Answered step by step

Verified Expert Solution

Question

1 Approved Answer

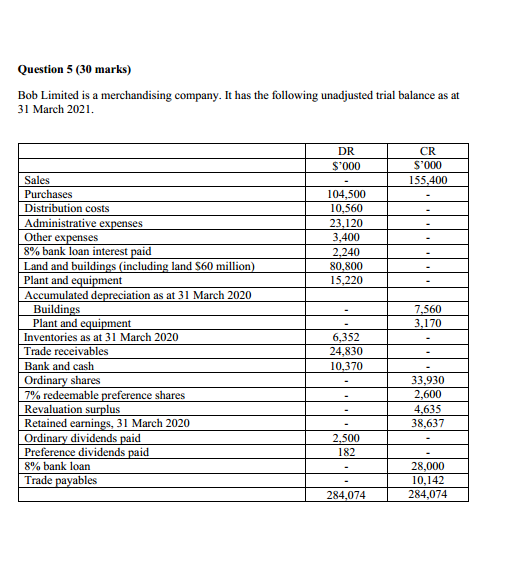

Question 5 (30 marks) Bob Limited is a merchandising company. It has the following unadjusted trial balance as at 31 March 2021. 2. The preference

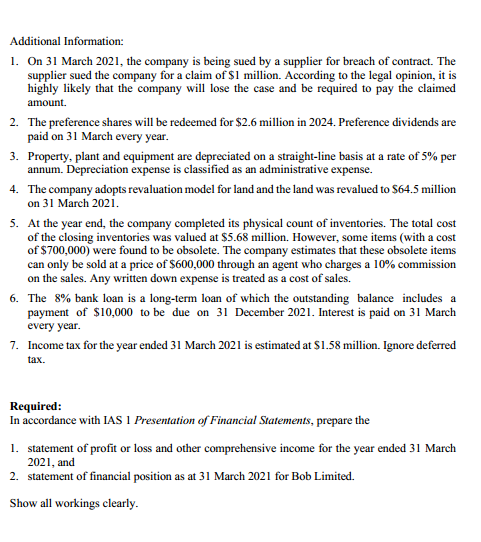

Question 5 (30 marks) Bob Limited is a merchandising company. It has the following unadjusted trial balance as at 31 March 2021. 2. The preference shares will be redeemed for $2.6 million in 2024 . Preference dividends are paid on 31 March every year. 3. Property, plant and equipment are depreciated on a straight-line basis at a rate of 5% per annum. Depreciation expense is classified as an administrative expense. 4. The company adopts revaluation model for land and the land was revalued to $64.5 million on 31 March 2021. 5. At the year end, the company completed its physical count of inventories. The total cost of the closing inventories was valued at $5.68 million. However, some items (with a cost of $700,000 ) were found to be obsolete. The company estimates that these obsolete items can only be sold at a price of $600,000 through an agent who charges a 10% commission on the sales. Any written down expense is treated as a cost of sales. 6. The 8% bank loan is a long-term loan of which the outstanding balance includes a payment of $10,000 to be due on 31 December 2021. Interest is paid on 31March every year. 7. Income tax for the year ended 31 March 2021 is estimated at $1.58 million. Ignore deferred tax. Required: In accordance with IAS 1 Presentation of Financial Statements, prepare the 1. statement of profit or loss and other comprehensive income for the year ended 31March 2021 , and 2. statement of financial position as at 31 March 2021 for Bob Limited. Show all workings clearly. Question 5 (30 marks) Bob Limited is a merchandising company. It has the following unadjusted trial balance as at 31 March 2021. 2. The preference shares will be redeemed for $2.6 million in 2024 . Preference dividends are paid on 31 March every year. 3. Property, plant and equipment are depreciated on a straight-line basis at a rate of 5% per annum. Depreciation expense is classified as an administrative expense. 4. The company adopts revaluation model for land and the land was revalued to $64.5 million on 31 March 2021. 5. At the year end, the company completed its physical count of inventories. The total cost of the closing inventories was valued at $5.68 million. However, some items (with a cost of $700,000 ) were found to be obsolete. The company estimates that these obsolete items can only be sold at a price of $600,000 through an agent who charges a 10% commission on the sales. Any written down expense is treated as a cost of sales. 6. The 8% bank loan is a long-term loan of which the outstanding balance includes a payment of $10,000 to be due on 31 December 2021. Interest is paid on 31March every year. 7. Income tax for the year ended 31 March 2021 is estimated at $1.58 million. Ignore deferred tax. Required: In accordance with IAS 1 Presentation of Financial Statements, prepare the 1. statement of profit or loss and other comprehensive income for the year ended 31March 2021 , and 2. statement of financial position as at 31 March 2021 for Bob Limited. Show all workings clearly

Question 5 (30 marks) Bob Limited is a merchandising company. It has the following unadjusted trial balance as at 31 March 2021. 2. The preference shares will be redeemed for $2.6 million in 2024 . Preference dividends are paid on 31 March every year. 3. Property, plant and equipment are depreciated on a straight-line basis at a rate of 5% per annum. Depreciation expense is classified as an administrative expense. 4. The company adopts revaluation model for land and the land was revalued to $64.5 million on 31 March 2021. 5. At the year end, the company completed its physical count of inventories. The total cost of the closing inventories was valued at $5.68 million. However, some items (with a cost of $700,000 ) were found to be obsolete. The company estimates that these obsolete items can only be sold at a price of $600,000 through an agent who charges a 10% commission on the sales. Any written down expense is treated as a cost of sales. 6. The 8% bank loan is a long-term loan of which the outstanding balance includes a payment of $10,000 to be due on 31 December 2021. Interest is paid on 31March every year. 7. Income tax for the year ended 31 March 2021 is estimated at $1.58 million. Ignore deferred tax. Required: In accordance with IAS 1 Presentation of Financial Statements, prepare the 1. statement of profit or loss and other comprehensive income for the year ended 31March 2021 , and 2. statement of financial position as at 31 March 2021 for Bob Limited. Show all workings clearly. Question 5 (30 marks) Bob Limited is a merchandising company. It has the following unadjusted trial balance as at 31 March 2021. 2. The preference shares will be redeemed for $2.6 million in 2024 . Preference dividends are paid on 31 March every year. 3. Property, plant and equipment are depreciated on a straight-line basis at a rate of 5% per annum. Depreciation expense is classified as an administrative expense. 4. The company adopts revaluation model for land and the land was revalued to $64.5 million on 31 March 2021. 5. At the year end, the company completed its physical count of inventories. The total cost of the closing inventories was valued at $5.68 million. However, some items (with a cost of $700,000 ) were found to be obsolete. The company estimates that these obsolete items can only be sold at a price of $600,000 through an agent who charges a 10% commission on the sales. Any written down expense is treated as a cost of sales. 6. The 8% bank loan is a long-term loan of which the outstanding balance includes a payment of $10,000 to be due on 31 December 2021. Interest is paid on 31March every year. 7. Income tax for the year ended 31 March 2021 is estimated at $1.58 million. Ignore deferred tax. Required: In accordance with IAS 1 Presentation of Financial Statements, prepare the 1. statement of profit or loss and other comprehensive income for the year ended 31March 2021 , and 2. statement of financial position as at 31 March 2021 for Bob Limited. Show all workings clearly Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started