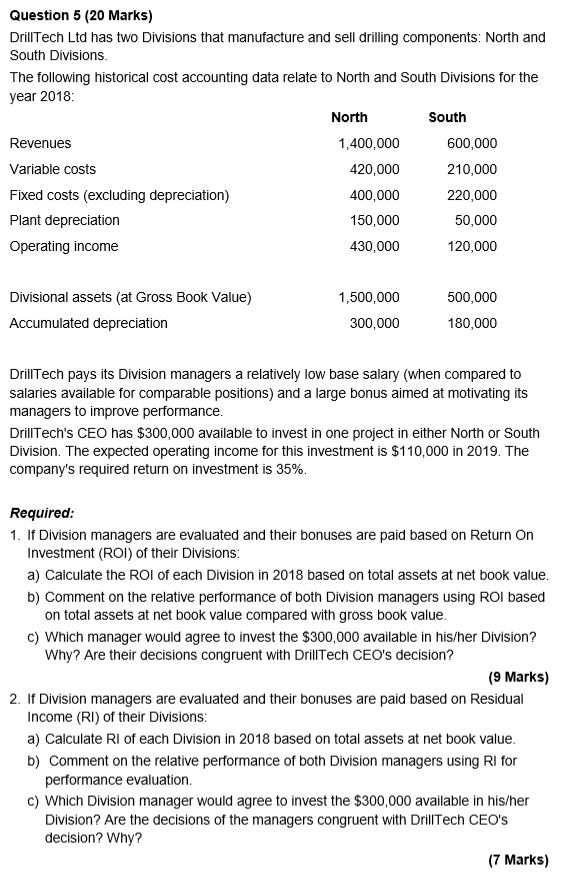

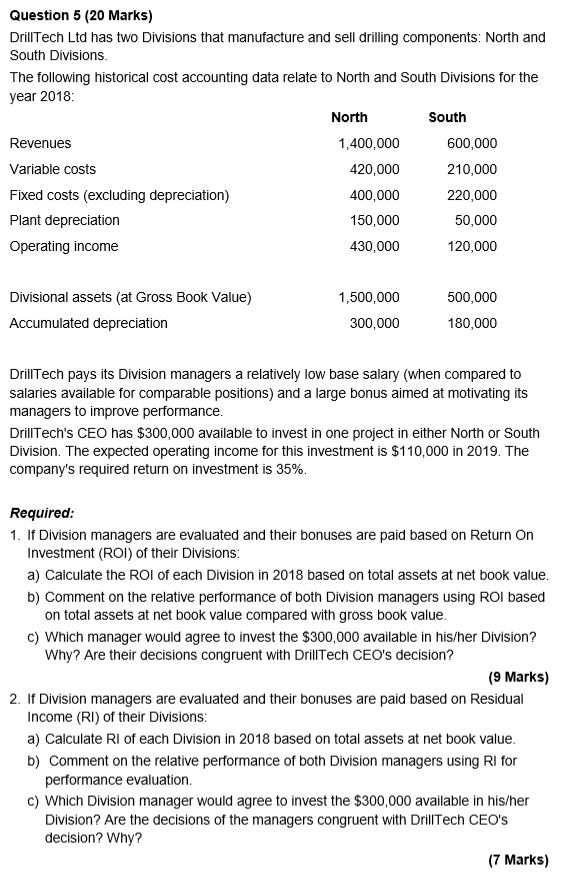

Question 5 (20 Marks) DrillTech Ltd has two Divisions that manufacture and sell drilling components: North and South Divisions. The following historical cost accounting data relate to North and South Divisions for the year 2018: North South Revenues 1,400,000 600,000 Variable costs 420,000 210,000 Fixed costs (excluding depreciation) 400,000 220,000 Plant depreciation 150,000 50,000 Operating income 430,000 120,000 Divisional assets (at Gross Book Value) Accumulated depreciation 1,500,000 300,000 500,000 180,000 DrillTech pays its Division managers a relatively low base salary (when compared to salaries available for comparable positions) and a large bonus aimed at motivating its managers to improve performance. Drill Tech's CEO has $300,000 available to invest in one project in either North or South Division. The expected operating income for this investment is $110,000 in 2019. The company's required return on investment is 35%. Required: 1. If Division managers are evaluated and their bonuses are paid based on Return On Investment (ROI) of their Divisions: a) Calculate the ROI of each Division in 2018 based on total assets at net book value. b) Comment on the relative performance of both Division managers using ROI based on total assets at net book value compared with gross book value. c) Which manager would agree to invest the $300,000 available in his/her Division? Why? Are their decisions congruent with Drill Tech CEO's decision? (9 Marks) 2. If Division managers are evaluated and their bonuses are paid based on Residual Income (RI) of their Divisions: a) Calculate RI of each Division in 2018 based on total assets at net book value. b) Comment on the relative performance of both Division managers using RI for performance evaluation. c) Which Division manager would agree to invest the $300,000 available in his/her Division? Are the decisions of the managers congruent with DrillTech CEO's decision? Why? (7 Marks) Question 5 (20 Marks) DrillTech Ltd has two Divisions that manufacture and sell drilling components: North and South Divisions. The following historical cost accounting data relate to North and South Divisions for the year 2018: North South Revenues 1,400,000 600,000 Variable costs 420,000 210,000 Fixed costs (excluding depreciation) 400,000 220,000 Plant depreciation 150,000 50,000 Operating income 430,000 120,000 Divisional assets (at Gross Book Value) Accumulated depreciation 1,500,000 300,000 500,000 180,000 DrillTech pays its Division managers a relatively low base salary (when compared to salaries available for comparable positions) and a large bonus aimed at motivating its managers to improve performance. Drill Tech's CEO has $300,000 available to invest in one project in either North or South Division. The expected operating income for this investment is $110,000 in 2019. The company's required return on investment is 35%. Required: 1. If Division managers are evaluated and their bonuses are paid based on Return On Investment (ROI) of their Divisions: a) Calculate the ROI of each Division in 2018 based on total assets at net book value. b) Comment on the relative performance of both Division managers using ROI based on total assets at net book value compared with gross book value. c) Which manager would agree to invest the $300,000 available in his/her Division? Why? Are their decisions congruent with Drill Tech CEO's decision? (9 Marks) 2. If Division managers are evaluated and their bonuses are paid based on Residual Income (RI) of their Divisions: a) Calculate RI of each Division in 2018 based on total assets at net book value. b) Comment on the relative performance of both Division managers using RI for performance evaluation. c) Which Division manager would agree to invest the $300,000 available in his/her Division? Are the decisions of the managers congruent with DrillTech CEO's decision? Why? (7 Marks)