Answered step by step

Verified Expert Solution

Question

1 Approved Answer

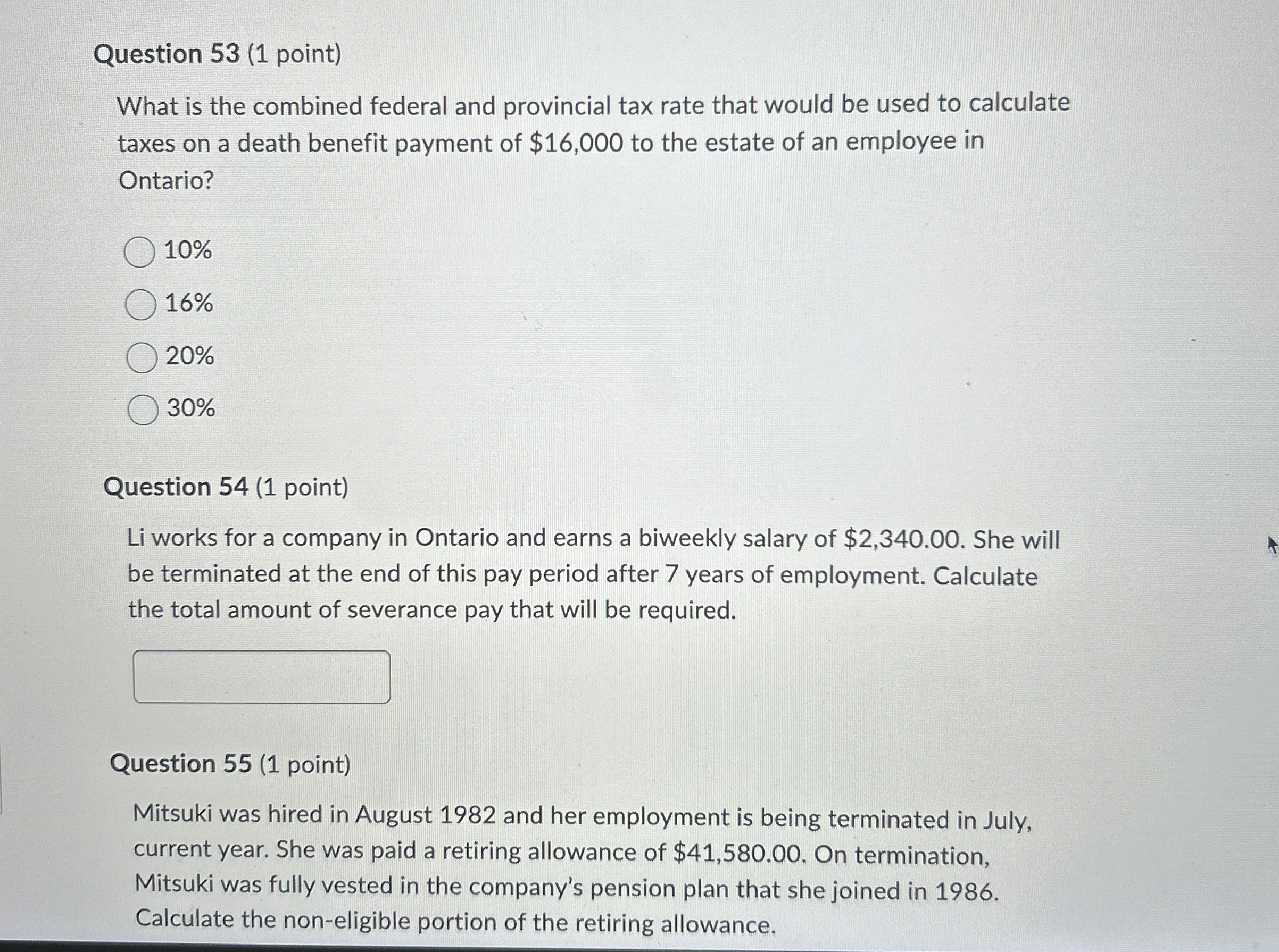

Question 5 3 ( 1 point ) What is the combined federal and provincial tax rate that would be used to calculate taxes on a

Question point

What is the combined federal and provincial tax rate that would be used to calculate taxes on a death benefit payment of $ to the estate of an employee in Ontario?

Question point

Li works for a company in Ontario and earns a biweekly salary of $ She will be terminated at the end of this pay period after years of employment. Calculate the total amount of severance pay that will be required.

Question point

Mitsuki was hired in August and her employment is being terminated in July, current year. She was paid a retiring allowance of $ On termination, Mitsuki was fully vested in the company's pension plan that she joined in Calculate the noneligible portion of the retiring allowance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started