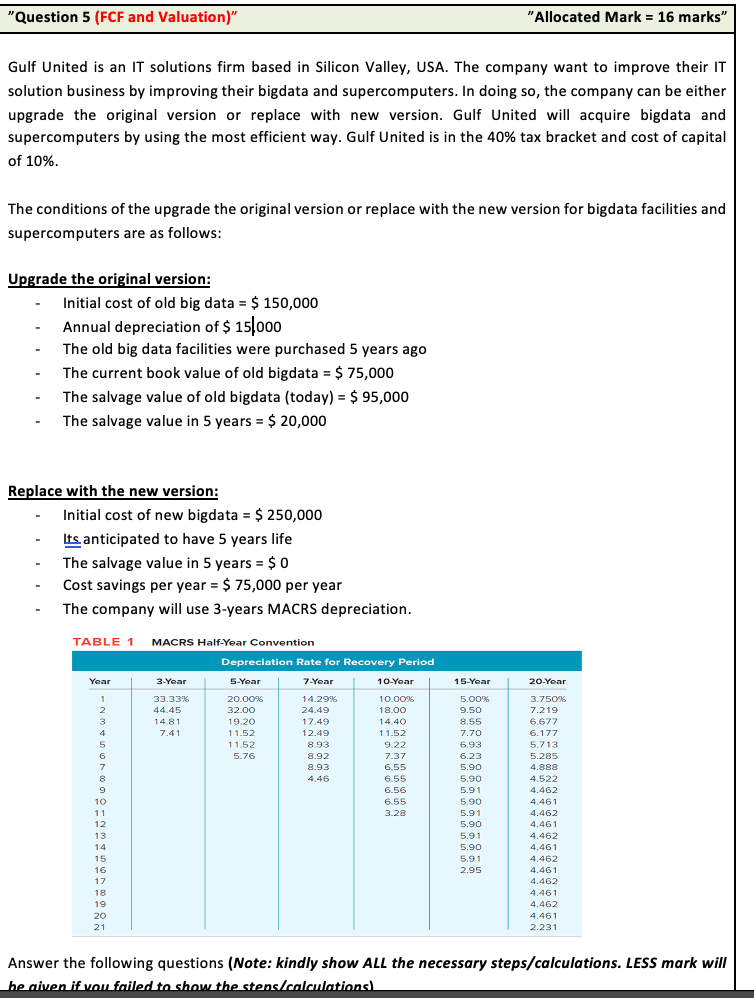

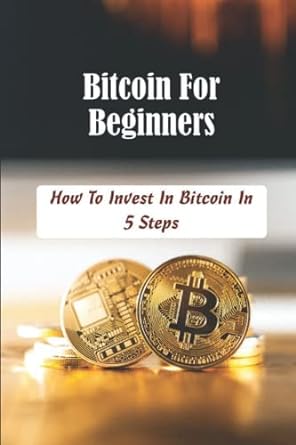

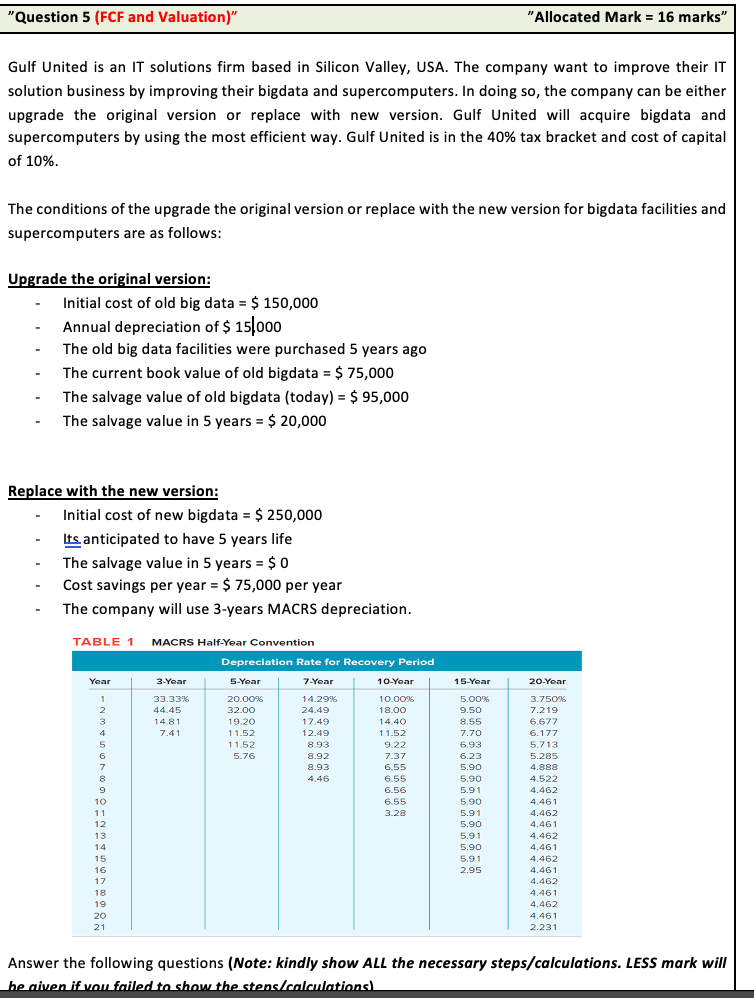

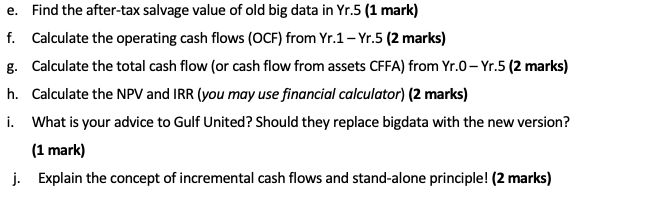

"Question 5 (FCF and Valuation)" "Allocated Mark = 16 marks" Gulf United is an IT solutions firm based in Silicon Valley, USA. The company want to improve their IT solution business by improving their bigdata and supercomputers. In doing so, the company can be either upgrade the original version or replace with new version. Gulf United will acquire bigdata and supercomputers by using the most efficient way. Gulf United is in the 40% tax bracket and cost of capital of 10% The conditions of the upgrade the original version or replace with the new version for bigdata facilities and supercomputers are as follows: Upgrade the original version: Initial cost of old big data = $ 150,000 Annual depreciation of $ 15000 The old big data facilities were purchased 5 years ago The current book value of old bigdata = $ 75,000 The salvage value of old bigdata (today) = $ 95,000 The salvage value in 5 years = $ 20,000 Replace with the new version: Initial cost of new bigdata = $ 250,000 Its anticipated to have 5 years life The salvage value in 5 years = $ 0 Cost savings per year = $ 75,000 per year The company will use 3-years MACRS depreciation. TABLE 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year 1 2 3 4 5 6 7 33.33% 44.45 14.81 7.41 20.00% 32.00 19.20 11.52 1 1.52 5.76 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10.00% 18.00 14.40 11.52 922 7.37 6.55 6.55 6.56 6.55 3.28 8 9 10 11 12 13 14 15 16 17 18 19 20 21 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 3.750% 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 Answer the following questions (Note: kindly show ALL the necessary steps/calculations. LESS mark will be given if vou failed to show the stens/calculations e. Find the after-tax salvage value of old big data in Yr.5 (1 mark) f. Calculate the operating cash flows (OCF) from Yr.1 - Yr.5 (2 marks) g. Calculate the total cash flow (or cash flow from assets CFFA) from Yr.0-Yr.5 (2 marks) h. Calculate the NPV and IRR (you may use financial calculator) (2 marks) i. What is your advice to Gulf United? Should they replace bigdata with the new version? (1 mark) j. Explain the concept of incremental cash flows and stand-alone principle! (2 marks)