Answered step by step

Verified Expert Solution

Question

1 Approved Answer

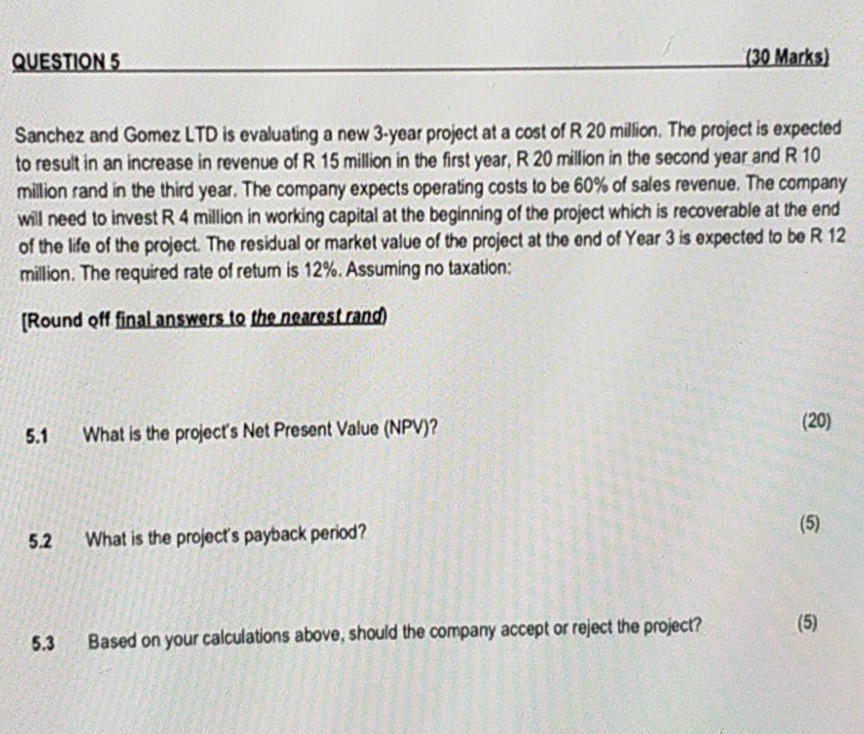

QUESTION 5 (30 Marks) Sanchez and Gomez LTD is evaluating a new 3-year project at a cost of R 20 million. The project is expected

QUESTION 5 (30 Marks) Sanchez and Gomez LTD is evaluating a new 3-year project at a cost of R 20 million. The project is expected to result in an increase in revenue of R 15 million in the first year, R 20 million in the second year and R 10 million and in the third year. The company expects operating costs to be 60% of sales revenue. The company will need to invest R 4 million in working capital at the beginning of the project which is recoverable at the end of the life of the project. The residual or market value of the project at the end of Year 3 is expected to be R 12 million. The required rate of return is 12%. Assuming no taxation: [Round off final answers to the nearest rand (20) 5.1 What is the project's Net Present Value (NPV)? (5) 5.2 What is the project's payback period? (5) 5.3 Based on your calculations above, should the company accept or reject the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started