QUESTION

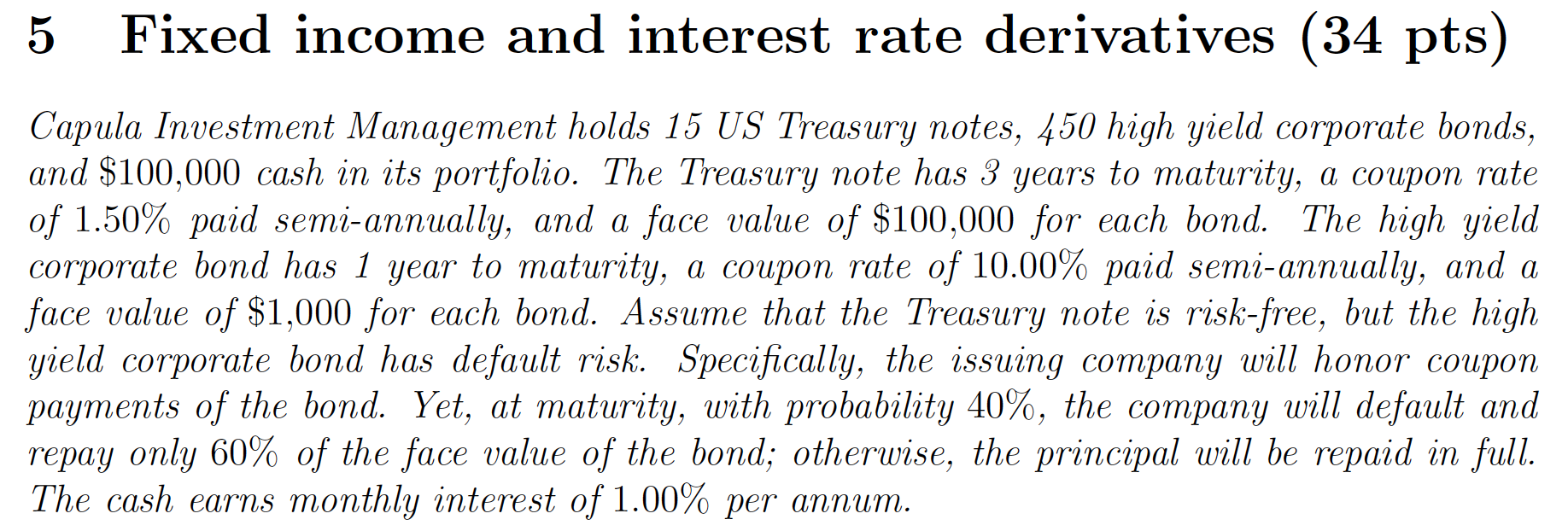

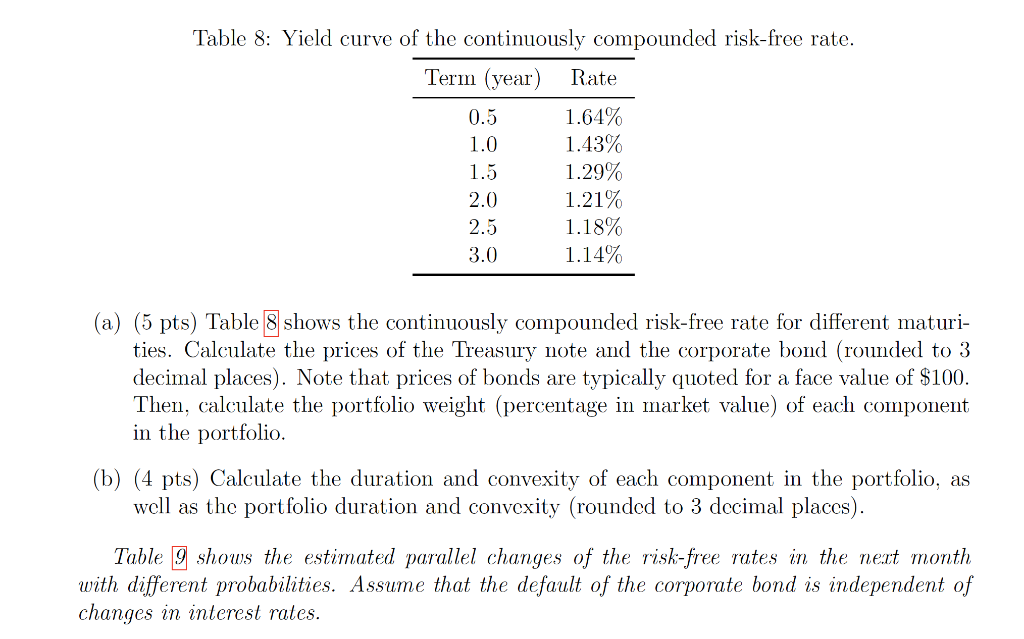

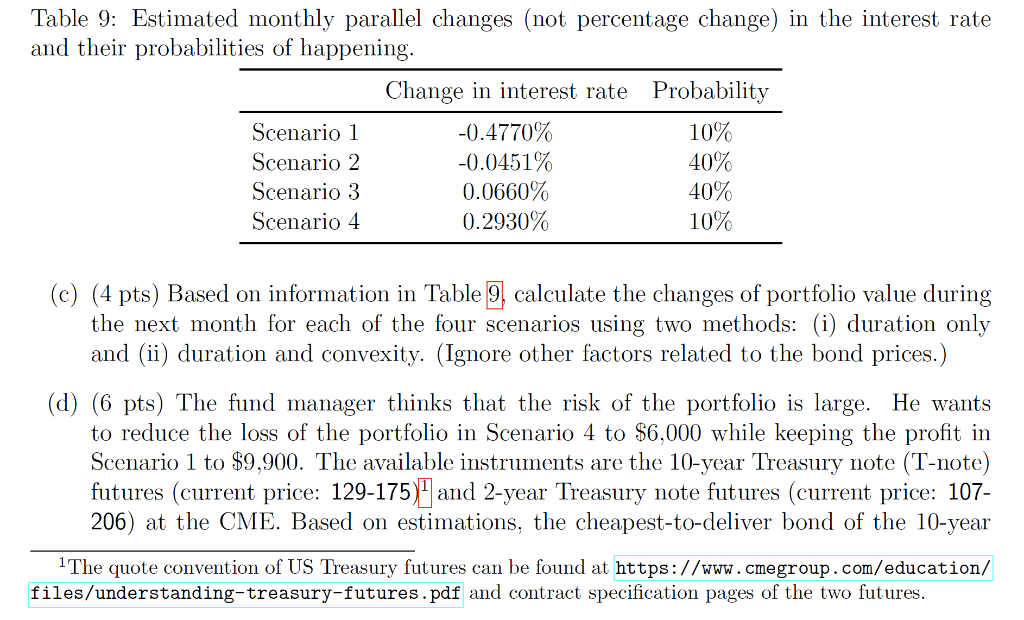

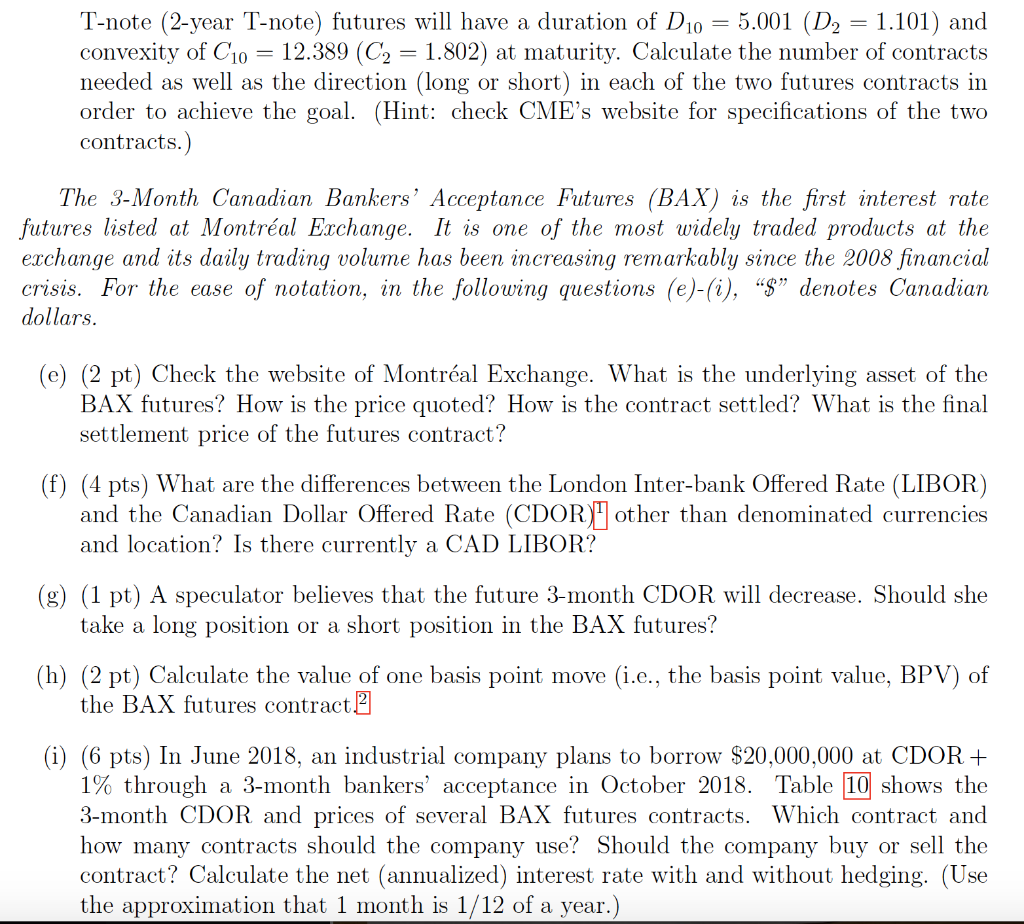

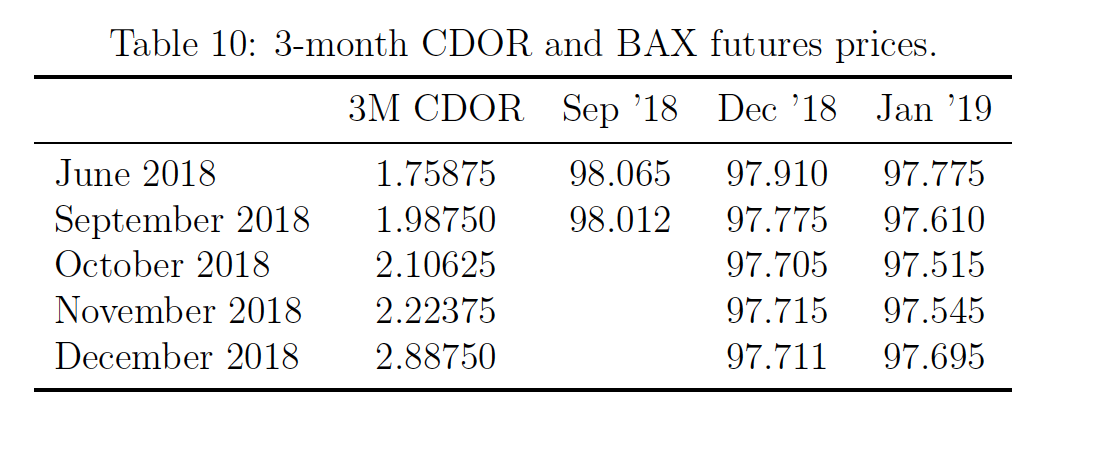

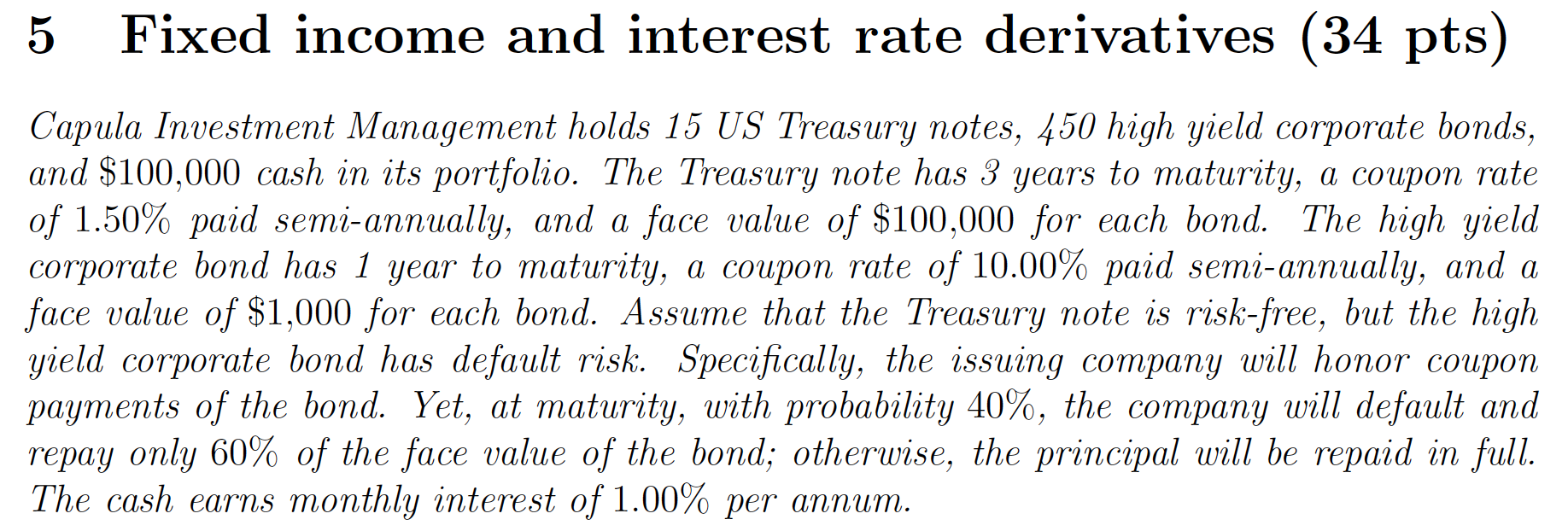

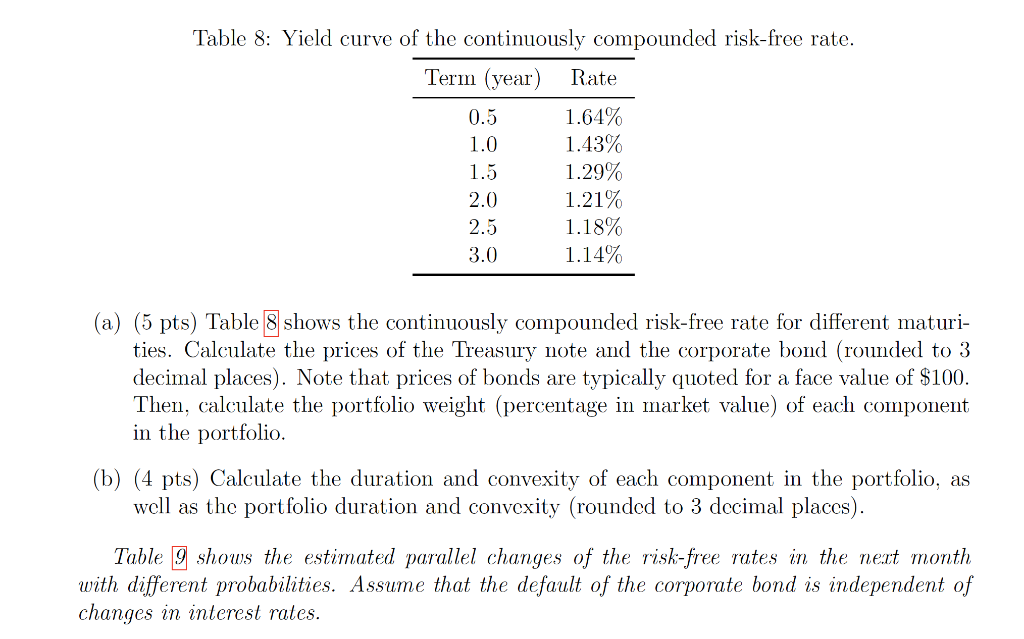

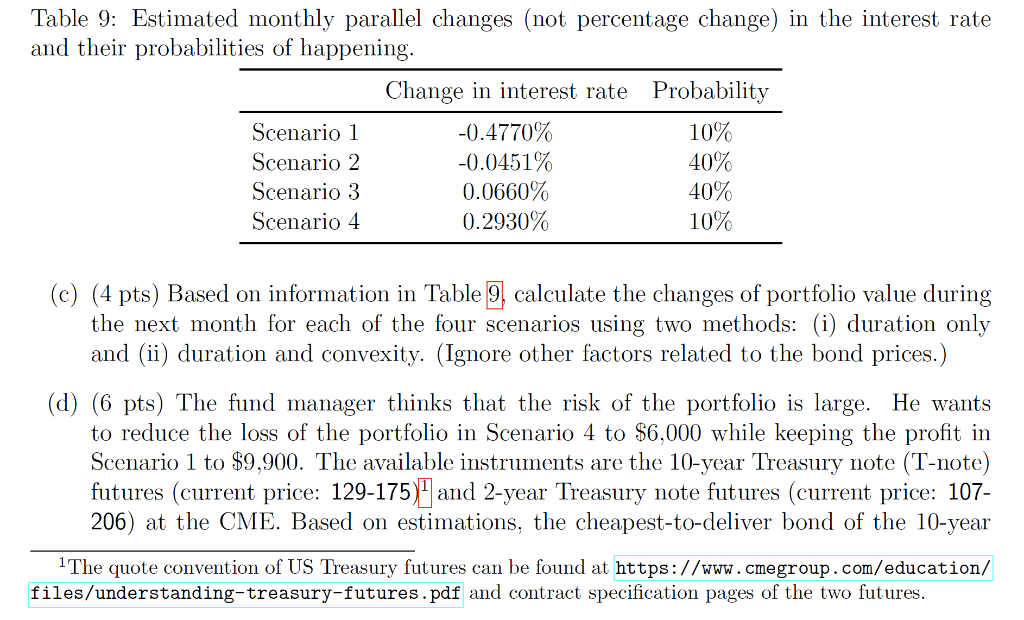

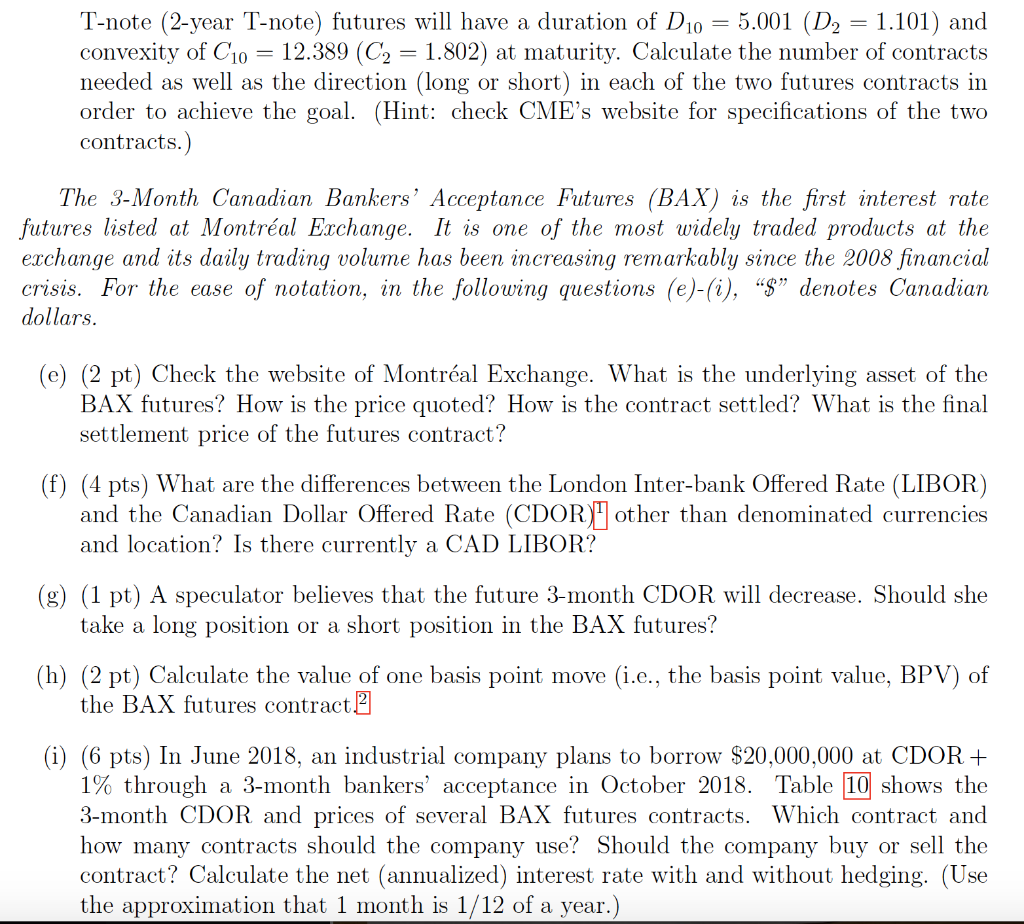

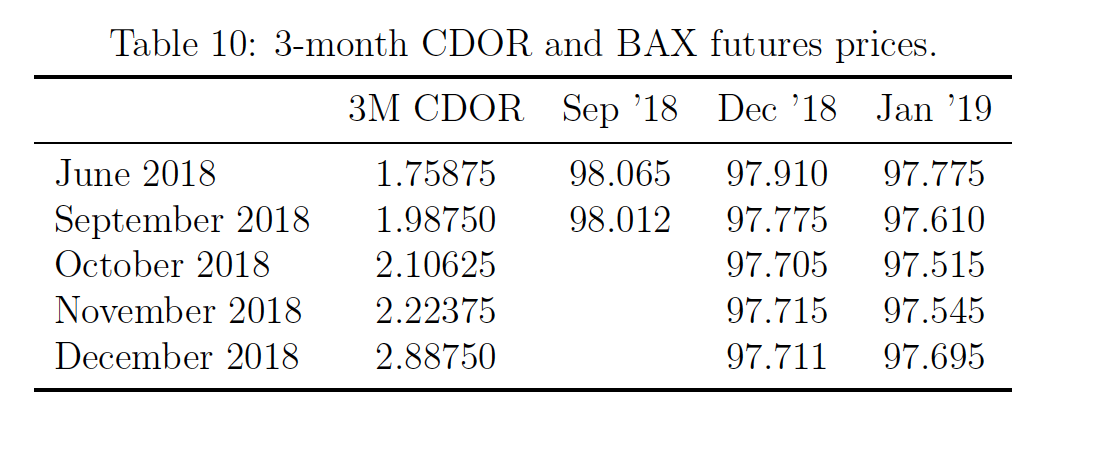

5 Fixed income and interest rate derivatives (34 pts) Capula Investment Management holds 15 US Treasury notes, 450 high yield corporate bonds, and $100,000 cash in its portfolio. The Treasury note has 3 years to maturity, a coupon rate of 1.50% paid semi-annually, and a face value of $100,000 for each bond. The high yield corporate bond has 1 year to maturity, a coupon rate of 10.00% paid semi-annually, and a face value of $1,000 for each bond. Assume that the Treasury note is risk-free, but the high yield corporate bond has default risk. Specifically, the issuing company will honor coupon payments of the bond. Yet, at maturity, with probability 40%, the company will default and repay only 60% of the face value of the bond; otherwise, the principal will be repaid in full. The cash earns monthly interest of 1.00% per annum. Table 8: Yield curve of the continuously compounded risk-free rate. Term (year) Rate 0.5 1.64% 1.43% 1.5 1.29% 2.0 1.21% 2.5 1.18% 3.0 1.14% 1.0 (a) (5 pts) Table 8 shows the continuously compounded risk-free rate for different maturi- ties. Calculate the prices of the Treasury note and the corporate bond (rounded to 3 decimal places). Note that prices of bonds are typically quoted for a face value of $100. Then, calculate the portfolio weight (percentage in market value) of each component in the portfolio. (b) (4 pts) Calculate the duration and convexity of each component in the portfolio, as well as the portfolio duration and convexity (rounded to 3 decimal places). Table g shows the estimated parallel changes of the risk-free rates in the next month with different probabilities. Assume that the default of the corporate bond is independent of changes in interest rates. Table 9: Estimated monthly parallel changes (not percentage change) in the interest rate and their probabilities of happening. Change in interest rate Probability Scenario 1 -0.4770% 10% Scenario 2 -0.0451% 40% Scenario 3 0.0660% 40% Scenario 4 0.2930% 10% (C) (4 pts) Based on information in Table 9 calculate the changes of portfolio value during the next month for each of the four scenarios using two methods: (i) duration only and (ii) duration and convexity. (Ignore other factors related to the bond prices.) (d) (6 pts) The fund manager thinks that the risk of the portfolio is large. He wants to reduce the loss of the portfolio in Scenario 4 to $6,000 while keeping the profit in Scenario 1 $9,900. The available instruments are the 10-year Treasury note (T-note) futures (current price: 129-175)) and 2-year Treasury note futures (current price: 107- 206) at the CME. Based on estimations, the cheapest-to-deliver bond of the 10-year 1 The quote convention of US Treasury futures can be found at https://www.cmegroup.com/education/ files/understanding-treasury-futures.pdf and contract specification pages of the two futures. T-note (2-year T-note) futures will have a duration of D10 = 5.001 (D2 = 1.101) and convexity of C10 = 12.389 (C2 = 1.802) at maturity. Calculate the number of contracts needed as well as the direction (long or short) in each of the two futures contracts in order to achieve the goal. (Hint: check CME's website for specifications of the two contracts.) The 3-Month Canadian Bankers Acceptance Futures (BAX) is the first interest rate futures listed at Montral Exchange. It is one of the most widely traded products at the exchange and its daily trading volume has been increasing remarkably since the 2008 financial crisis. For the ease of notation, in the following questions (e)-(i), "$" denotes Canadian dollars. (e) (2 pt) Check the website of Montral Exchange. What is the underlying asset of the BAX futures? How is the price quoted? How is the contract settled? What is the final settlement price of the futures contract? (f) (4 pts) What are the differences between the London Inter-bank Offered Rate (LIBOR) and the Canadian Dollar Offered Rate (CDOR) other than denominated currencies and location? Is there currently a CAD LIBOR? (g) (1 pt) A speculator believes that the future 3-month CDOR will decrease. Should she take a long position or a short position in the BAX futures? (h) (2 pt) Calculate the value of one basis point move (i.e., the basis point value, BPV) of the BAX futures contract 2 (i) (6 pts) In June 2018, an industrial company plans to borrow $20,000,000 at CDOR + 1% through a 3-month bankers' acceptance in October 2018. Table 10 shows the 3-month CDOR and prices of several BAX futures contracts. Which contract and how many contracts should the company use? Should the company buy or sell the contract? Calculate the net (annualized) interest rate with and without hedging. (Use the approximation that 1 month is 1/12 of a year.) Table 10: 3-month CDOR and BAX futures prices. 3M CDOR Sep '18 Dec '18 Jan '19 98.065 98.012 June 2018 September 2018 October 2018 November 2018 December 2018 1.75875 1.98750 2.10625 2.22375 2.88750 97.910 97.775 97.705 97.715 97.711 97.775 97.610 97.515 97.545 97.695 5 Fixed income and interest rate derivatives (34 pts) Capula Investment Management holds 15 US Treasury notes, 450 high yield corporate bonds, and $100,000 cash in its portfolio. The Treasury note has 3 years to maturity, a coupon rate of 1.50% paid semi-annually, and a face value of $100,000 for each bond. The high yield corporate bond has 1 year to maturity, a coupon rate of 10.00% paid semi-annually, and a face value of $1,000 for each bond. Assume that the Treasury note is risk-free, but the high yield corporate bond has default risk. Specifically, the issuing company will honor coupon payments of the bond. Yet, at maturity, with probability 40%, the company will default and repay only 60% of the face value of the bond; otherwise, the principal will be repaid in full. The cash earns monthly interest of 1.00% per annum. Table 8: Yield curve of the continuously compounded risk-free rate. Term (year) Rate 0.5 1.64% 1.43% 1.5 1.29% 2.0 1.21% 2.5 1.18% 3.0 1.14% 1.0 (a) (5 pts) Table 8 shows the continuously compounded risk-free rate for different maturi- ties. Calculate the prices of the Treasury note and the corporate bond (rounded to 3 decimal places). Note that prices of bonds are typically quoted for a face value of $100. Then, calculate the portfolio weight (percentage in market value) of each component in the portfolio. (b) (4 pts) Calculate the duration and convexity of each component in the portfolio, as well as the portfolio duration and convexity (rounded to 3 decimal places). Table g shows the estimated parallel changes of the risk-free rates in the next month with different probabilities. Assume that the default of the corporate bond is independent of changes in interest rates. Table 9: Estimated monthly parallel changes (not percentage change) in the interest rate and their probabilities of happening. Change in interest rate Probability Scenario 1 -0.4770% 10% Scenario 2 -0.0451% 40% Scenario 3 0.0660% 40% Scenario 4 0.2930% 10% (C) (4 pts) Based on information in Table 9 calculate the changes of portfolio value during the next month for each of the four scenarios using two methods: (i) duration only and (ii) duration and convexity. (Ignore other factors related to the bond prices.) (d) (6 pts) The fund manager thinks that the risk of the portfolio is large. He wants to reduce the loss of the portfolio in Scenario 4 to $6,000 while keeping the profit in Scenario 1 $9,900. The available instruments are the 10-year Treasury note (T-note) futures (current price: 129-175)) and 2-year Treasury note futures (current price: 107- 206) at the CME. Based on estimations, the cheapest-to-deliver bond of the 10-year 1 The quote convention of US Treasury futures can be found at https://www.cmegroup.com/education/ files/understanding-treasury-futures.pdf and contract specification pages of the two futures. T-note (2-year T-note) futures will have a duration of D10 = 5.001 (D2 = 1.101) and convexity of C10 = 12.389 (C2 = 1.802) at maturity. Calculate the number of contracts needed as well as the direction (long or short) in each of the two futures contracts in order to achieve the goal. (Hint: check CME's website for specifications of the two contracts.) The 3-Month Canadian Bankers Acceptance Futures (BAX) is the first interest rate futures listed at Montral Exchange. It is one of the most widely traded products at the exchange and its daily trading volume has been increasing remarkably since the 2008 financial crisis. For the ease of notation, in the following questions (e)-(i), "$" denotes Canadian dollars. (e) (2 pt) Check the website of Montral Exchange. What is the underlying asset of the BAX futures? How is the price quoted? How is the contract settled? What is the final settlement price of the futures contract? (f) (4 pts) What are the differences between the London Inter-bank Offered Rate (LIBOR) and the Canadian Dollar Offered Rate (CDOR) other than denominated currencies and location? Is there currently a CAD LIBOR? (g) (1 pt) A speculator believes that the future 3-month CDOR will decrease. Should she take a long position or a short position in the BAX futures? (h) (2 pt) Calculate the value of one basis point move (i.e., the basis point value, BPV) of the BAX futures contract 2 (i) (6 pts) In June 2018, an industrial company plans to borrow $20,000,000 at CDOR + 1% through a 3-month bankers' acceptance in October 2018. Table 10 shows the 3-month CDOR and prices of several BAX futures contracts. Which contract and how many contracts should the company use? Should the company buy or sell the contract? Calculate the net (annualized) interest rate with and without hedging. (Use the approximation that 1 month is 1/12 of a year.) Table 10: 3-month CDOR and BAX futures prices. 3M CDOR Sep '18 Dec '18 Jan '19 98.065 98.012 June 2018 September 2018 October 2018 November 2018 December 2018 1.75875 1.98750 2.10625 2.22375 2.88750 97.910 97.775 97.705 97.715 97.711 97.775 97.610 97.515 97.545 97.695