Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 5 fully explained Question 5 On January 1, 2010, a borrower took-out a 3/1 ARM for 20 years bearing initial APR of 4%. Thereafter,

question 5 fully explained

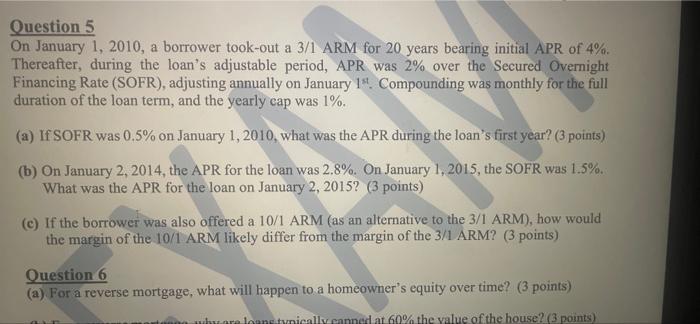

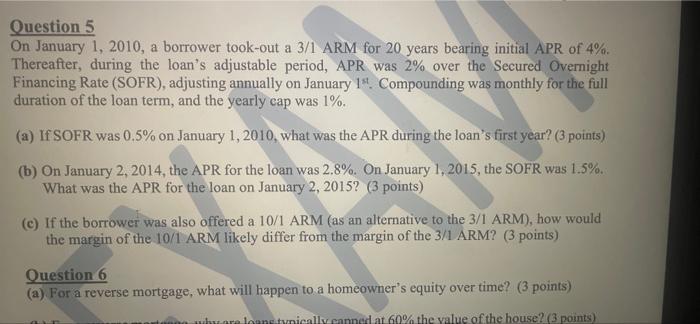

Question 5 On January 1, 2010, a borrower took-out a 3/1 ARM for 20 years bearing initial APR of 4%. Thereafter, during the loan's adjustable period, APR was 2% over the Secured Overnight Financing Rate (SOFR), adjusting annually on January 1". Compounding was monthly for the full duration of the loan term, and the yearly cap was 1%. (a) If SOFR was 0.5% on January 1, 2010, what was the APR during the loan's first year? (3 points) (b) On January 2, 2014, the APR for the loan was 2.8%. On January 1, 2015, the SOFR was 1.5%. What was the APR for the loan on January 2, 2015? (3 points) (c) If the borrower was also offered a 10/1 ARM (as an alternative to the 3/1 ARM), how would the margin of the 10/1 ARM likely differ from the margin of the 3/1 ARM? (3 points) Question 6 (a) For a reverse mortgage, what will happen to a homeowner's equity over time? (3 points) why are loan tynically canned at 60% the value of the house? (3 points) Question 5 On January 1, 2010, a borrower took-out a 3/1 ARM for 20 years bearing initial APR of 4%. Thereafter, during the loan's adjustable period, APR was 2% over the Secured Overnight Financing Rate (SOFR), adjusting annually on January 1". Compounding was monthly for the full duration of the loan term, and the yearly cap was 1%. (a) If SOFR was 0.5% on January 1, 2010, what was the APR during the loan's first year? (3 points) (b) On January 2, 2014, the APR for the loan was 2.8%. On January 1, 2015, the SOFR was 1.5%. What was the APR for the loan on January 2, 2015? (3 points) (c) If the borrower was also offered a 10/1 ARM (as an alternative to the 3/1 ARM), how would the margin of the 10/1 ARM likely differ from the margin of the 3/1 ARM? (3 points) Question 6 (a) For a reverse mortgage, what will happen to a homeowner's equity over time? (3 points) why are loan tynically canned at 60% the value of the house? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started