Answered step by step

Verified Expert Solution

Question

1 Approved Answer

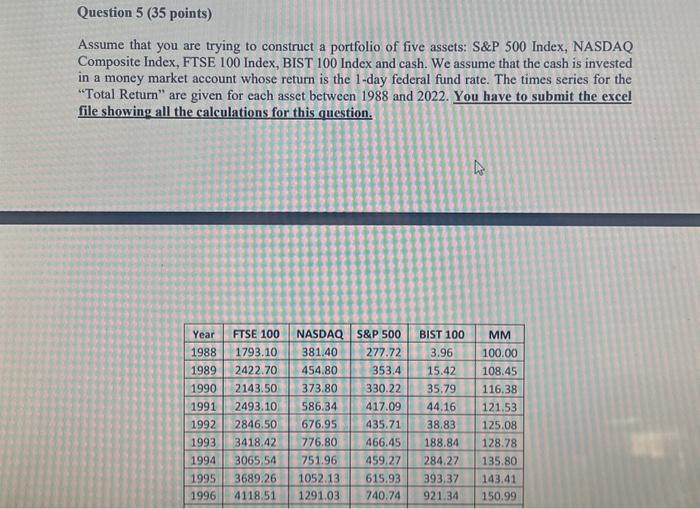

Question 5 (35 points) Assume that you are trying to construct a portfolio of five assets: S&P 500 Index, NASDAQ Composite Index, FTSE 100 Index,

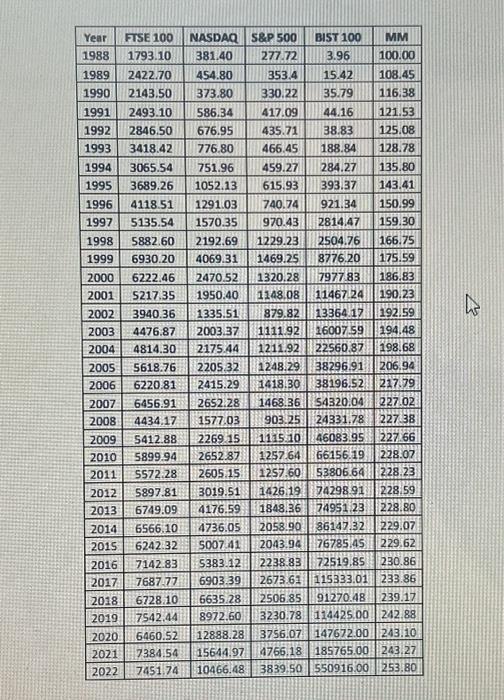

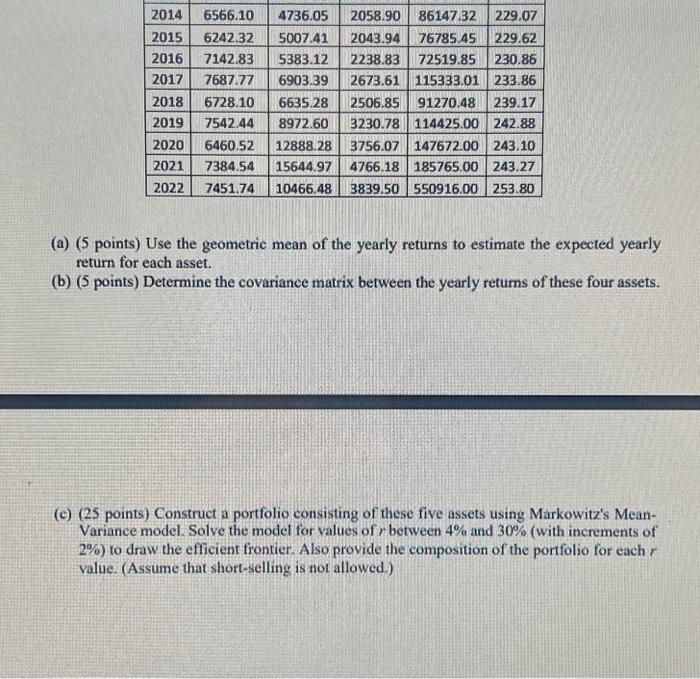

Question 5 (35 points) Assume that you are trying to construct a portfolio of five assets: S&P 500 Index, NASDAQ Composite Index, FTSE 100 Index, BIST 100 Index and cash. We assume that the cash is invested in a money market account whose return is the 1-day federal fund rate. The times series for the "Total Return" are given for each asset between 1988 and 2022. You have to submit the excel file showing all the calculations for this question. Year FTSE 100 NASDAQ S&P 500 BIST 100 381.40 1988 1793.10 1989 2422.70 454.80 1990 2143.50 373.80 1991 2493.10 586.34 1992 2846.50 676.95 1993 3418.42 776.80 1994 3065.54 751.96 1052.13 1995 3689.26 1996 4118.51 1291.03 277.72 3.96 353.4 15.42 330.22 35.79 417.09 44.16 435.71 38.83 466.45 188.84 459.27 284.27 615.93 393.37 740.74 921.34 h MM 100.00 108.45 116.38 121.53 125.08 128.78 135.80 143.41 150.99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started