Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Geoftrey Corporation is owned 80% by Zylog Corporation and 20% by Ron Gillett, a Geoffrey employee. A prequidation bolance sheot for Goofrey is

Question 5

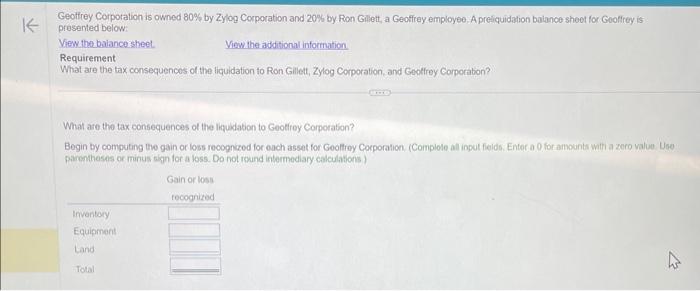

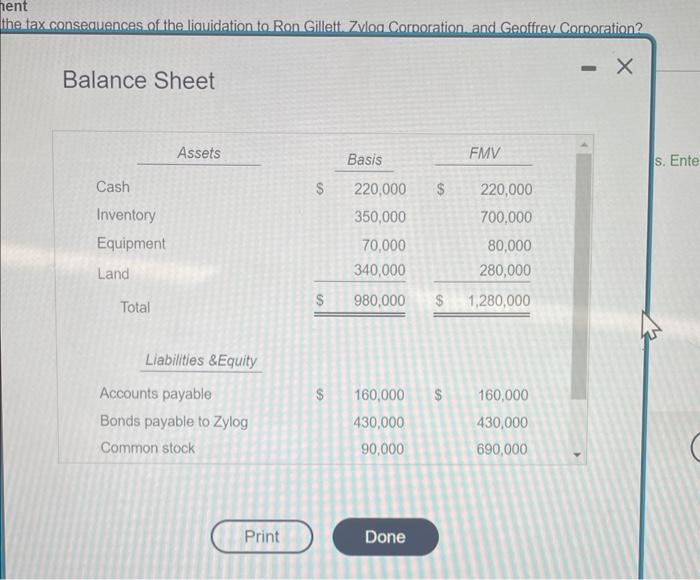

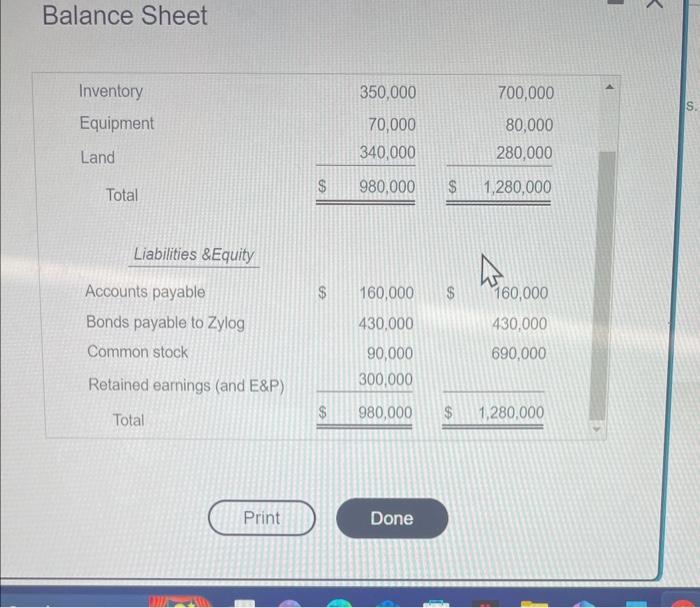

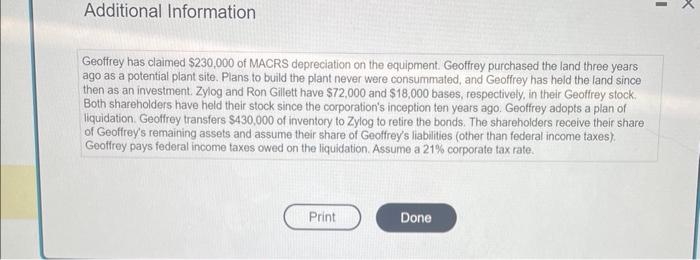

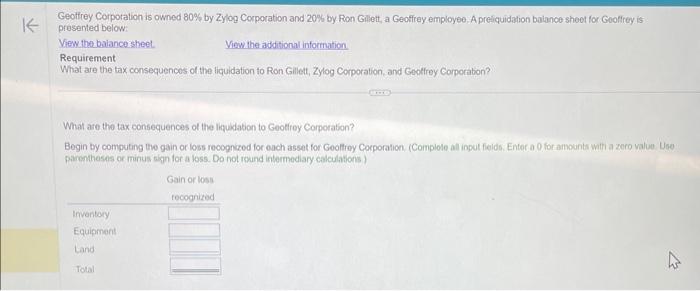

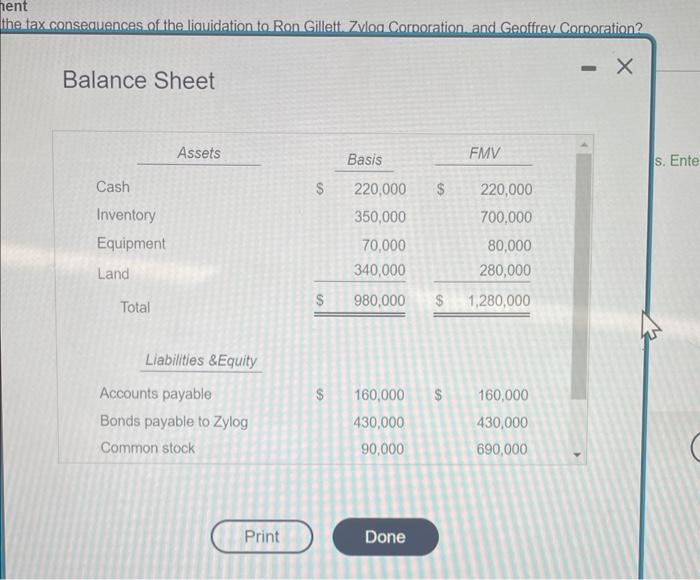

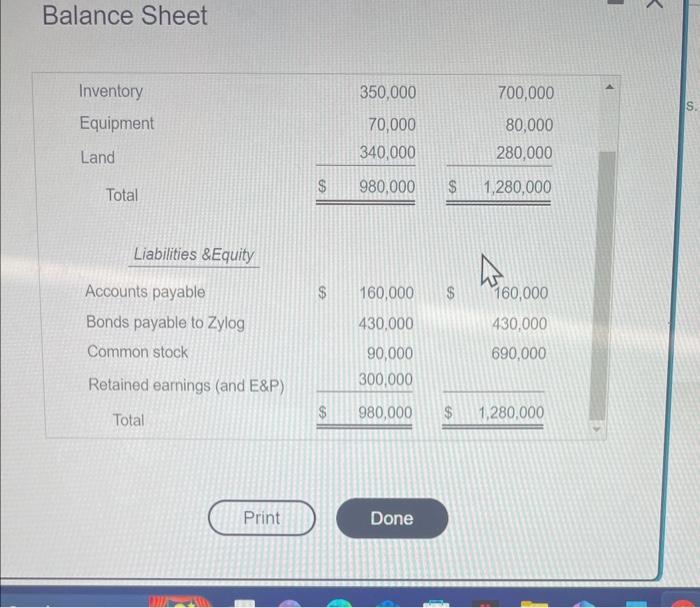

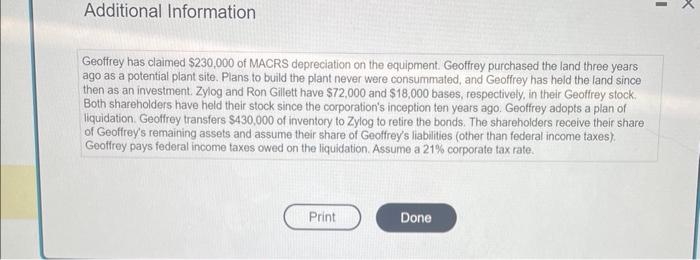

Geoftrey Corporation is owned 80% by Zylog Corporation and 20% by Ron Gillett, a Geoffrey employee. A prequidation bolance sheot for Goofrey is presented below: View the baiancesheel. View the additional information Requirement What are the tax consequences of the liquidation to Ron Gillett, Zylog Corporation, and Geotley Corporation? What are the tax consequences of the lifuidation to Geotirey Corporation? Begin by computing the gain or loss recognczed for ouch asset for Geoltroy Corporation. (Complole all input fielde. Entor a 0 for announts witi a zoro value. Use parentheses or minus sign for a loss. Do not rownd intermediary calculations ) tax conseguences of the liquidation to Ron Gillett. Zvlo . Corporation and Geoffrev Corooration? Balance Sheet Balance Sheet Additional Information Geoffrey has claimed $230,000 of MACRS depreciation on the equipment. Geoffrey purchased the land three years ago as a potential plant site. Plans to build the plant never were consummated, and Geoffey has held the land since then as an investment. Zylog and Ron Gillett have $72,000 and $18,000 bases, respectively, in their Geoffrey stock. Both shareholders have held their stock since the corporation's inception ten years ago. Geoffrey adopts a plan of liquidation. Geoffrey transfers $430,000 of inventory to Zylog to retire the bonds. The shareholders receive their share of Geoffrey's remaining assets and assume their share of Geoffrey's liabilities (other than federal income taxes): Geoffrey pays federal income taxes owed on the liquidation. Assume a 21% corporate tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started