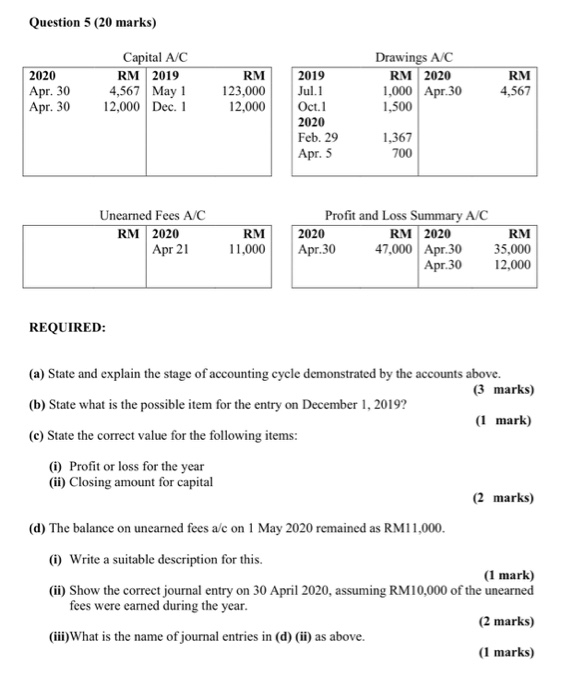

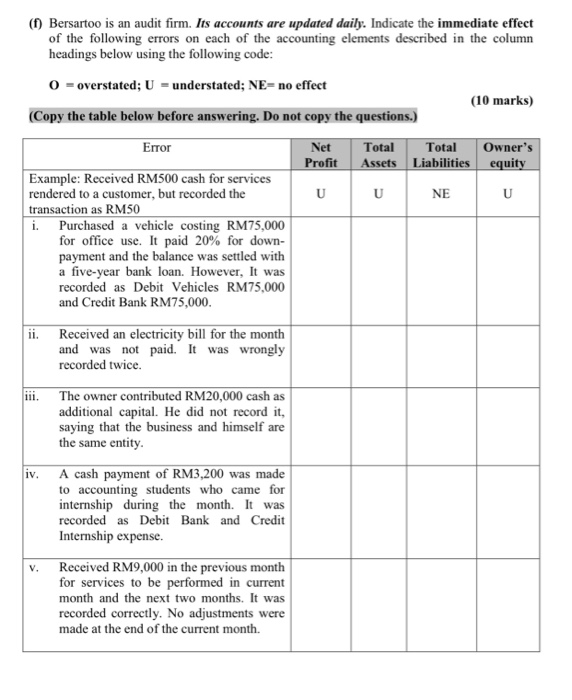

Question 5 (20 marks) 2020 Apr. 30 Apr. 30 Capital A/C RM 2019 ,567 May 1 12,000 Dec. 1 Drawings A/C RM 2020 1,000 Apr.30 1,500 RM 123,000 12,000 4 RM 4,567 2019 Jul. 1 Oct. 1 2020 Feb. 29 Apr. 5 1,367 700 Unearned Fees A/C RM 2020 Apr 21 RM 11,000 Profit and Loss Summary A/C 2020 RM 2020 Apr.30 47,000 Apr 30 Apr.30 RM 35,000 12,000 REQUIRED: (a) State and explain the stage of accounting cycle demonstrated by the accounts above. (3 marks) (b) State what is the possible item for the entry on December 1, 2019? (1 mark) (c) State the correct value for the following items: (0) Profit or loss for the year (ii) Closing amount for capital (2 marks) (d) The balance on unearned fees a/c on 1 May 2020 remained as RM11,000. (i) Write a suitable description for this. (1 mark) (ii) Show the correct journal entry on 30 April 2020, assuming RM10,000 of the unearned fees were earned during the year. (2 marks) (iii) What is the name of journal entries in (d) (ii) as above. (1 marks) (1) Bersartoo is an audit firm. Its accounts are updated daily. Indicate the immediate effect of the following errors on each of the accounting elements described in the column headings below using the following code: O = overstated; U = understated; NE= no effect (10 marks) (Copy the table below before answering. Do not copy the questions.) Error Net Profit Total Assets Total Liabilities Owner's equity NE Example: Received RM500 cash for services rendered to a customer, but recorded the transaction as RM50 Purchased a vehicle costing RM75,000 for office use. It paid 20% for down- payment and the balance was settled with a five-year bank loan. However, It was recorded as Debit Vehicles RM75.000 and Credit Bank RM75,000. Received an electricity bill for the month and was not paid. It was wrongly recorded twice. The owner contributed RM20,000 cash as additional capital. He did not record it, saying that the business and himself are the same entity. A cash payment of RM3,200 was made to accounting students who came for internship during the month. It was recorded as Debit Bank and Credit Internship expense. Received RM9,000 in the previous month for services to be performed in current month and the next two months. It was recorded correctly. No adjustments were made at the end of the current month