Question: Question 5 Analysts at OilFirmX are considering how much to bid in a government auction for drilling rights in a new lease area in the

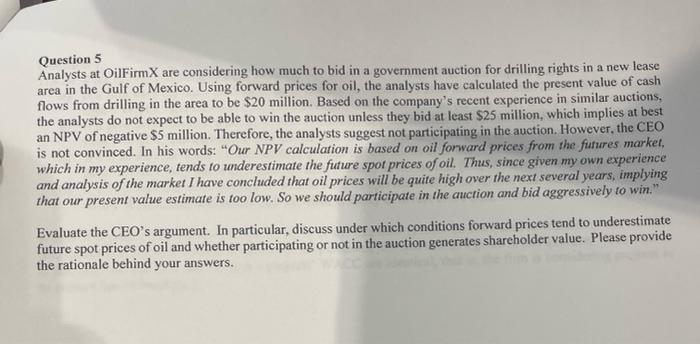

Question 5 Analysts at OilFirmX are considering how much to bid in a government auction for drilling rights in a new lease area in the Gulf of Mexico. Using forward prices for oil, the analysts have calculated the present value of cash flows from drilling in the area to be $20 million. Based on the company's recent experience in similar auctions, the analysts do not expect to be able to win the auction unless they bid at least $25 million, which implies at best an NPV of negative $5 million. Therefore, the analysts suggest not participating in the auction. However, the CEO is not convinced. In his words: "Our NPV calculation is based on oil forward prices from the futures market, which in my experience, tends to underestimate the future spor prices of oil. Thus, since given my own experience and analysis of the market I have concluded that oil prices will be quite high over the next several years, implying that our present value estimate is too low. So we should participate in the auction and bid aggressively to win." Evaluate the CEO's argument. In particular, discuss under which conditions forward prices tend to underestimate future spot prices of oil and whether participating or not in the auction generates shareholder value. Please provide the rationale behind your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts