5.1.1

| Direct material usage variance |

| = |

| = |

| = |

(3 marks)

5.1.2

| Direct labour rate variance |

| = |

| = |

| = |

(3 marks)

5.1.3

| Direct labour efficiency variance |

| = |

| = |

| = |

(3 marks)

5.1.4

| Variable overhead expenditure variance |

| = |

| = |

| = |

| = |

(3 marks)

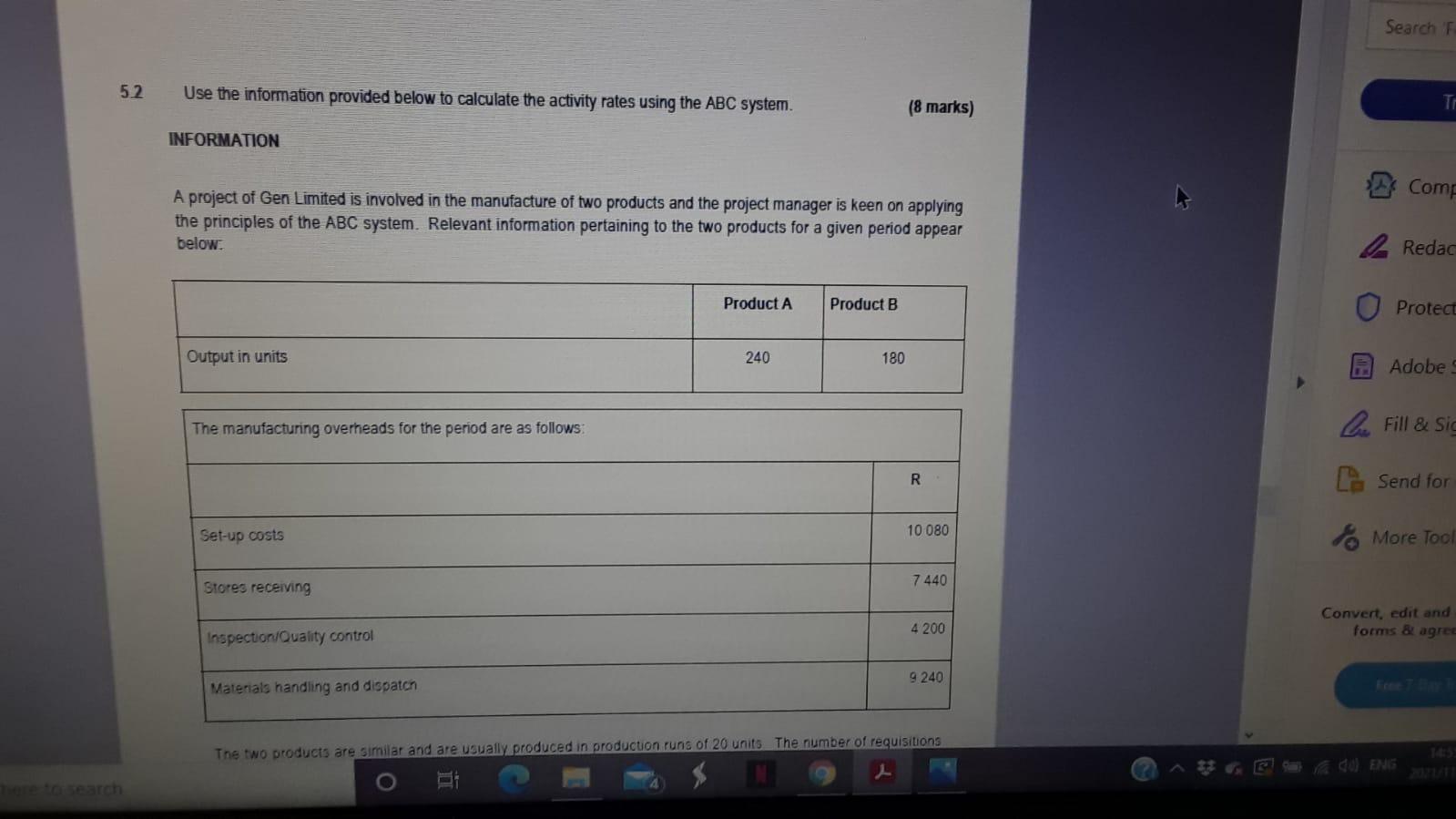

5.2

ABC COSTING

(8 marks)

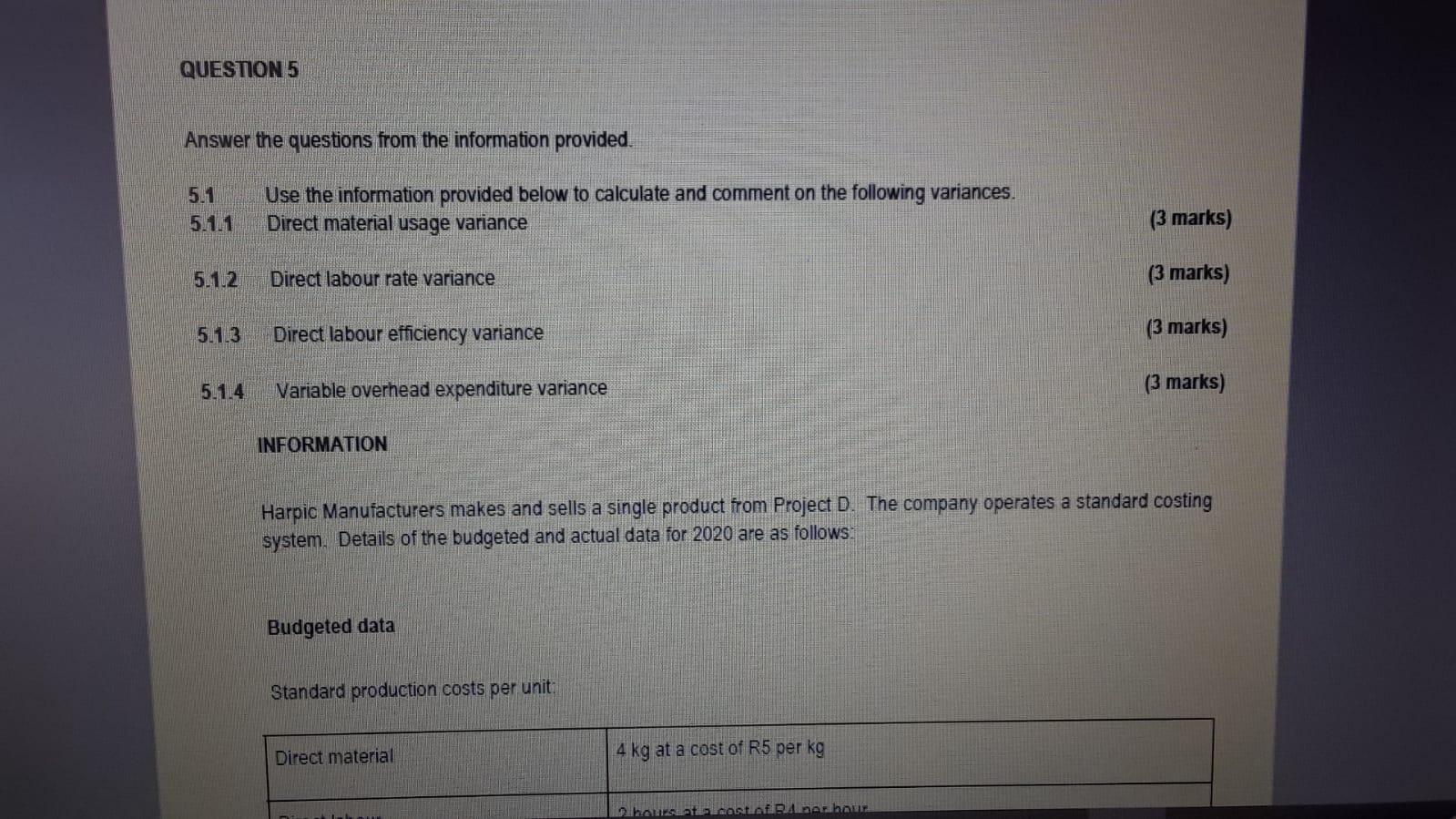

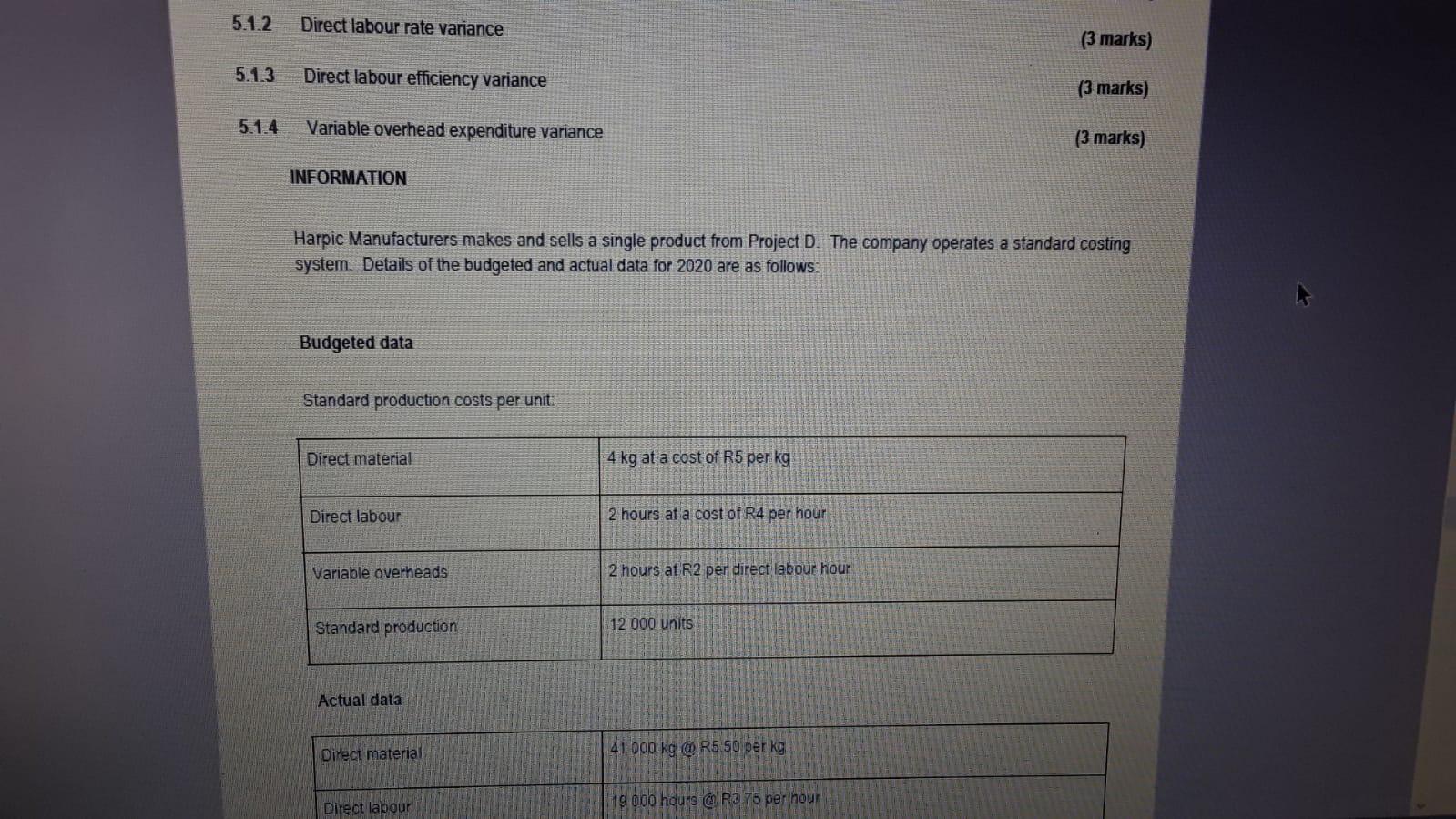

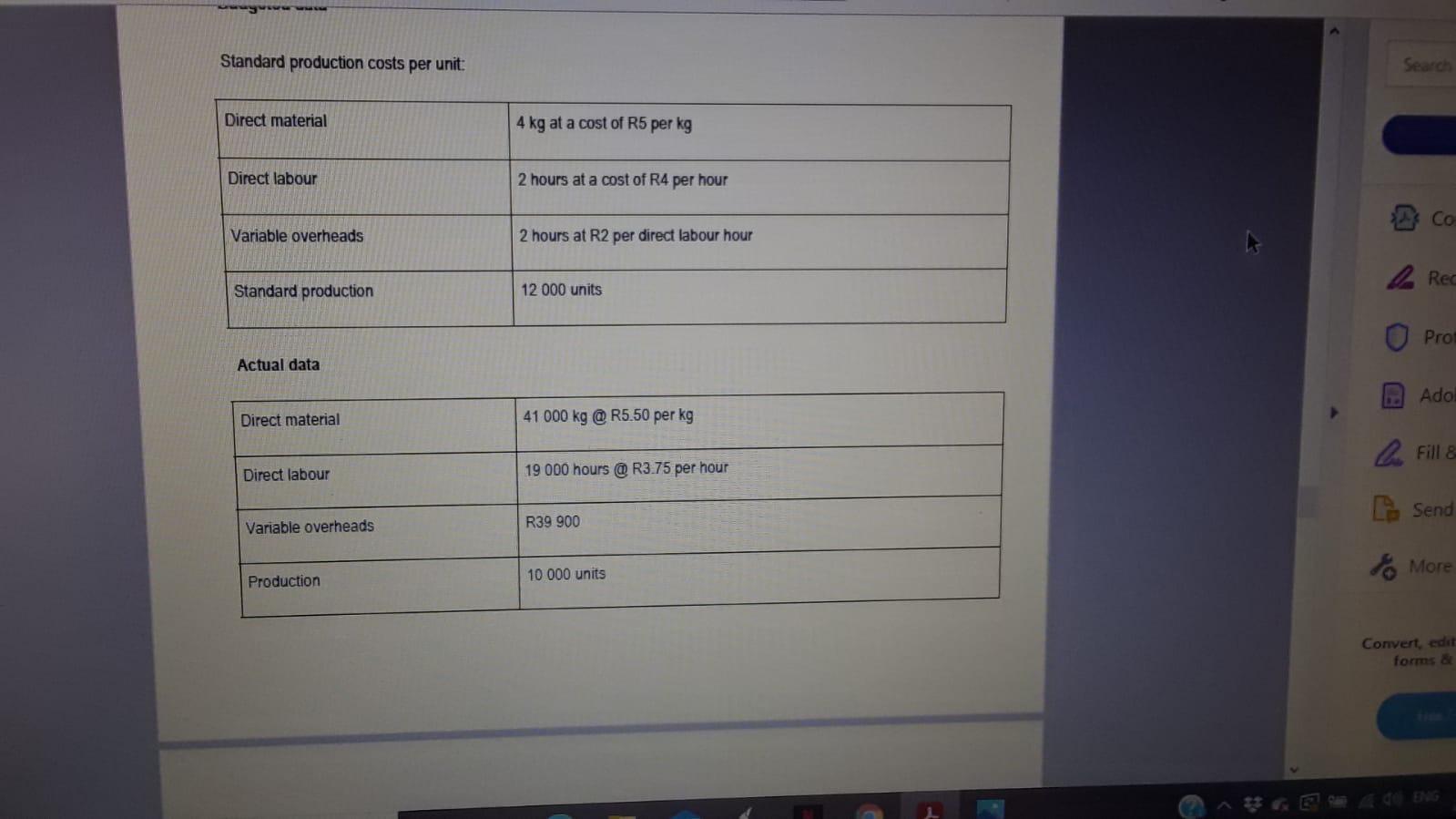

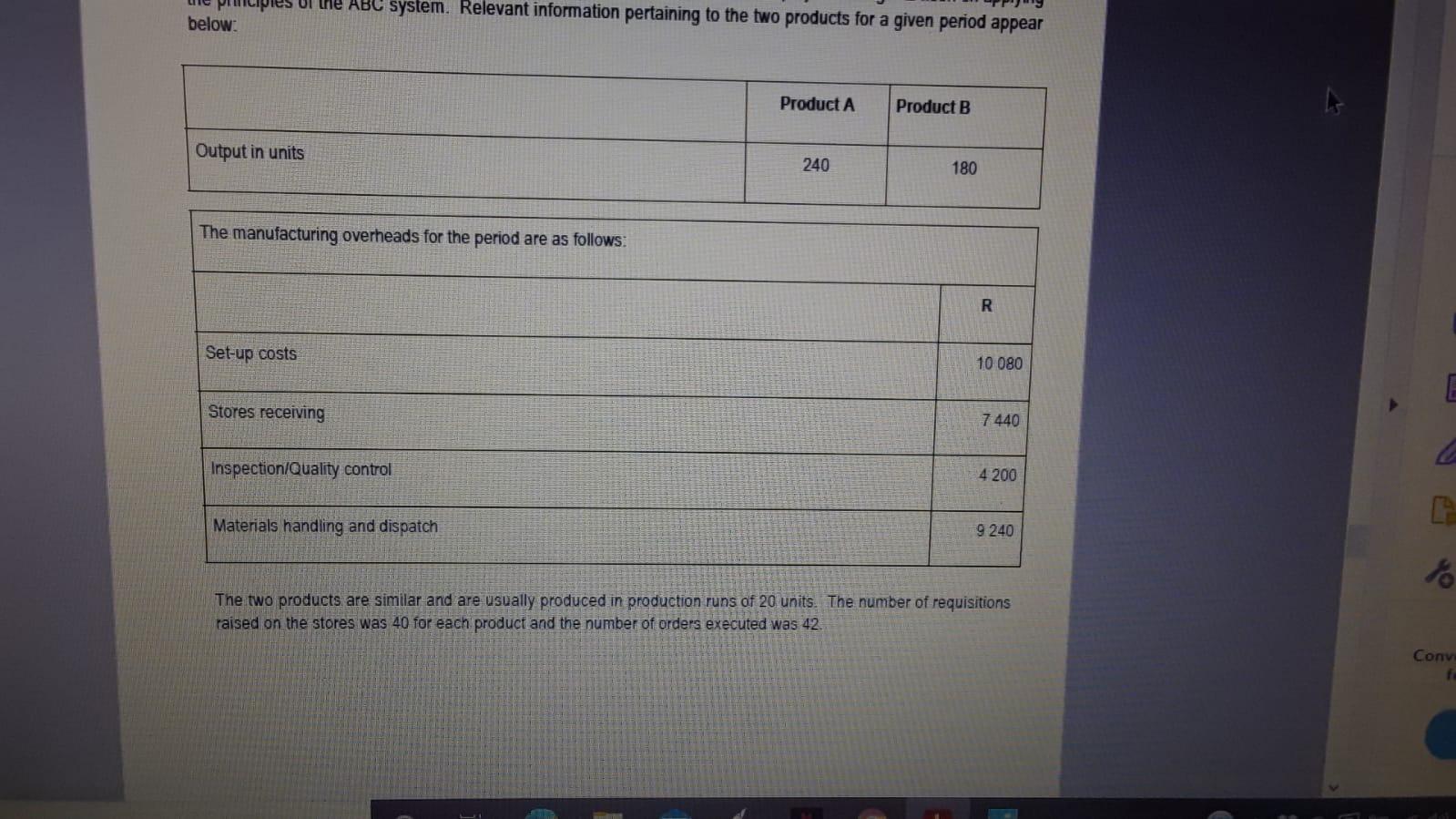

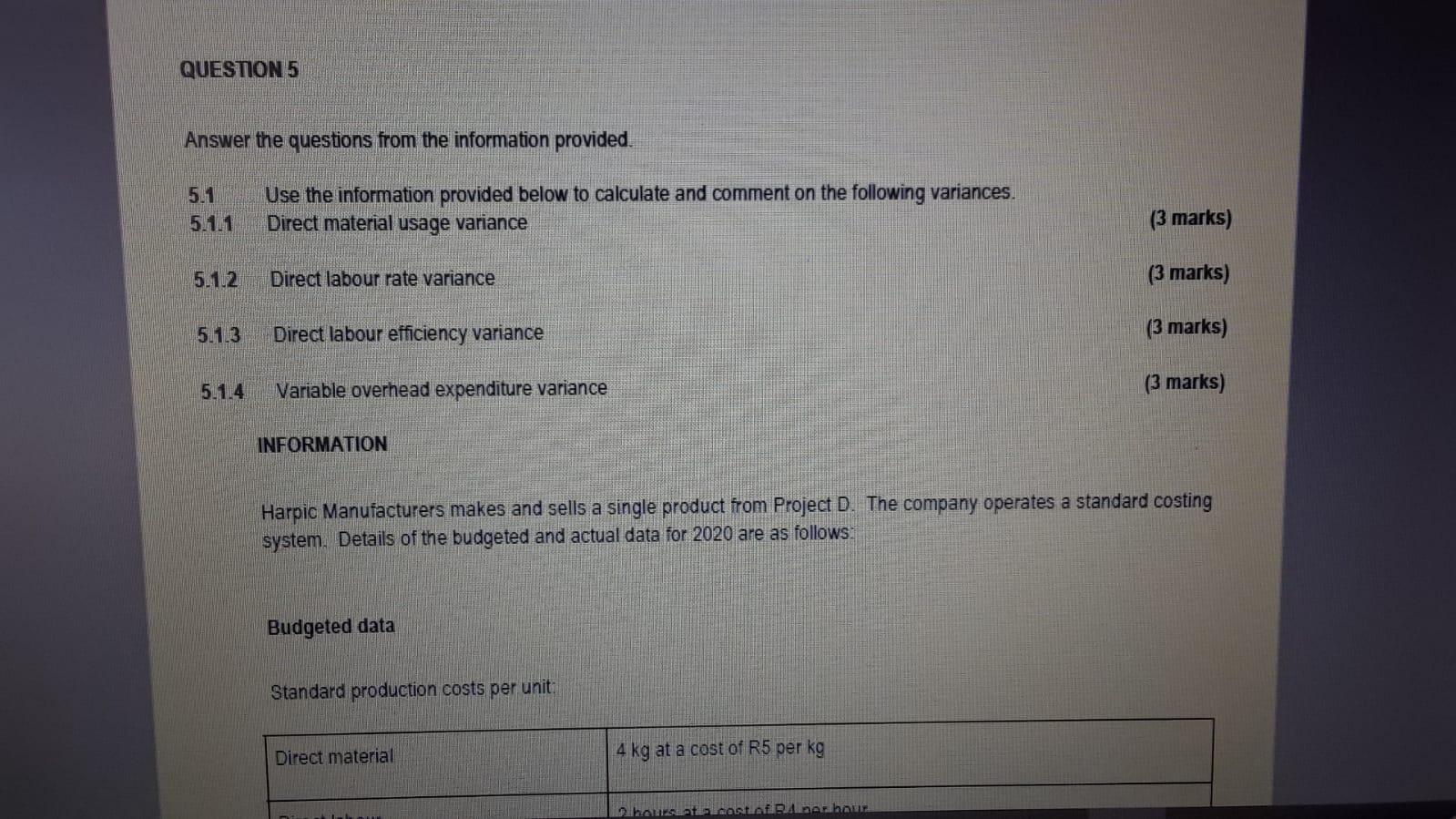

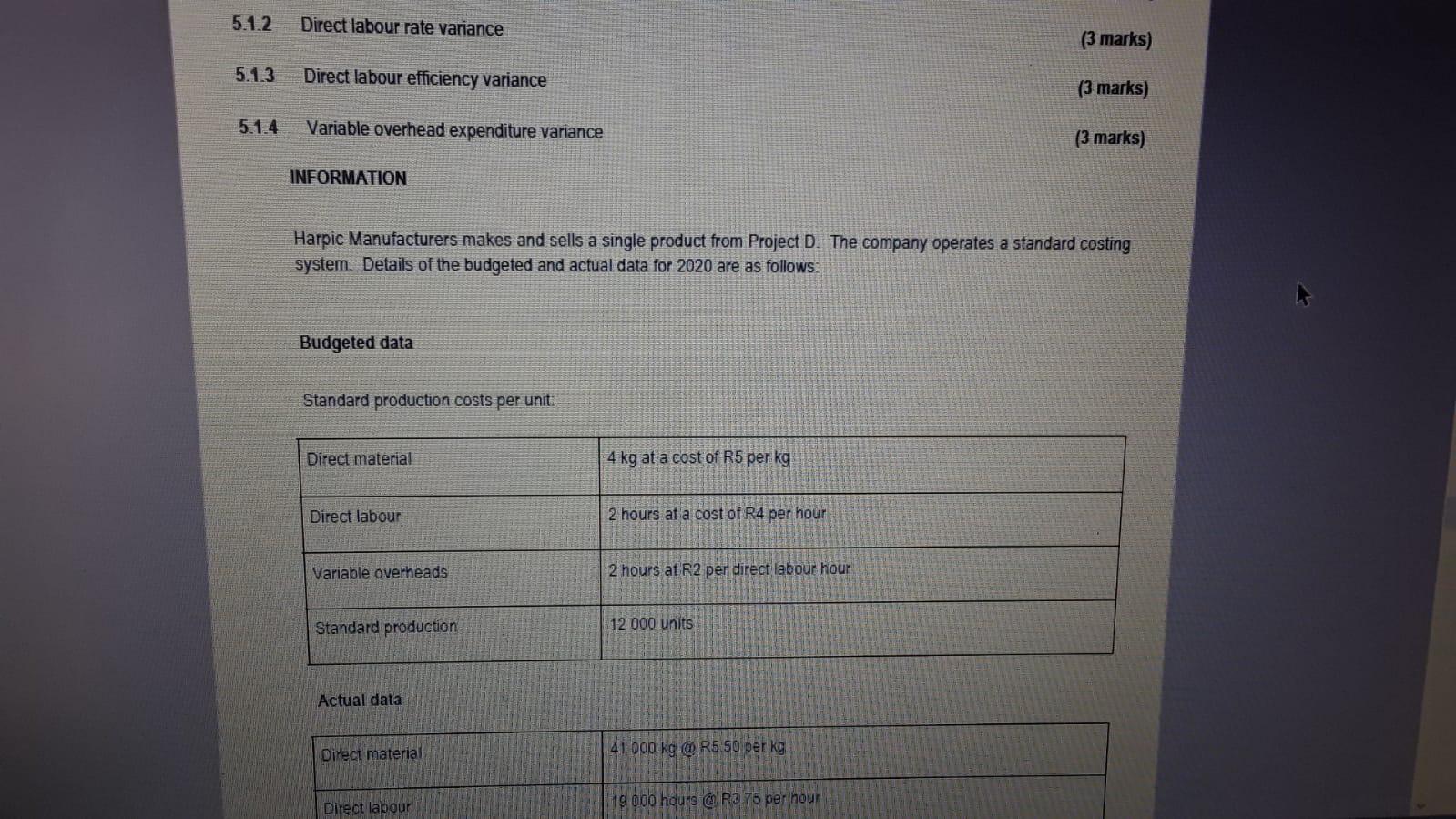

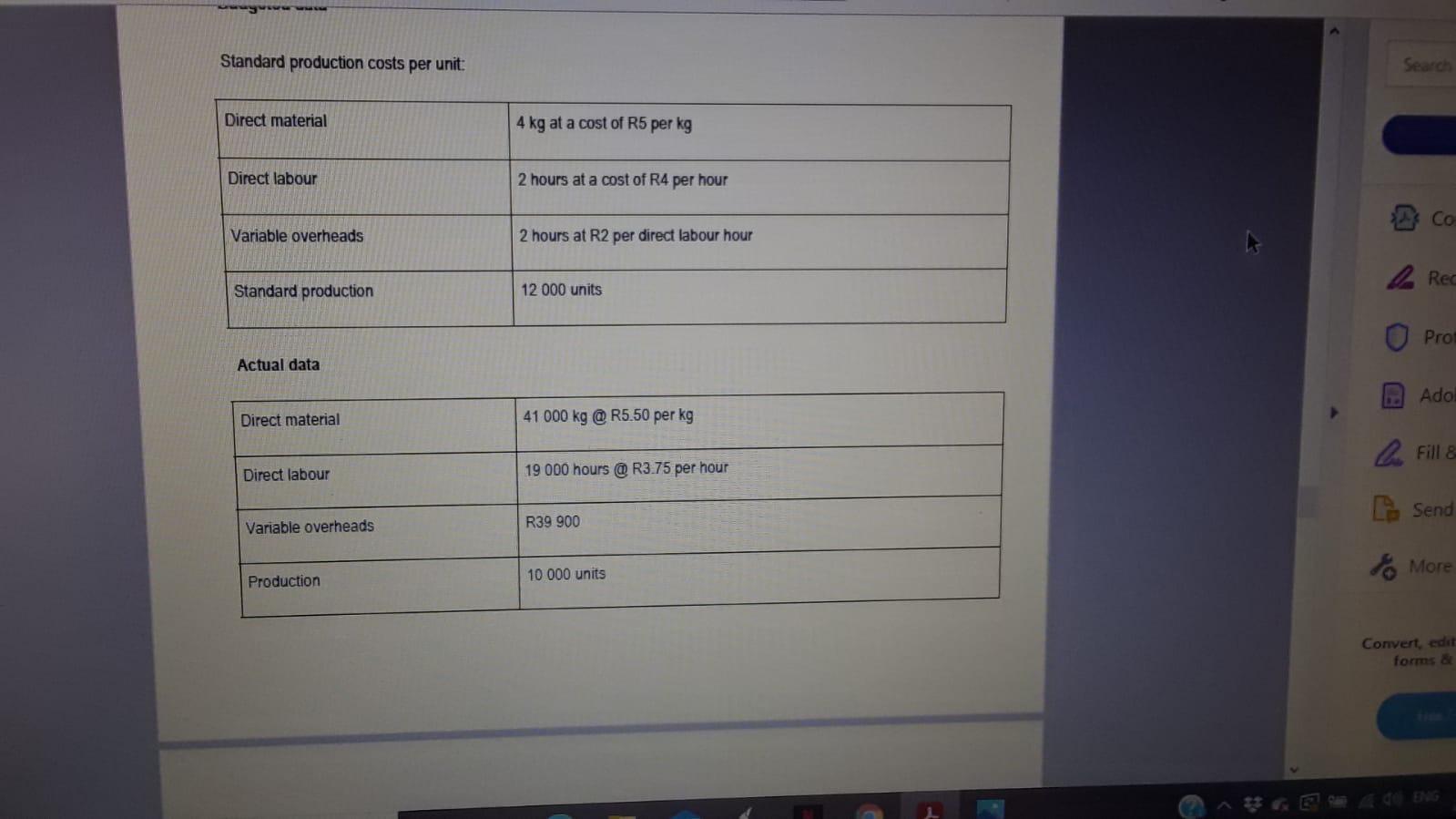

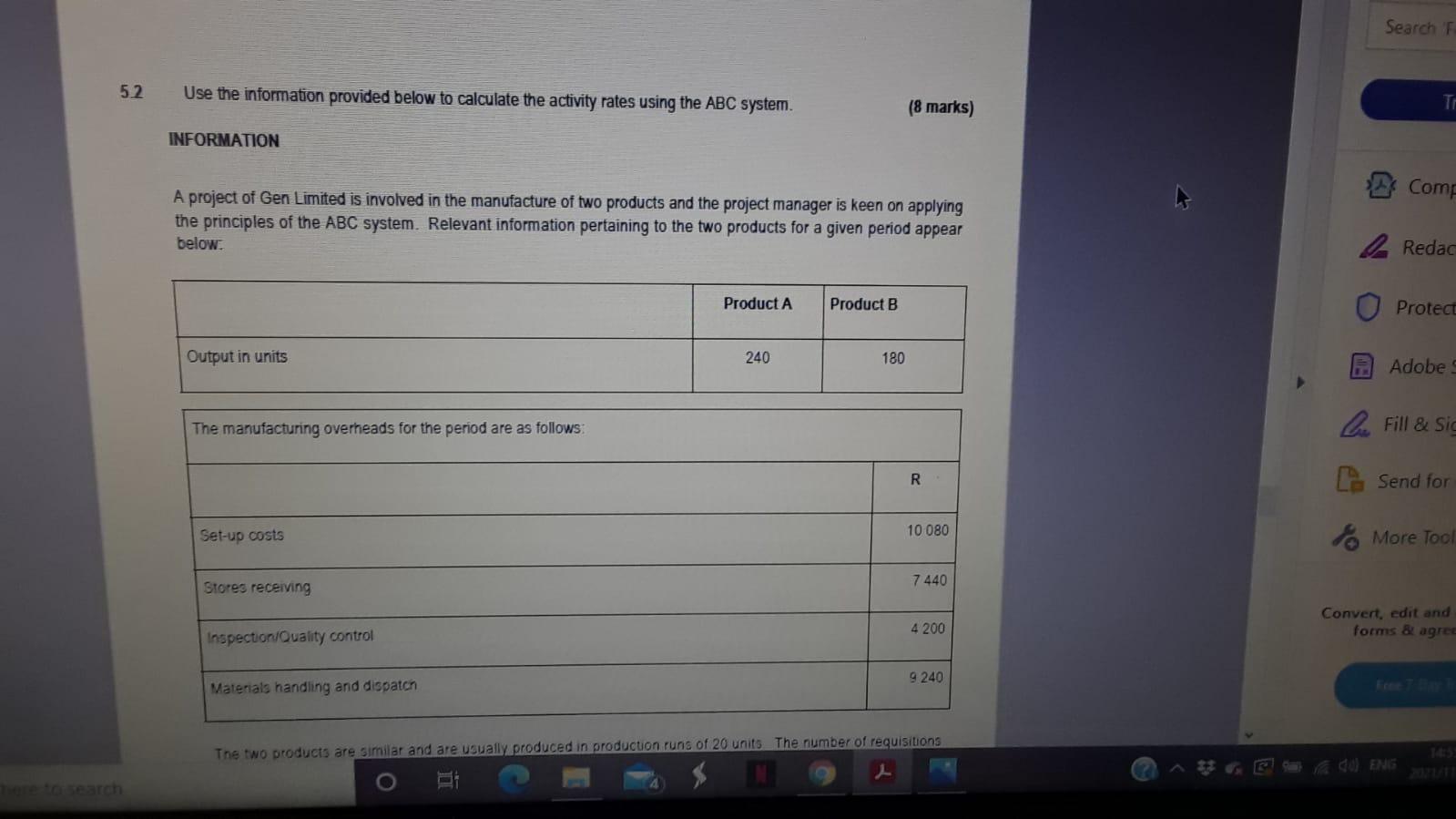

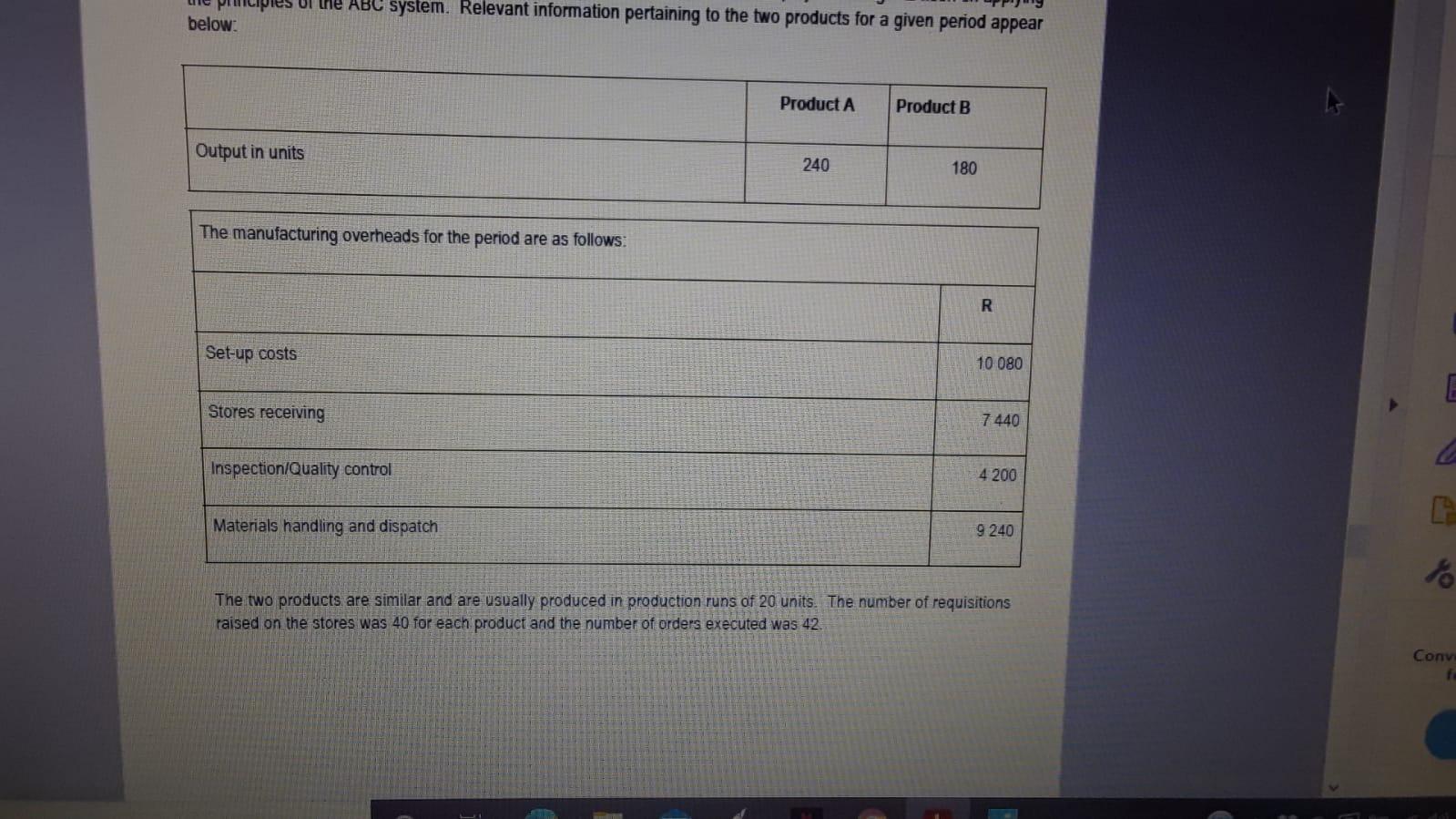

QUESTION 5 Answer the questions from the information provided. 5.1 5.1.1 Use the information provided below to calculate and comment on the following variances. Direct material usage variance (3 marks) 5.1.2 Direct labour rate variance (3 marks) 5.1.3 Direct labour efficiency variance (3 marks) 5.1.4 Variable overhead expenditure variance (3 marks) INFORMATION Harpic Manufacturers makes and sells a single product from Project D. The company operates a standard costing system. Details of the budgeted and actual data for 2020 are as follows: Budgeted data Standard production costs per unit: Direct material 4 kg at a cost of R5 per kg hon Sant Anahon 5.1.2 Direct labour rate variance (3 marks) 5.1.3 Direct labour efficiency variance (3 marks) 5.1.4 Variable overhead expenditure variance (3 marks) INFORMATION Harpic Manufacturers makes and sells a single product from Project D. The company operates a standard costing system. Details of the budgeted and actual data for 2020 are as follows: Budgeted data Standard production costs per unit: Direct material 4 kg at a cost of R5 per kg Direct labour 2 hours at a cost of R4 per hour Variable overheads 2 hours at R2 per direct labour hour Standard production 12 000 units Actual data Direct material 41 000 kg @ R5 50 per kg Direct labour 19 000 hours to R3 75 per hour unyevu Standard production costs per unit: Search Direct material 4 kg at a cost of R5 per kg Direct labour 2 hours at a cost of R4 per hour Variable overheads 2 hours at R2 per direct labour hour be Red Standard production 12 000 units Proi Actual data Adol Direct material 41 000 kg @ R5.50 per kg le Fill & Direct labour 19 000 hours @ R3.75 per hour Send Variable overheads R39 900 10 000 units More Production Convert dat forms & Search F 52 Use the information provided below to calculate the activity rates using the ABC system. (8 marks) TO INFORMATION Comp A project of Gen Limited is involved in the manufacture of two products and the project manager is keen on applying the principles of the ABC system. Relevant information pertaining to the two products for a given period appear below. Da Redac Product A Product B Protect Output in units 240 180 Adobe The manufacturing overheads for the period are as follows: Du Fill & Sic R Send for Set-up costs 10 080 More Tool 7 440 Stores receiving 4 200 Convert, edit and forms & agree Inspection Quality control 9 240 Materials handling and dispatch The two products are similar and are usually produced in production runs of 20 units The number of requisitions ENS ILIPIES UILE ABC system. Relevant information pertaining to the two products for a given period appear below: Product A Product B Output in units 240 180 The manufacturing overheads for the period are as follows: R Set-up costs 10 080 Stores receiving 7 440 Inspection/Quality control 4200 [ Materials handling and dispatch 9 240 o The two products are similar and are usually produced in production runs of 20 units. The number of requisitions raised on the stores was 40 for each product and the number of orders executed was 42 Conv f