Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 5 Answer the following questions based on the information provided 5.1 Study the information provided below and calculate the following. Where applicable, use the

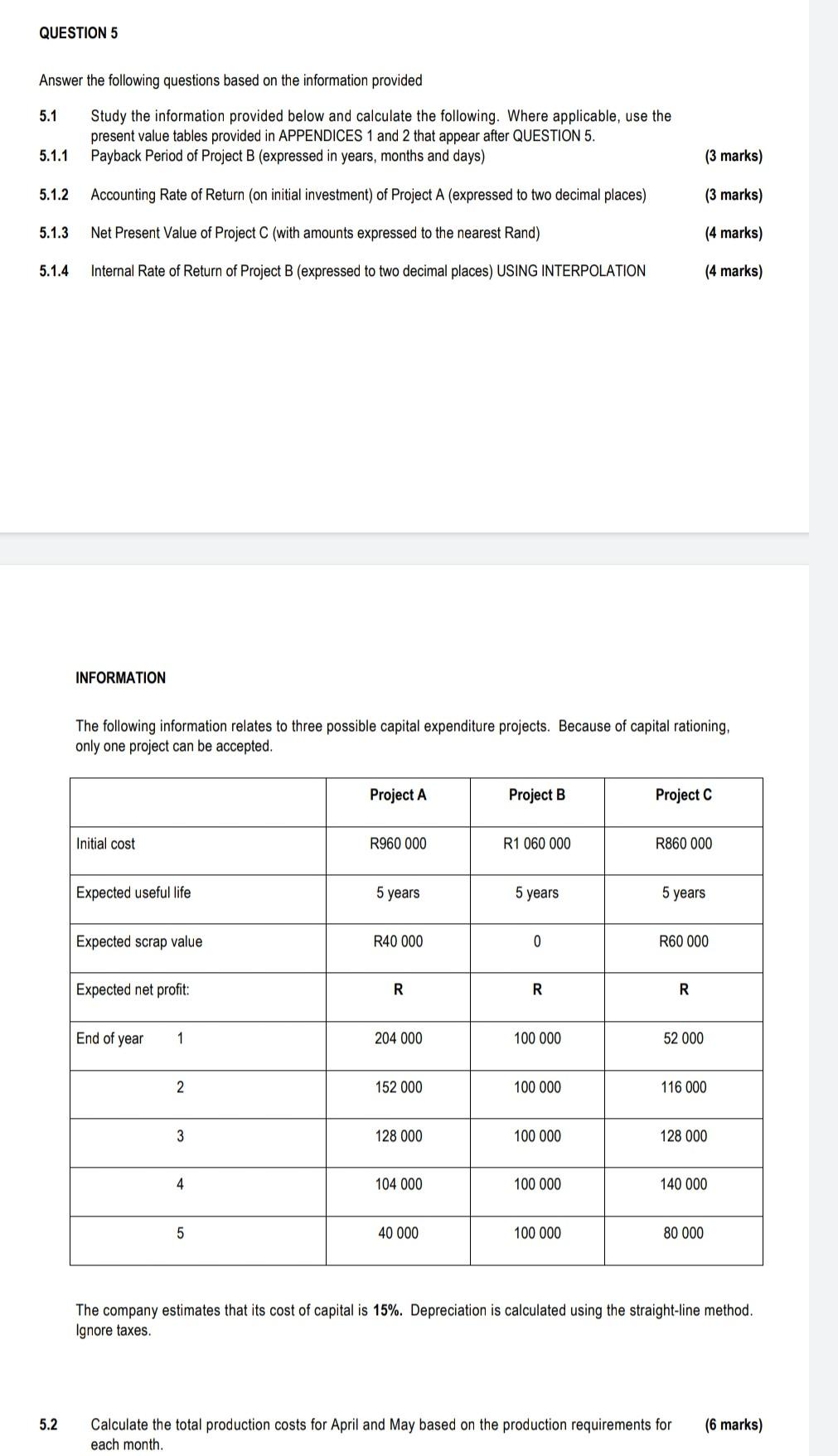

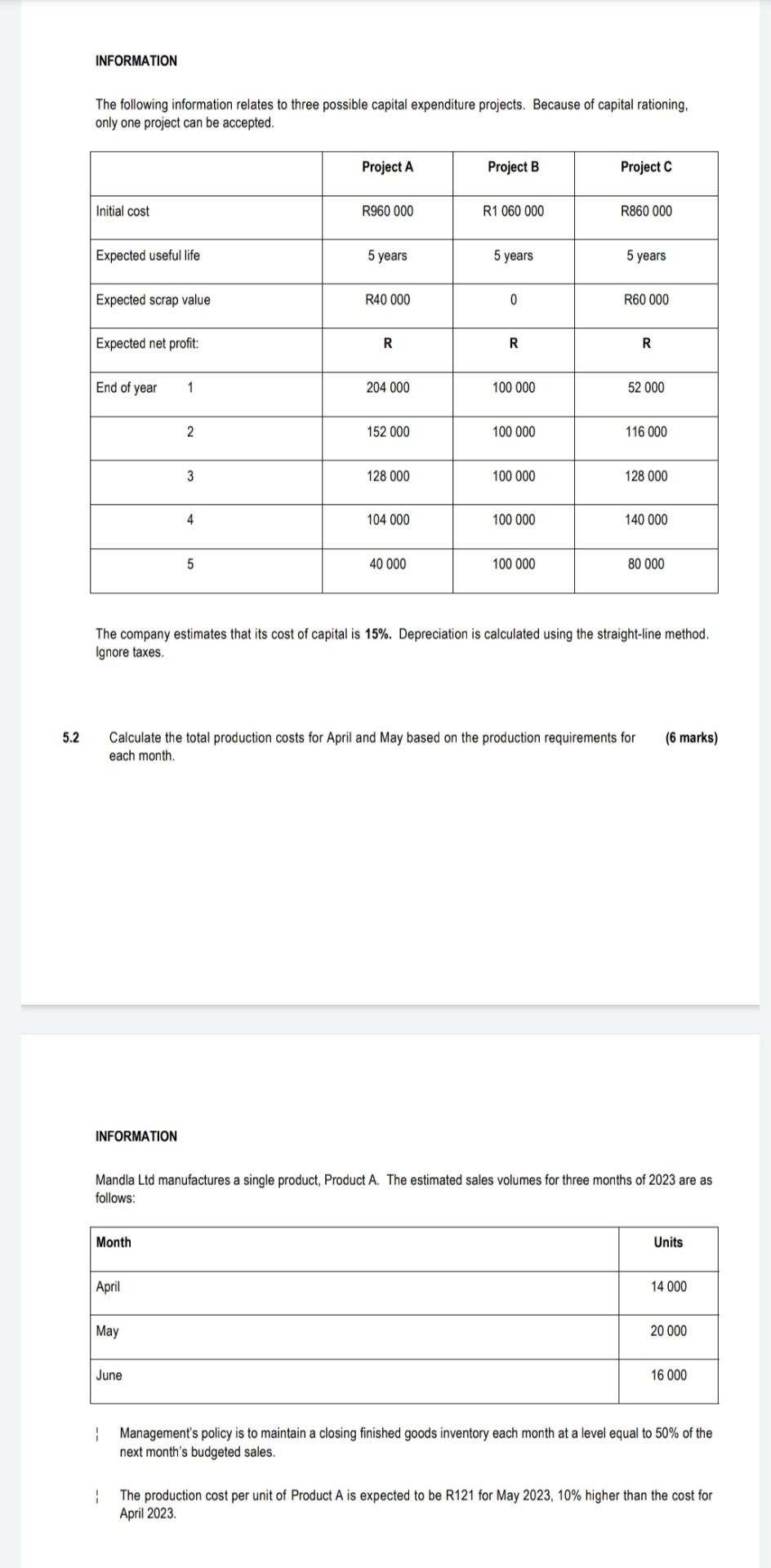

QUESTION 5 Answer the following questions based on the information provided 5.1 Study the information provided below and calculate the following. Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. Payback Period of Project B (expressed in years, months and days) 5.1.1 (3 marks) 5.1.2 Accounting Rate of Return (on initial investment) of Project A (expressed to two decimal places) (3 marks) 5.1.3 Net Present Value of Project C (with amounts expressed to the nearest Rand) (4 marks) 5.1.4 Internal Rate of Return of Project B (expressed to two decimal places) USING INTERPOLATION (4 marks) INFORMATION The following information relates to three possible capital expenditure projects. Because of capital rationing, only one project can be accepted. Project A Project B Project C Initial cost R960 000 R1 060 000 R860 000 Expected useful life 5 years 5 years 5 years Expected scrap value R40 000 0 R60 000 Expected net profit: R R R End of year 1 204 000 100 000 52 000 2 152 000 100 000 116 000 3 128 000 100 000 128 000 4 104 000 100 000 140 000 5 40 000 100 000 80 000 The company estimates that its cost of capital is 15%. Depreciation is calculated using the straight-line method. Ignore taxes. 5.2 (6 marks) Calculate the total production costs for April and May based on the production requirements for each month. INFORMATION The following information relates to three possible capital expenditure projects. Because of capital rationing, only one project can be accepted. Project A Project B Project C R860 000 Initial cost R960 000 R1 060 000 Expected useful life 5 years 5 years 5 years Expected scrap value R40 000 0 R60 000 Expected net profit: R R R End of year 1 204 000 100 000 52 000 2 152 000 100 000 116 000 3 128 000 100 000 128 000 4 104 000 100 000 140 000 5 40 000 100 000 80 000 The company estimates that its cost of capital is 15%. Depreciation is calculated using the straight-line method. Ignore taxes. 5.2 Calculate the total production costs for April and May based on the production requirements for (6 marks) each month. INFORMATION Mandla Ltd manufactures a single product, Product A. The estimated sales volumes for three months of 2023 are as follows: Month Units April 14 000 May 20 000 June 16 000 1 Management's policy is to maintain a closing finished goods inventory each month at a level equal to 50% of the next month's budgeted sales. 1 The production cost per unit of Product A is expected to be R121 for May 2023, 10% higher than the cost for April 2023. QUESTION 5 Answer the following questions based on the information provided 5.1 Study the information provided below and calculate the following. Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. Payback Period of Project B (expressed in years, months and days) 5.1.1 (3 marks) 5.1.2 Accounting Rate of Return (on initial investment) of Project A (expressed to two decimal places) (3 marks) 5.1.3 Net Present Value of Project C (with amounts expressed to the nearest Rand) (4 marks) 5.1.4 Internal Rate of Return of Project B (expressed to two decimal places) USING INTERPOLATION (4 marks) INFORMATION The following information relates to three possible capital expenditure projects. Because of capital rationing, only one project can be accepted. Project A Project B Project C Initial cost R960 000 R1 060 000 R860 000 Expected useful life 5 years 5 years 5 years Expected scrap value R40 000 0 R60 000 Expected net profit: R R R End of year 1 204 000 100 000 52 000 2 152 000 100 000 116 000 3 128 000 100 000 128 000 4 104 000 100 000 140 000 5 40 000 100 000 80 000 The company estimates that its cost of capital is 15%. Depreciation is calculated using the straight-line method. Ignore taxes. 5.2 (6 marks) Calculate the total production costs for April and May based on the production requirements for each month. INFORMATION The following information relates to three possible capital expenditure projects. Because of capital rationing, only one project can be accepted. Project A Project B Project C R860 000 Initial cost R960 000 R1 060 000 Expected useful life 5 years 5 years 5 years Expected scrap value R40 000 0 R60 000 Expected net profit: R R R End of year 1 204 000 100 000 52 000 2 152 000 100 000 116 000 3 128 000 100 000 128 000 4 104 000 100 000 140 000 5 40 000 100 000 80 000 The company estimates that its cost of capital is 15%. Depreciation is calculated using the straight-line method. Ignore taxes. 5.2 Calculate the total production costs for April and May based on the production requirements for (6 marks) each month. INFORMATION Mandla Ltd manufactures a single product, Product A. The estimated sales volumes for three months of 2023 are as follows: Month Units April 14 000 May 20 000 June 16 000 1 Management's policy is to maintain a closing finished goods inventory each month at a level equal to 50% of the next month's budgeted sales. 1 The production cost per unit of Product A is expected to be R121 for May 2023, 10% higher than the cost for April 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started