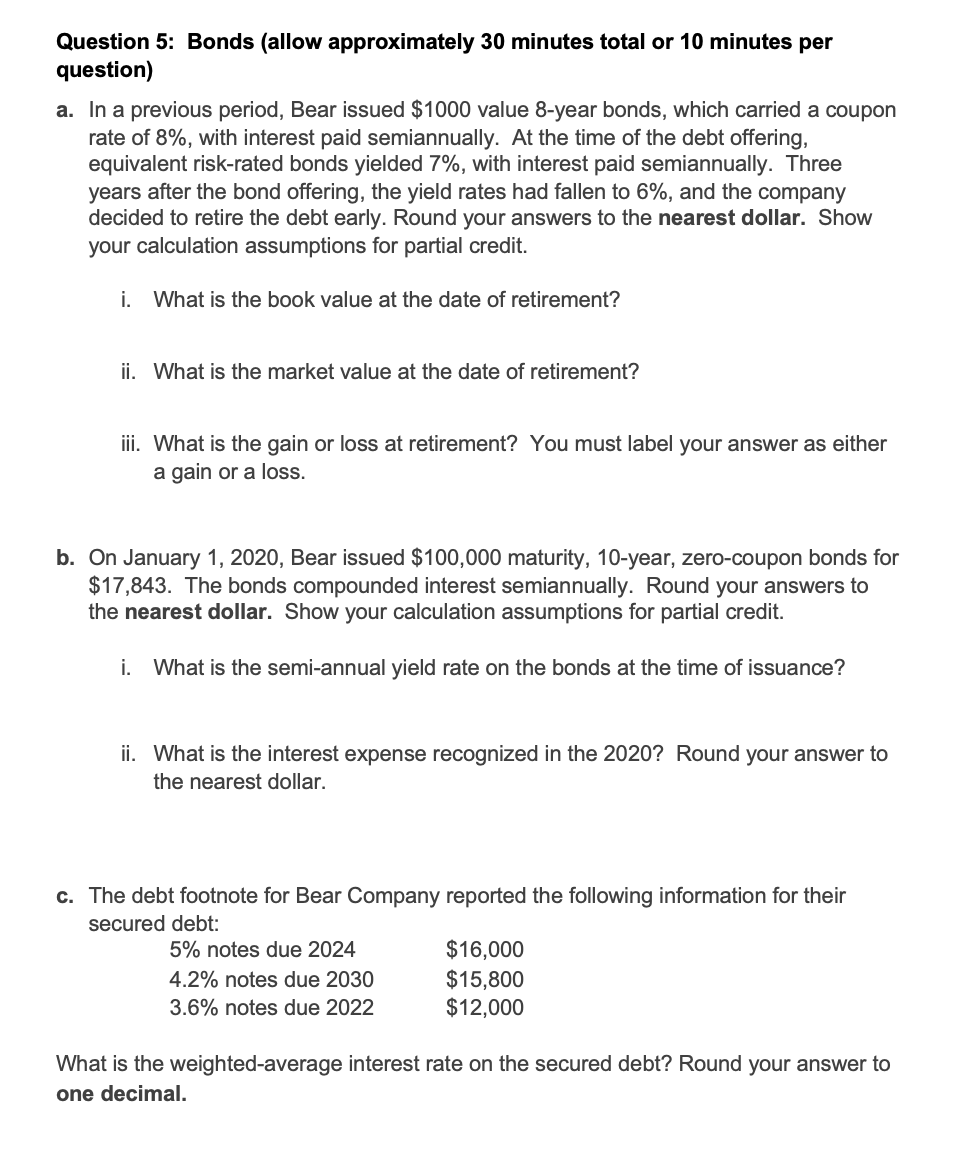

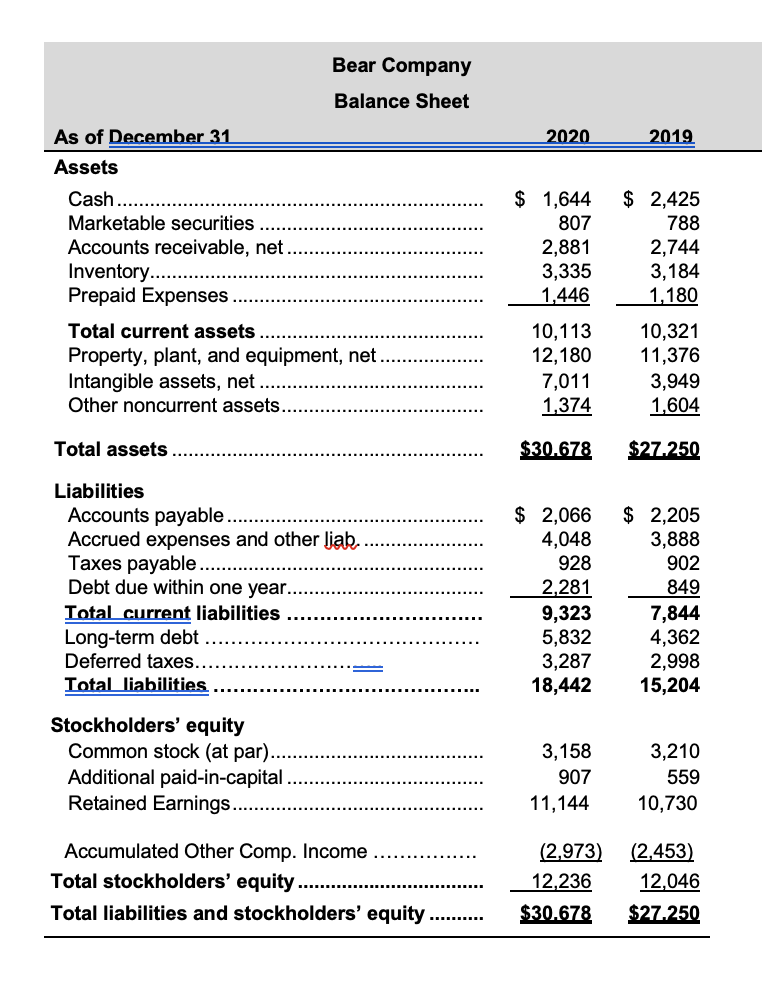

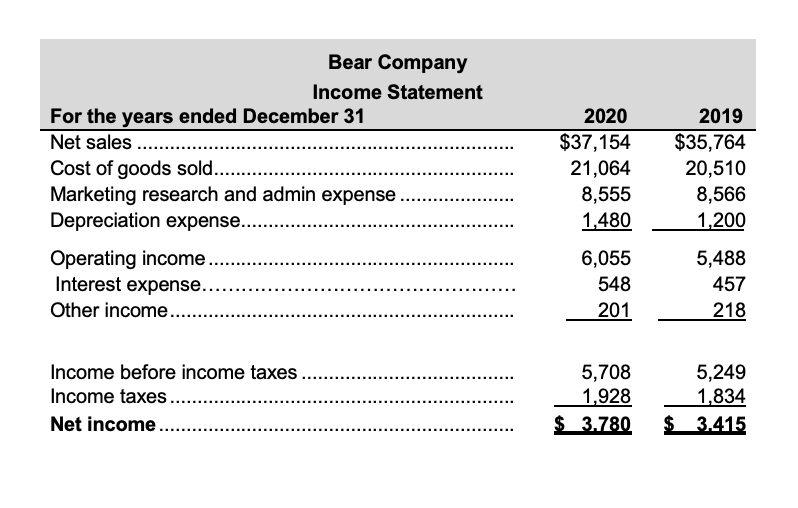

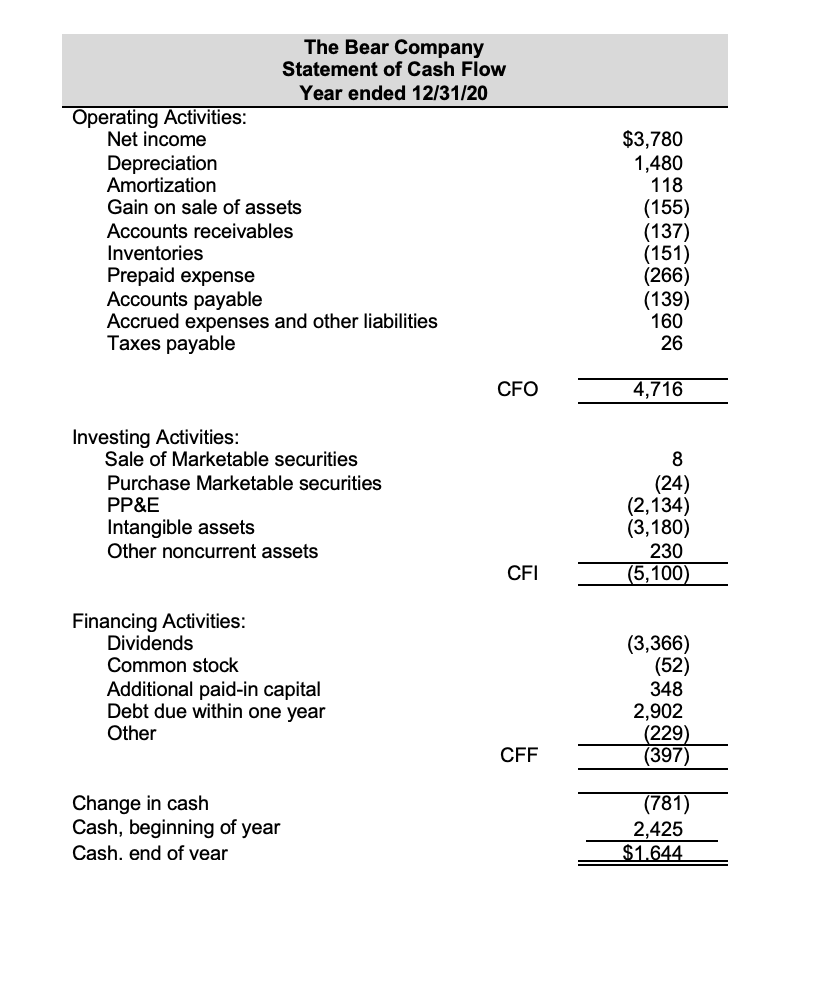

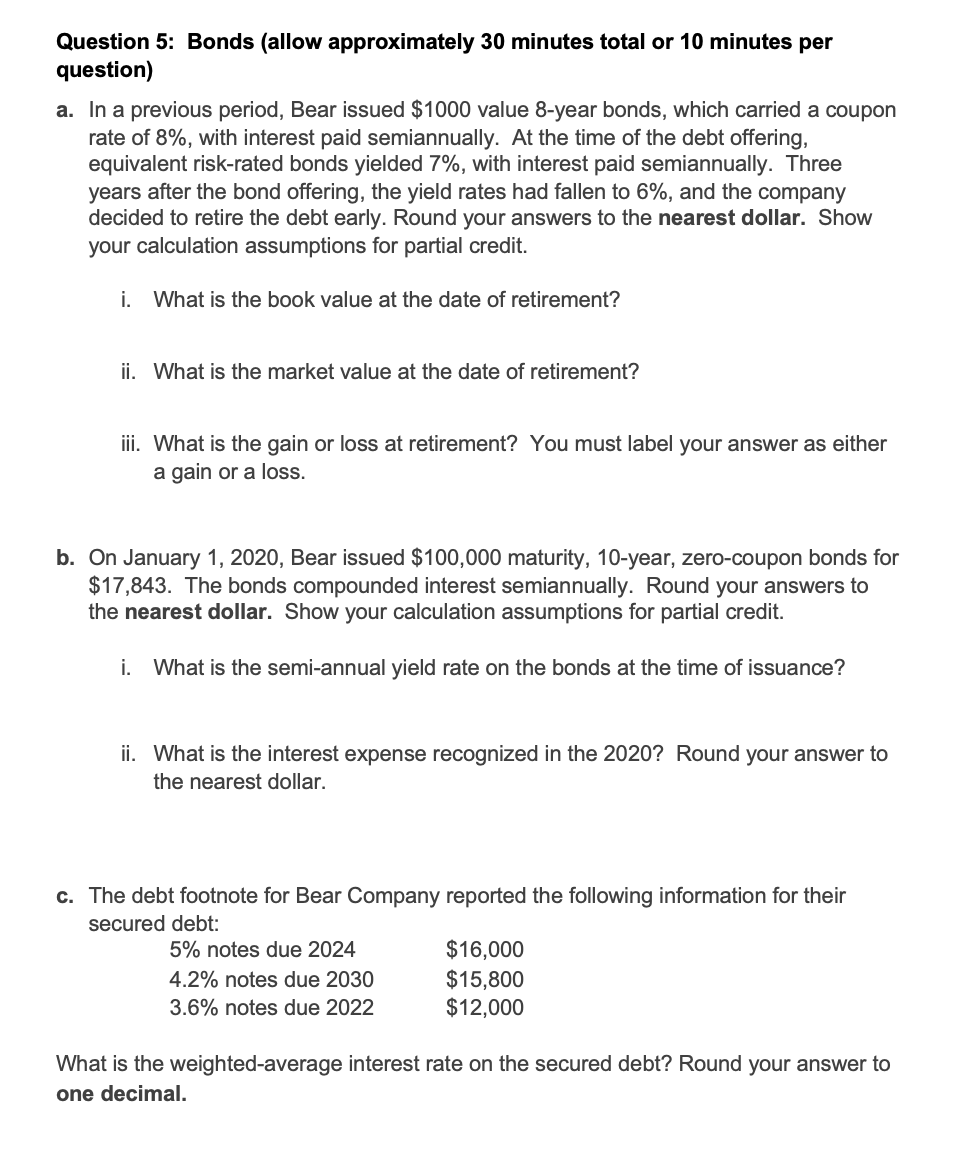

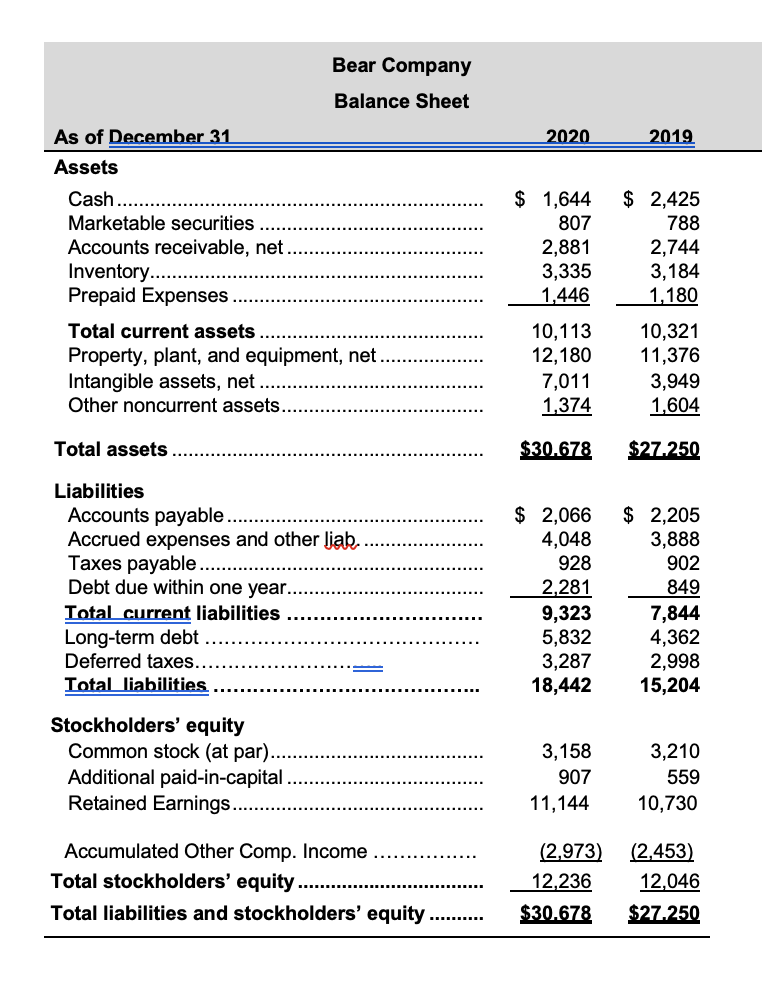

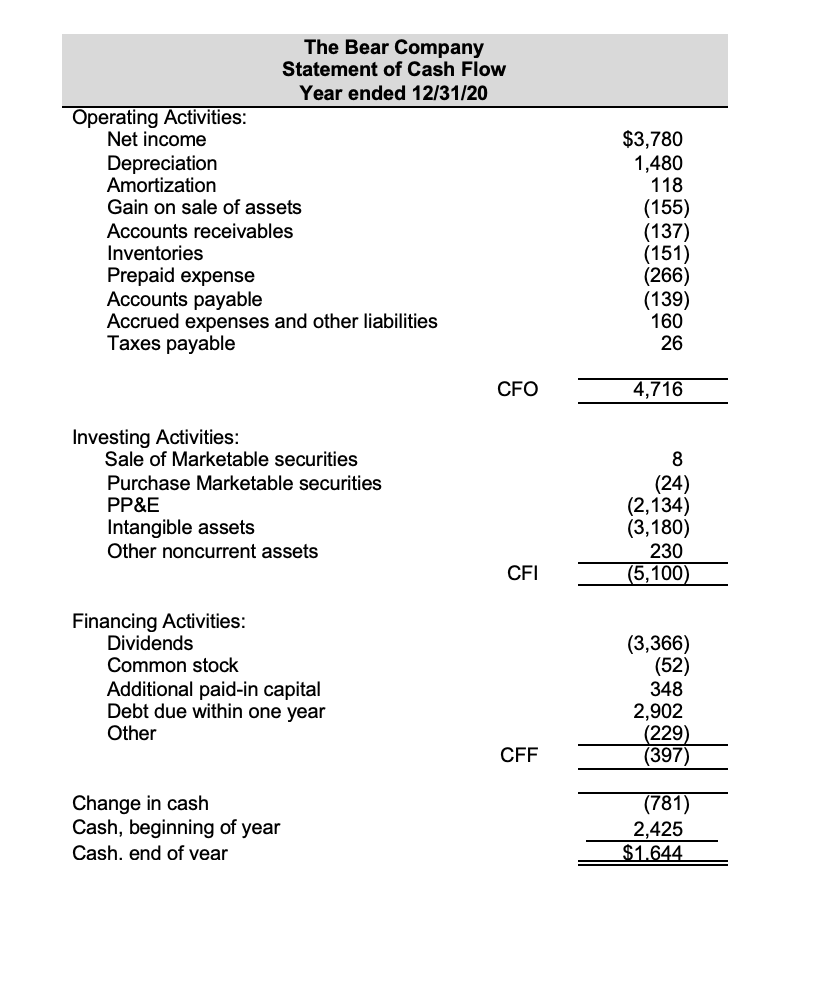

Question 5: Bonds (allow approximately 30 minutes total or 10 minutes per question) a. In a previous period, Bear issued $1000 value 8-year bonds, which carried a coupon rate of 8%, with interest paid semiannually. At the time of the debt offering, equivalent risk-rated bonds yielded 7%, with interest paid semiannually. Three years after the bond offering, the yield rates had fallen to 6%, and the company decided to retire the debt early. Round your answers to the nearest dollar. Show your calculation assumptions for partial credit. i. What is the book value at the date of retirement? ii. What is the market value at the date of retirement? iii. What is the gain or loss at retirement? You must label your answer as either a gain or a loss. b. On January 1, 2020, Bear issued $100,000 maturity, 10-year, zero-coupon bonds for $17,843. The bonds compounded interest semiannually. Round your answers to the nearest dollar. Show your calculation assumptions for partial credit. i. What is the semi-annual yield rate on the bonds at the time of issuance? ii. What is the interest expense recognized in the 2020? Round your answer to the nearest dollar. C. The debt footnote for Bear Company reported the following information for their secured debt: 5% notes due 2024 $16,000 4.2% notes due 2030 $15,800 3.6% notes due 2022 $12,000 What is the weighted average interest rate on the secured debt? Round your answer to one decimal. Bear Company Balance Sheet 2020 2019 As of December 31 Assets Cash.. Marketable securities Accounts receivable, net. Inventory...... Prepaid Expenses Total current assets. Property, plant, and equipment, net. Intangible assets, net Other noncurrent assets. $ 1,644 807 2,881 3,335 1,446 $ 2,425 788 2,744 3,184 1,180 10,113 12,180 7,011 1,374 10,321 11,376 3,949 1,604 Total assets $30.678 $27.250 Liabilities Accounts payable Accrued expenses and other liab. Taxes payable Debt due within one year Total current liabilities Long-term debt Deferred taxes.. Total liabilities. $ 2,066 4,048 928 2.281 9,323 5,832 3,287 18,442 $ 2,205 3,888 902 849 7,844 4,362 2,998 15,204 Stockholders' equity Common stock (at par). Additional paid-in-capital Retained Earnings.. 3,158 907 11,144 3,210 559 10,730 Accumulated Other Comp. Income Total stockholders' equity. Total liabilities and stockholders' equity .......... (2,973) 12,236 $30.678 (2,453) 12,046 $27.250 Bear Company Income Statement For the years ended December 31 Net sales ........... Cost of goods sold............. Marketing research and admin expense Depreciation expense. Operating income Interest expense...... Other income....... 2020 $37,154 21,064 8,555 1,480 2019 $35,764 20,510 8,566 1.200 6,055 548 201 5,488 457 218 Income before income taxes ..... Income taxes ....... Net income 5,708 1,928 $ 3.780 5,249 1,834 $ 3.415 The Bear Company Statement of Cash Flow Year ended 12/31/20 Operating Activities: Net income Depreciation Amortization Gain on sale of assets Accounts receivables Inventories Prepaid expense Accounts payable Accrued expenses and other liabilities Taxes payable $3,780 1,480 118 (155) (137) (151) (266) (139) 160 26 CFO 4,716 Investing Activities: Sale of Marketable securities Purchase Marketable securities PP&E Intangible assets Other noncurrent assets 8 (24) (2,134) (3,180) 230 (5,100) CFI Financing Activities: Dividends Common stock Additional paid-in capital Debt due within one year Other (3,366) (52) 348 2,902 (229) (397) CFF Change in cash Cash, beginning of year Cash. end of vear (781) 2,425 $1.644 Question 5: Bonds (allow approximately 30 minutes total or 10 minutes per question) a. In a previous period, Bear issued $1000 value 8-year bonds, which carried a coupon rate of 8%, with interest paid semiannually. At the time of the debt offering, equivalent risk-rated bonds yielded 7%, with interest paid semiannually. Three years after the bond offering, the yield rates had fallen to 6%, and the company decided to retire the debt early. Round your answers to the nearest dollar. Show your calculation assumptions for partial credit. i. What is the book value at the date of retirement? ii. What is the market value at the date of retirement? iii. What is the gain or loss at retirement? You must label your answer as either a gain or a loss. b. On January 1, 2020, Bear issued $100,000 maturity, 10-year, zero-coupon bonds for $17,843. The bonds compounded interest semiannually. Round your answers to the nearest dollar. Show your calculation assumptions for partial credit. i. What is the semi-annual yield rate on the bonds at the time of issuance? ii. What is the interest expense recognized in the 2020? Round your answer to the nearest dollar. C. The debt footnote for Bear Company reported the following information for their secured debt: 5% notes due 2024 $16,000 4.2% notes due 2030 $15,800 3.6% notes due 2022 $12,000 What is the weighted average interest rate on the secured debt? Round your answer to one decimal. Bear Company Balance Sheet 2020 2019 As of December 31 Assets Cash.. Marketable securities Accounts receivable, net. Inventory...... Prepaid Expenses Total current assets. Property, plant, and equipment, net. Intangible assets, net Other noncurrent assets. $ 1,644 807 2,881 3,335 1,446 $ 2,425 788 2,744 3,184 1,180 10,113 12,180 7,011 1,374 10,321 11,376 3,949 1,604 Total assets $30.678 $27.250 Liabilities Accounts payable Accrued expenses and other liab. Taxes payable Debt due within one year Total current liabilities Long-term debt Deferred taxes.. Total liabilities. $ 2,066 4,048 928 2.281 9,323 5,832 3,287 18,442 $ 2,205 3,888 902 849 7,844 4,362 2,998 15,204 Stockholders' equity Common stock (at par). Additional paid-in-capital Retained Earnings.. 3,158 907 11,144 3,210 559 10,730 Accumulated Other Comp. Income Total stockholders' equity. Total liabilities and stockholders' equity .......... (2,973) 12,236 $30.678 (2,453) 12,046 $27.250 Bear Company Income Statement For the years ended December 31 Net sales ........... Cost of goods sold............. Marketing research and admin expense Depreciation expense. Operating income Interest expense...... Other income....... 2020 $37,154 21,064 8,555 1,480 2019 $35,764 20,510 8,566 1.200 6,055 548 201 5,488 457 218 Income before income taxes ..... Income taxes ....... Net income 5,708 1,928 $ 3.780 5,249 1,834 $ 3.415 The Bear Company Statement of Cash Flow Year ended 12/31/20 Operating Activities: Net income Depreciation Amortization Gain on sale of assets Accounts receivables Inventories Prepaid expense Accounts payable Accrued expenses and other liabilities Taxes payable $3,780 1,480 118 (155) (137) (151) (266) (139) 160 26 CFO 4,716 Investing Activities: Sale of Marketable securities Purchase Marketable securities PP&E Intangible assets Other noncurrent assets 8 (24) (2,134) (3,180) 230 (5,100) CFI Financing Activities: Dividends Common stock Additional paid-in capital Debt due within one year Other (3,366) (52) 348 2,902 (229) (397) CFF Change in cash Cash, beginning of year Cash. end of vear (781) 2,425 $1.644