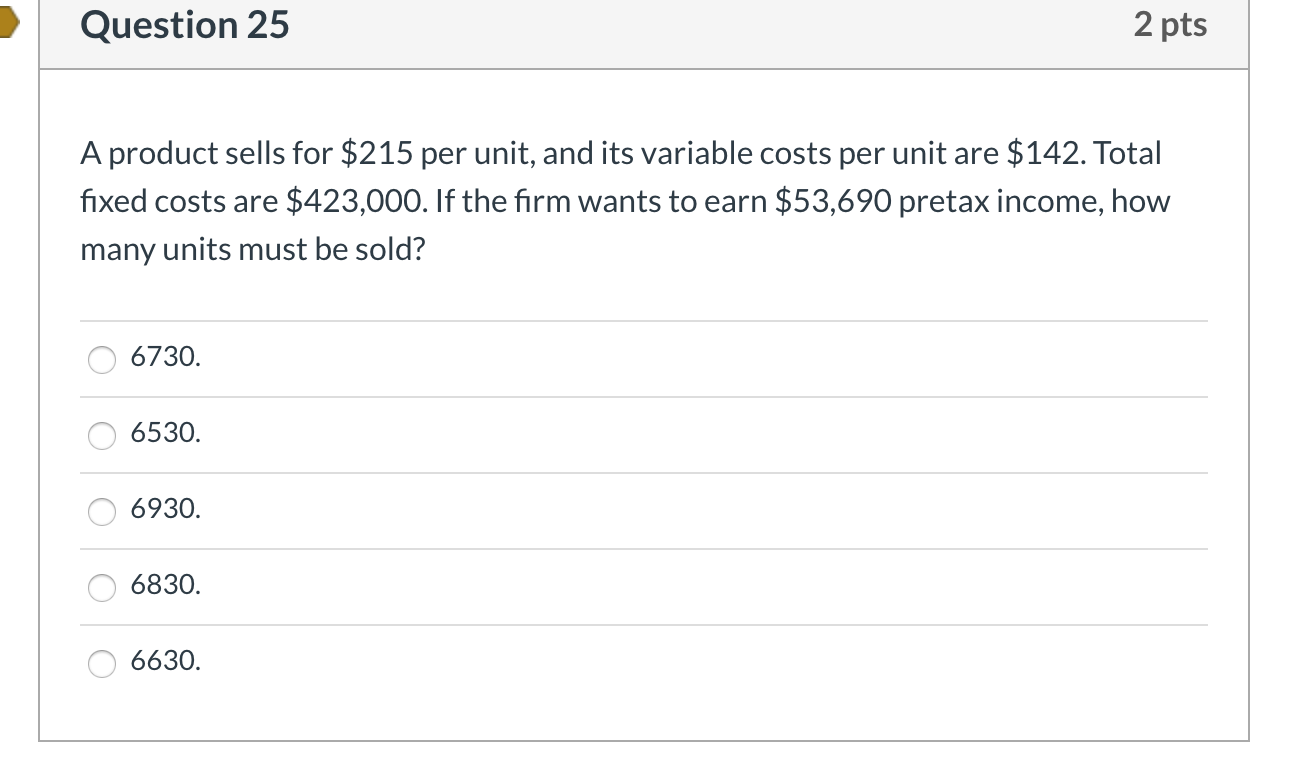

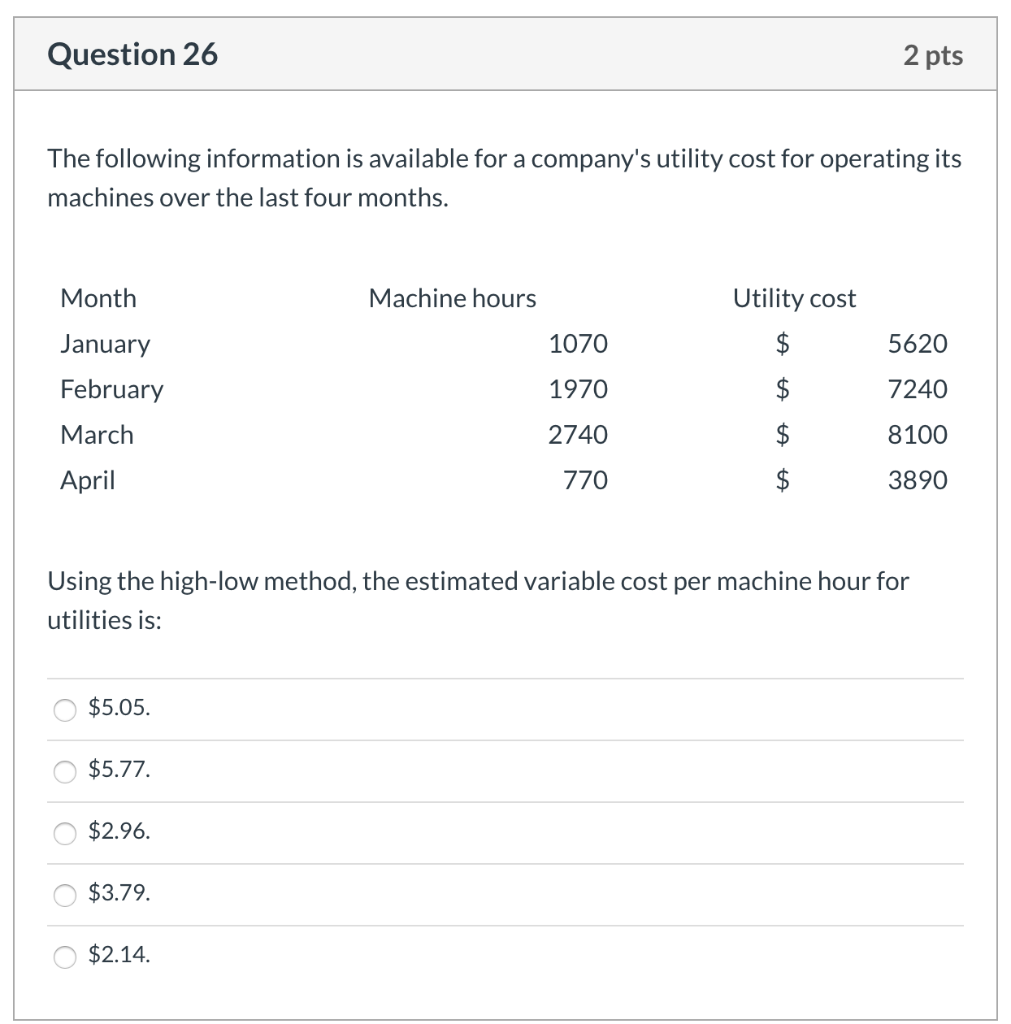

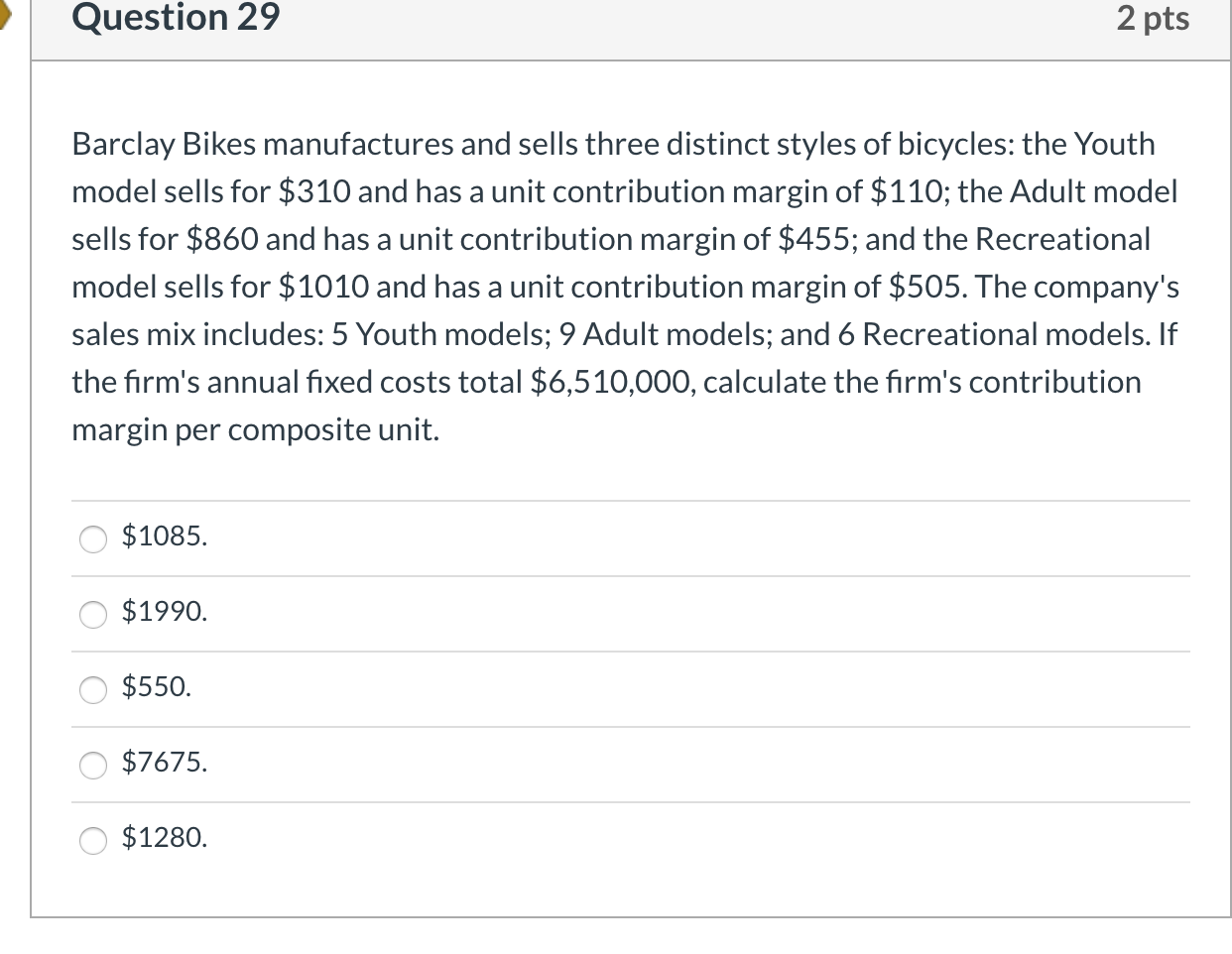

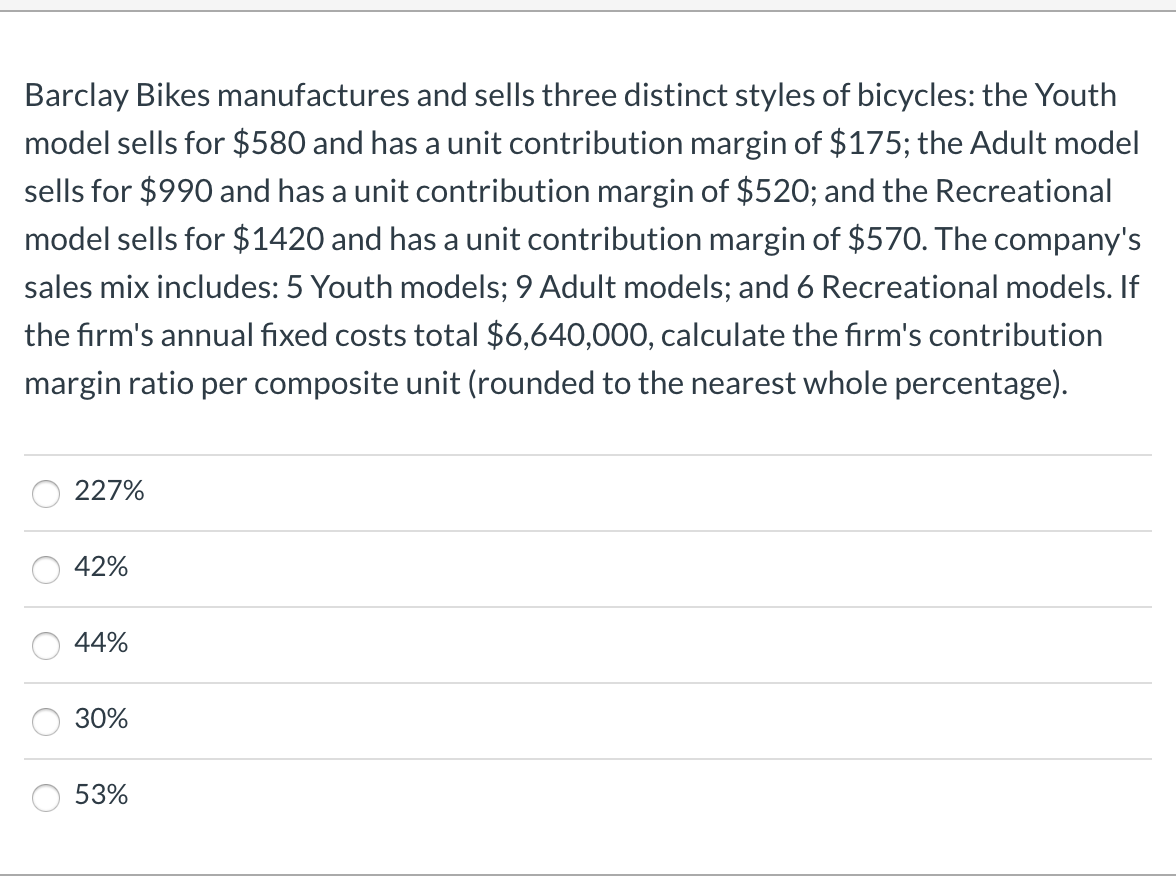

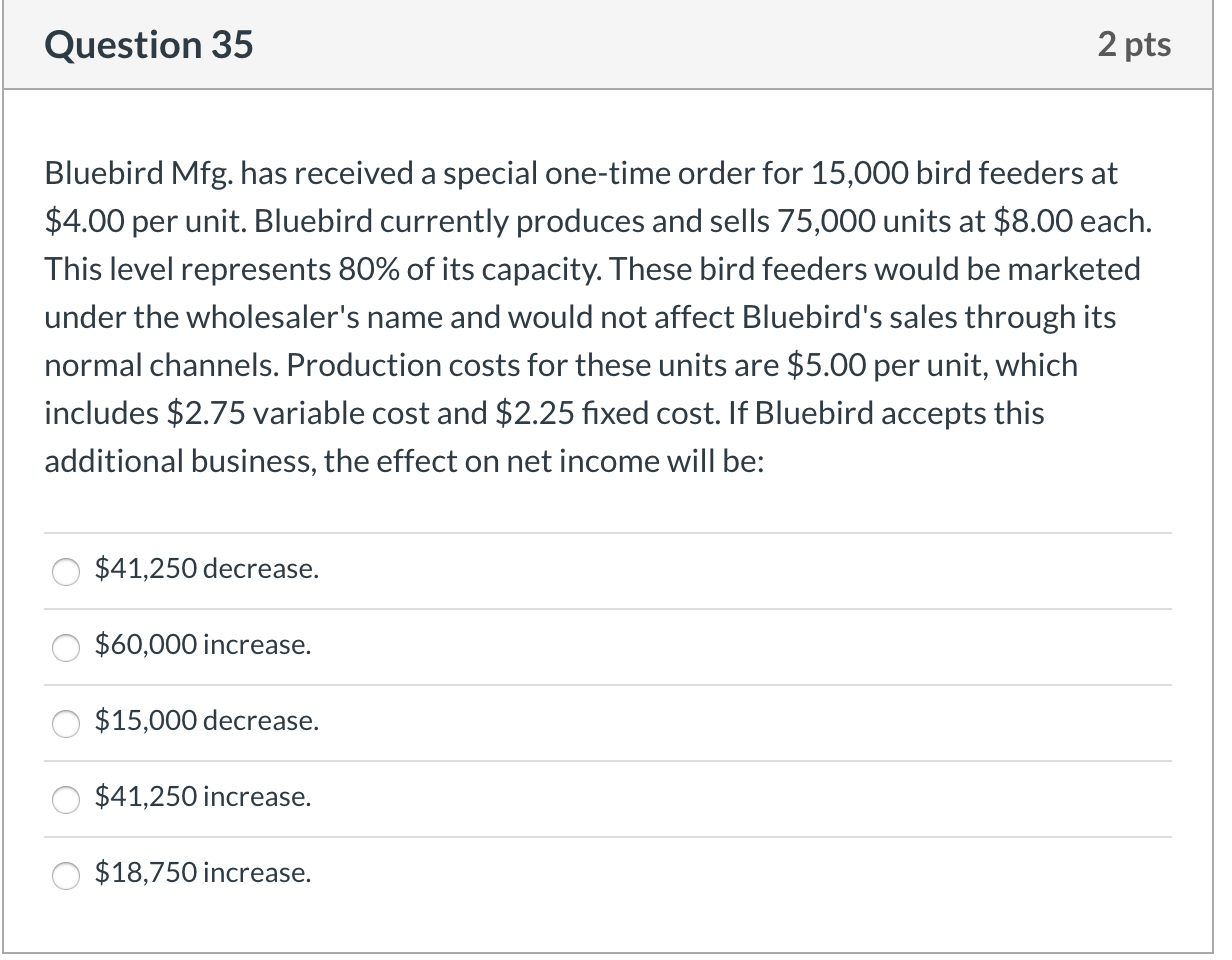

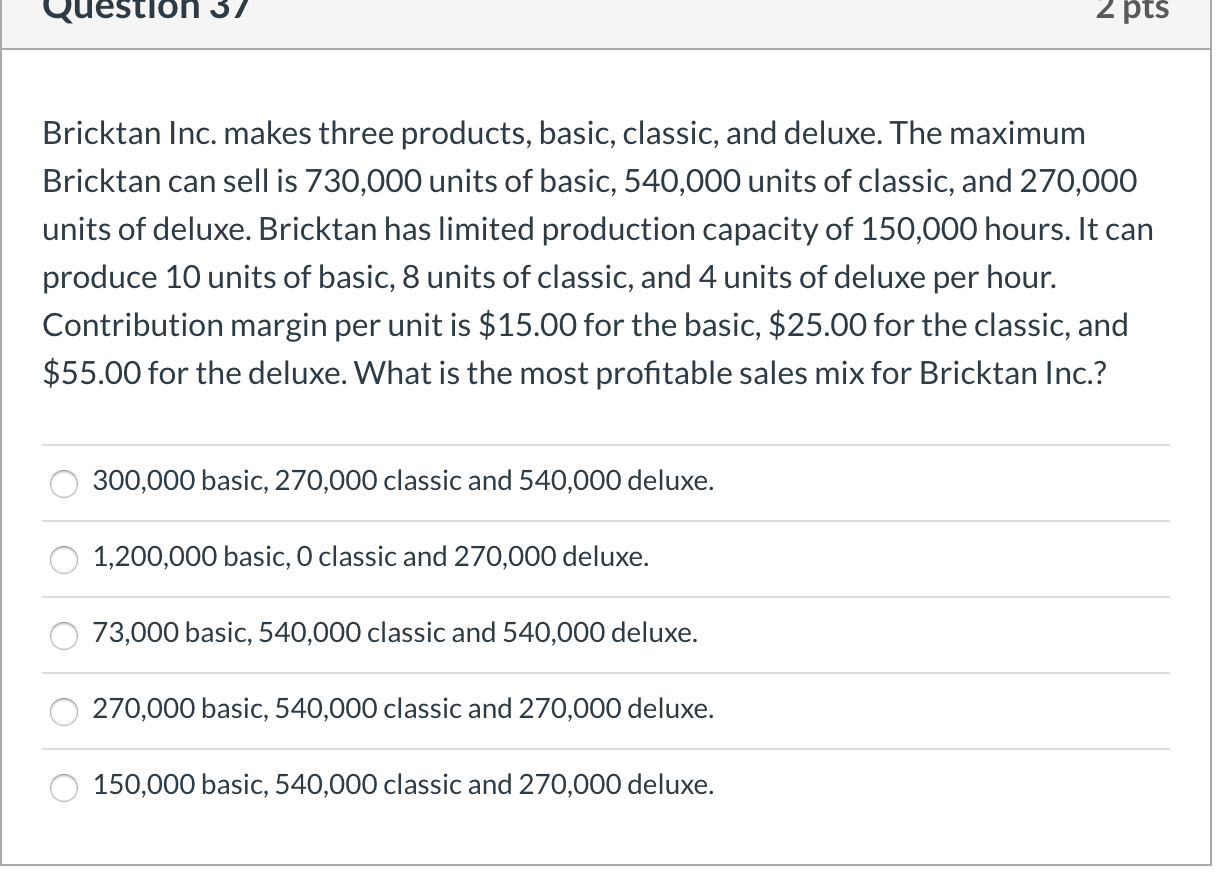

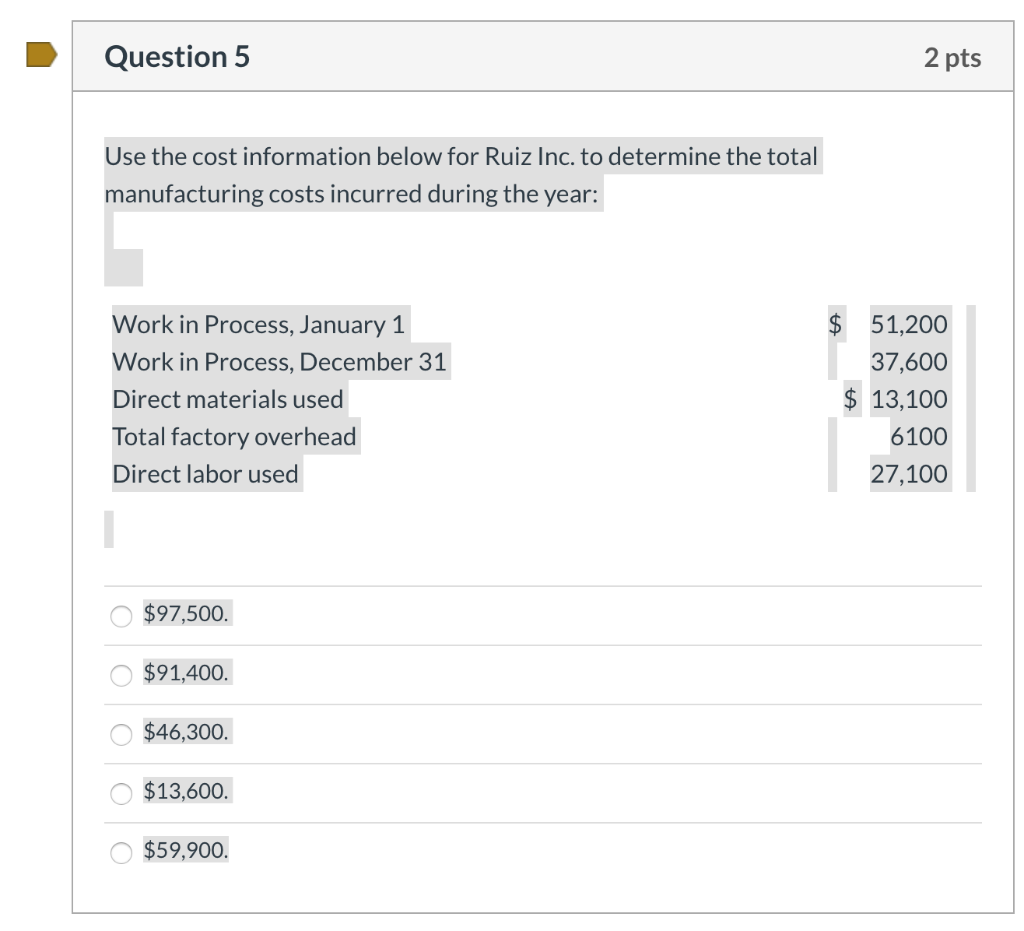

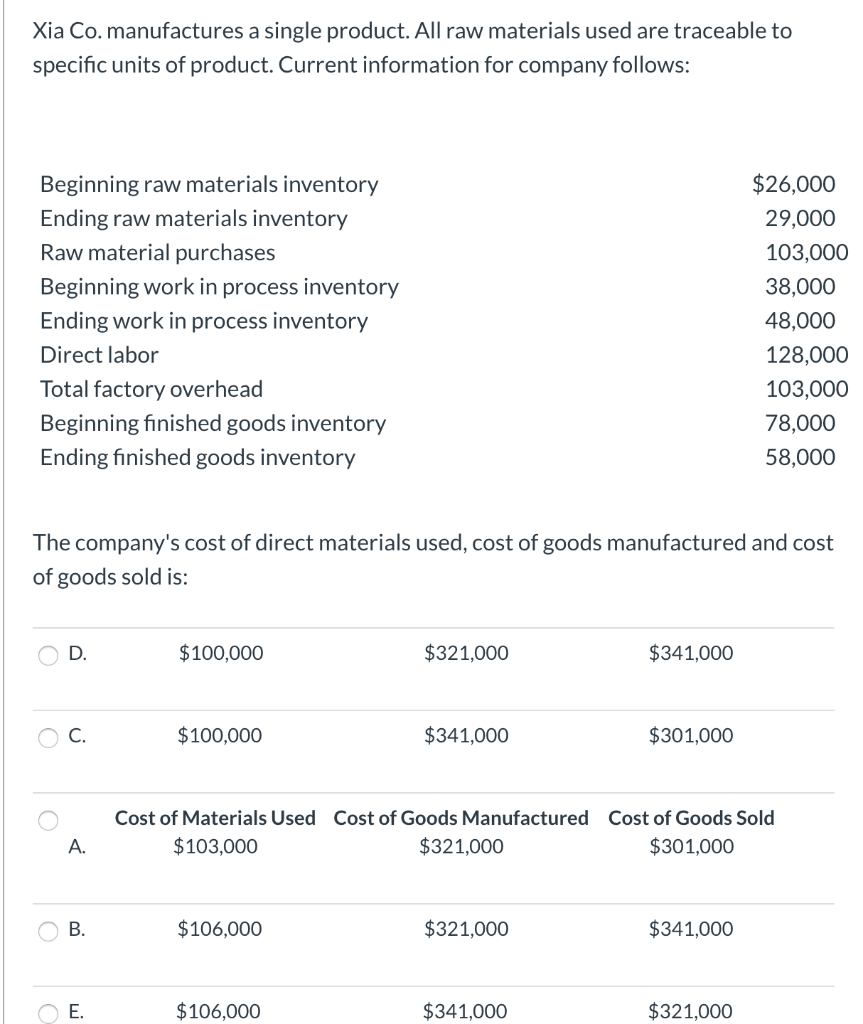

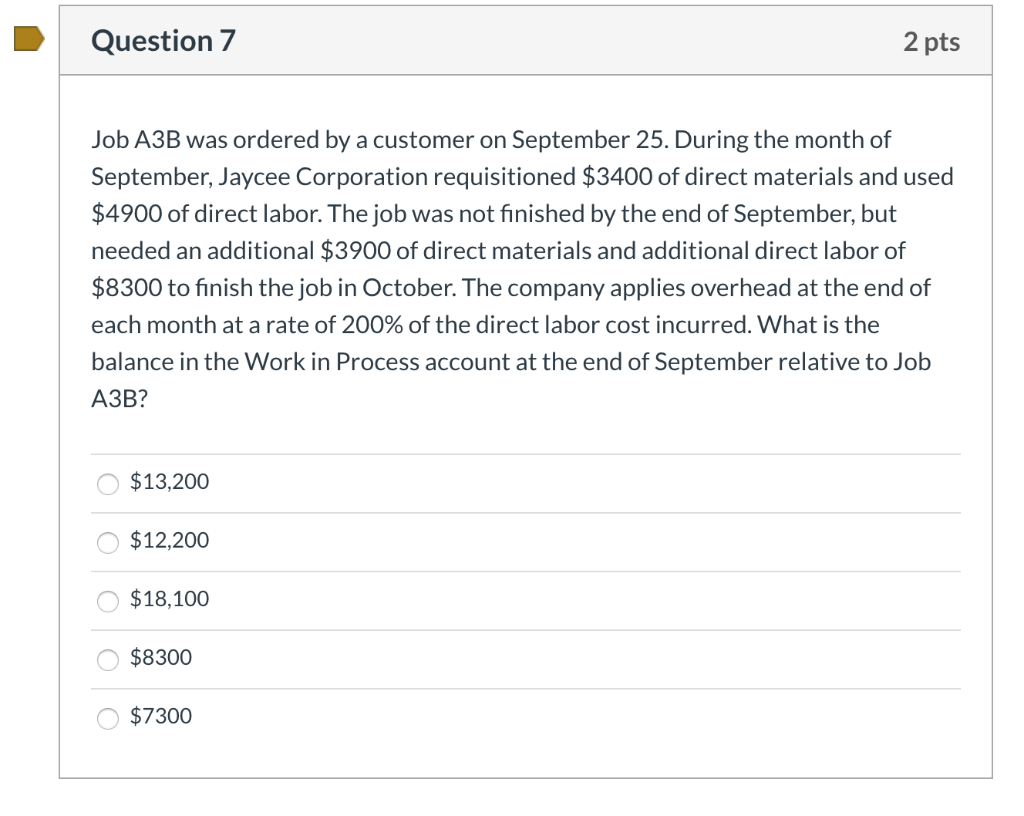

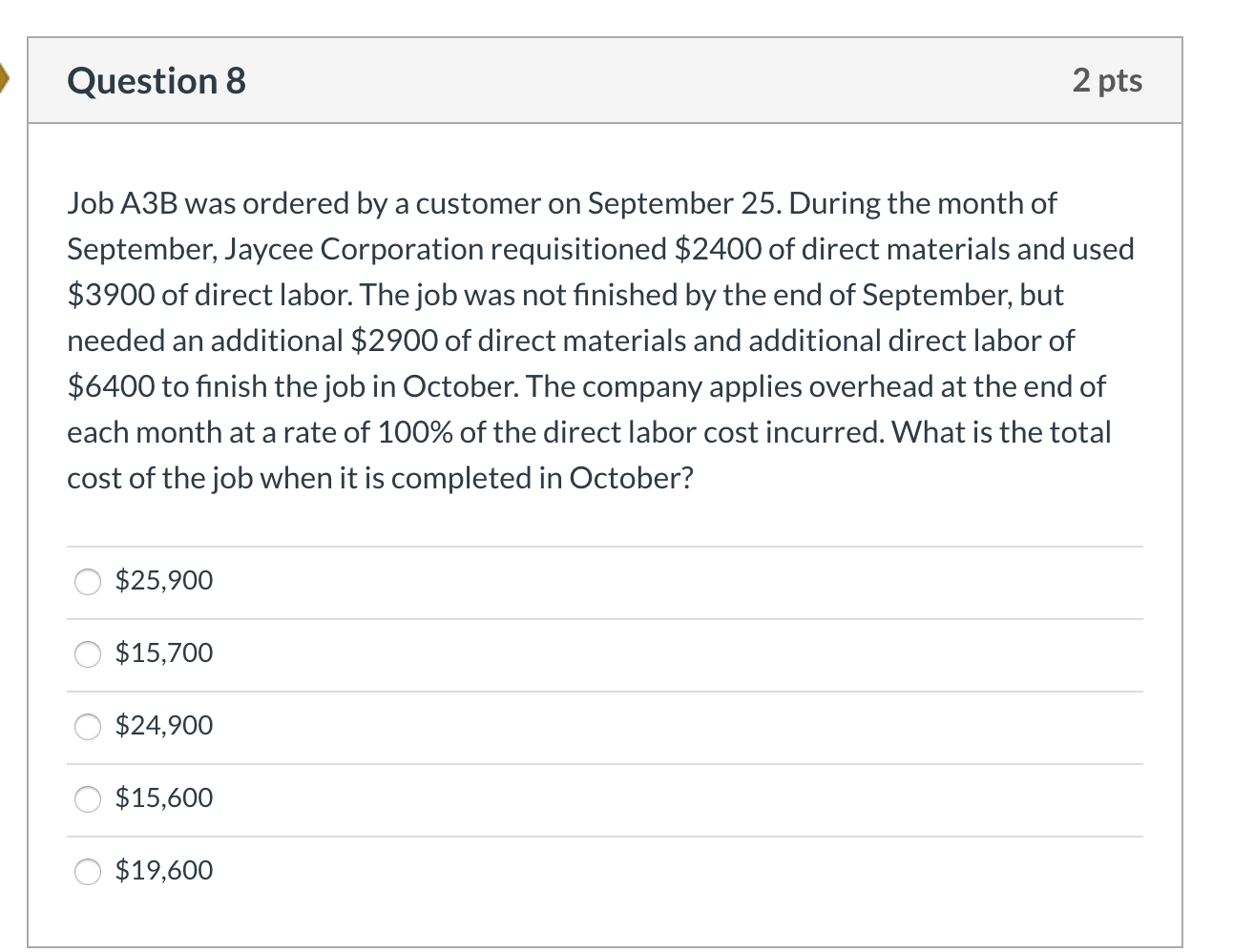

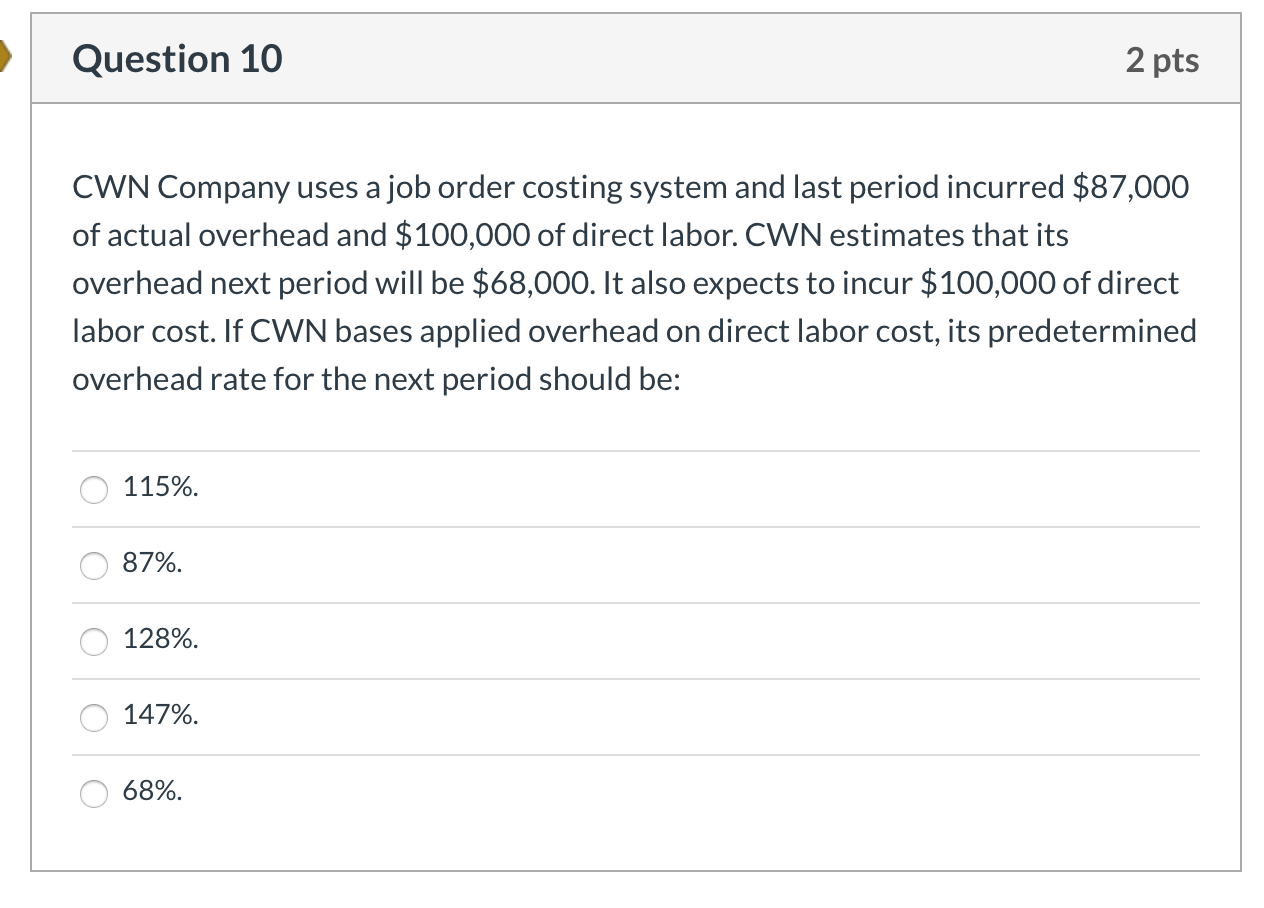

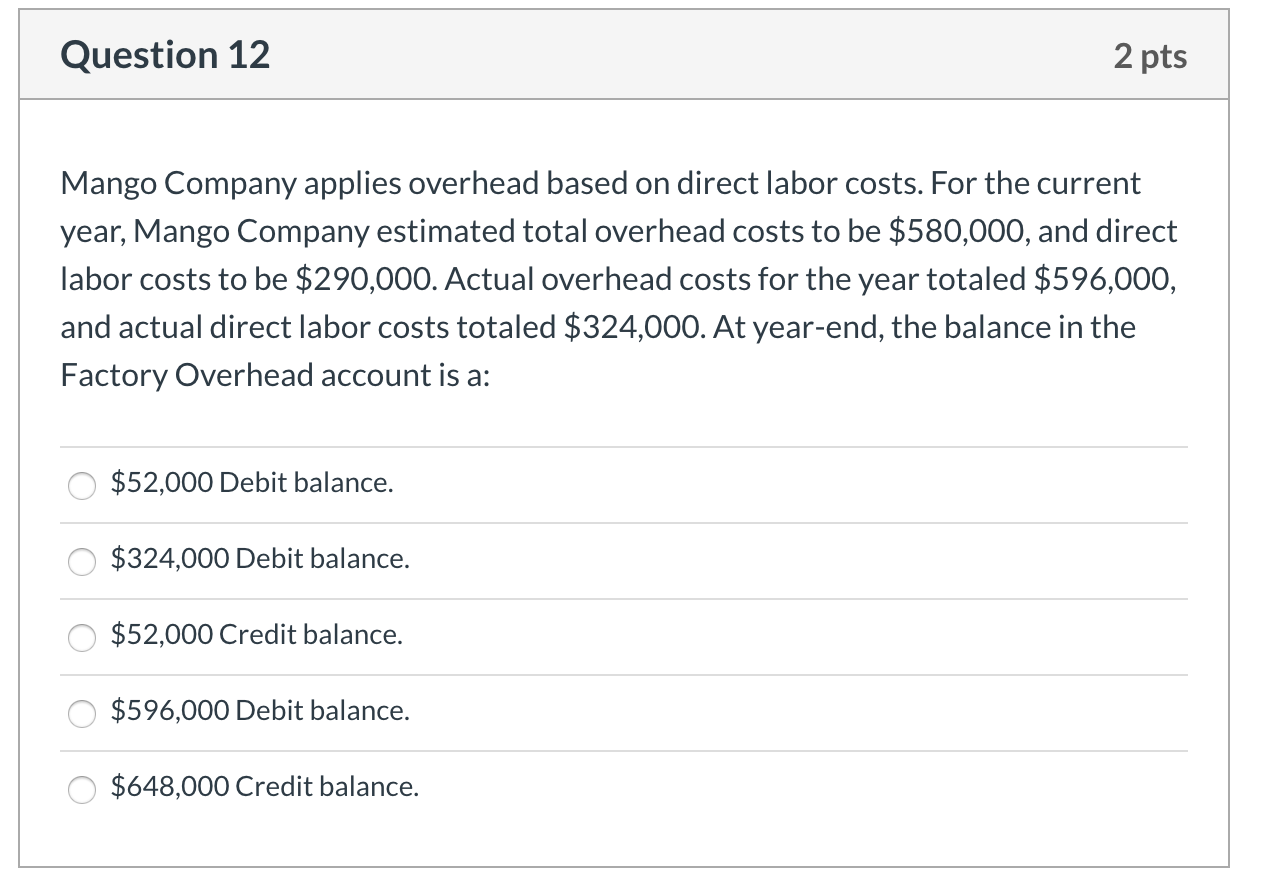

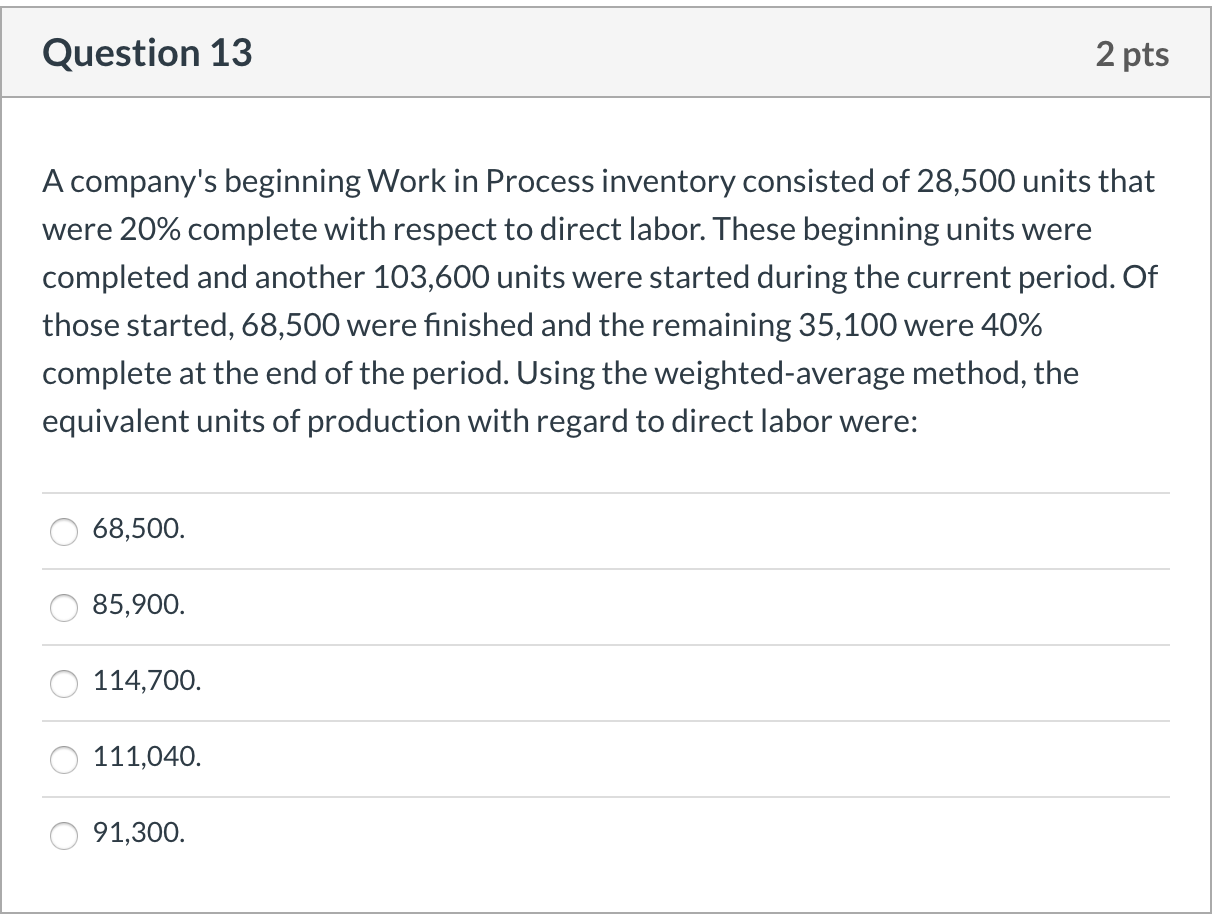

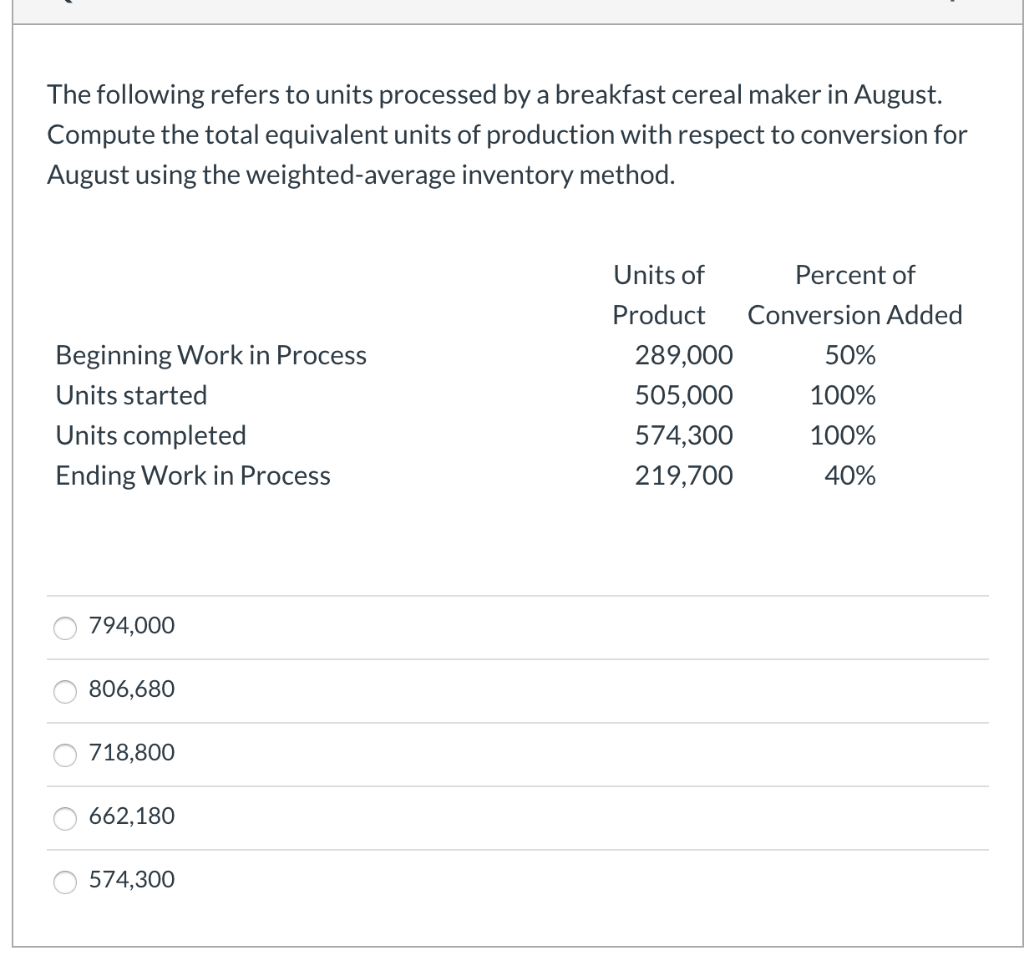

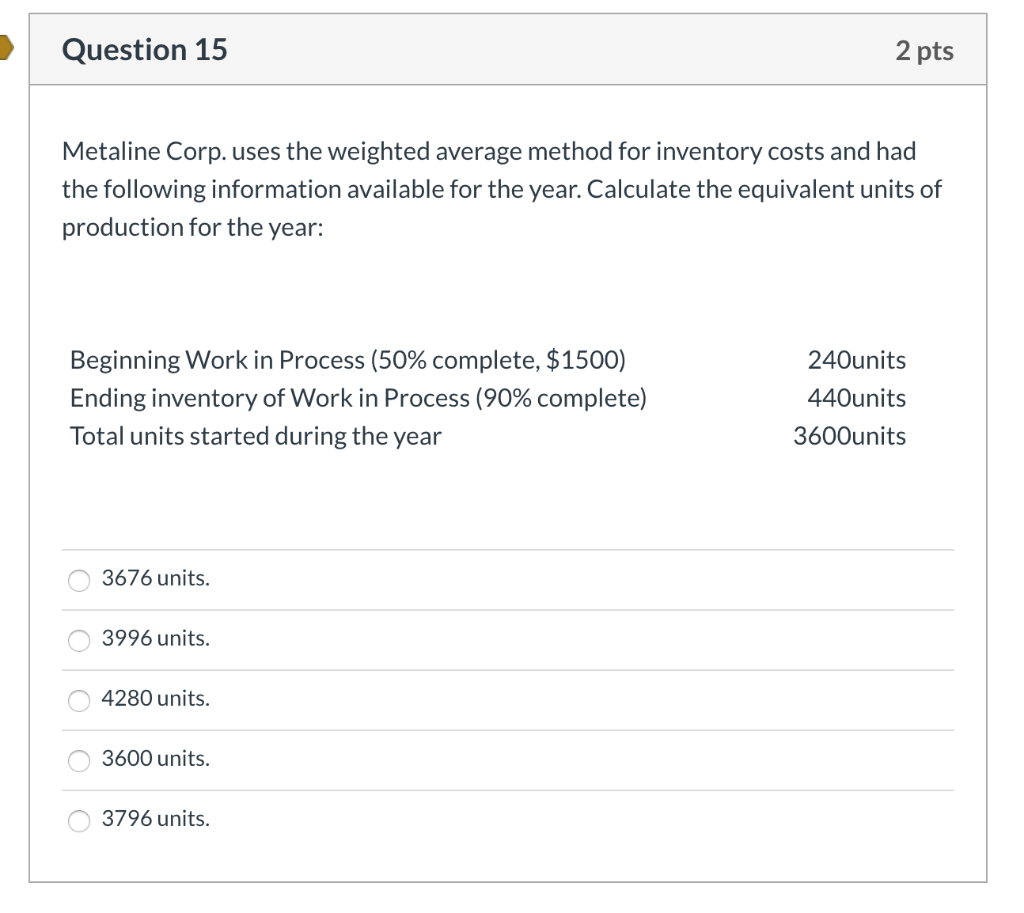

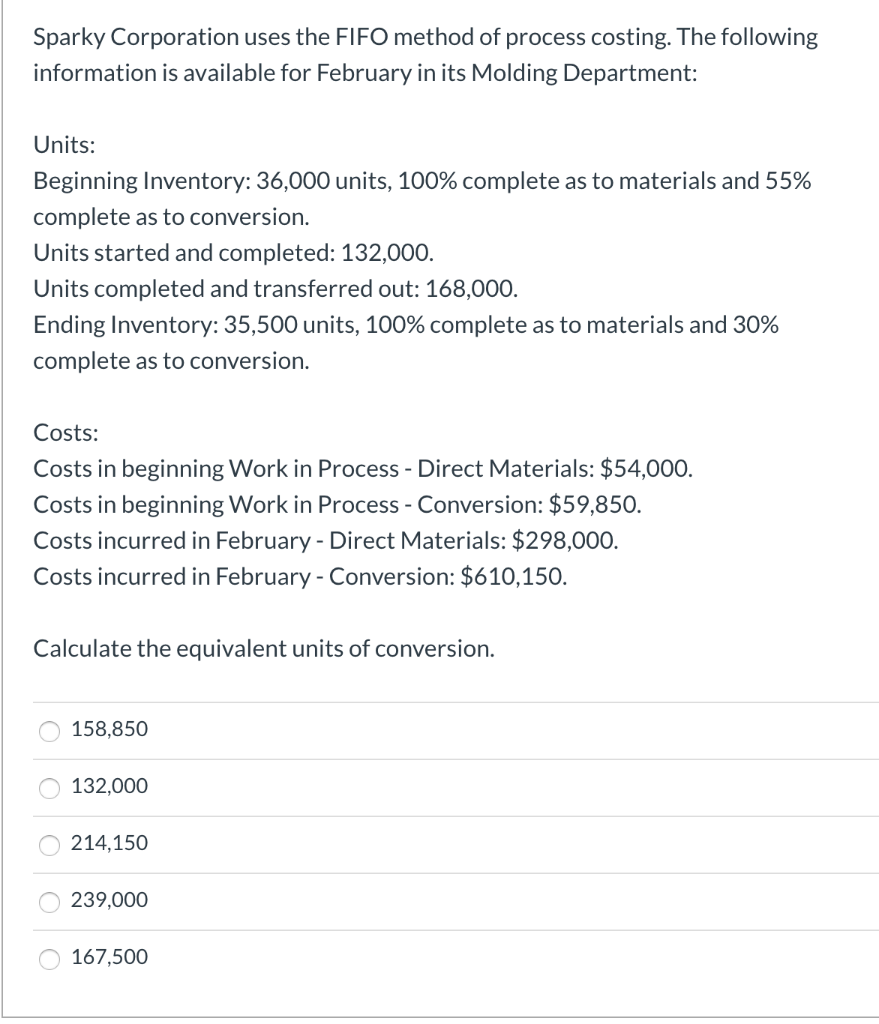

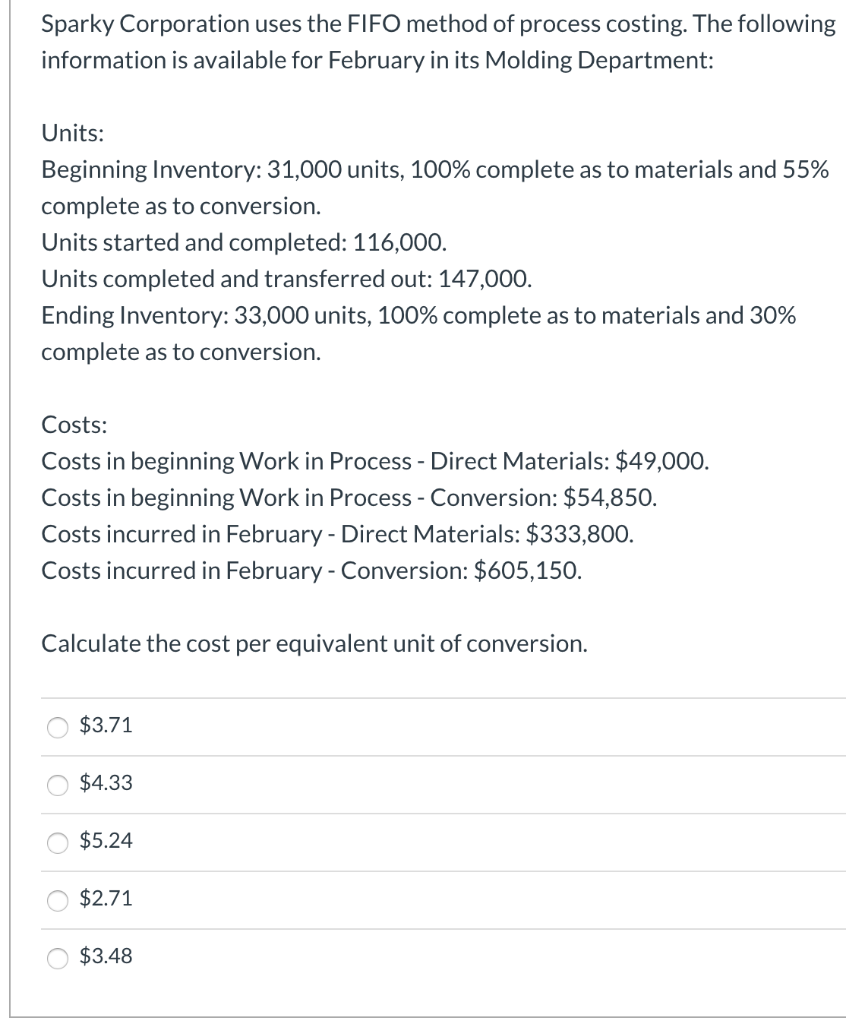

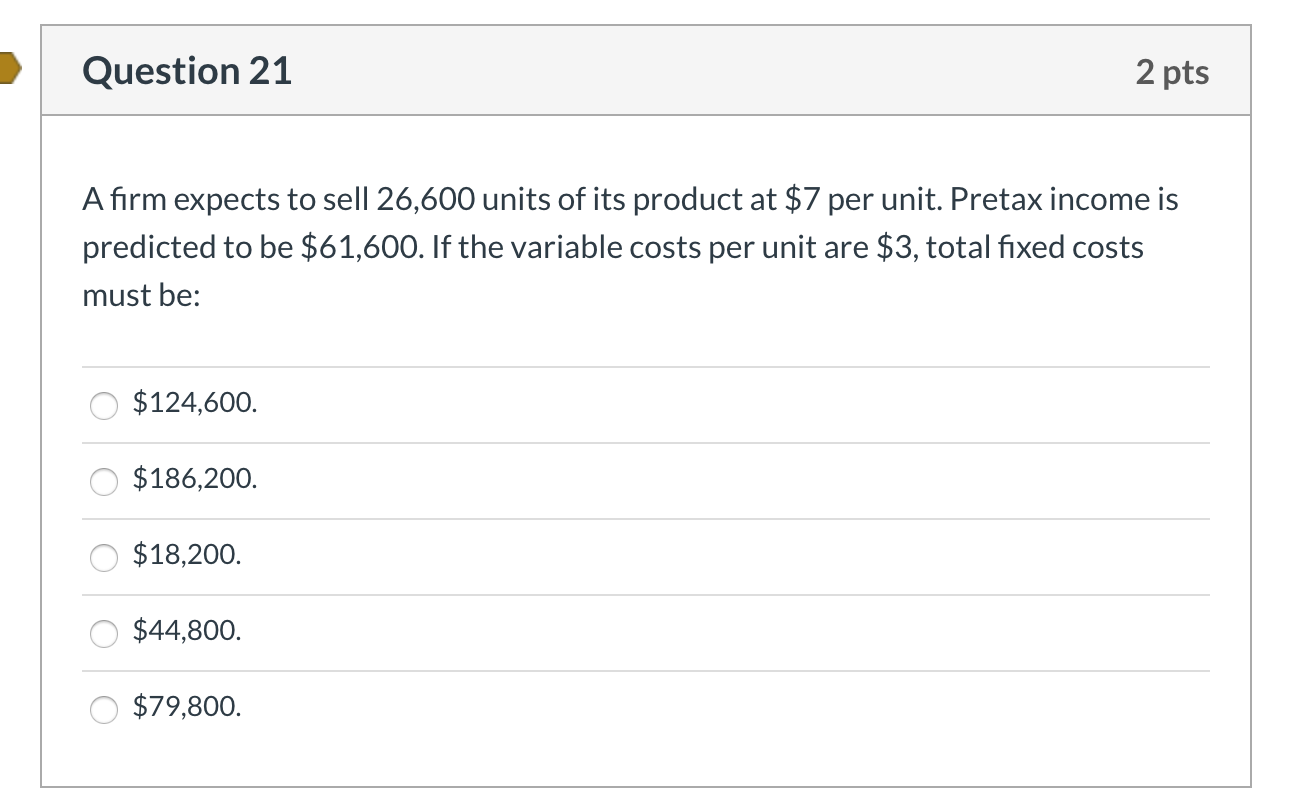

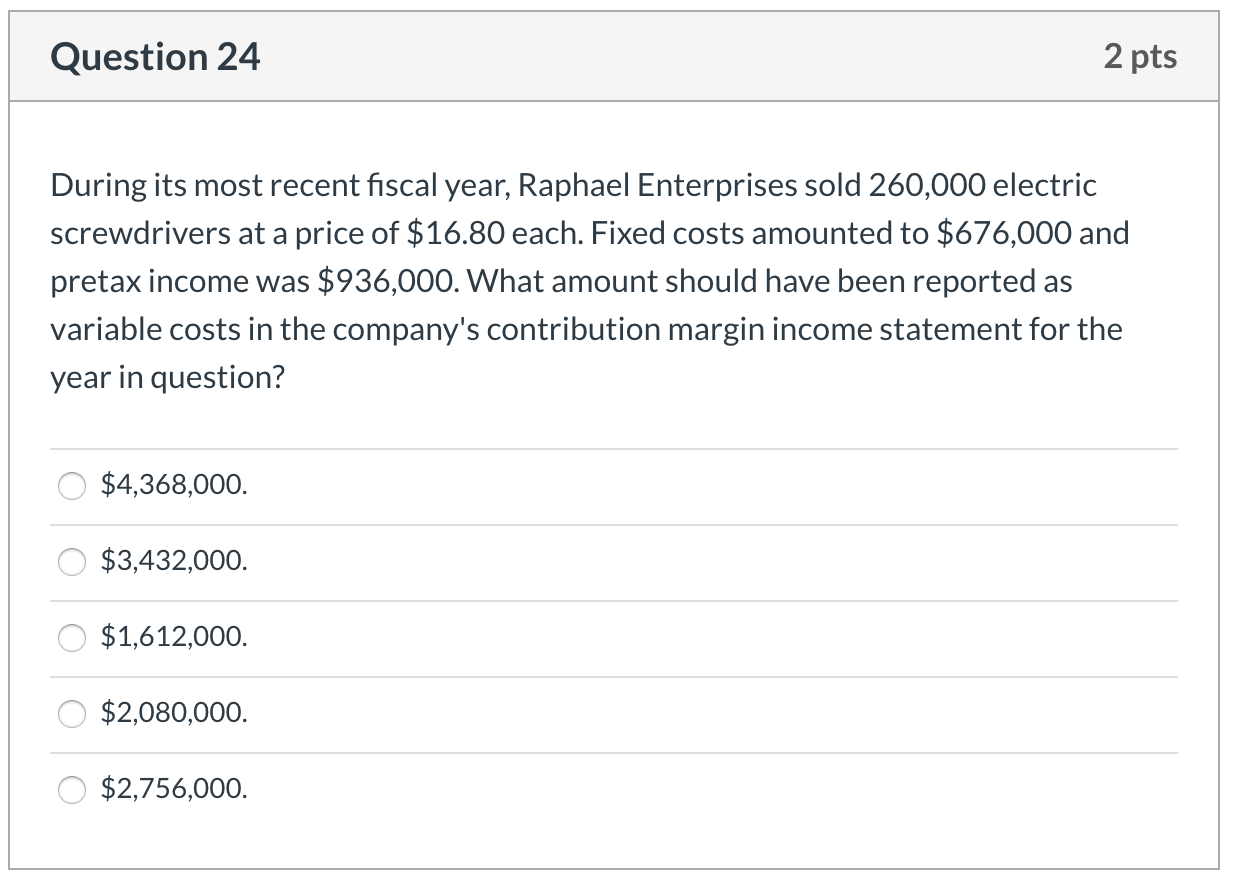

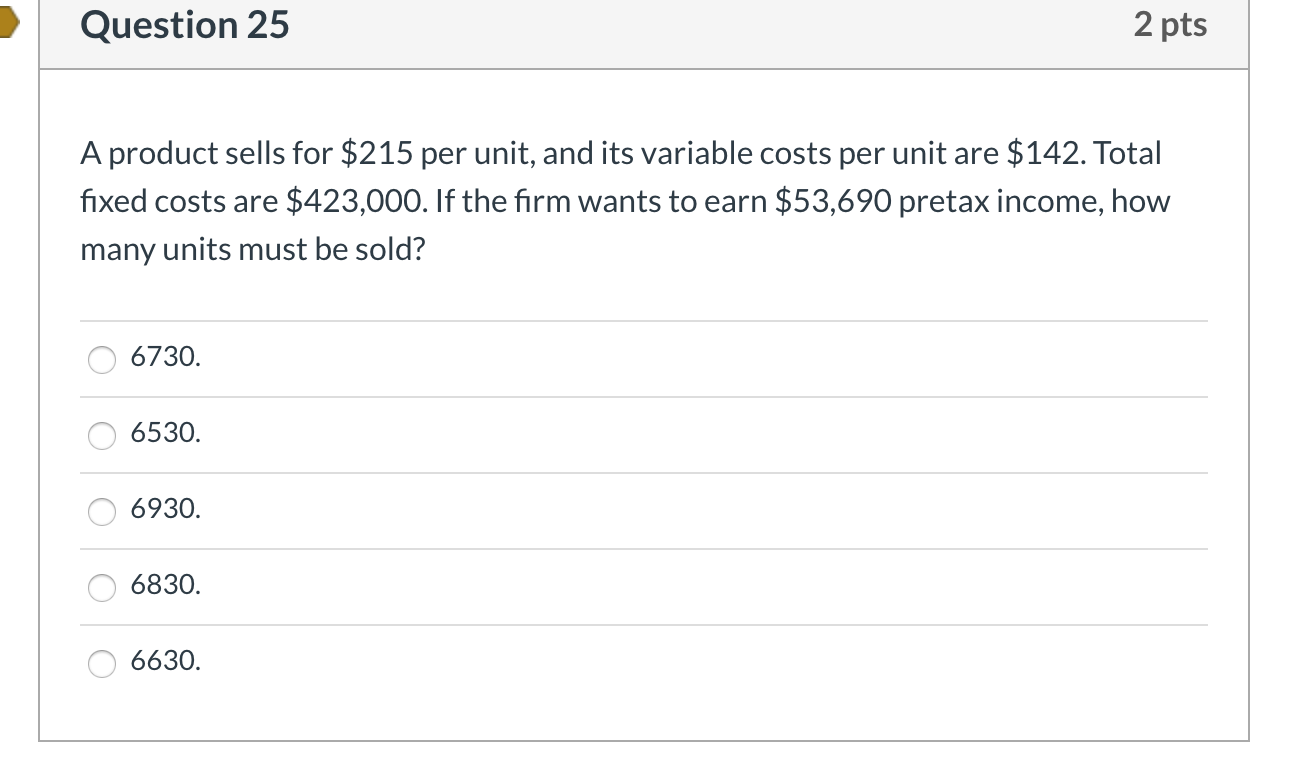

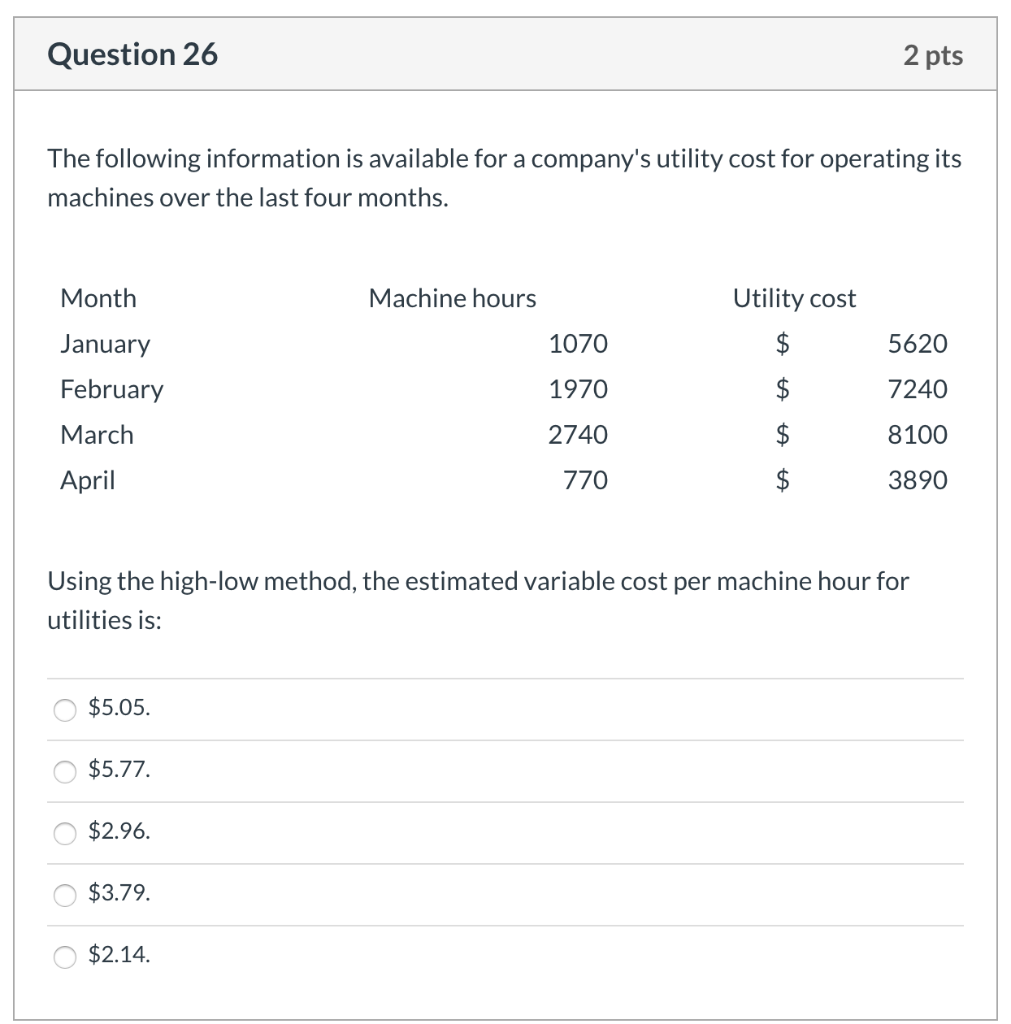

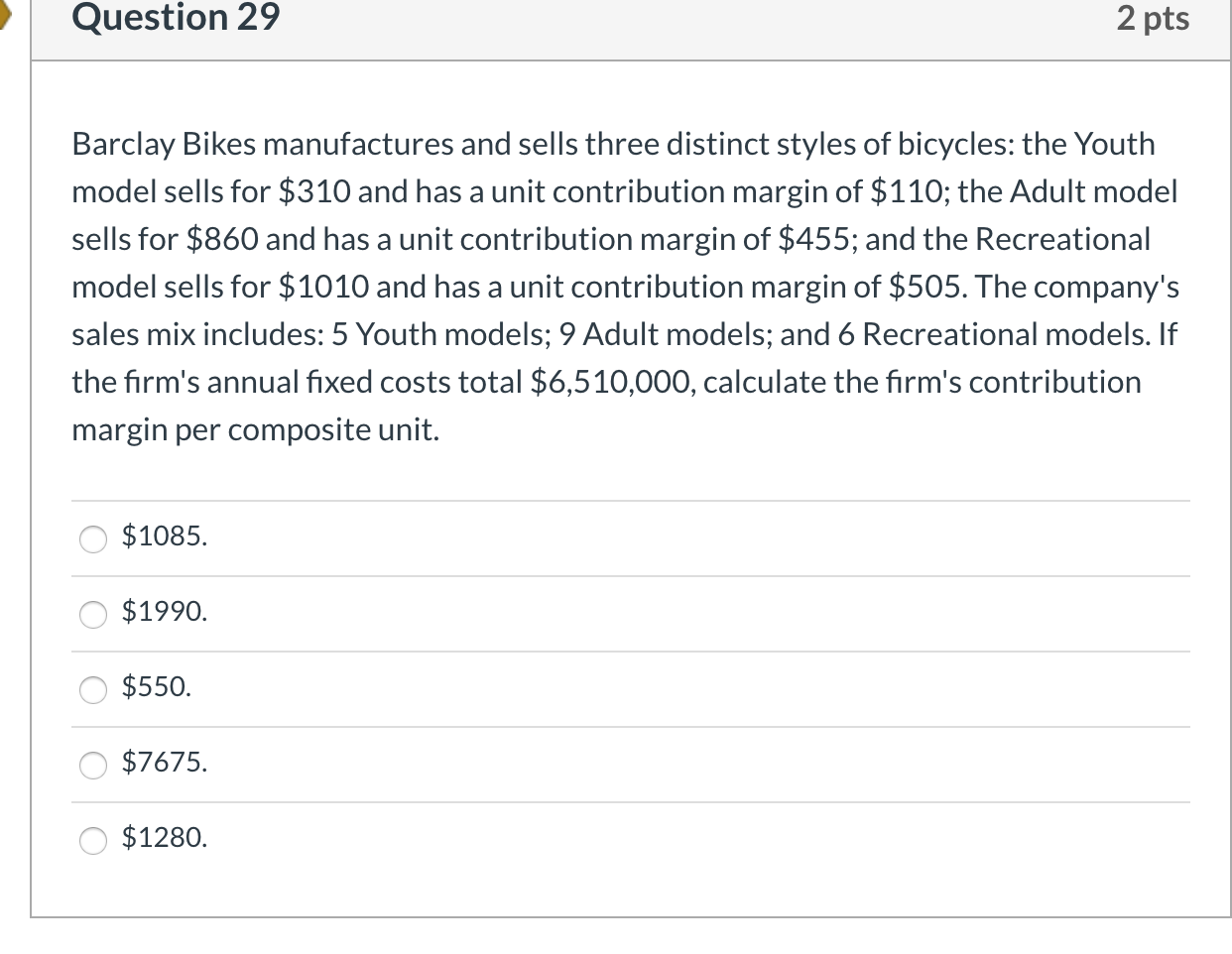

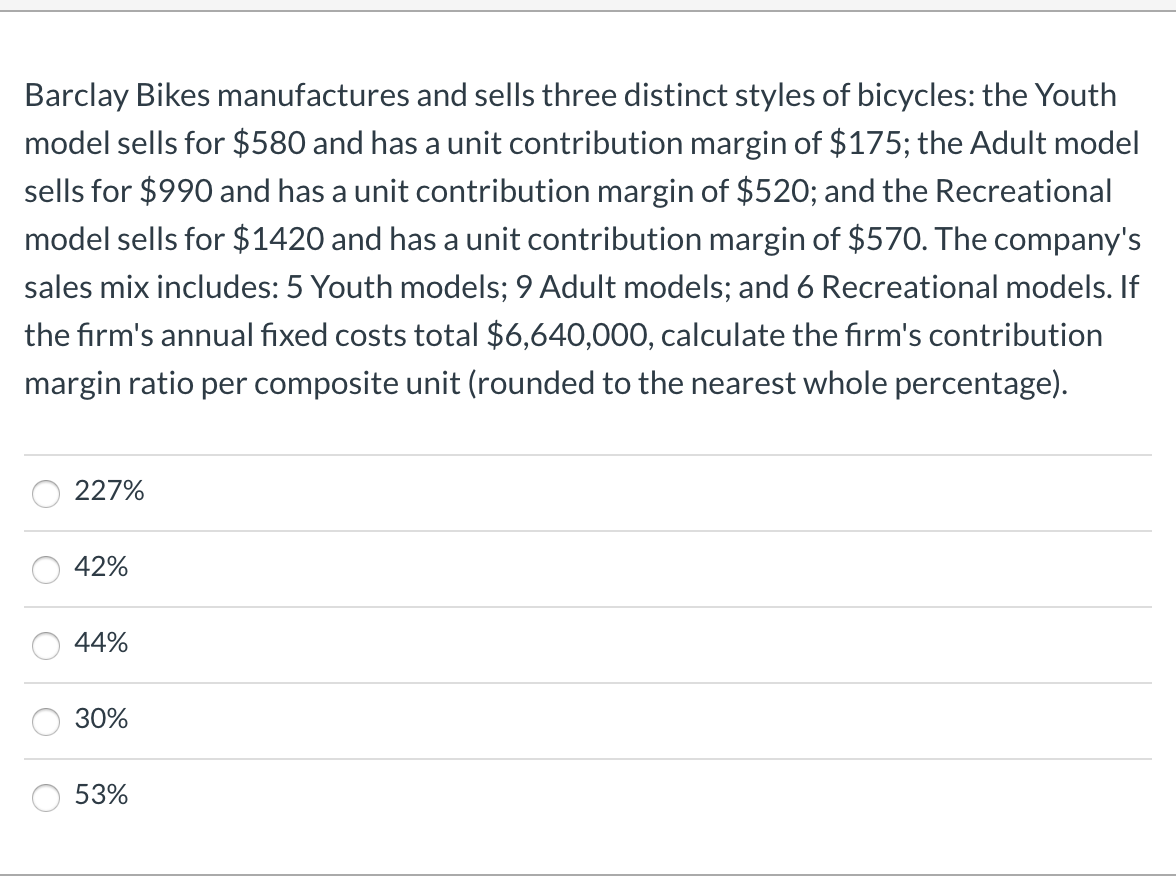

Question 5 2 pts Use the cost information below for Ruiz Inc. to determine the total manufacturing costs incurred during the year: Work in Process, January 1 Work in Process, December 31 Direct materials used Total factory overhead Direct labor used $ 51,200 37,600 $ 13,100 6100 27,100 O $97,500. O $91,400. $46,300. O $13,600. O $59,900. Xia Co. manufactures a single product. All raw materials used are traceable to specific units of product. Current information for company follows: Beginning raw materials inventory Ending raw materials inventory Raw material purchases Beginning work in process inventory Ending work in process inventory Direct labor Total factory overhead Beginning finished goods inventory Ending finished goods inventory $26,000 29,000 103,000 38,000 48,000 128,000 103,000 78,000 58,000 The company's cost of direct materials used, cost of goods manufactured and cost of goods sold is: OD. $100,000 $321,000 $341,000 OC. $100,000 $341,000 $301,000 o Cost of Materials Used Cost of Goods Manufactured Cost of Goods Sold $ 103,000 $321,000 $301,000 A. 0 $106,000 $321,000 $341,000 0 $100,000 $341,000 $321,000 Question 7 2 pts Job A3B was ordered by a customer on September 25. During the month of September, Jaycee Corporation requisitioned $3400 of direct materials and used $4900 of direct labor. The job was not finished by the end of September, but needed an additional $3900 of direct materials and additional direct labor of $8300 to finish the job in October. The company applies overhead at the end of each month at a rate of 200% of the direct labor cost incurred. What is the balance in the Work in Process account at the end of September relative to Job A3B? $13,200 $12,200 $18,100 $8300 O $7300 Question 8 2 pts Job A3B was ordered by a customer on September 25. During the month of September, Jaycee Corporation requisitioned $2400 of direct materials and used $3900 of direct labor. The job was not finished by the end of September, but needed an additional $2900 of direct materials and additional direct labor of $6400 to finish the job in October. The company applies overhead at the end of each month at a rate of 100% of the direct labor cost incurred. What is the total cost of the job when it is completed in October? O $25,900 O $15,700 0 $24,900 $15,600 0 $19,600 Question 10 2 pts CWN Company uses a job order costing system and last period incurred $87,000 of actual overhead and $100,000 of direct labor. CWN estimates that its overhead next period will be $68,000. It also expects to incur $100,000 of direct labor cost. If CWN bases applied overhead on direct labor cost, its predetermined overhead rate for the next period should be: 0115%. 0 87% O 128%. 0 147%. O 68%. Question 12 2 pts Mango Company applies overhead based on direct labor costs. For the current year, Mango Company estimated total overhead costs to be $580,000, and direct labor costs to be $290,000. Actual overhead costs for the year totaled $596,000, and actual direct labor costs totaled $324,000. At year-end, the balance in the Factory Overhead account is a: 0 $52,000 Debit balance. O $324,000 Debit balance. 0 $52,000 Credit balance. O $596,000 Debit balance. O $648,000 Credit balance. Question 13 2 pts A company's beginning Work in Process inventory consisted of 28,500 units that were 20% complete with respect to direct labor. These beginning units were completed and another 103,600 units were started during the current period. Of those started, 68,500 were finished and the remaining 35,100 were 40% complete at the end of the period. Using the weighted average method, the equivalent units of production with regard to direct labor were: 0 68,500. O 85,900. O 114,700. 0111,040. 0 91,300. The following refers to units processed by a breakfast cereal maker in August. Compute the total equivalent units of production with respect to conversion for August using the weighted-average inventory method. Beginning Work in Process Units started Units completed Ending Work in Process Units of Product 289,000 505,000 574,300 219,700 Percent of Conversion Added 50% 100% 100% 40% 0794,000 806,680 O 718,800 0 662,180 O 574,300 Question 15 2 pts Metaline Corp. uses the weighted average method for inventory costs and had the following information available for the year. Calculate the equivalent units of production for the year: Beginning Work in Process (50% complete, $1500) Ending inventory of Work in Process (90% complete) Total units started during the year 240units 440units 3600units 3676 units. 3996 units. 4280 units. 3600 units. 3796 units. Sparky Corporation uses the FIFO method of process costing. The following information is available for February in its Molding Department: Units: Beginning Inventory: 36,000 units, 100% complete as to materials and 55% complete as to conversion. Units started and completed: 132,000. Units completed and transferred out: 168,000. Ending Inventory: 35,500 units, 100% complete as to materials and 30% complete as to conversion. Costs: Costs in beginning Work in Process - Direct Materials: $54,000. Costs in beginning Work in Process - Conversion: $59,850. Costs incurred in February - Direct Materials: $298,000. Costs incurred in February - Conversion: $610,150. Calculate the equivalent units of conversion. 158,850 132,000 o 214,150 239,000 O 167,500 Sparky Corporation uses the FIFO method of process costing. The following information is available for February in its Molding Department: Units: Beginning Inventory: 31,000 units, 100% complete as to materials and 55% complete as to conversion. Units started and completed: 116,000. Units completed and transferred out: 147,000. Ending Inventory: 33,000 units, 100% complete as to materials and 30% complete as to conversion. Costs: Costs in beginning Work in Process - Direct Materials: $49,000. Costs in beginning Work in Process - Conversion: $54,850. Costs incurred in February - Direct Materials: $333,800. Costs incurred in February - Conversion: $605,150. Calculate the cost per equivalent unit of conversion. $3.71 $4.33 $5.24 O $2.71 O $3.48 Question 21 2 pts A firm expects to sell 26,600 units of its product at $7 per unit. Pretax income is predicted to be $61,600. If the variable costs per unit are $3, total fixed costs must be: O $124,600. O $186,200. 0 $18,200. 0 $44,800. 0 $79,800. Question 24 2 pts During its most recent fiscal year, Raphael Enterprises sold 260,000 electric screwdrivers at a price of $16.80 each. Fixed costs amounted to $676,000 and pretax income was $936,000. What amount should have been reported as variable costs in the company's contribution margin income statement for the year in question? O $4,368,000. 0 $3,432,000. $1,612,000. O $2,080,000. 0 $2,756,000. Question 25 2 pts A product sells for $215 per unit, and its variable costs per unit are $142. Total fixed costs are $423,000. If the firm wants to earn $53,690 pretax income, how many units must be sold? 0 6730. 0 6530. 0 6930. O 6830. 0 6630. Question 26 2 pts The following information is available for a company's utility cost for operating its machines over the last four months. Month Machine hours Utility cost January 1070 A 5620 7240 February 1970 " March 2740 8100 " April 770 3890 " Using the high-low method, the estimated variable cost per machine hour for utilities is: $5.05. $5.77. $2.96. O $3.79. $2.14. Question 29 2 pts Barclay Bikes manufactures and sells three distinct styles of bicycles: the Youth model sells for $310 and has a unit contribution margin of $110; the Adult model sells for $860 and has a unit contribution margin of $455; and the Recreational model sells for $1010 and has a unit contribution margin of $505. The company's sales mix includes: 5 Youth models; 9 Adult models; and 6 Recreational models. If the firm's annual fixed costs total $6,510,000, calculate the firm's contribution margin per composite unit. 0 $1085. O $1990. O $550. 0 $7675. 0 $1280. Question 35 2 pts Bluebird Mfg. has received a special one-time order for 15,000 bird feeders at $4.00 per unit. Bluebird currently produces and sells 75,000 units at $8.00 each. This level represents 80% of its capacity. These bird feeders would be marketed under the wholesaler's name and would not affect Bluebird's sales through its normal channels. Production costs for these units are $5.00 per unit, which includes $2.75 variable cost and $2.25 fixed cost. If Bluebird accepts this additional business, the effect on net income will be: 0 $41,250 decrease. 0 $60,000 increase. O $15,000 decrease. 0 $41,250 increase. 0 $18,750 increase. Question 3) 2 pts Bricktan Inc. makes three products, basic, classic, and deluxe. The maximum Bricktan can sell is 730,000 units of basic, 540,000 units of classic, and 270,000 units of deluxe. Bricktan has limited production capacity of 150,000 hours. It can produce 10 units of basic, 8 units of classic, and 4 units of deluxe per hour. Contribution margin per unit is $15.00 for the basic, $25.00 for the classic, and $55.00 for the deluxe. What is the most profitable sales mix for Bricktan Inc.? 0 300,000 basic, 270,000 classic and 540,000 deluxe. 0 1,200,000 basic, 0 classic and 270,000 deluxe. 0 73,000 basic, 540,000 classic and 540,000 deluxe. 0 270,000 basic, 540,000 classic and 270,000 deluxe. O 150,000 basic, 540,000 classic and 270,000 deluxe