Answered step by step

Verified Expert Solution

Question

1 Approved Answer

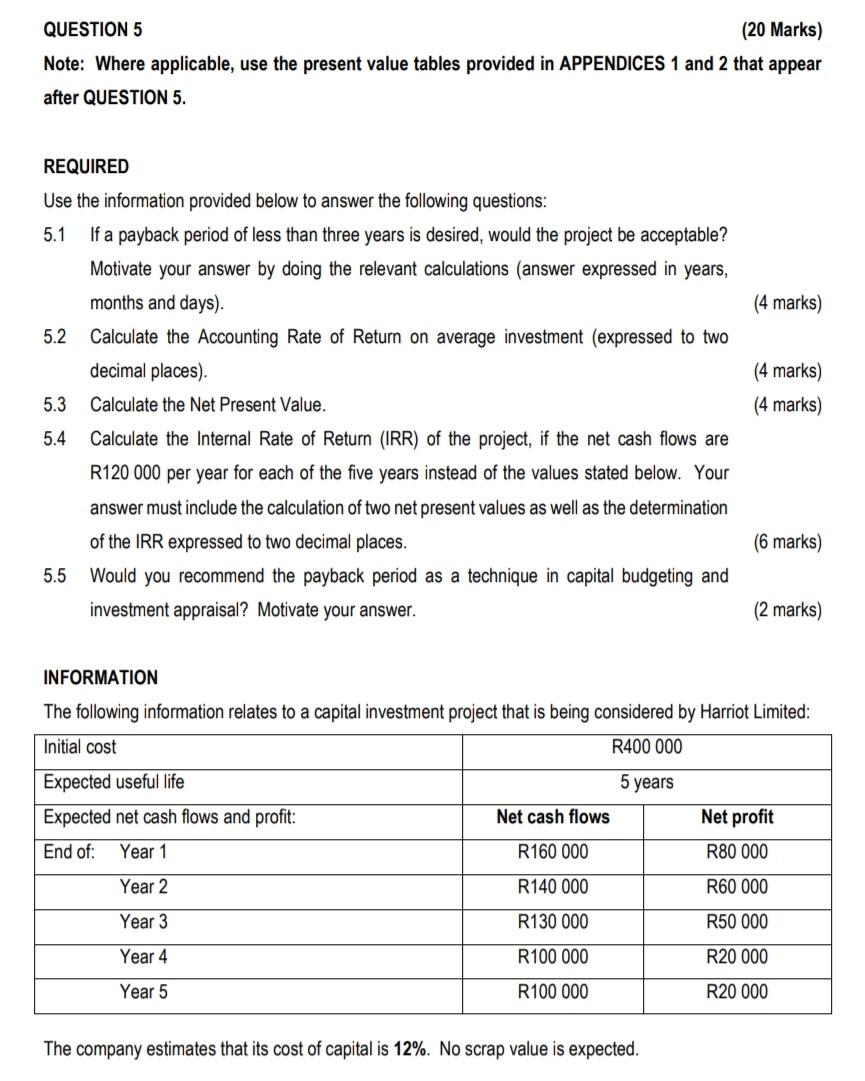

QUESTION 5 (20 Marks) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Use

QUESTION 5 (20 Marks) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Use the information provided below to answer the following questions: 5.1 If a payback period of less than three years is desired, would the project be acceptable? Motivate your answer by doing the relevant calculations (answer expressed in years, months and days). (4 marks) 5.2 Calculate the Accounting Rate of Return on average investment (expressed to two decimal places). (4 marks) 5.3 Calculate the Net Present Value. (4 marks) 5.4 Calculate the Internal Rate of Return (IRR) of the project, if the net cash flows are R120 000 per year for each of the five years instead of the values stated below. Your answer must include the calculation of two net present values as well as the determination of the IRR expressed to two decimal places. (6 marks) 5.5 Would you recommend the payback period as a technique in capital budgeting and investment appraisal? Motivate your answer. (2 marks) INFORMATION The following information relates to a capital investment project that is being considered by Harriot Limited: The company estimates that its cost of capital is \12. No scrap value is expected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started