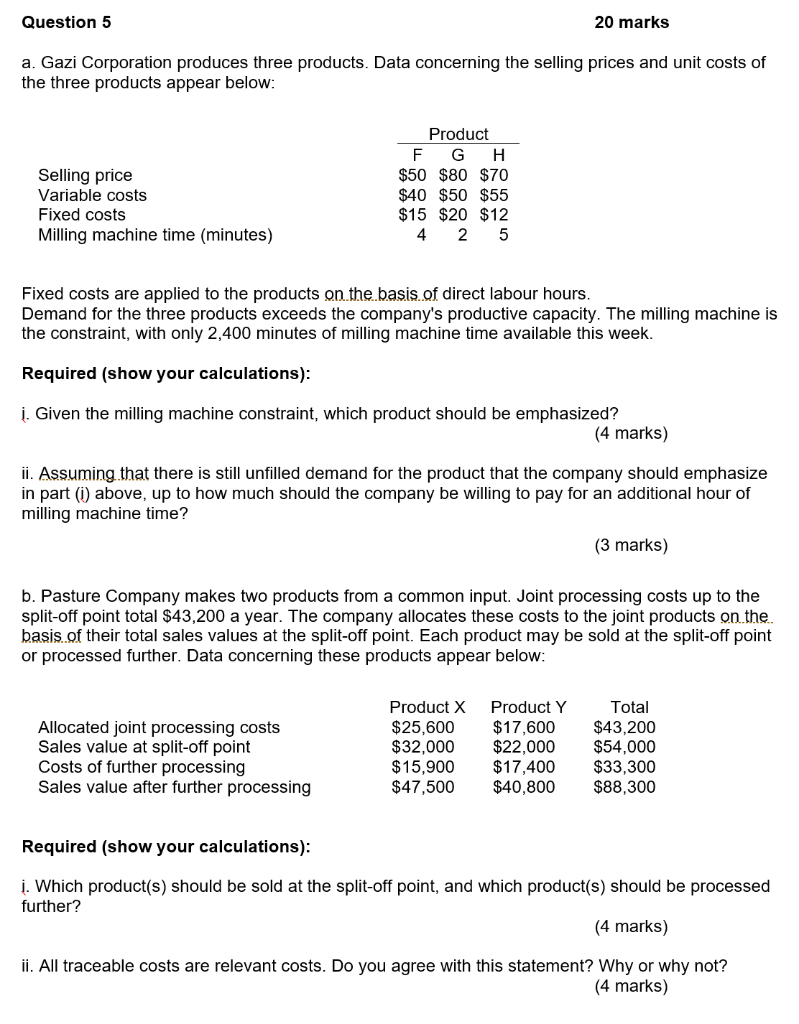

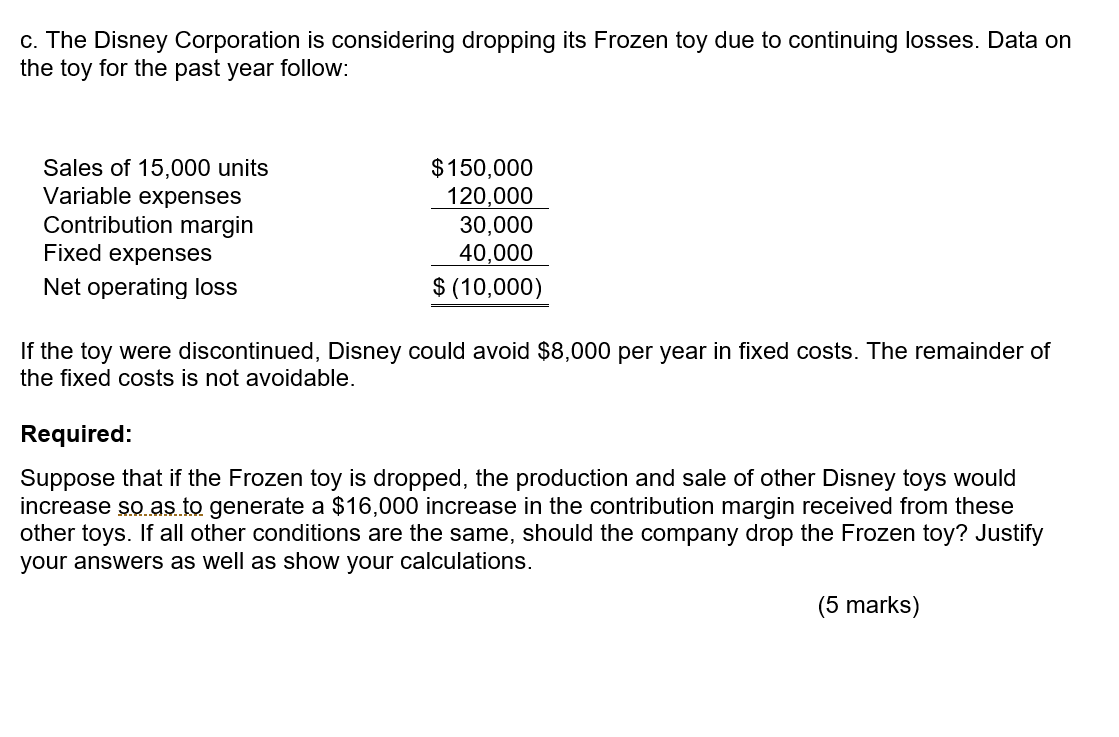

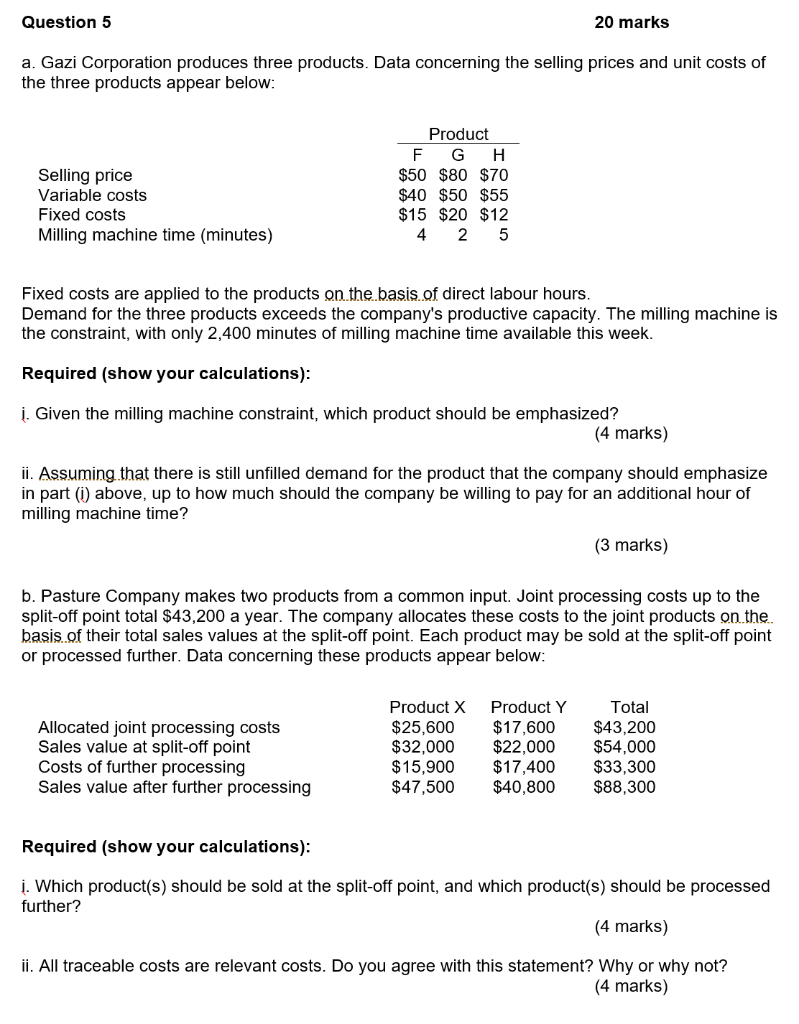

Question 5 20 marks a. Gazi Corporation produces three products. Data concerning the selling prices and unit costs of the three products appear below: Selling price Variable costs Fixed costs Milling machine time (minutes) Product F G H $50 $80 $70 $40 $50 $55 $15 $20 $12 4 2 5 Fixed costs are applied to the products on the basis of direct labour hours. Demand for the three products exceeds the company's productive capacity. The milling machine is the constraint, with only 2,400 minutes of milling machine time available this week. Required (show your calculations): . Given the milling machine constraint, which product should be emphasized? (4 marks) ii. Assuming that there is still unfilled demand for the product that the company should emphasize in part (1) above, up to how much should the company be willing to pay for an additional hour of milling machine time? (3 marks) b. Pasture Company makes two products from a common input. Joint processing costs up to the split-off point total $43,200 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below: Allocated joint processing costs Sales value at split-off point Costs of further processing Sales value after further processing Product X $25,600 $32,000 $15,900 $47,500 Product Y $17,600 $22,000 $17,400 $40,800 Total $43,200 $54,000 $33,300 $88,300 Required (show your calculations): . Which product(s) should be sold at the split-off point, and which product(s) should be processed further? (4 marks) ii. All traceable costs are relevant costs. Do you agree with this statement? Why or why not? (4 marks) c. The Disney Corporation is considering dropping its Frozen toy due to continuing losses. Data on the toy for the past year follow: Sales of 15,000 units Variable expenses Contribution margin Fixed expenses Net operating loss $ 150,000 120,000 30,000 40,000 $ (10,000) If the toy were discontinued, Disney could avoid $8,000 per year in fixed costs. The remainder of the fixed costs is not avoidable. Required: Suppose that if the Frozen toy is dropped, the production and sale of other Disney toys would increase so as to generate a $16,000 increase in the contribution margin received from these other toys. If all other conditions are the same, should the company drop the Frozen toy? Justify your answers as well as show your calculations