Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 5 (20 MARKS) (a) Define residual claimants. (2 marks) (b) Louis is a securities analyst in an investment banking firm. His supervisor asked him

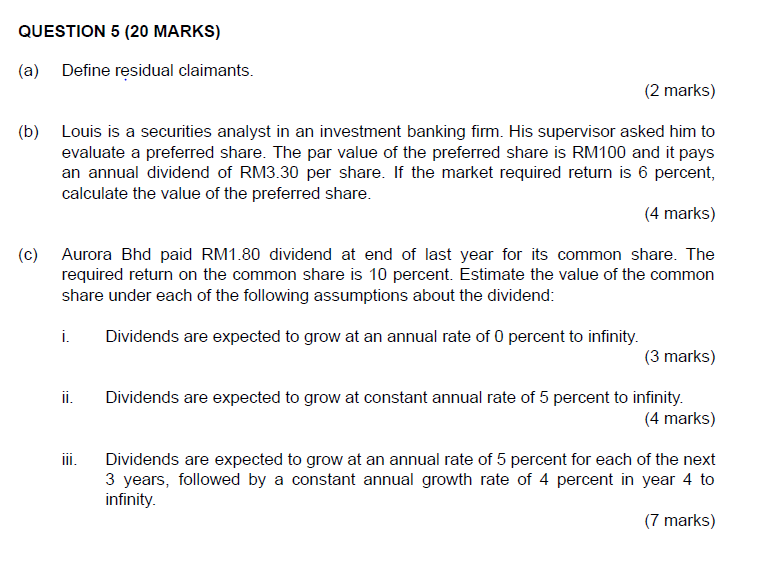

QUESTION 5 (20 MARKS) (a) Define residual claimants. (2 marks) (b) Louis is a securities analyst in an investment banking firm. His supervisor asked him to evaluate a preferred share. The par value of the preferred share is RM100 and it pays an annual dividend of RM3.30 per share. If the market required return is 6 percent, calculate the value of the preferred share. (4 marks) (c) Aurora Bhd paid RM1.80 dividend at end of last year for its common share. The required return on the common share is 10 percent. Estimate the value of the common share under each of the following assumptions about the dividend: i. Dividends are expected to grow at an annual rate of 0 percent to infinity. (3 marks) ii. Dividends are expected to grow at constant annual rate of 5 percent to infinity. (4 marks) iii. Dividends are expected to grow at an annual rate of 5 percent for each of the next 3 years, followed by a constant annual growth rate of 4 percent in year 4 to infinity. (7 marks)

QUESTION 5 (20 MARKS) (a) Define residual claimants. (2 marks) (b) Louis is a securities analyst in an investment banking firm. His supervisor asked him to evaluate a preferred share. The par value of the preferred share is RM100 and it pays an annual dividend of RM3.30 per share. If the market required return is 6 percent, calculate the value of the preferred share. (4 marks) (c) Aurora Bhd paid RM1.80 dividend at end of last year for its common share. The required return on the common share is 10 percent. Estimate the value of the common share under each of the following assumptions about the dividend: i. Dividends are expected to grow at an annual rate of 0 percent to infinity. (3 marks) ii. Dividends are expected to grow at constant annual rate of 5 percent to infinity. (4 marks) iii. Dividends are expected to grow at an annual rate of 5 percent for each of the next 3 years, followed by a constant annual growth rate of 4 percent in year 4 to infinity. (7 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started