Question 5 a) Ancova Bhd. wants to estimate its cost of capital. The company employs you as the financial consultant for the estimation purpose.

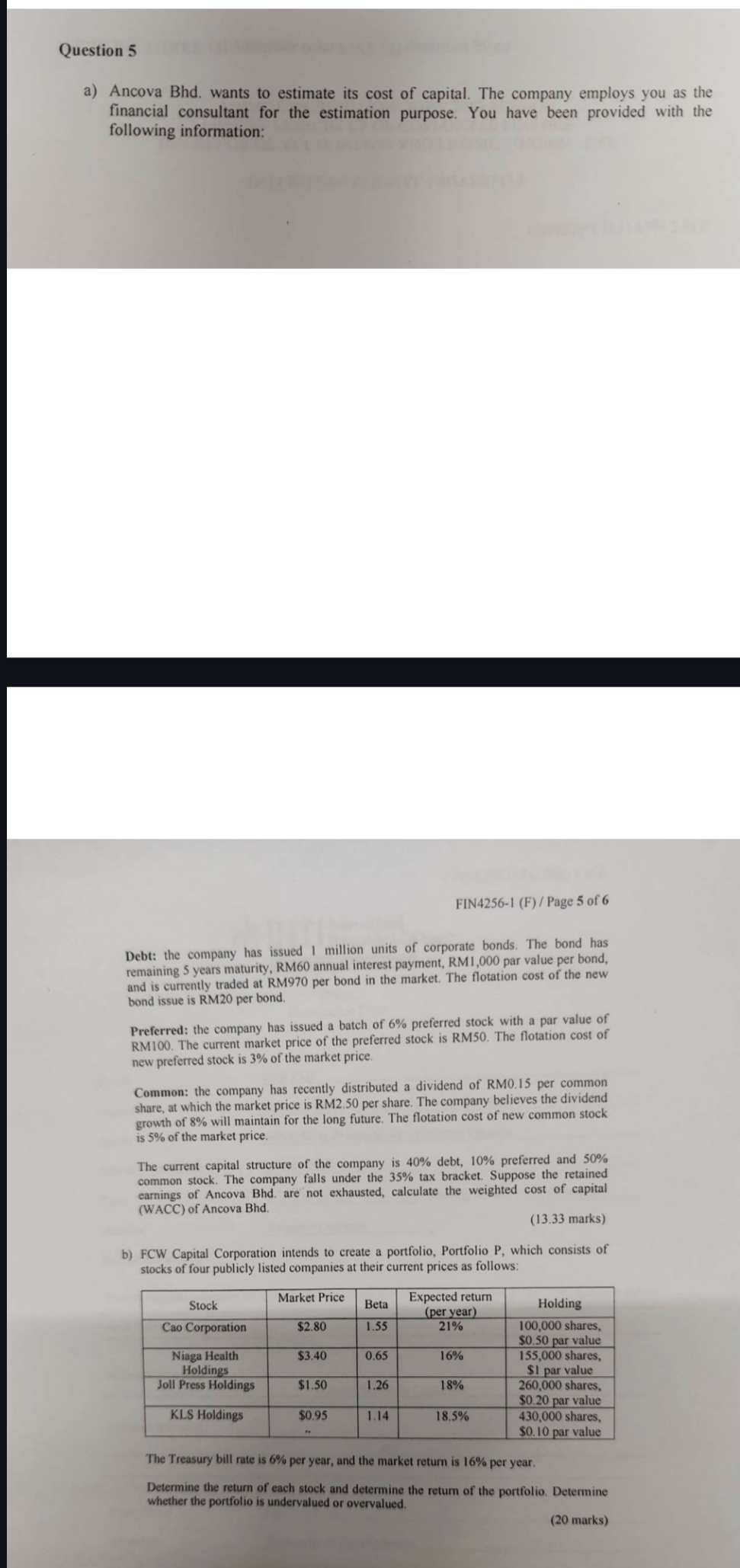

Question 5 a) Ancova Bhd. wants to estimate its cost of capital. The company employs you as the financial consultant for the estimation purpose. You have been provided with the following information: FIN4256-1 (F)/Page 5 of 6 Debt: the company has issued 1 million units of corporate bonds. The bond has remaining 5 years maturity, RM60 annual interest payment, RM1,000 par value per bond, and is currently traded at RM970 per bond in the market. The flotation cost of the new bond issue is RM20 per bond. Preferred: the company has issued a batch of 6% preferred stock with a par value of RM100. The current market price of the preferred stock is RM50. The flotation cost of new preferred stock is 3% of the market price. Common: the company has recently distributed a dividend of RM0.15 per common share, at which the market price is RM2.50 per share. The company believes the dividend growth of 8% will maintain for the long future. The flotation cost of new common stock is 5% of the market price. The current capital structure of the company is 40% debt, 10% preferred and 50% common stock. The company falls under the 35% tax bracket. Suppose the retained earnings of Ancova Bhd. are not exhausted, calculate the weighted cost of capital (WACC) of Ancova Bhd. (13.33 marks) b) FCW Capital Corporation intends to create a portfolio, Portfolio P, which consists of stocks of four publicly listed companies at their current prices as follows: Market Price Expected return Stock Beta Holding (per year) Cao Corporation $2.80 1.55 21% 100,000 shares, $0.50 par value Niaga Health $3.40 0.65 16% 155,000 shares, Holdings $1 par value Joll Press Holdings $1.50 1.26 18% 260,000 shares, $0.20 par value KLS Holdings $0.95 1.14 18.5% 430,000 shares, $0.10 par value The Treasury bill rate is 6% per year, and the market return is 16% per year. Determine the return of each stock and determine the return of the portfolio. Determine whether the portfolio is undervalued or overvalued. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started