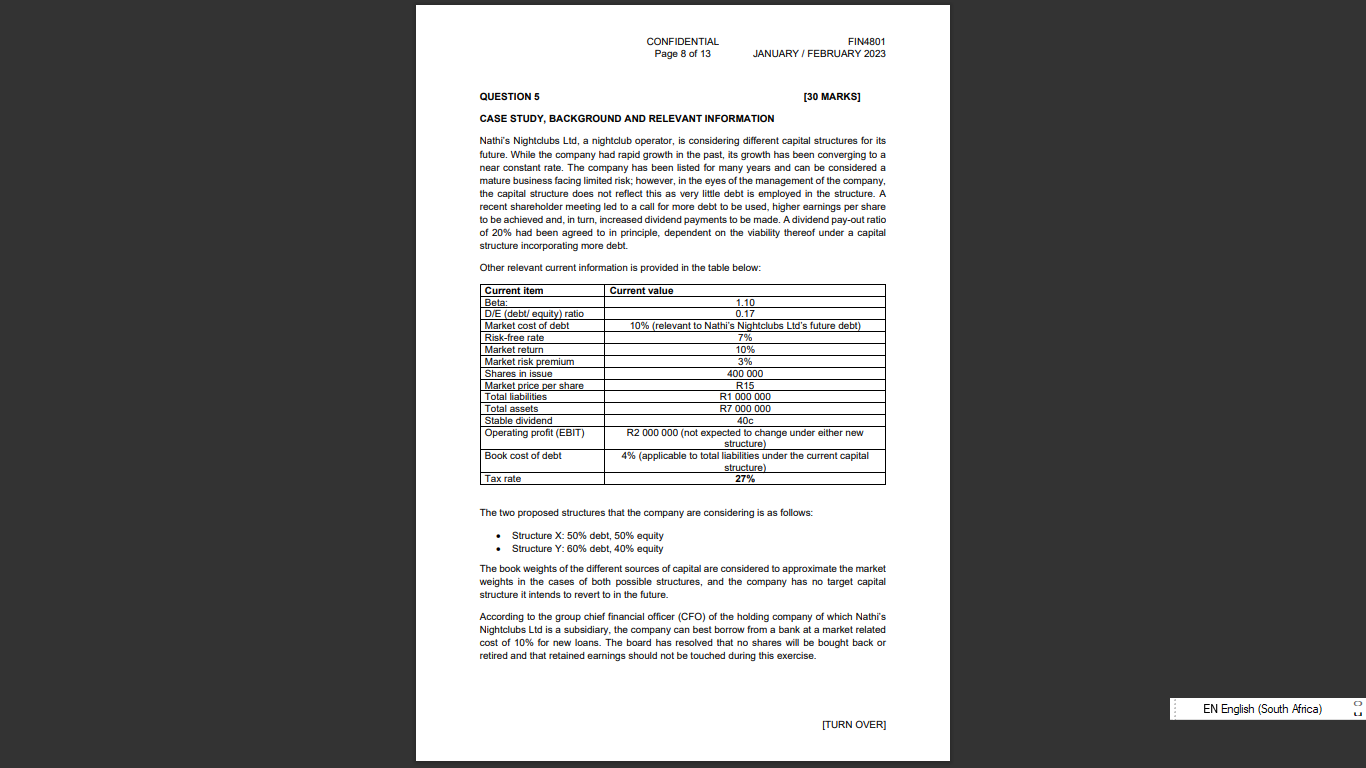

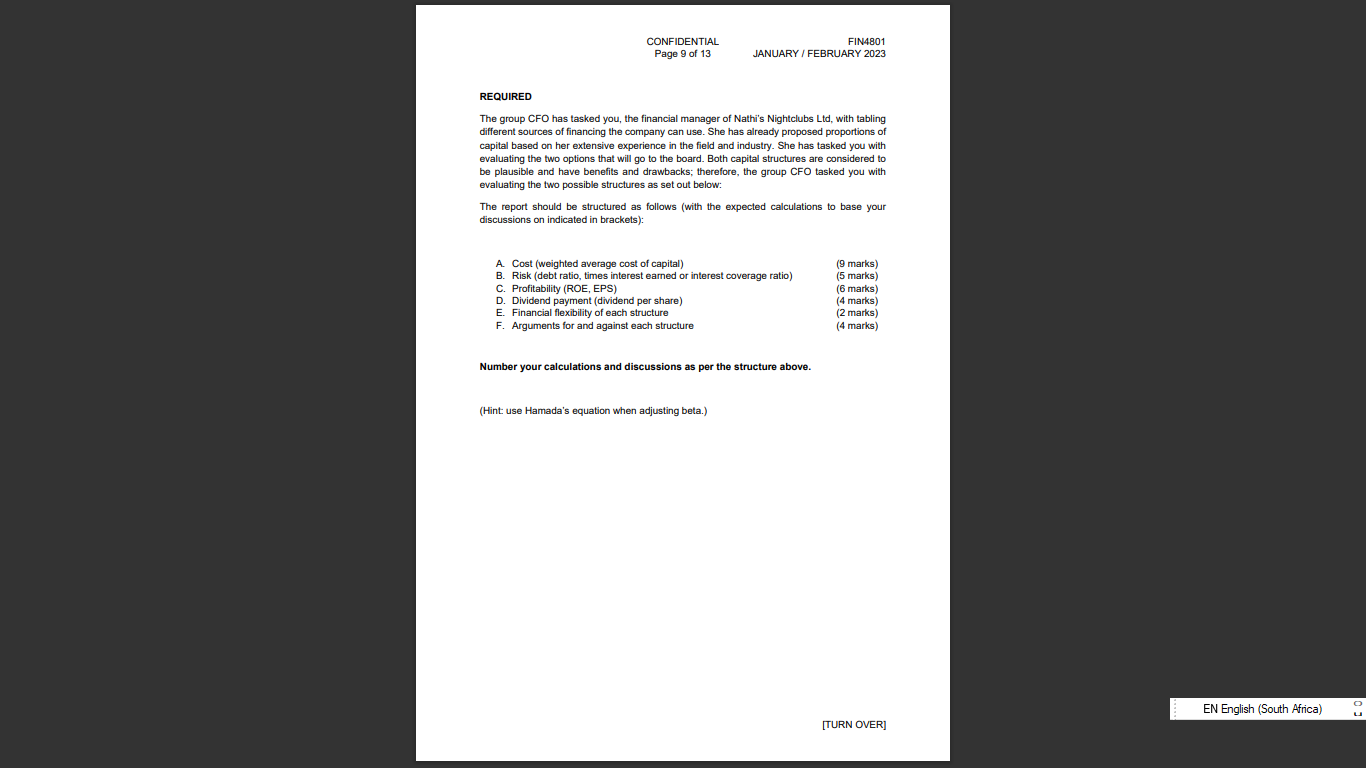

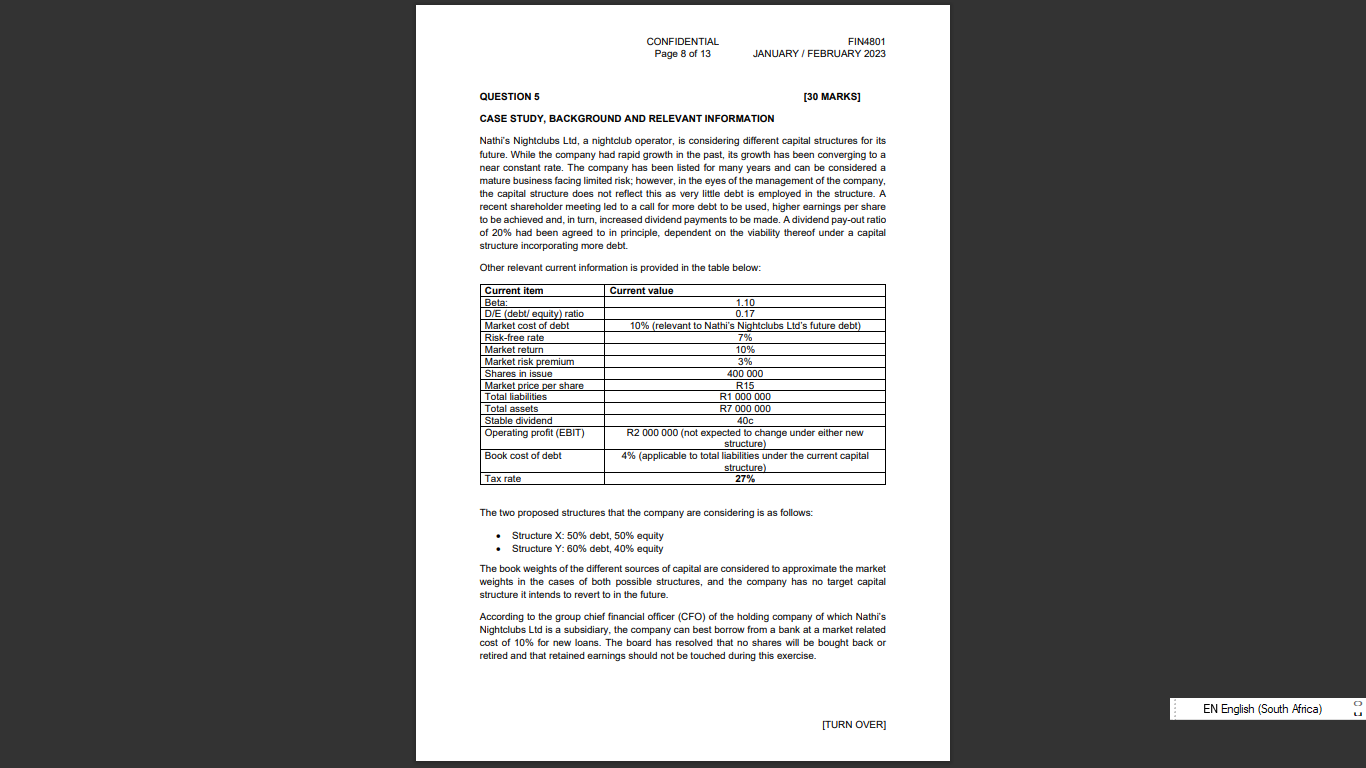

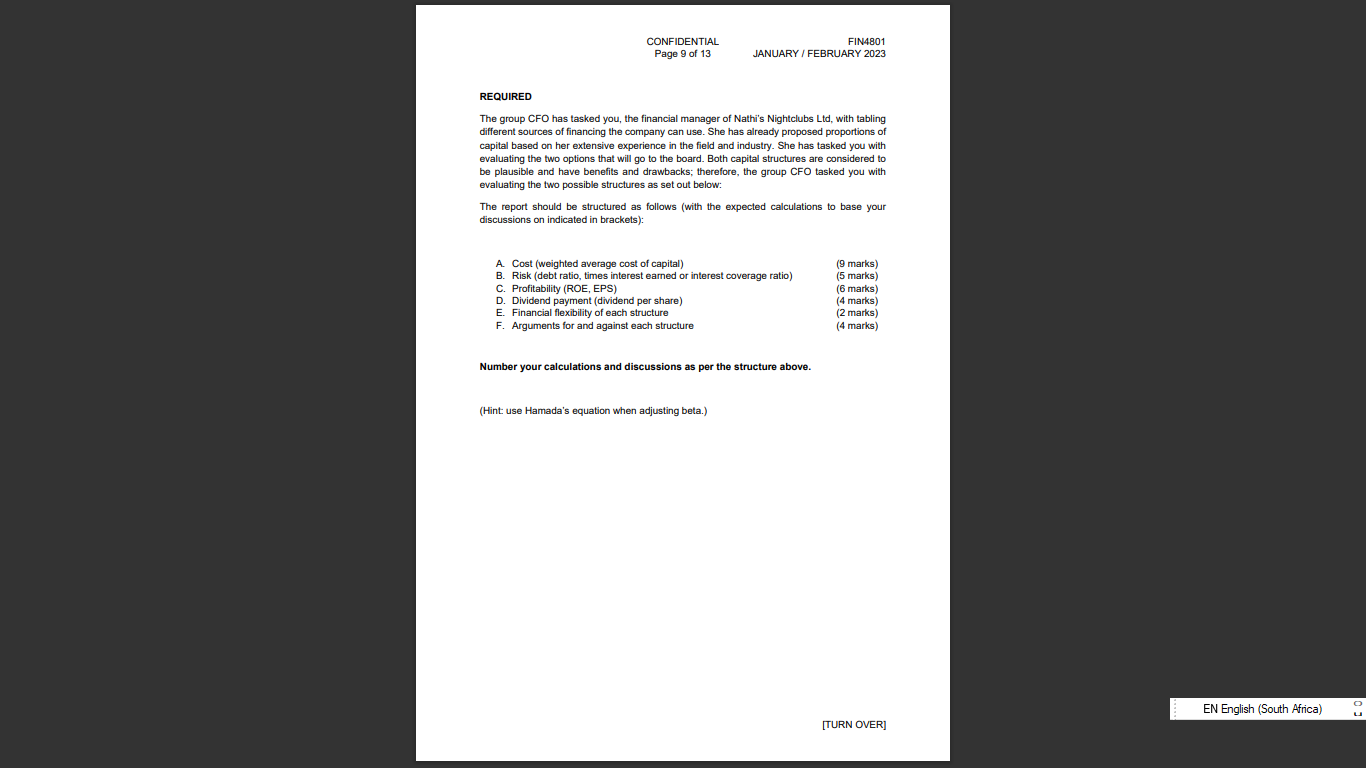

QUESTION 5 [30 MARKS] CASE STUDY, BACKGROUND AND RELEVANT INFORMATION Nathi's Nightclubs Ltd, a nightclub operator, is considering different capital structures for its future. While the company had rapid growth in the past, its growth has been converging to a near constant rate. The company has been listed for many years and can be considered a mature business facing limited risk; however, in the eyes of the management of the company, the capital structure does not reflect this as very little debt is employed in the structure. A recent shareholder meeting led to a call for more debt to be used, higher earnings per share to be achieved and, in turn, increased dividend payments to be made. A dividend pay-out ratio of 20% had been agreed to in principle, dependent on the viability thereof under a capital structure incorporating more debt. Other relevant current information is provided in the table below: The two proposed structures that the company are considering is as follows: - Structure X: 50% debt, 50% equity - Structure Y: 60% debt, 40% equity The book weights of the different sources of capital are considered to approximate the market weights in the cases of both possible structures, and the company has no target capital structure it intends to revert to in the future. According to the group chief financial officer (CFO) of the holding company of which Nathi's Nightclubs Ltd is a subsidiary, the company can best borrow from a bank at a market related cost of 10% for new loans. The board has resolved that no shares will be bought back or retired and that retained earnings should not be touched during this exercise. REQUIRED The group CFO has tasked you, the financial manager of Nathi's Nightclubs Ltd, with tabling different sources of financing the company can use. She has already proposed proportions of capital based on her extensive experience in the field and industry. She has tasked you with evaluating the two options that will go to the board. Both capital structures are considered to be plausible and have benefits and drawbacks; therefore, the group CFO tasked you with evaluating the two possible structures as set out below: The report should be structured as follows (with the expected calculations to base your discussions on indicated in brackets): Number your calculations and discussions as per the structure above. (Hint: use Hamada's equation when adjusting beta.) QUESTION 5 [30 MARKS] CASE STUDY, BACKGROUND AND RELEVANT INFORMATION Nathi's Nightclubs Ltd, a nightclub operator, is considering different capital structures for its future. While the company had rapid growth in the past, its growth has been converging to a near constant rate. The company has been listed for many years and can be considered a mature business facing limited risk; however, in the eyes of the management of the company, the capital structure does not reflect this as very little debt is employed in the structure. A recent shareholder meeting led to a call for more debt to be used, higher earnings per share to be achieved and, in turn, increased dividend payments to be made. A dividend pay-out ratio of 20% had been agreed to in principle, dependent on the viability thereof under a capital structure incorporating more debt. Other relevant current information is provided in the table below: The two proposed structures that the company are considering is as follows: - Structure X: 50% debt, 50% equity - Structure Y: 60% debt, 40% equity The book weights of the different sources of capital are considered to approximate the market weights in the cases of both possible structures, and the company has no target capital structure it intends to revert to in the future. According to the group chief financial officer (CFO) of the holding company of which Nathi's Nightclubs Ltd is a subsidiary, the company can best borrow from a bank at a market related cost of 10% for new loans. The board has resolved that no shares will be bought back or retired and that retained earnings should not be touched during this exercise. REQUIRED The group CFO has tasked you, the financial manager of Nathi's Nightclubs Ltd, with tabling different sources of financing the company can use. She has already proposed proportions of capital based on her extensive experience in the field and industry. She has tasked you with evaluating the two options that will go to the board. Both capital structures are considered to be plausible and have benefits and drawbacks; therefore, the group CFO tasked you with evaluating the two possible structures as set out below: The report should be structured as follows (with the expected calculations to base your discussions on indicated in brackets): Number your calculations and discussions as per the structure above. (Hint: use Hamada's equation when adjusting beta.)