Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 (23 points) Saved Listen Cancun Company manufactures two products, Product C and Product D. Overhead currently is applied to the products on the

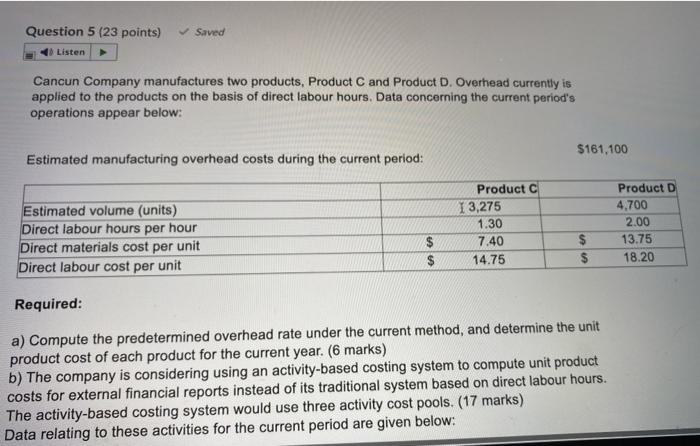

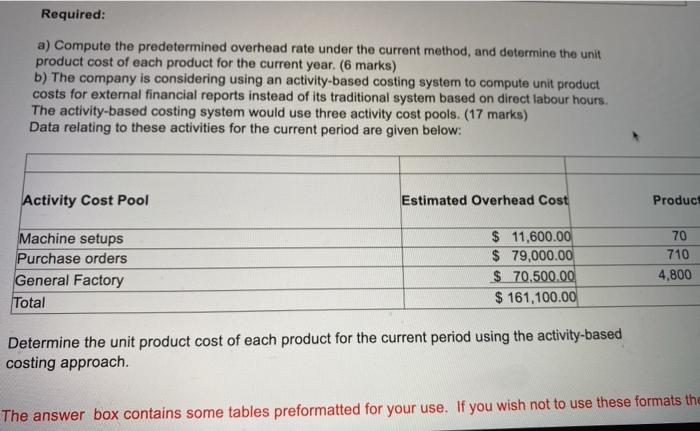

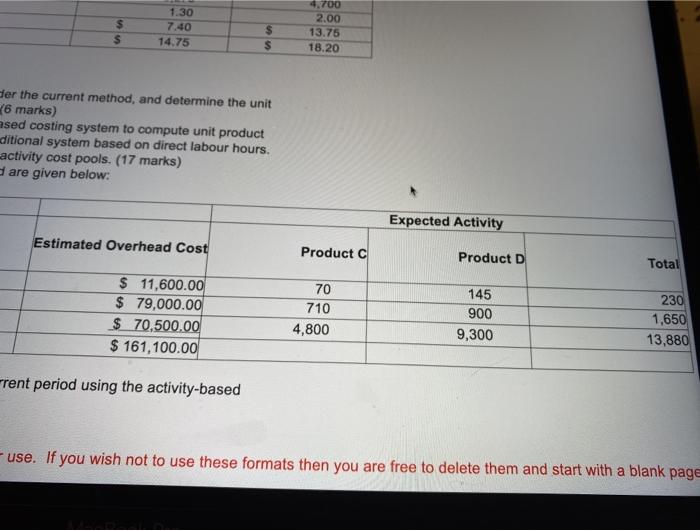

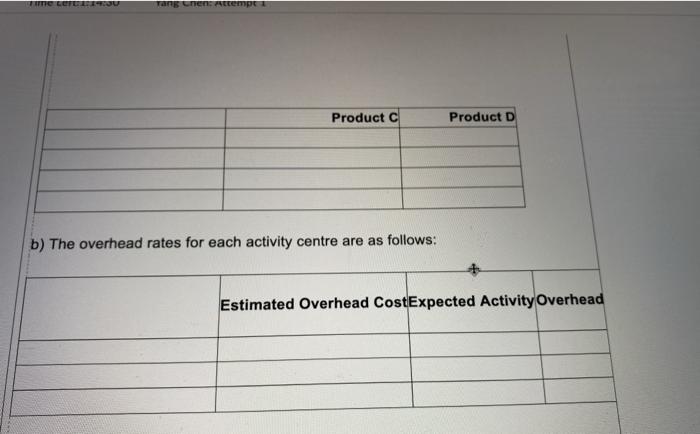

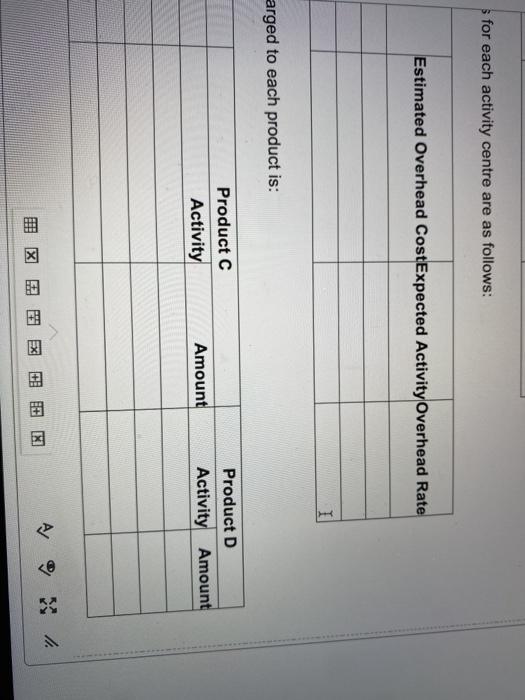

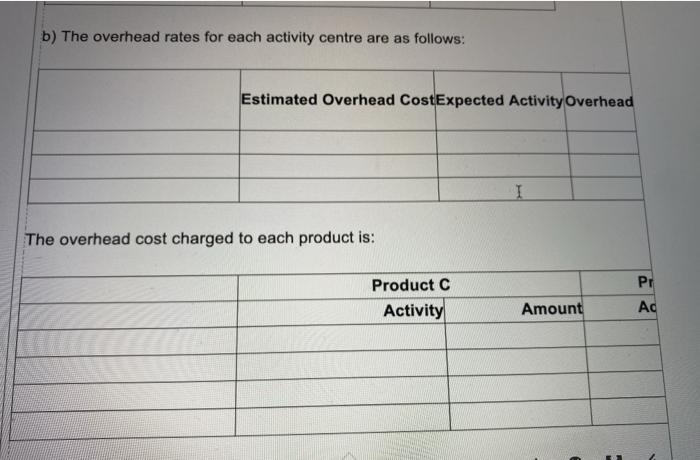

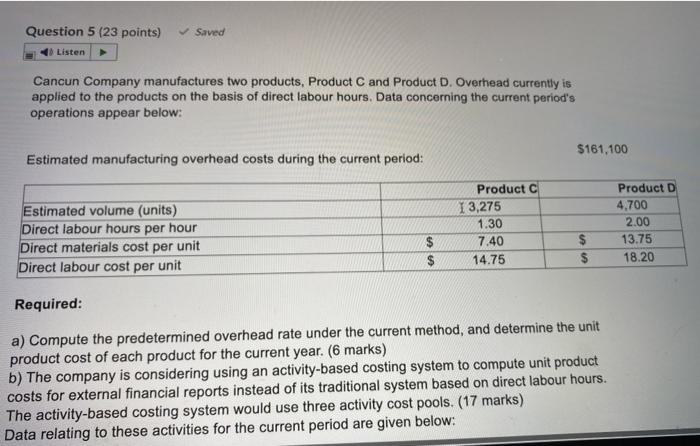

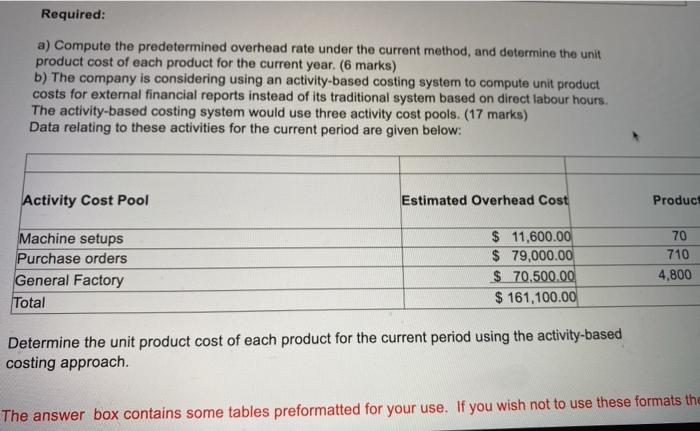

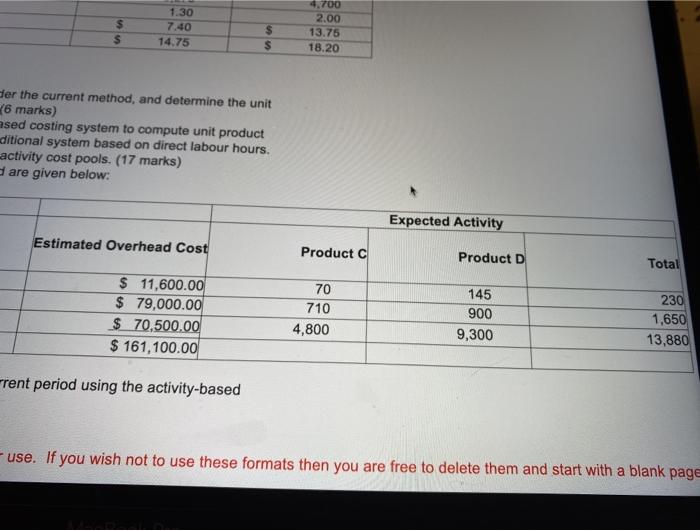

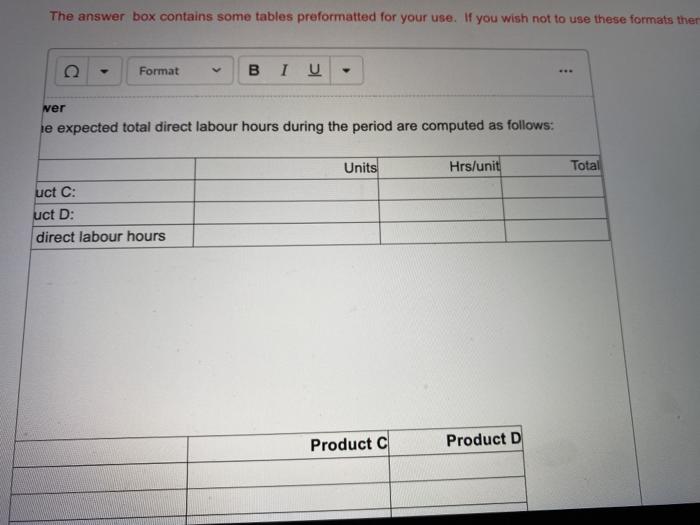

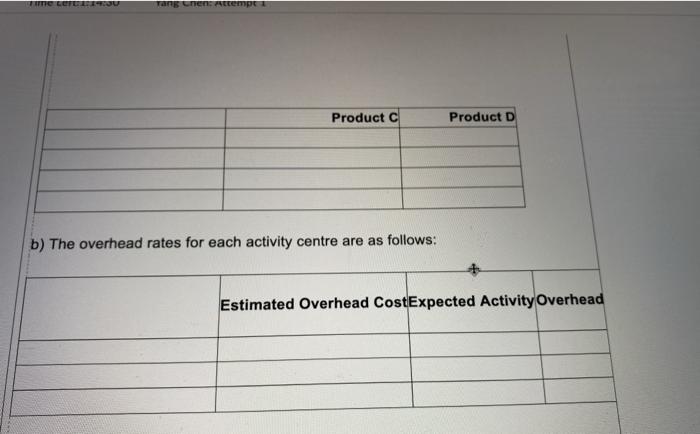

Question 5 (23 points) Saved Listen Cancun Company manufactures two products, Product C and Product D. Overhead currently is applied to the products on the basis of direct labour hours. Data concerning the current period's operations appear below: $161.100 Estimated manufacturing overhead costs during the current period: Estimated volume (units) Direct labour hours per hour Direct materials cost per unit Direct labour cost per unit Product C 13,275 1.30 7.40 14.75 Product D 4.700 2.00 13.75 18.20 $ $ $ $ Required: a) Compute the predetermined overhead rate under the current method, and determine the unit product cost of each product for the current year. (6 marks) b) The company is considering using an activity-based costing system to compute unit product costs for external financial reports instead of its traditional system based on direct labour hours. The activity-based costing system would use three activity cost pools. (17 marks) Data relating to these activities for the current period are given below: Required: a) Compute the predetermined overhead rate under the current method, and determine the unit product cost of each product for the current year. (6 marks) b) The company is considering using an activity-based costing system to compute unit product costs for external financial reports instead of its traditional system based on direct labour hours. The activity-based costing system would use three activity cost pools. (17 marks) Data relating to these activities for the current period are given below: Activity Cost Pool Estimated Overhead Cost Product Machine setups Purchase orders General Factory Total $ 11,600.00 $ 79,000.00 $ 70,500.00 $ 161,100.00 70 710 4,800 Determine the unit product cost of each product for the current period using the activity-based costing approach. The answer box contains some tables preformatted for your use. If you wish not to use these formats the 1.30 7.40 14.75 4.700 2.00 13.75 18.20 $ S $ der the current method, and determine the unit 6 marks) ased costing system to compute unit product ditional system based on direct labour hours. activity cost pools. (17 marks) are given below: Expected Activity Estimated Overhead Cost Product C Product D Total $ 11,600.00 $ 79,000.00 $ 70,500.00 $ 161,100.00 70 710 4,800 145 900 9,300 230 1,650 13,880 Frent period using the activity-based - use. If you wish not to use these formats then you are free to delete them and start with a blank page The answer box contains some tables preformatted for your use. If you wish not to use these formats ther Format BI U ver le expected total direct labour hours during the period are computed as follows: Units Hrs/unit Total uct C: uct D: direct labour hours Product C Product D Tanschens Attempt Product C Product D b) The overhead rates for each activity centre are as follows: Estimated Overhead CostExpected Activity Overhead $ for each activity centre are as follows: Estimated Overhead CostExpected Activity Overhead Rate arged to each product is: Product C Activity Product D Activity Amount Amount + b) The overhead rates for each activity centre are as follows: Estimated Overhead CostExpected Activity Overhead The overhead cost charged to each product is: Product C Activity Pr Ad Amount

Question 5 (23 points) Saved Listen Cancun Company manufactures two products, Product C and Product D. Overhead currently is applied to the products on the basis of direct labour hours. Data concerning the current period's operations appear below: $161.100 Estimated manufacturing overhead costs during the current period: Estimated volume (units) Direct labour hours per hour Direct materials cost per unit Direct labour cost per unit Product C 13,275 1.30 7.40 14.75 Product D 4.700 2.00 13.75 18.20 $ $ $ $ Required: a) Compute the predetermined overhead rate under the current method, and determine the unit product cost of each product for the current year. (6 marks) b) The company is considering using an activity-based costing system to compute unit product costs for external financial reports instead of its traditional system based on direct labour hours. The activity-based costing system would use three activity cost pools. (17 marks) Data relating to these activities for the current period are given below: Required: a) Compute the predetermined overhead rate under the current method, and determine the unit product cost of each product for the current year. (6 marks) b) The company is considering using an activity-based costing system to compute unit product costs for external financial reports instead of its traditional system based on direct labour hours. The activity-based costing system would use three activity cost pools. (17 marks) Data relating to these activities for the current period are given below: Activity Cost Pool Estimated Overhead Cost Product Machine setups Purchase orders General Factory Total $ 11,600.00 $ 79,000.00 $ 70,500.00 $ 161,100.00 70 710 4,800 Determine the unit product cost of each product for the current period using the activity-based costing approach. The answer box contains some tables preformatted for your use. If you wish not to use these formats the 1.30 7.40 14.75 4.700 2.00 13.75 18.20 $ S $ der the current method, and determine the unit 6 marks) ased costing system to compute unit product ditional system based on direct labour hours. activity cost pools. (17 marks) are given below: Expected Activity Estimated Overhead Cost Product C Product D Total $ 11,600.00 $ 79,000.00 $ 70,500.00 $ 161,100.00 70 710 4,800 145 900 9,300 230 1,650 13,880 Frent period using the activity-based - use. If you wish not to use these formats then you are free to delete them and start with a blank page The answer box contains some tables preformatted for your use. If you wish not to use these formats ther Format BI U ver le expected total direct labour hours during the period are computed as follows: Units Hrs/unit Total uct C: uct D: direct labour hours Product C Product D Tanschens Attempt Product C Product D b) The overhead rates for each activity centre are as follows: Estimated Overhead CostExpected Activity Overhead $ for each activity centre are as follows: Estimated Overhead CostExpected Activity Overhead Rate arged to each product is: Product C Activity Product D Activity Amount Amount + b) The overhead rates for each activity centre are as follows: Estimated Overhead CostExpected Activity Overhead The overhead cost charged to each product is: Product C Activity Pr Ad Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started