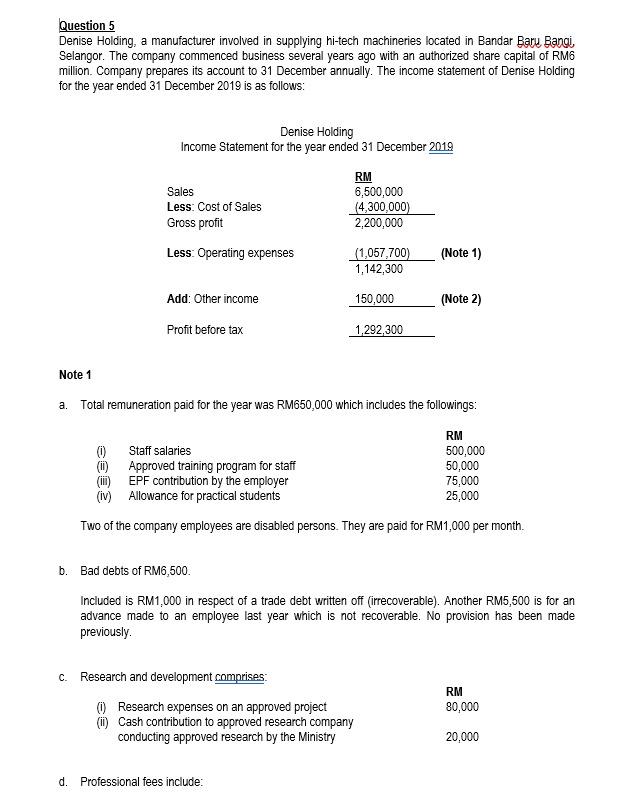

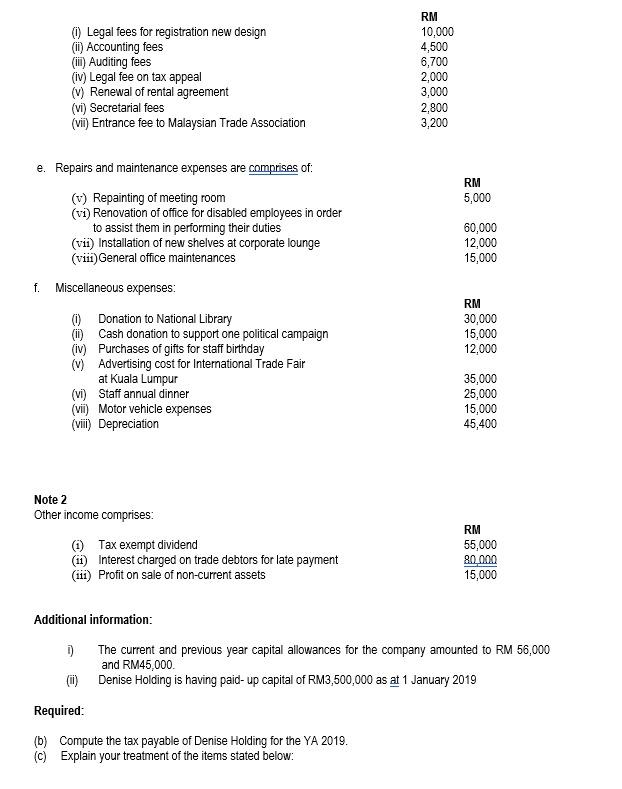

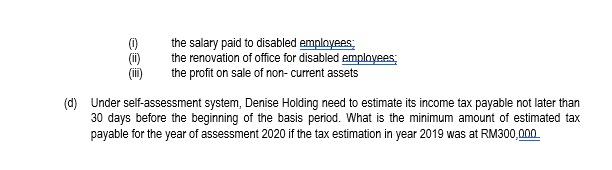

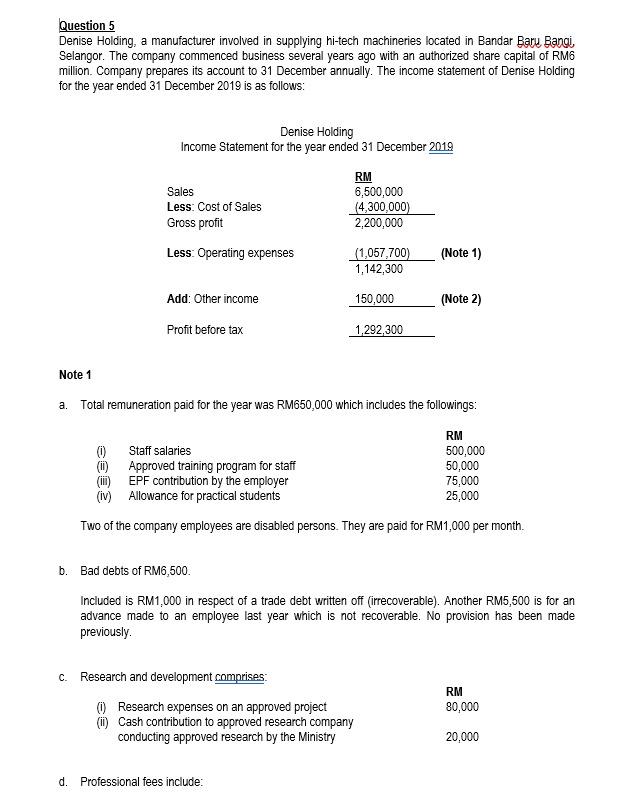

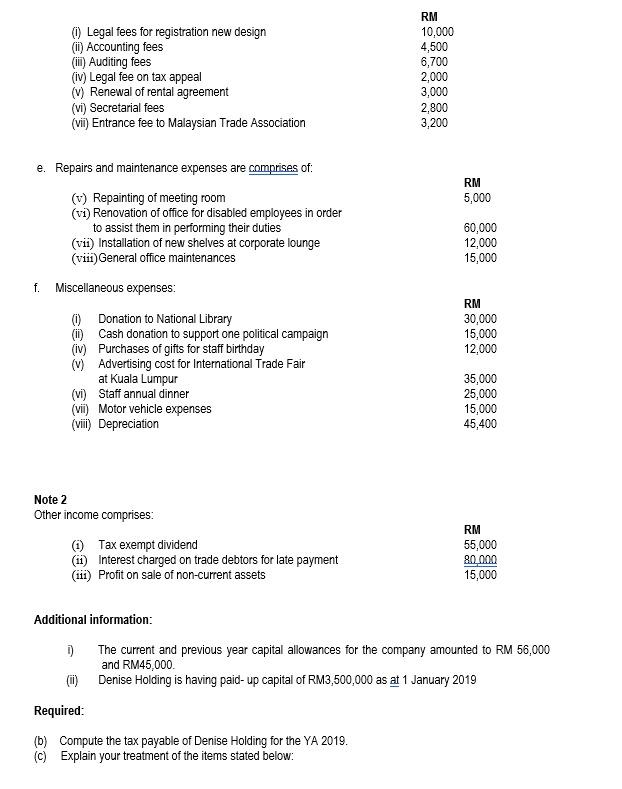

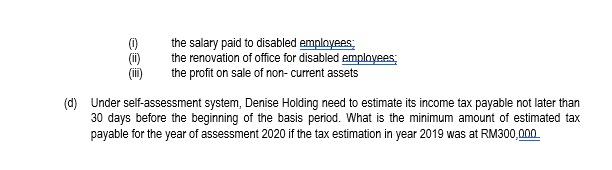

Question 5 Denise Holding, a manufacturer involved in supplying hi-tech machineries located in Bandar Baru Bangi, Selangor. The company commenced business several years ago with an authorized share capital of RM6 million. Company prepares its account to 31 December annually. The income statement of Denise Holding for the year ended 31 December 2019 is as follows: Denise Holding Income Statement for the year ended 31 December 2019 RM Sales 6,500,000 Less: Cost of Sales (4,300,000) Gross profit 2,200,000 Less: Operating expenses (1,057,700) (Note 1) 1,142,300 Add: Other income 150,000 (Note 2) Profit before tax 1,292,300 Note 1 a. Total remuneration paid for the year was RM650,000 which includes the followings: 0) Staff salaries (0) Approved training program for staff (i) EPF contribution by the employer (iv) Allowance for practical students RM 500,000 50,000 75,000 25,000 Two of the company employees are disabled persons. They are paid for RM1,000 per month. b. Bad debts of RM6,500 Included is RM1,000 in respect of a trade debt written off (irrecoverable). Another RM5,500 is for an advance made to an employee last year which is not recoverable. No provision has been made previously. C. Research and development comprises 0 Research expenses on an approved project (i) Cash contribution to approved research company conducting approved research by the Ministry RM 80,000 20,000 d. Professional fees include: () Legal fees for registration new design (1) Accounting fees (iii) Auditing fees (iv) Legal fee on tax appeal () Renewal of rental agreement (vi) Secretarial fees (vii) Entrance fee to Malaysian Trade Association RM 10,000 4,500 6,700 2,000 3,000 2,800 3,200 RM 5,000 e. Repairs and maintenance expenses are comprises of (v) Repainting of meeting room (vi) Renovation of office for disabled employees in order to assist them in performing their duties (vii) Installation of new shelves at corporate lounge (viii) General office maintenances 60,000 12,000 15,000 f. Miscellaneous expenses: RM 30,000 15,000 12,000 0 Donation to National Library (i) Cash donation to support one political campaign (iv) Purchases of gifts for staff birthday (v) Advertising cost for International Trade Fair at Kuala Lumpur (vi) Staff annual dinner (vii) Motor vehicle expenses (viii) Depreciation 35,000 25,000 15,000 45,400 Note 2 Other income comprises: Tax exempt dividend (1) Interest charged on trade debtors for late payment (111) Profit on sale of non-current assets RM 55,000 80.000 15,000 Additional information: D) The current and previous year capital allowances for the company amounted to RM 56,000 and RM45.000 ) Denise Holding is having paid-up capital of RM3,500,000 as at 1 January 2019 Required: (b) Compute the tax payable of Denise Holding for the YA 2019. (c) Explain your treatment of the items stated below: the salary paid to disabled employees, ( the renovation of office for disabled employees (iii) the profit on sale of non-current assets (d) Under self-assessment system, Denise Holding need to estimate its income tax payable not later than 30 days before the beginning of the basis period. What is the minimum amount of estimated tax payable for the year of assessment 2020 if the tax estimation in year 2019 was at RM300,000 Question 5 Denise Holding, a manufacturer involved in supplying hi-tech machineries located in Bandar Baru Bangi, Selangor. The company commenced business several years ago with an authorized share capital of RM6 million. Company prepares its account to 31 December annually. The income statement of Denise Holding for the year ended 31 December 2019 is as follows: Denise Holding Income Statement for the year ended 31 December 2019 RM Sales 6,500,000 Less: Cost of Sales (4,300,000) Gross profit 2,200,000 Less: Operating expenses (1,057,700) (Note 1) 1,142,300 Add: Other income 150,000 (Note 2) Profit before tax 1,292,300 Note 1 a. Total remuneration paid for the year was RM650,000 which includes the followings: 0) Staff salaries (0) Approved training program for staff (i) EPF contribution by the employer (iv) Allowance for practical students RM 500,000 50,000 75,000 25,000 Two of the company employees are disabled persons. They are paid for RM1,000 per month. b. Bad debts of RM6,500 Included is RM1,000 in respect of a trade debt written off (irrecoverable). Another RM5,500 is for an advance made to an employee last year which is not recoverable. No provision has been made previously. C. Research and development comprises 0 Research expenses on an approved project (i) Cash contribution to approved research company conducting approved research by the Ministry RM 80,000 20,000 d. Professional fees include: () Legal fees for registration new design (1) Accounting fees (iii) Auditing fees (iv) Legal fee on tax appeal () Renewal of rental agreement (vi) Secretarial fees (vii) Entrance fee to Malaysian Trade Association RM 10,000 4,500 6,700 2,000 3,000 2,800 3,200 RM 5,000 e. Repairs and maintenance expenses are comprises of (v) Repainting of meeting room (vi) Renovation of office for disabled employees in order to assist them in performing their duties (vii) Installation of new shelves at corporate lounge (viii) General office maintenances 60,000 12,000 15,000 f. Miscellaneous expenses: RM 30,000 15,000 12,000 0 Donation to National Library (i) Cash donation to support one political campaign (iv) Purchases of gifts for staff birthday (v) Advertising cost for International Trade Fair at Kuala Lumpur (vi) Staff annual dinner (vii) Motor vehicle expenses (viii) Depreciation 35,000 25,000 15,000 45,400 Note 2 Other income comprises: Tax exempt dividend (1) Interest charged on trade debtors for late payment (111) Profit on sale of non-current assets RM 55,000 80.000 15,000 Additional information: D) The current and previous year capital allowances for the company amounted to RM 56,000 and RM45.000 ) Denise Holding is having paid-up capital of RM3,500,000 as at 1 January 2019 Required: (b) Compute the tax payable of Denise Holding for the YA 2019. (c) Explain your treatment of the items stated below: the salary paid to disabled employees, ( the renovation of office for disabled employees (iii) the profit on sale of non-current assets (d) Under self-assessment system, Denise Holding need to estimate its income tax payable not later than 30 days before the beginning of the basis period. What is the minimum amount of estimated tax payable for the year of assessment 2020 if the tax estimation in year 2019 was at RM300,000