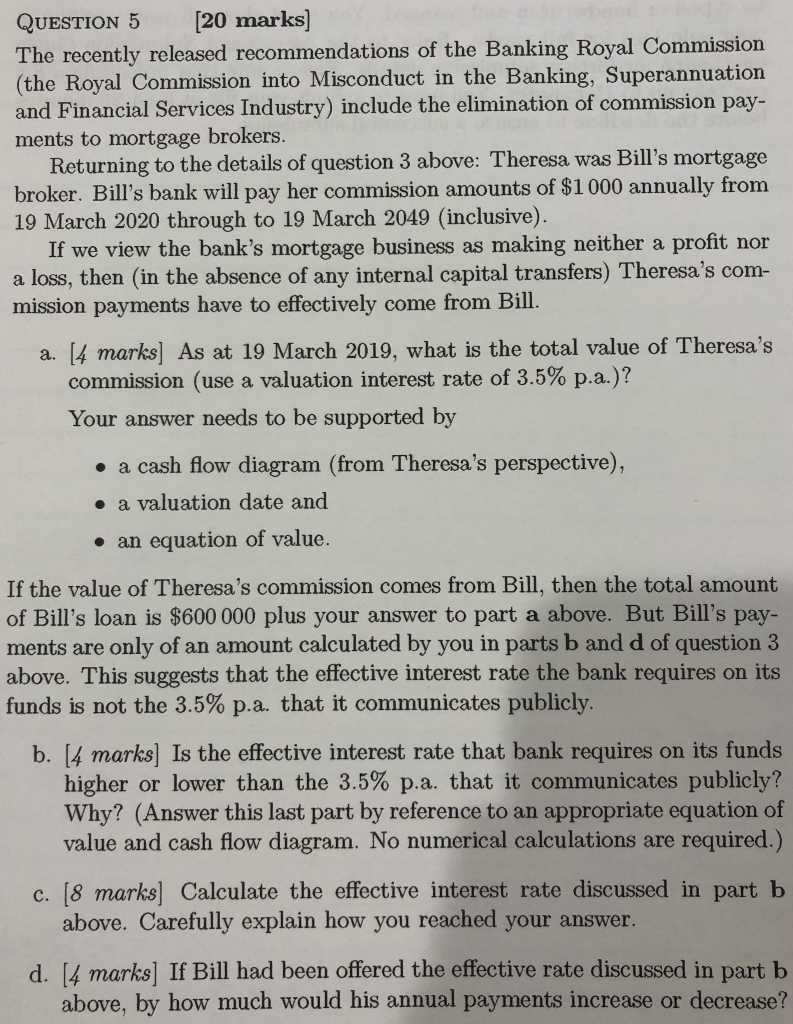

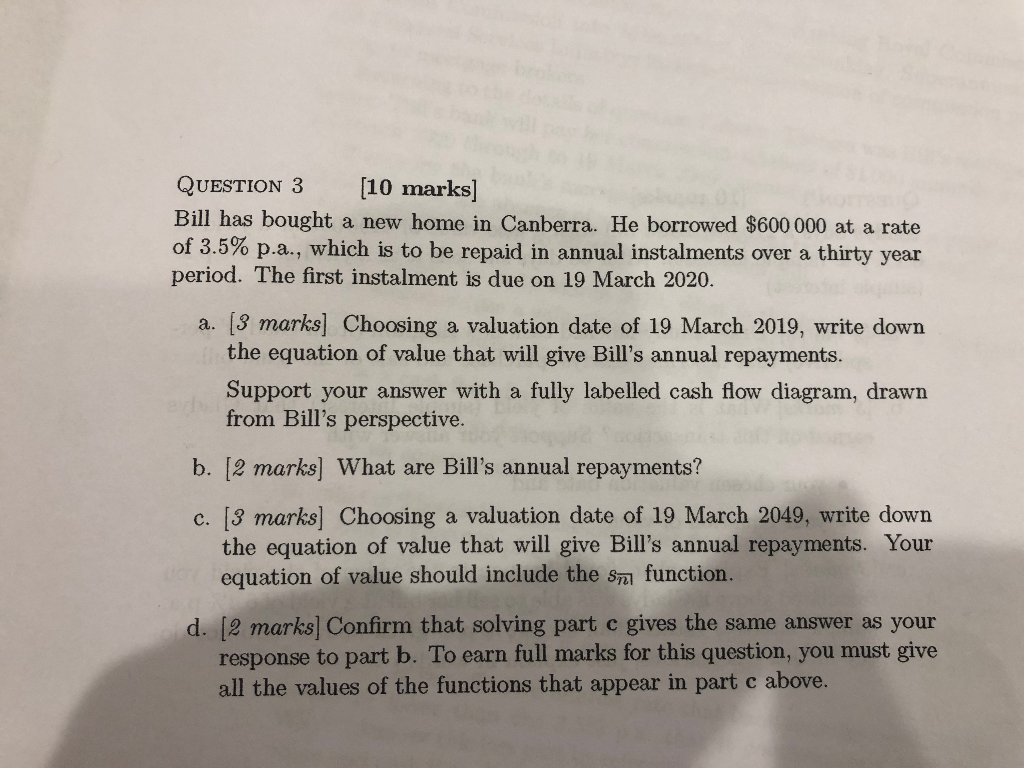

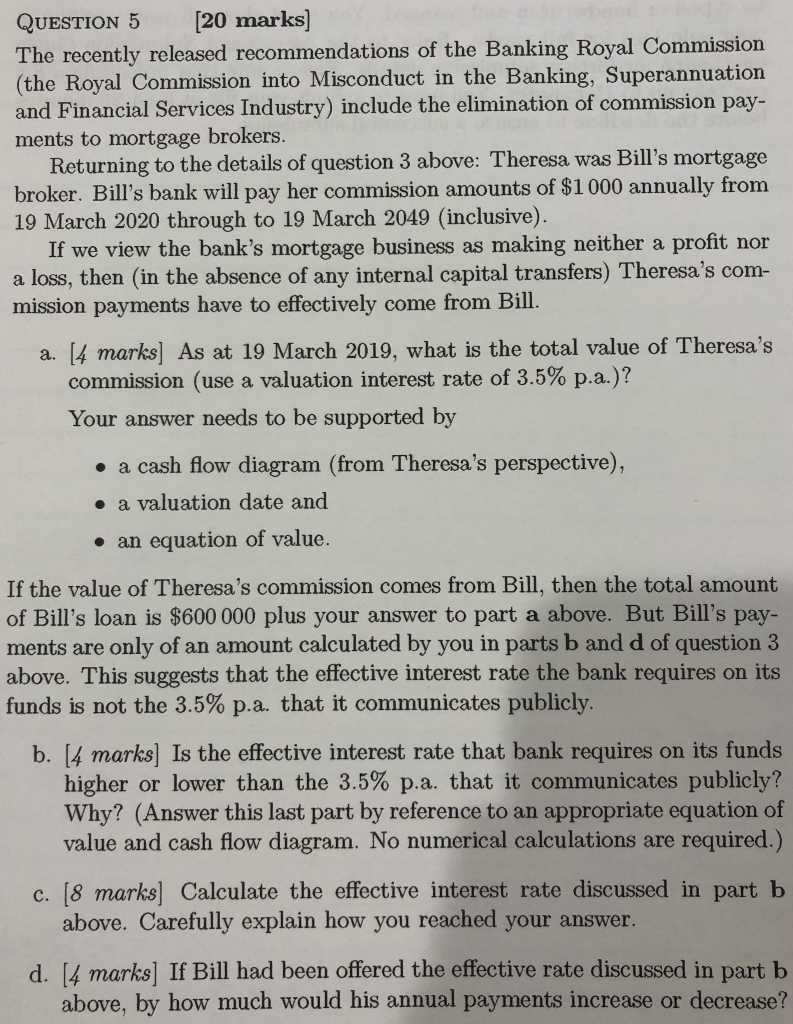

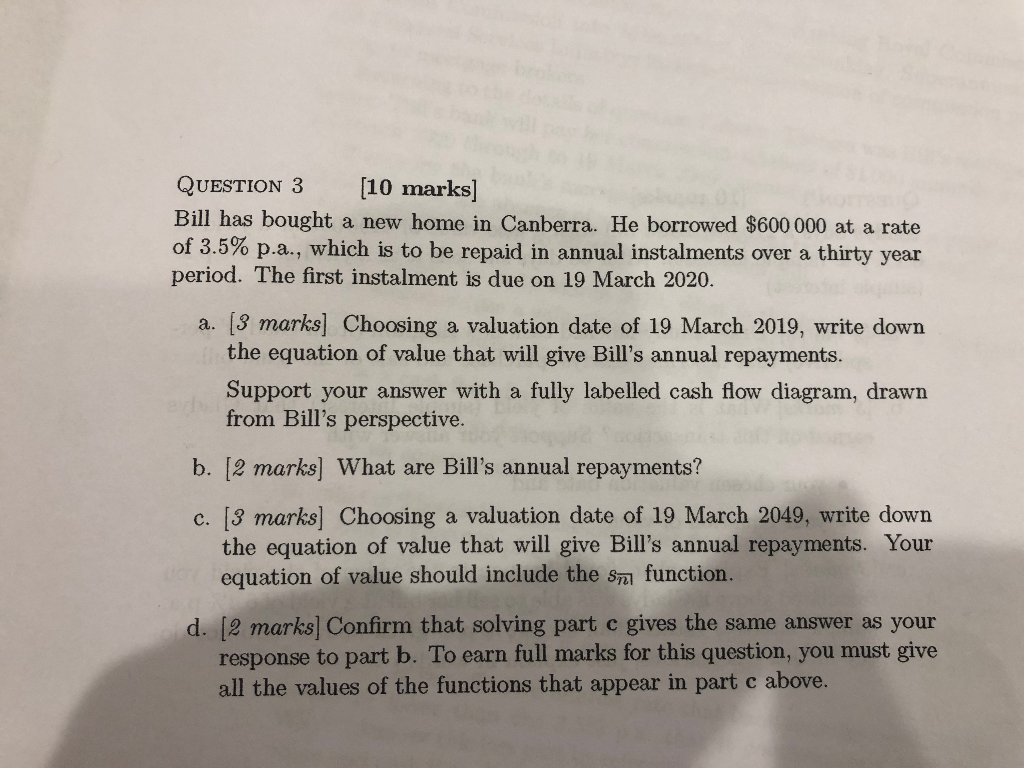

QUESTION 5 [20 marks] The recently released recommendations of the Banking Royal Commission (the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry) include the elimination of commission pay- ments to mortgage brokers. Returning to the details of question 3 above: Theresa was Bill's mortgage broker. Bill's bank will pay her commission amounts of $1000 annually from 19 March 2020 through to 19 March 2049 (inclusive). If we view the bank's mortgage business as making neither a profit nor a loss, then (in the absence of any internal capital transfers) Theresa's com- mission payments have to effectively come from Bill. a. 4 marks] As at 19 March 2019, what is the total value of Theresa's commission (use a valuation interest rate of 3.5% pa.)? Your answer needs to be supported by a cash flow diagram (from Theresa's perspective), a valuation date and an equation of value. If the value of Theresa's commission comes from Bill, then the total amount of Bill's loan is $600 000 plus your answer to part a above. But Bill's pay- ments are only of an amount calculated by you in parts b and d of question 3 above. This suggests that the effective interest rate the bank requires on its funds is not the 3.5% pa. that it communicates publicly b. [4 marks] Is the effective interest rate that bank requires on its funds higher or lower than the 3.5% pa. that it communicates publicly? Why? (Answer this last part by reference to an appropriate equation of value and cash flow diagram. No numerical calculations are required.) 8 marks] Calculate the effective interest rate discussed in above. Carefully explain how you reached your answer c. [ part b d. [4 marks] If Bill had been offered the effective rate discussed in part b above, by how much would his annual payments increase or decrease? QUESTION 3 [10 marks] Bill has bought a new home in Canberra. He borrowed $600000 at a rate of 3.5% pa, which is to be repaid in annual instalments over a thirty year a. [3 marks] Choosing a valuation date of 19 March 2019, write down Support your answer with a fully labelled cash flow diagram, drawn period. The first instalment is due on 19 March 2020. the equation of value that will give Bill's annual repayments. from Bill's perspective. b. [2 marks] What are Bill's annual repayments? c. [3 marks] Choosing a valuation date of 19 March 2049, write down the equation of value that will give Bill's annual repayments. Your equation of value should include the sm function. d. [2 marks] Confirm that solving part c gives the same answer as your response to part b. To earn full marks for this question, you must give all the values of the functions that appear in part c above