Answered step by step

Verified Expert Solution

Question

1 Approved Answer

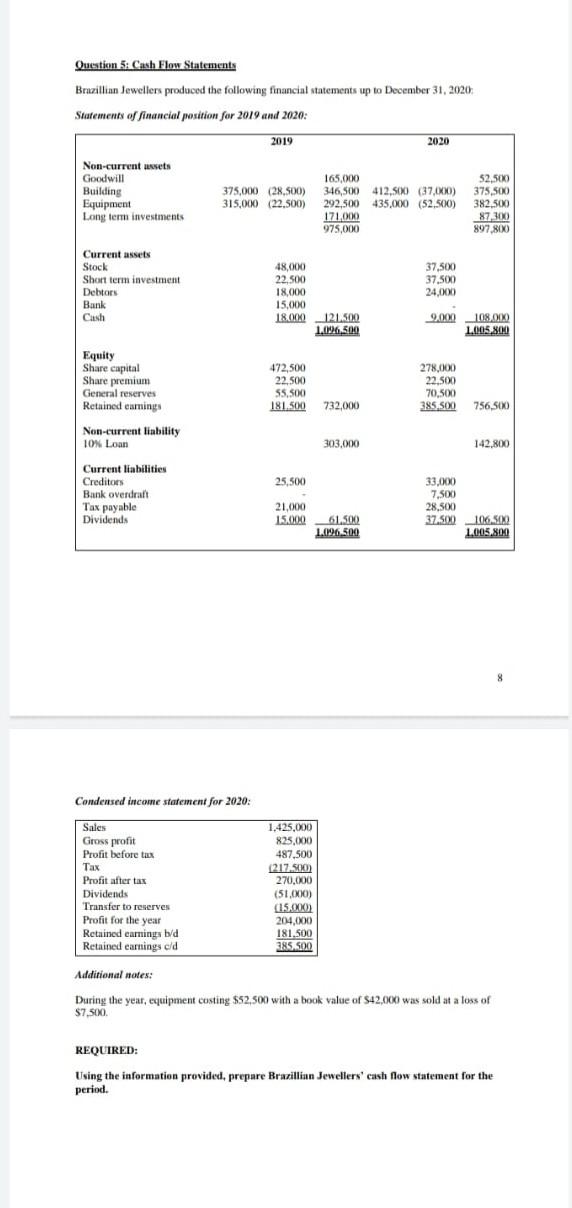

Question 5: Cash Flow Statements Brazillian Jewellers produced the following financial statements up to December 31, 2020 Statements of financial position for 2019 and 2020:

Question 5: Cash Flow Statements Brazillian Jewellers produced the following financial statements up to December 31, 2020 Statements of financial position for 2019 and 2020: 2019 2020 Non-current assets Goodwill Building Equipment Long term investments 375,000 (28.500) 315,000 (22.500) ) 165.000 346,500 412.500 (37,000) 292,500 435,000 (52,500) 171.000 975,000 52,500 375,500 382.500 87300 897.80) Current assets Stock Short term investment Debtors Bank Cash 48,000 22.500 18.000 15,000 18.000 37,500 37,500 24,000 121.500 1.096,500 9.000 108.000 1.005.800 Equity Share capital Share premium General reserves Retained earnings Non-current liability 10% Loan 472,500 22.500 55.500 181.500 278,000 22.500 70.500 385,500 756,560 732,000 303,000 142.800 25.500 Current liabilities Creditors Bank overdratt Tax payable Dividends 21.000 15.00.0 33,000 7.500 28,500 37.500 106.500 1005.800 61.500 1.096,500 Condensed income statement for 2020: Sales Gross profit Profit before tax Tax Profit after tax Dividends Transfer to reserves Profit for the year Retained earnings b/d Retained earnings eld 1.425,000 825,000 487,500 (217.500) 270,000 (51.000) (15.00 204.000 181,500 385.500 Additional notes: During the year, equipment costing $52,500 with a book value of $42,000 was sold at a loss of $7,500 REQUIRED: Using the information provided, prepare Brazillian Jewellers' cash flow statement for the period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started