Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 5 - 8 please 4. A stock provides dividends of $10/year, and the prevailing market return (r) equals 6%. a. Assuming that the dividends

question 5 - 8 please

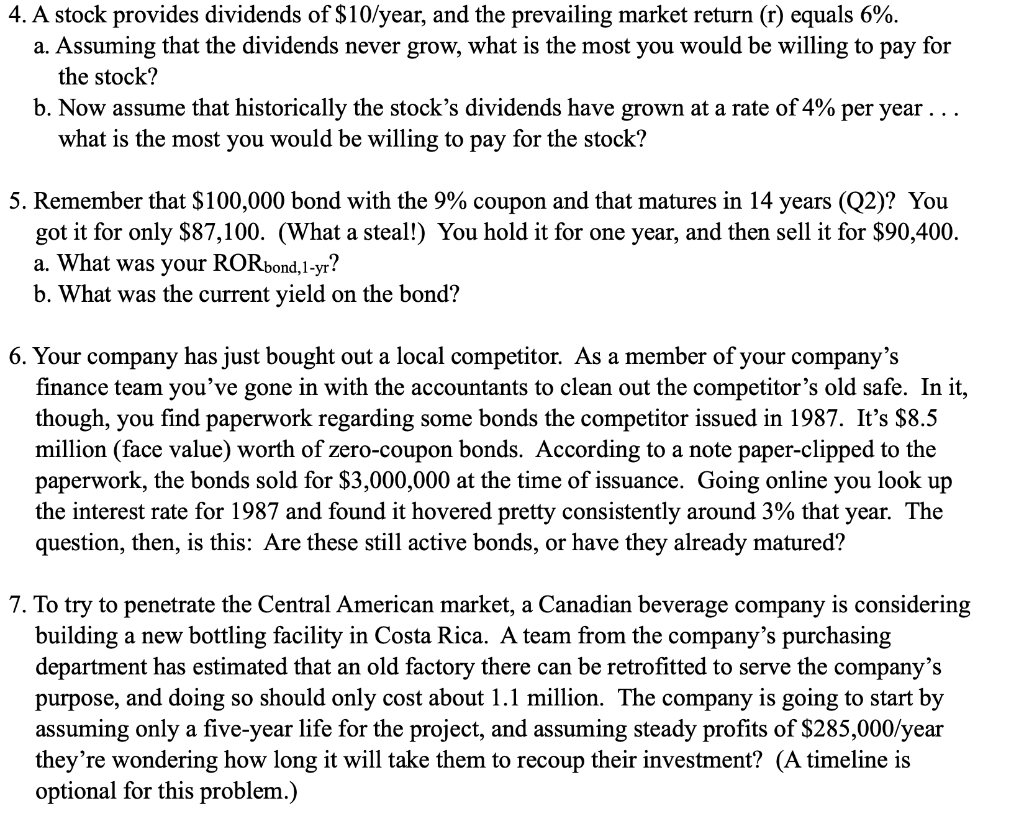

4. A stock provides dividends of $10/year, and the prevailing market return (r) equals 6%. a. Assuming that the dividends never grow, what is the most you would be willing to pay for the stock? b. Now assume that historically the stocks dividends have grown at a rate of 4% per year ... what is the most you would be willing to pay for the stock? 5. Remember that $100,000 bond with the 9% coupon and that matures in 14 years (Q2)? You got it for only $87,100. (What a steal!) You hold it for one year, and then sell it for $90,400. a. What was your RORbond, 1-yr? b. What was the current yield on the bond? 6. Your company has just bought out a local competitor. As a member of your company's finance team you've gone in with the accountants to clean out the competitor's old safe. In it, though, you find paperwork regarding some bonds the competitor issued in 1987. It's $8.5 million (face value) worth of zero-coupon bonds. According to a note paper-clipped to the paperwork, the bonds sold for $3,000,000 at the time of issuance. Going online you the interest rate for 1987 and found it hovered pretty consistently around 3% that year. The question, then, is this: Are these still active bonds, or have they already matured? look up 7. To try to penetrate the Central American market, a Canadian beverage company is considering building a new bottling facility in Costa Rica. A team from the company's purchasing department has estimated that an old factory there can be retrofitted to serve the company's purpose, and doing so should only cost about 1.1 million. The company is going to start by assuming only a five-year life for the project, and assuming steady profits of $285,000/year they're wondering how long it will take them to recoup their investment? (A timeline is optional for this problem.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started