Answered step by step

Verified Expert Solution

Question

1 Approved Answer

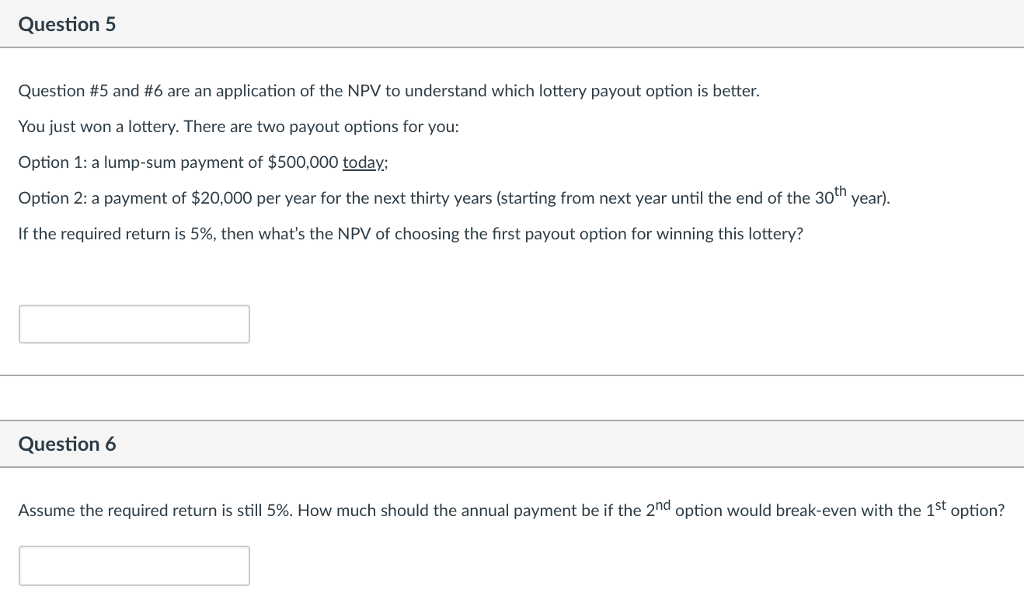

Question # 5 and # 6 are an application of the NPV to understand which lottery payout option is better. You just won a lottery.

Question # and # are an application of the NPV to understand which lottery payout option is better.

You just won a lottery. There are two payout options for you:

Option : a lumpsum payment of $ today;

Option : a payment of $ per year for the next thirty years starting from next year until the end of the th year

If the required return is then whats the NPV of choosing the first payout option for winning this lottery?

Hint: the value of the option is considered as the opportunity costs of choosing the first payout option.

Flag question: Question

Question pts

Assume the required return is still How much should the annual payment be if the nd option would breakeven with the st option?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started