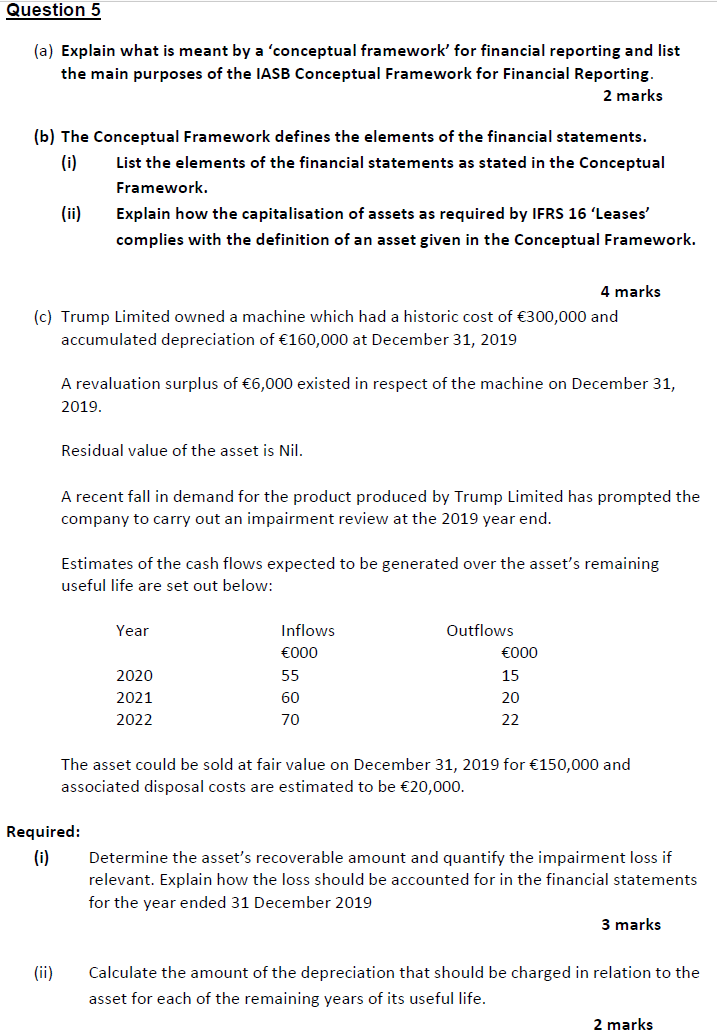

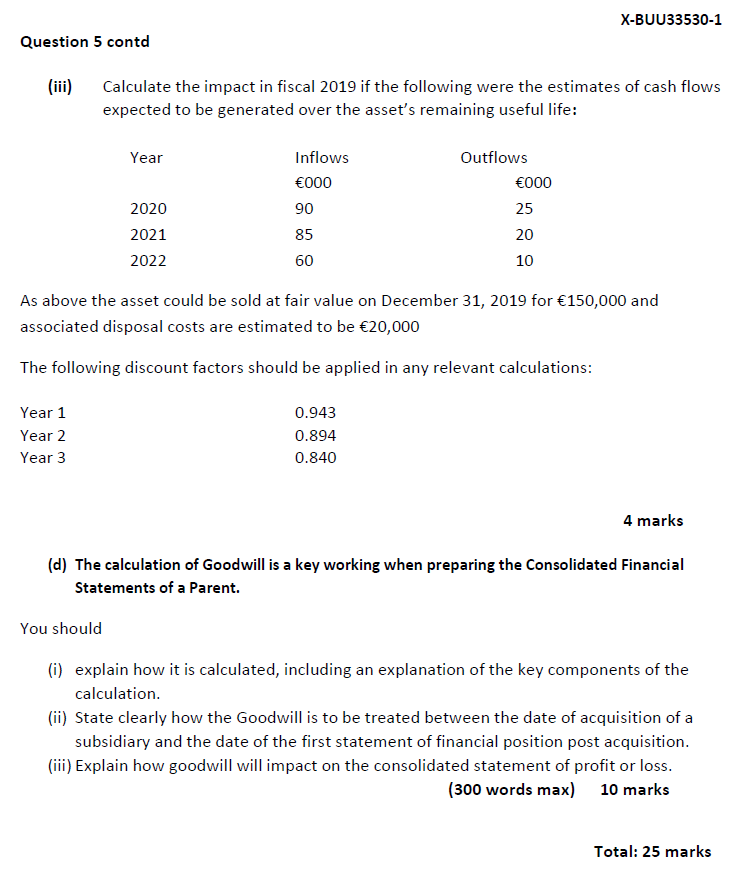

Question 5 (a) Explain what is meant by a 'conceptual framework' for financial reporting and list the main purposes of the IASB Conceptual Framework for Financial Reporting. 2 marks (b) The Conceptual Framework defines the elements of the financial statements. (i) List the elements of the financial statements as stated in the Conceptual Framework. Explain how the capitalisation of assets as required by IFRS 16 'Leases' complies with the definition of an asset given in the Conceptual Framework. 4 marks (c) Trump Limited owned a machine which had a historic cost of 300,000 and accumulated depreciation of 160,000 at December 31, 2019 A revaluation surplus of 6,000 existed in respect of the machine on December 31, 2019. Residual value of the asset is Nil. A recent fall in demand for the product produced by Trump Limited has prompted the company to carry out an impairment review at the 2019 year end. Estimates of the cash flows expected to be generated over the asset's remaining useful life are set out below: Year 2020 2021 2022 Inflows 000 55 60 70 Outflows 000 15 20 22 The asset could be sold at fair value on December 31, 2019 for 150,000 and associated disposal costs are estimated to be 20,000. Required: (i) Determine the asset's recoverable amount and quantify the impairment loss if relevant. Explain how the loss should be accounted for in the financial statements for the year ended 31 December 2019 3 marks (ii) Calculate the amount of the depreciation that should be charged in relation to the asset for each of the remaining years of its useful life. 2 marks X-BUU33530-1 Question 5 contd Calculate the impact in fiscal 2019 if the following were the estimates of cash flows expected to be generated over the asset's remaining useful life: Year Inflows 000 90 2020 2021 2022 Outflows 000 25 20 10 85 60 As above the asset could be sold at fair value on December 31, 2019 for 150,000 and associated disposal costs are estimated to be 20,000 The following discount factors should be applied in any relevant calculations: Year 1 Year 2 Year 3 0.943 0.894 0.840 4 marks (d) The calculation of Goodwill is a key working when preparing the Consolidated Financial Statements of a Parent. You should (i) explain how it is calculated, including an explanation of the key components of the calculation. (ii) State clearly how the Goodwill is to be treated between the date of acquisition of a subsidiary and the date of the first statement of financial position post acquisition. (iii) Explain how goodwill will impact on the consolidated statement of profit or loss. (300 words max 10 marks Total: 25 marks Question 5 (a) Explain what is meant by a 'conceptual framework' for financial reporting and list the main purposes of the IASB Conceptual Framework for Financial Reporting. 2 marks (b) The Conceptual Framework defines the elements of the financial statements. (i) List the elements of the financial statements as stated in the Conceptual Framework. Explain how the capitalisation of assets as required by IFRS 16 'Leases' complies with the definition of an asset given in the Conceptual Framework. 4 marks (c) Trump Limited owned a machine which had a historic cost of 300,000 and accumulated depreciation of 160,000 at December 31, 2019 A revaluation surplus of 6,000 existed in respect of the machine on December 31, 2019. Residual value of the asset is Nil. A recent fall in demand for the product produced by Trump Limited has prompted the company to carry out an impairment review at the 2019 year end. Estimates of the cash flows expected to be generated over the asset's remaining useful life are set out below: Year 2020 2021 2022 Inflows 000 55 60 70 Outflows 000 15 20 22 The asset could be sold at fair value on December 31, 2019 for 150,000 and associated disposal costs are estimated to be 20,000. Required: (i) Determine the asset's recoverable amount and quantify the impairment loss if relevant. Explain how the loss should be accounted for in the financial statements for the year ended 31 December 2019 3 marks (ii) Calculate the amount of the depreciation that should be charged in relation to the asset for each of the remaining years of its useful life. 2 marks X-BUU33530-1 Question 5 contd Calculate the impact in fiscal 2019 if the following were the estimates of cash flows expected to be generated over the asset's remaining useful life: Year Inflows 000 90 2020 2021 2022 Outflows 000 25 20 10 85 60 As above the asset could be sold at fair value on December 31, 2019 for 150,000 and associated disposal costs are estimated to be 20,000 The following discount factors should be applied in any relevant calculations: Year 1 Year 2 Year 3 0.943 0.894 0.840 4 marks (d) The calculation of Goodwill is a key working when preparing the Consolidated Financial Statements of a Parent. You should (i) explain how it is calculated, including an explanation of the key components of the calculation. (ii) State clearly how the Goodwill is to be treated between the date of acquisition of a subsidiary and the date of the first statement of financial position post acquisition. (iii) Explain how goodwill will impact on the consolidated statement of profit or loss. (300 words max 10 marks Total: 25 marks