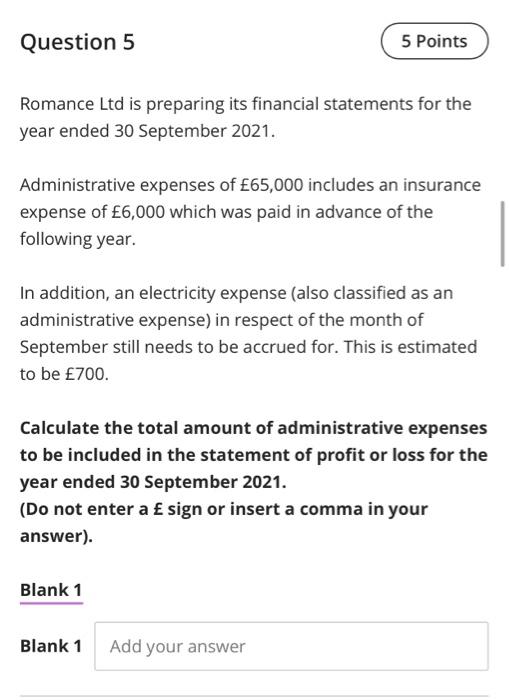

Question: Question 5 5 Points Romance Ltd is preparing its financial statements for the year ended 30 September 2021. Administrative expenses of 65,000 includes an insurance

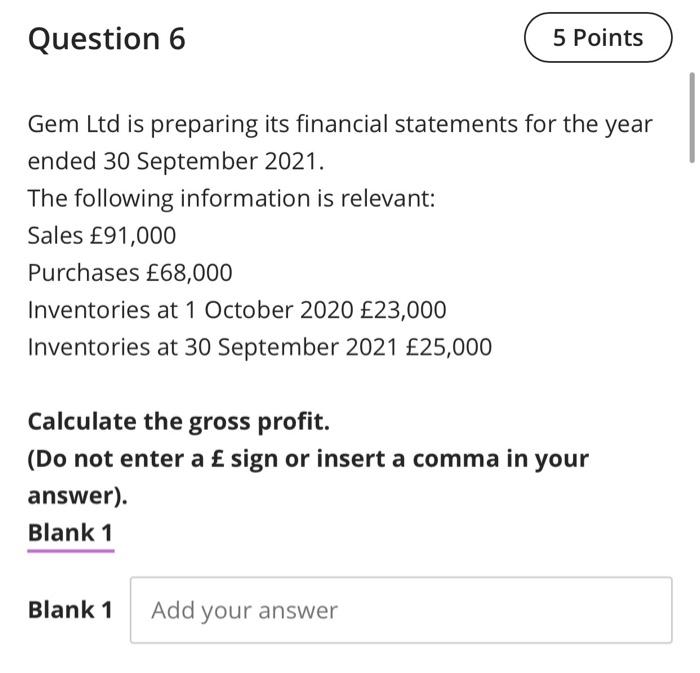

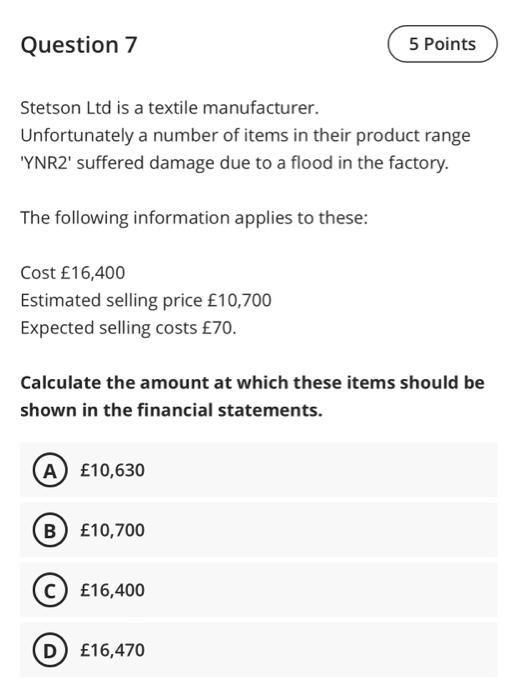

Question 5 5 Points Romance Ltd is preparing its financial statements for the year ended 30 September 2021. Administrative expenses of 65,000 includes an insurance expense of 6,000 which was paid in advance of the following year. In addition, an electricity expense (also classified as an administrative expense) in respect of the month of September still needs to be accrued for. This is estimated to be 700. Calculate the total amount of administrative expenses to be included in the statement of profit or loss for the year ended 30 September 2021. (Do not enter a sign or insert a comma in your answer). Blank 1 Blank 1 Add your answer Question 6 5 Points Gem Ltd is preparing its financial statements for the year ended 30 September 2021. The following information is relevant: Sales 91,000 Purchases 68,000 Inventories at 1 October 2020 23,000 Inventories at 30 September 2021 25,000 Calculate the gross profit. (Do not enter a sign or insert a comma in your answer). Blank 1 Blank 1 Add your answer Question 7 5 Points Stetson Ltd is a textile manufacturer. Unfortunately a number of items in their product range 'YNR2' suffered damage due to a flood in the factory. The following information applies to these: Cost 16,400 Estimated selling price 10,700 Expected selling costs 70. Calculate the amount at which these items should be shown in the financial statements. A 10,630 B 10,700 C 16,400 D 16,470

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts