Answered step by step

Verified Expert Solution

Question

1 Approved Answer

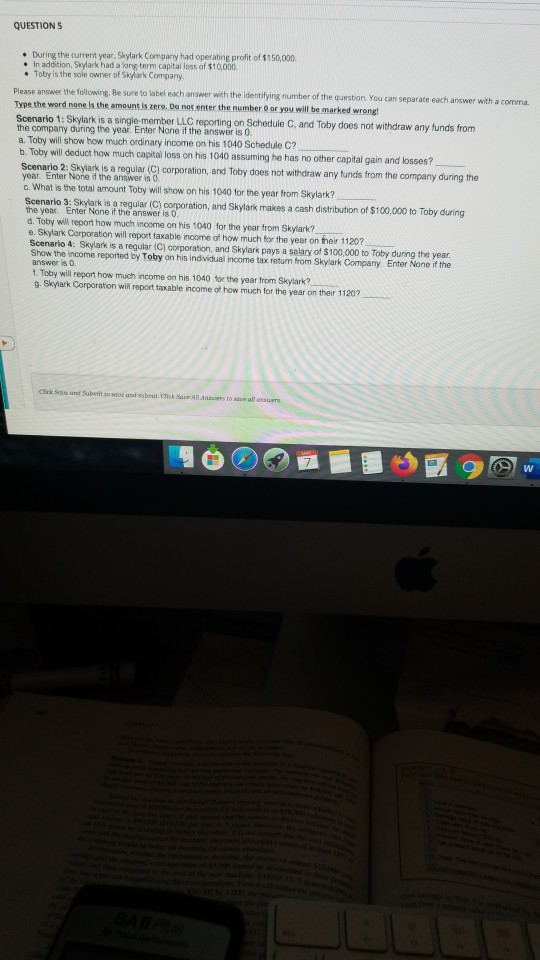

question 5 all parts QUESTIONS . During the current year, Skylark Company had operating profit of $150,000 In addition, Skylark had a long term capitaloss

question 5 all parts

QUESTIONS . During the current year, Skylark Company had operating profit of $150,000 In addition, Skylark had a long term capitaloss of $10,000 Toby is the sole owner of Skylark Company Please answer the following Be sure to be each answer with the entifying number of the question. You can separate each answer with a comma Type the word none is the amount is zero, Demetenter the number or you will be marked wrong Scenario 1: Skylark is a single member LLC reporting on Schedule C, and Toby does not withdraw any funds from the company during the year. Enter None if the answer is 0. a. Toby will show how much ordinary income on his 1040 Schedule C? 6. Toby will deduct how much capital loss on his 1040 assuming he has no other capital gain and losses? Scenario 2: Skylark is a regular (C) corporation, and Toby does not withdraw any funds from the company during the year. Enter Noned the answer is 0. c. What is the total amount Toby will show on his 1040 for the year from Skylark? Scenario 3: Skylark is a regular (C) corporation, and Skylark makes a cash distribution of $100,000 to Toby during The year Emer None if the answer is 0. d. Toby will report how much income on his 1040 for the year from Skylark? e. Skylark Corporation will report taxable income of how much for the year on their 1120? Scenario 4: Skylark is a regular (C) corporation, and Skylark pays a salary of $100,000 to Toby during the year, Slow The come reported by Toby on his individual income tax return from Skylark Company Enter None if the answers. 1. Toby will report how much income on his 1040 for the year from Skylark? Skylark Corporation will report taxable income of how much for the year on their 11207Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started