Question

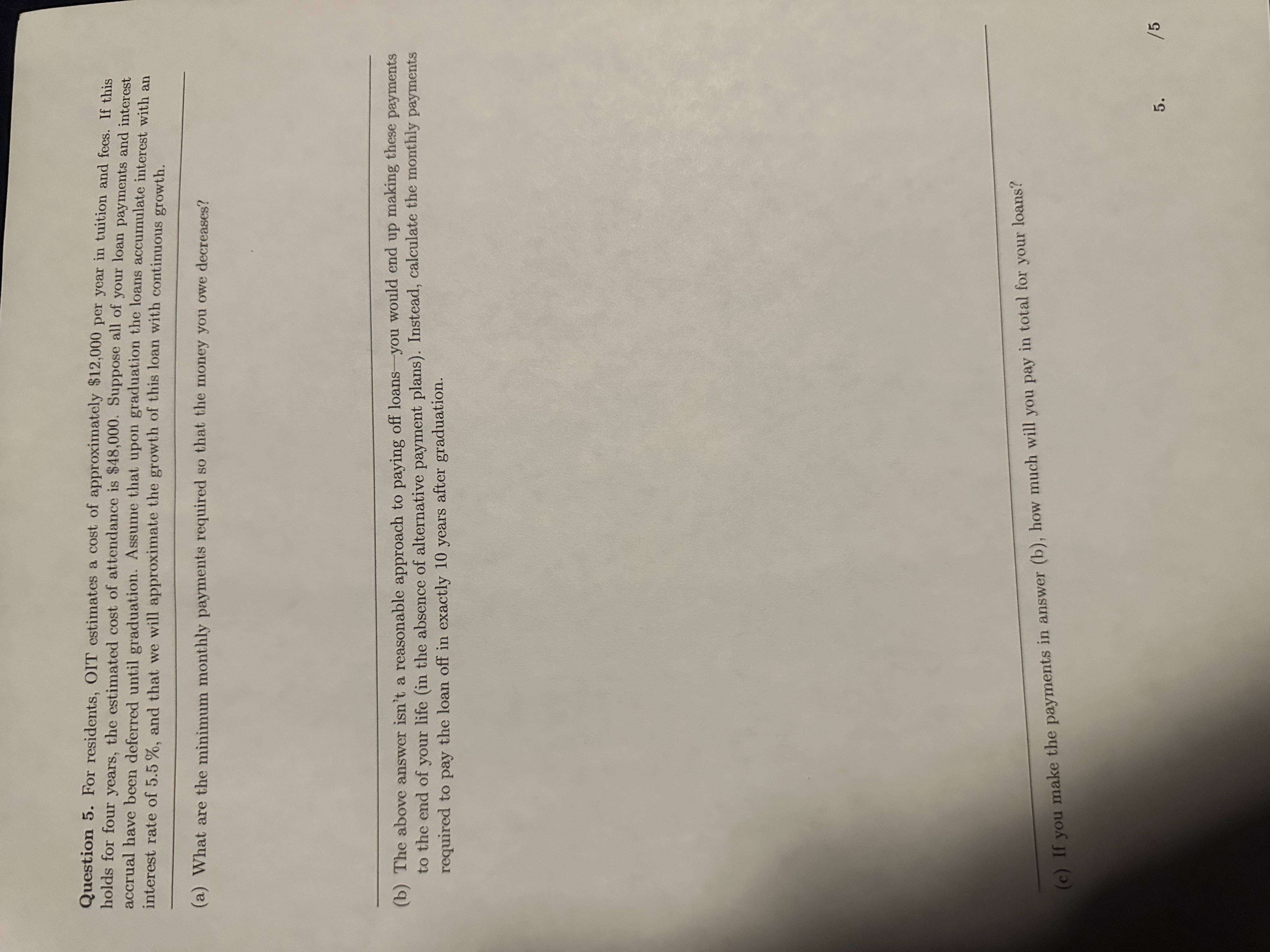

Question 5. For residents, OIT estimates a cost of approximately $12,000 per year in tuition and fees. If this holds for four years, the estimated

Question 5. For residents, OIT estimates a cost of approximately

$12,000per year in tuition and fees. If this holds for four years, the estimated cost of attendance is

$48,000. Suppose all of your loan payments and interest accrual have been deferred until graduation. Assume that upon graduation the loans accumulate interest with an interest rate of

5.5%, and that we will approximate the growth of this loan with continuous growth.\ (a) What are the minimum monthly payments required so that the money you owe decreases?\ (b) The above answer isn't a reasonable approach to paying off loans - you would end up making these payments to the end of your life (in the absence of alternative payment plans). Instead, calculate the monthly payments required to pay the loan off in exactly 10 years after graduation.\ (c) If you make the payments in answer (b), how much will you pay in total for your loans?\ 5.\

/5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started