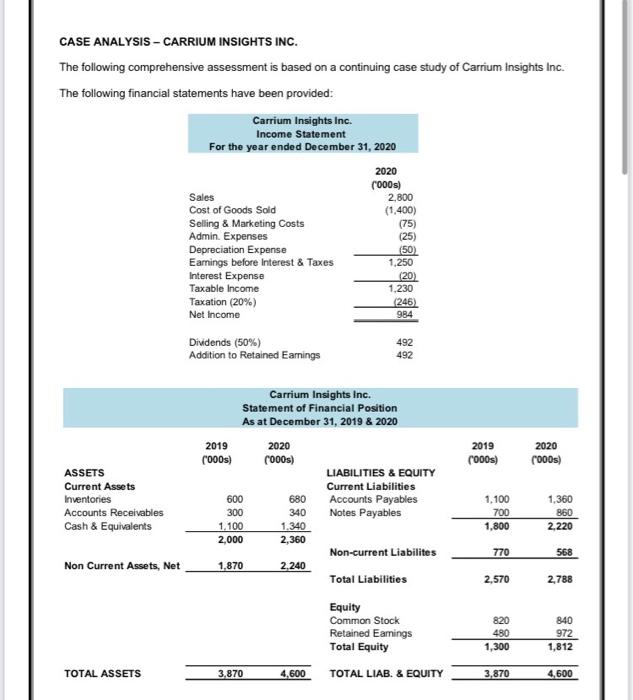

Question 5 25 MARKS PART A 15 Marks As a responsible corporate citizen, Carrium Insights Inc set up a college fund for under-privileged students in its community 10 years ago. Carrium deposited $2,500 monthly over the 10 year period in an account earning 6% compounded monthly, no withdrawals were allowed during this funding period. Required: (a) Compute the value of this college fund today, after 10 years' worth of monthly deposits (5 Marks) (b) If Carrium deposits the value of this fund (answer in (a) above) into a new account earning 8% interest annually, how much would Carrium be able to withdraw at the beginning of each year over the next 10 years to assist qualifying students? (7 Marks) (c) The CEO has indicated that he would like the fund to be set up with $500,000 instead of the current amount (answer from (a) above). How long will it take to accumulate $500,000 if Carrium deposits the amount from part (a) in the same account earning 8% interest annually? (3 Marks) PART B 10 Marks The Accounting Manager is seeking to analyse the company's sources and uses of cash for the year 2020 Required: Utilize the 2020 financial statements for Carrium Insights Inc. provided on page 2 to prepare Carrium Insights Inc. Cash Flow Statement for 2020. (10 Marks) CASE ANALYSIS - CARRIUM INSIGHTS INC. The following comprehensive assessment is based on a continuing case study of Carrium insights Inc. The following financial statements have been provided: Carrium Insights Inc. Income Statement For the year ended December 31, 2020 2020 (000s) Sales 2.800 Cost of Goods Sold (1,400) Selling & Marketing Costs (75) Admin. Expenses (25) Depreciation Expense (50) Earnings before Interest & Taxes 1.250 Interest Expense Taxable income Taxation (20%) Net Income 984 (20) 1,230 (246) Dividends (50%) Addition to Retained Eamings 492 492 2019 rooos) 2020 000s) ASSETS Current Assets Inventories Accounts Receivables Cash & Equivalents 1,360 340 Carrium Insights Inc. Statement of Financial Position As at December 31, 2019 & 2020 2019 2020 ('000) (000s) LIABILITIES & EQUITY Current Liabilities 600 680 Accounts Payables 300 Notes Payables 1.100 1.340 2,000 2,360 Non-current Liabilites 1,870 2,240 Total Liabilities Equity Common Stock Retained Earnings Total Equity 1,100 700 1,800 860 2.220 770 568 Non Current Assets, Net 2,570 2,788 820 480 1,300 840 972 1,812 TOTAL ASSETS 3,870 4,600 TOTAL LIAB. & EQUITY 3,870 4,600