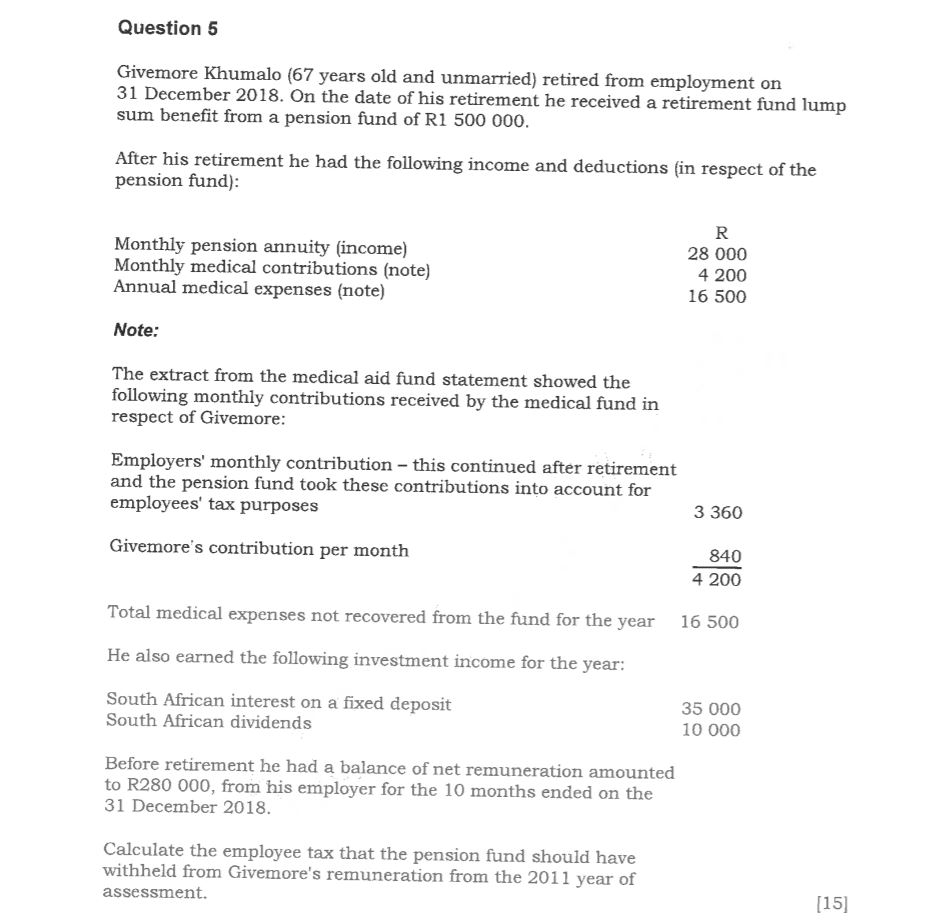

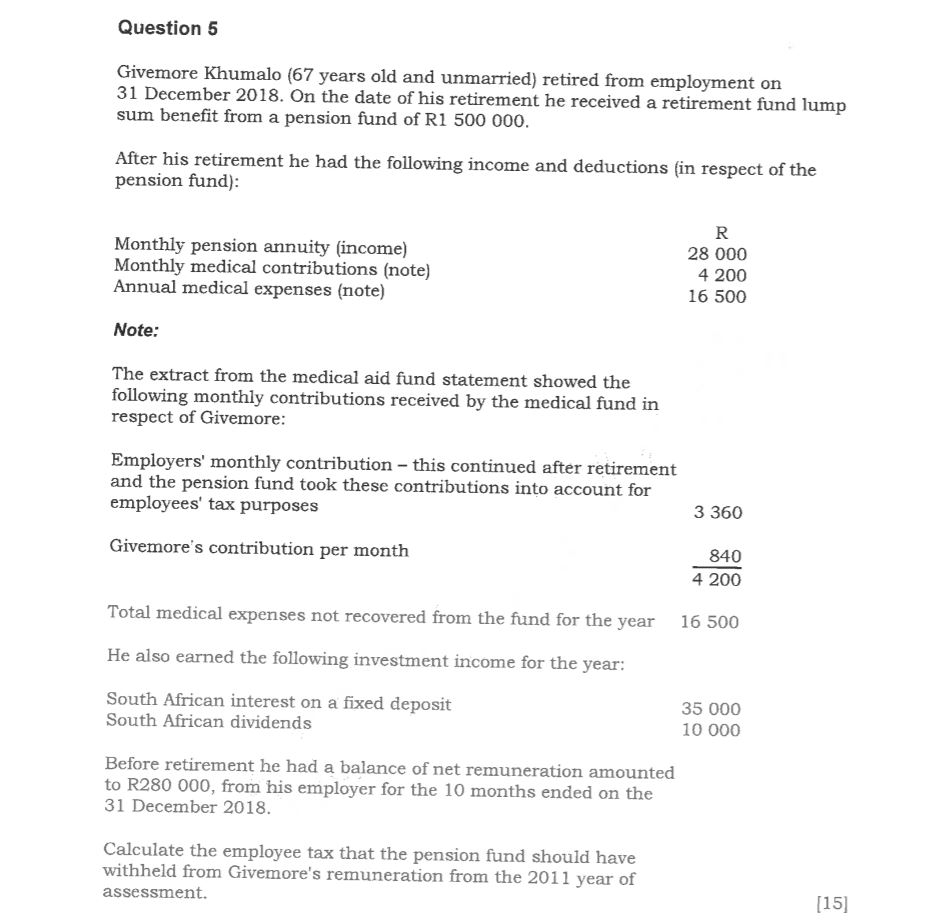

Question 5 Givemore Khumalo (67 years old and unmarried) retired from employment on 31 December 2018. On the date of his retirement he received a retirement fund lump sum benefit from a pension fund of R1 500 000. After his retirement he had the following income and deductions in respect of the pension fund): Monthly pension annuity (income) Monthly medical contributions (note) Annual medical expenses (note) 28 000 4 200 16 500 Note: The extract from the medical aid fund statement showed the following monthly contributions received by the medical fund in respect of Givemore: Employers' monthly contribution - this continued after retirement and the pension fund took these contributions into account for employees' tax purposes 3360 Givemore's contribution per month 840 4 200 Total medical expenses not recovered from the fund for the year 16 500 He also earned the following investment income for the year: South African interest on a fixed deposit South African dividends 35 000 10 000 Before retirement he had a balance of net remuneration amounted to R280 000, from his employer for the 10 months ended on the 31 December 2018. Calculate the employee tax that the pension fund should have withheld from Givemore's remuneration from the 2011 year of assessment. [15] Question 5 Givemore Khumalo (67 years old and unmarried) retired from employment on 31 December 2018. On the date of his retirement he received a retirement fund lump sum benefit from a pension fund of R1 500 000. After his retirement he had the following income and deductions in respect of the pension fund): Monthly pension annuity (income) Monthly medical contributions (note) Annual medical expenses (note) 28 000 4 200 16 500 Note: The extract from the medical aid fund statement showed the following monthly contributions received by the medical fund in respect of Givemore: Employers' monthly contribution - this continued after retirement and the pension fund took these contributions into account for employees' tax purposes 3360 Givemore's contribution per month 840 4 200 Total medical expenses not recovered from the fund for the year 16 500 He also earned the following investment income for the year: South African interest on a fixed deposit South African dividends 35 000 10 000 Before retirement he had a balance of net remuneration amounted to R280 000, from his employer for the 10 months ended on the 31 December 2018. Calculate the employee tax that the pension fund should have withheld from Givemore's remuneration from the 2011 year of assessment. [15]