Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 5 FazzPrint Bhd is currently involves in printing and advertising business and is considering to expand its business by setting up a new branch

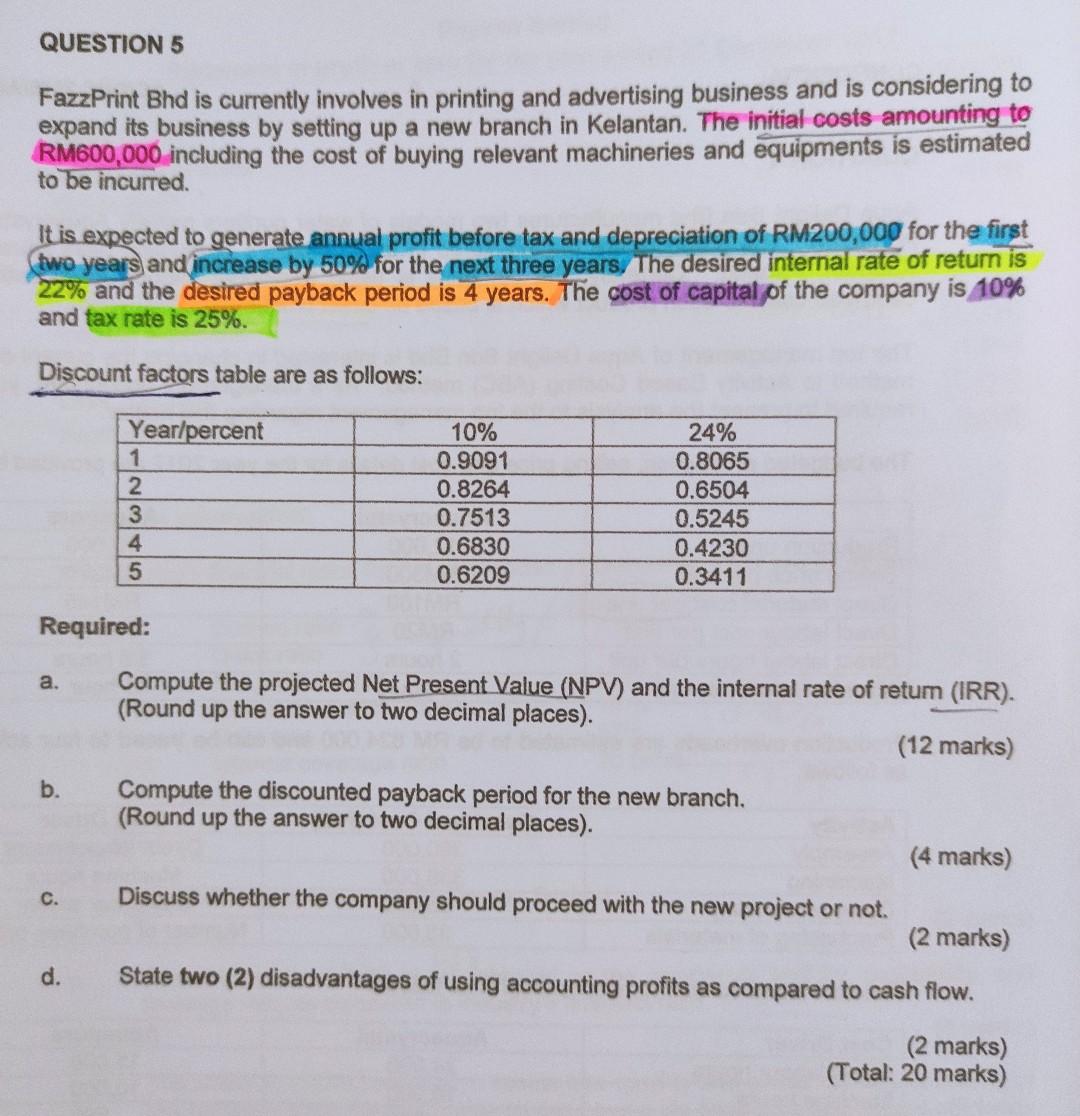

QUESTION 5 FazzPrint Bhd is currently involves in printing and advertising business and is considering to expand its business by setting up a new branch in Kelantan. The initial costs amounting to RM600,000 including the cost of buying relevant machineries and equipments is estimated to be incurred. It is expected to generate annual profit before tax and depreciation of RM200,000 for the first two years and increase by 50% for the next three years. The desired internal rate of return is 22% and the desired payback period is 4 years. The cost of capital of the company is 10% and tax rate is 25%. Discount factors table are as follows: Year/percent 1 2 3 4 5 10% 0.9091 0.8264 0.7513 0.6830 0.6209 24% 0.8065 0.6504 0.5245 0.4230 0.3411 Required: a. Compute the projected Net Present Value (NPV) and the internal rate of retum (IRR). (Round up the answer to two decimal places). (12 marks) Compute the discounted payback period for the new branch. (Round up the answer to two decimal places). (4 marks) b. C. Discuss whether the company should proceed with the new project or not. (2 marks) d. State two (2) disadvantages of using accounting profits as compared to cash flow. (2 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started