Question

QUESTION 5 [35 MARKS] You have recently joined a reputable audit firm, Adam and Partners. The audit senior of the team auditing AB Manufacturers has

QUESTION 5 [35 MARKS]

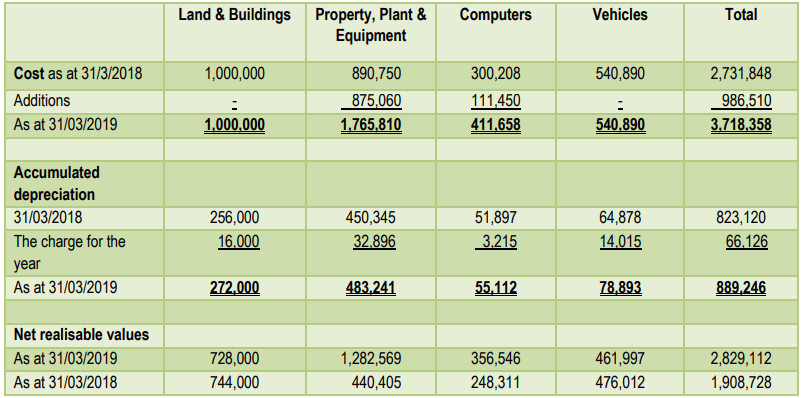

You have recently joined a reputable audit firm, Adam and Partners. The audit senior of the team auditing AB Manufacturers has delegated the auditing of noncurrent assets to you. You are informed that the company has heavy investments in noncurrent assets particularly in the year being audited due to a government contract it won. The contract is for five years. She stated that preliminary materiality is set at R50,000. Additional information provided to you includes:

There is a noncurrent register and you have access to it;

A reconciliation of physical noncurrent assets and a sample of entries in the accounts is done every four months;

There is an appropriate authorisation of the acquisition of noncurrent assets. The production manager has an authorisation limit of R8,000 while the CEO authorises acquisitions above that to a limit of R220,000. The board authorises acquisitions above the CEOs limit; and

Procurement department does not action any requisitions that are not appropriated or authorised.

The following information was also provided:

Note: Land and buildings figure includes R150,000 relating to the value of land

5.1 Outline risks associated with auditing noncurrent assets. No calculations are needed. (10)

5.2 Suggest audit procedures you would undertake on noncurrent assets in respect of the following assertions:

i. Existence (6)

ii. Valuations (ignore depreciation) (10)

iii. Completeness (4) (20)

5.3 Explain how you would evaluate the appropriateness of depreciation rates applied as per the noncurrent assets schedule above. (5)

Include Introduction, Body and Conclusion.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started