Answered step by step

Verified Expert Solution

Question

1 Approved Answer

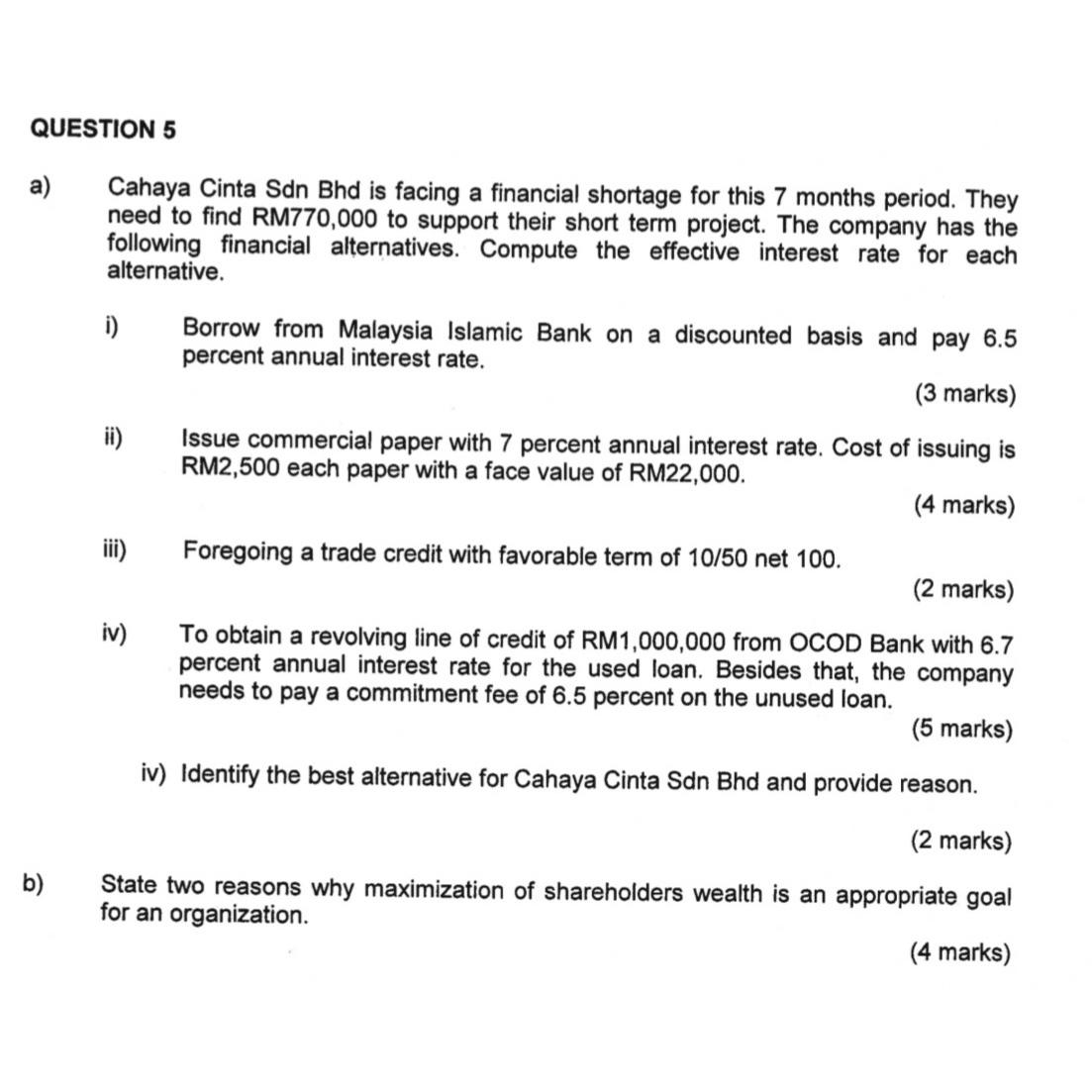

QUESTION 5 a ) Cahaya Cinta Sdn Bhd is facing a financial shortage for this 7 months period. They need to find RM 7 7

QUESTION

a Cahaya Cinta Sdn Bhd is facing a financial shortage for this months period. They need to find RM to support their short term project. The company has the following financial alternatives. Compute the effective interest rate for each alternative.

i Borrow from Malaysia Islamic Bank on a discounted basis and pay percent annual interest rate.

marks

ii Issue commercial paper with percent annual interest rate. Cost of issuing is RM each paper with a face value of RM

marks

iii Foregoing a trade credit with favorable term of net

marks

iv To obtain a revolving line of credit of RM from OCOD Bank with percent annual interest rate for the used loan. Besides that, the company needs to pay a commitment fee of percent on the unused loan.

marks

iv Identify the best alternative for Cahaya Cinta Sdn Bhd and provide reason.

marks

b State two reasons why maximization of shareholders wealth is an appropriate goal for an organization.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started