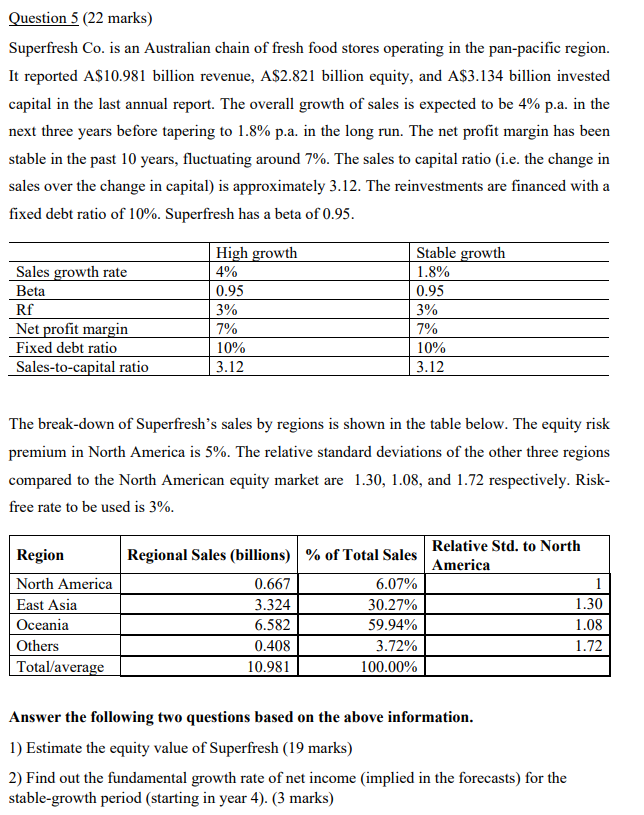

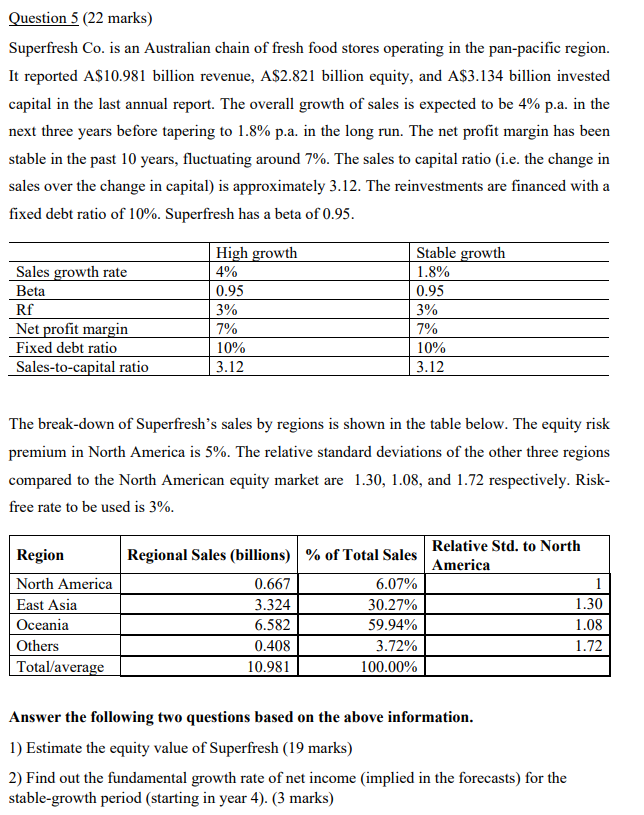

Question 5 (22 marks) Superfresh Co. is an Australian chain of fresh food stores operating in the pan-pacific region. It reported A$10.981 billion revenue, A$2.821 billion equity, and A$3.134 billion invested capital in the last annual report. The overall growth of sales is expected to be 4% p.a. in the next three years before tapering to 1.8% p.a. in the long run. The net profit margin has been stable in the past 10 years, fluctuating around 7%. The sales to capital ratio (i.e. the change in sales over the change in capital) is approximately 3.12. The reinvestments are financed with a fixed debt ratio of 10%. Superfresh has a beta of 0.95. Sales growth rate Beta Rf High growth 4% 0.95 3% 7% 10% 3.12 Stable growth 1.8% 0.95 3% 7% 10% 3.12 Net profit margin Fixed debt ratio Sales-to-capital ratio The break-down of Superfresh's sales by regions is shown in the table below. The equity risk premium in North America is 5%. The relative standard deviations of the other three regions compared to the North American equity market are 1.30, 1.08, and 1.72 respectively. Risk- free rate to be used is 3%. Relative Std. to North America Region North America East Asia Oceania Others Total/average Regional Sales (billions) % of Total Sales 0.667 6.07% 3.324 30.27% 6.582 59.94% 0.408 3.72% 10.981 100.00% 1.30 1.08 1.72 Answer the following two questions based on the above information. 1) Estimate the equity value of Superfresh (19 marks) 2) Find out the fundamental growth rate of net income (implied in the forecasts) for the stable-growth period (starting in year 4). (3 marks) Question 5 (22 marks) Superfresh Co. is an Australian chain of fresh food stores operating in the pan-pacific region. It reported A$10.981 billion revenue, A$2.821 billion equity, and A$3.134 billion invested capital in the last annual report. The overall growth of sales is expected to be 4% p.a. in the next three years before tapering to 1.8% p.a. in the long run. The net profit margin has been stable in the past 10 years, fluctuating around 7%. The sales to capital ratio (i.e. the change in sales over the change in capital) is approximately 3.12. The reinvestments are financed with a fixed debt ratio of 10%. Superfresh has a beta of 0.95. Sales growth rate Beta Rf High growth 4% 0.95 3% 7% 10% 3.12 Stable growth 1.8% 0.95 3% 7% 10% 3.12 Net profit margin Fixed debt ratio Sales-to-capital ratio The break-down of Superfresh's sales by regions is shown in the table below. The equity risk premium in North America is 5%. The relative standard deviations of the other three regions compared to the North American equity market are 1.30, 1.08, and 1.72 respectively. Risk- free rate to be used is 3%. Relative Std. to North America Region North America East Asia Oceania Others Total/average Regional Sales (billions) % of Total Sales 0.667 6.07% 3.324 30.27% 6.582 59.94% 0.408 3.72% 10.981 100.00% 1.30 1.08 1.72 Answer the following two questions based on the above information. 1) Estimate the equity value of Superfresh (19 marks) 2) Find out the fundamental growth rate of net income (implied in the forecasts) for the stable-growth period (starting in year 4)