Answered step by step

Verified Expert Solution

Question

1 Approved Answer

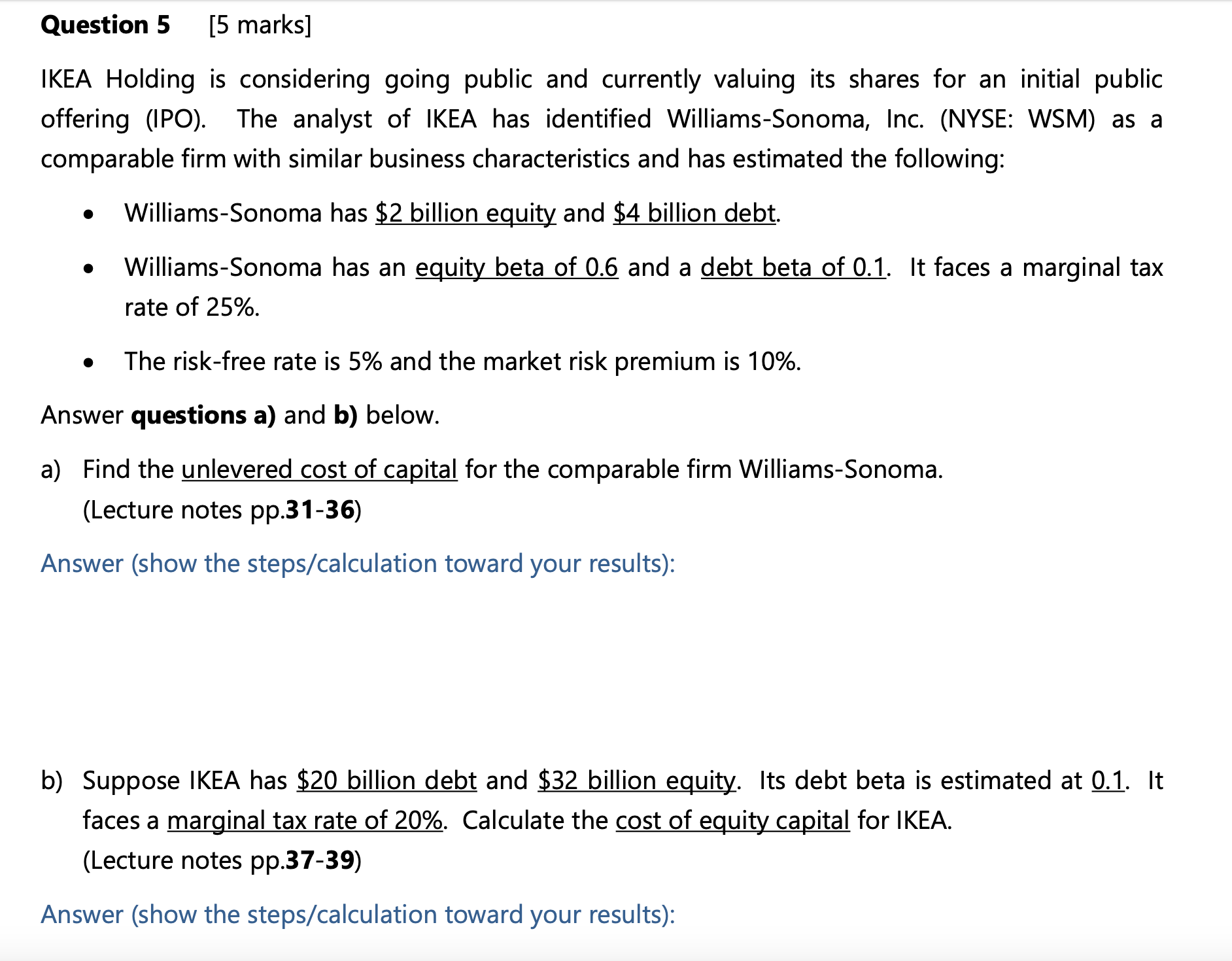

Question 5 [5 marks] IKEA Holding is considering going public and currently valuing its shares for an initial public offering (IPO). The analyst of

Question 5 [5 marks] IKEA Holding is considering going public and currently valuing its shares for an initial public offering (IPO). The analyst of IKEA has identified Williams-Sonoma, Inc. (NYSE: WSM) as a comparable firm with similar business characteristics and has estimated the following: Williams-Sonoma has $2 billion equity and $4 billion debt. Williams-Sonoma has an equity beta of 0.6 and a debt beta of 0.1. It faces a marginal tax rate of 25%. The risk-free rate is 5% and the market risk premium is 10%. Answer questions a) and b) below. a) Find the unlevered cost of capital for the comparable firm Williams-Sonoma. (Lecture notes pp.31-36) Answer (show the steps/calculation toward your results): b) Suppose IKEA has $20 billion debt and $32 billion equity. Its debt beta is estimated at 0.1. It faces a marginal tax rate of 20%. Calculate the cost of equity capital for IKEA. (Lecture notes pp.37-39) Answer (show the steps/calculation toward your results):

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a To find the unlevered cost of capital Ku for WilliamsSonoma we can use the Hamada equation Ku Ke 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started