Answered step by step

Verified Expert Solution

Question

1 Approved Answer

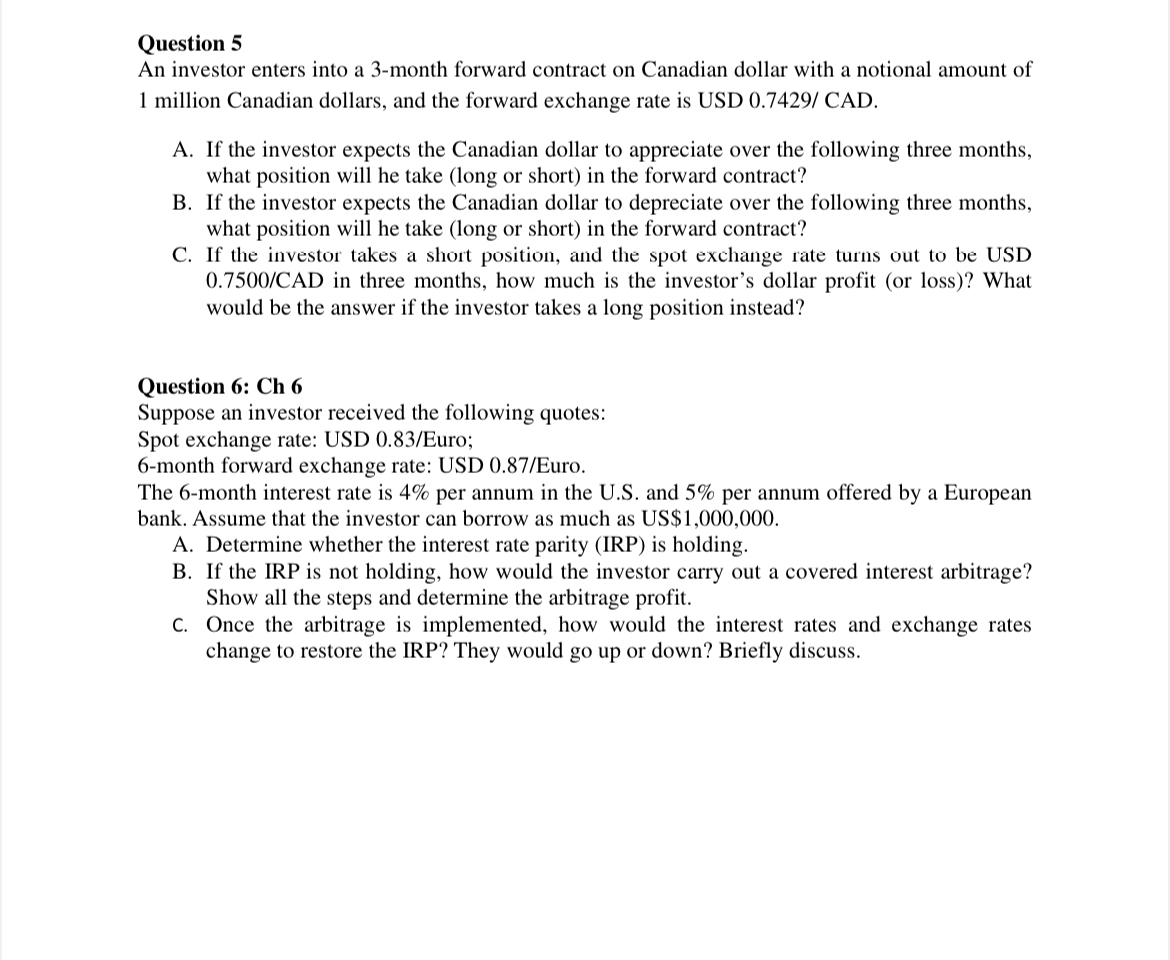

Question 5 An investor enters into a 3 - month forward contract on Canadian dollar with a notional amount of 1 million Canadian dollars, and

Question

An investor enters into a month forward contract on Canadian dollar with a notional amount of million Canadian dollars, and the forward exchange rate is USD CAD.

A If the investor expects the Canadian dollar to appreciate over the following three months, what position will he take long or short in the forward contract?

B If the investor expects the Canadian dollar to depreciate over the following three months, what position will he take long or short in the forward contract?

C If the investor takes a short position, and the spot exchange rate turns out to be USD in three months, how much is the investor's dollar profit or loss What would be the answer if the investor takes a long position instead?

Question : Ch

Suppose an investor received the following quotes:

Spot exchange rate: USD Euro;

month forward exchange rate: USD Euro.

The month interest rate is per annum in the US and per annum offered by a European bank. Assume that the investor can borrow as much as US $

A Determine whether the interest rate parity IRP is holding.

B If the IRP is not holding, how would the investor carry out a covered interest arbitrage? Show all the steps and determine the arbitrage profit.

C Once the arbitrage is implemented, how would the interest rates and exchange rates change to restore the IRP? They would go up or down? Briefly discuss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started