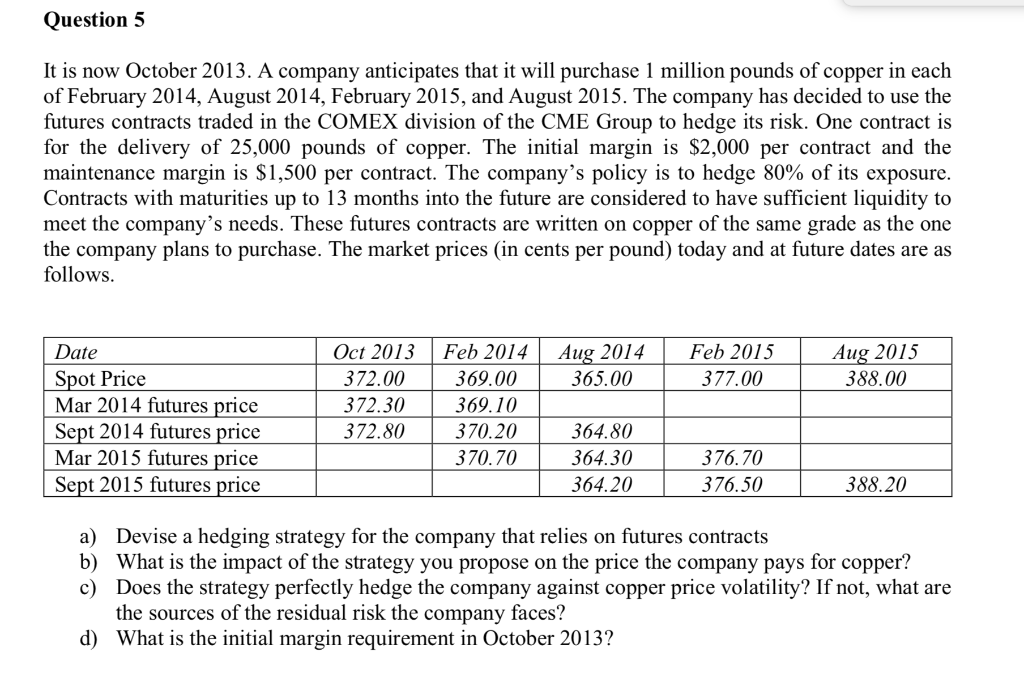

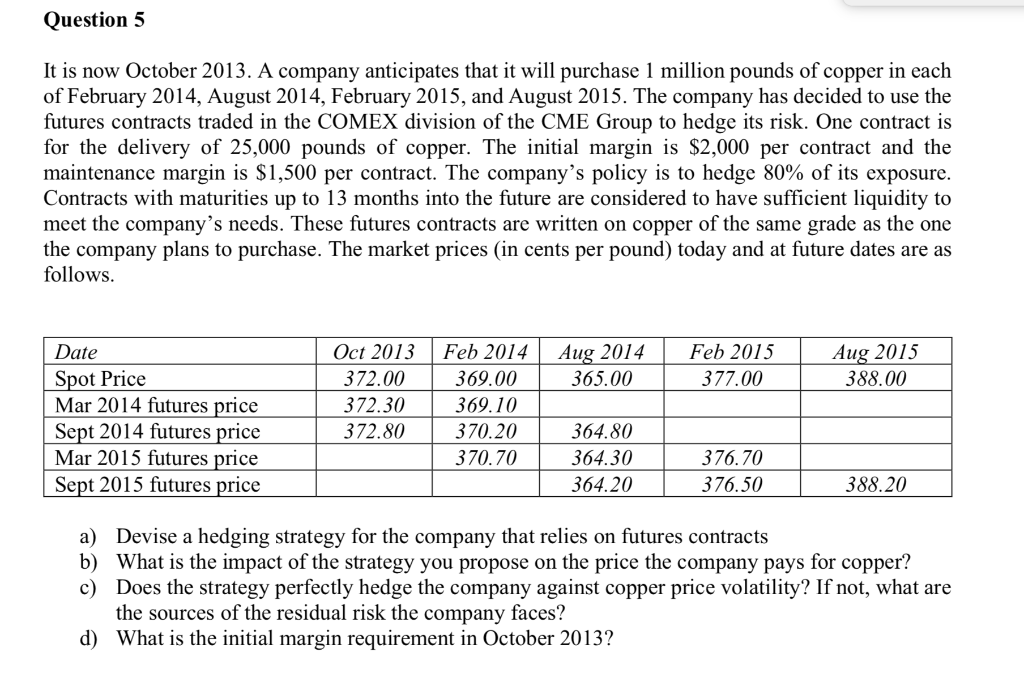

Question 5 It is now October 2013. A company anticipates that it will purchase 1 million pounds of copper in each of February 2014, August 2014, February 2015, and August 2015. The company has decided to use the futures contracts traded in the COMEX division of the CME Group to hedge its risk. One contract is for the delivery of 25,000 pounds of copper. The initial margin is $2,000 per contract and the maintenance margin is $1,500 per contract. The company's policy is to hedge 80% of its exposure. Contracts with maturities up to 13 months into the future are considered to have sufficient liquidity to meet the company's needs. These futures contracts are written on copper of the same grade as the one the company plans to purchase. The market prices (in cents per pound) today and at future dates are as follows. Aug 2014 365.00 Feb 2015 377.00 Aug 2015 388.00 Date Spot Price Mar 2014 futures price Sept 2014 futures price Mar 2015 futures price Sept 2015 futures price Oct 2013 372.00 372.30 372.80 Feb 2014 369.00 369.10 370.20 370.70 364.80 364.30 364.20 376.70 376.50 388.20 a) Devise a hedging strategy for the company that relies on futures contracts b) What is the impact of the strategy you propose on the price the company pays for copper? c) Does the strategy perfectly hedge the company against copper price volatility? If not, what are the sources of the residual risk the company faces? d) What is the initial margin requirement in October 2013? Question 5 It is now October 2013. A company anticipates that it will purchase 1 million pounds of copper in each of February 2014, August 2014, February 2015, and August 2015. The company has decided to use the futures contracts traded in the COMEX division of the CME Group to hedge its risk. One contract is for the delivery of 25,000 pounds of copper. The initial margin is $2,000 per contract and the maintenance margin is $1,500 per contract. The company's policy is to hedge 80% of its exposure. Contracts with maturities up to 13 months into the future are considered to have sufficient liquidity to meet the company's needs. These futures contracts are written on copper of the same grade as the one the company plans to purchase. The market prices (in cents per pound) today and at future dates are as follows. Aug 2014 365.00 Feb 2015 377.00 Aug 2015 388.00 Date Spot Price Mar 2014 futures price Sept 2014 futures price Mar 2015 futures price Sept 2015 futures price Oct 2013 372.00 372.30 372.80 Feb 2014 369.00 369.10 370.20 370.70 364.80 364.30 364.20 376.70 376.50 388.20 a) Devise a hedging strategy for the company that relies on futures contracts b) What is the impact of the strategy you propose on the price the company pays for copper? c) Does the strategy perfectly hedge the company against copper price volatility? If not, what are the sources of the residual risk the company faces? d) What is the initial margin requirement in October 2013