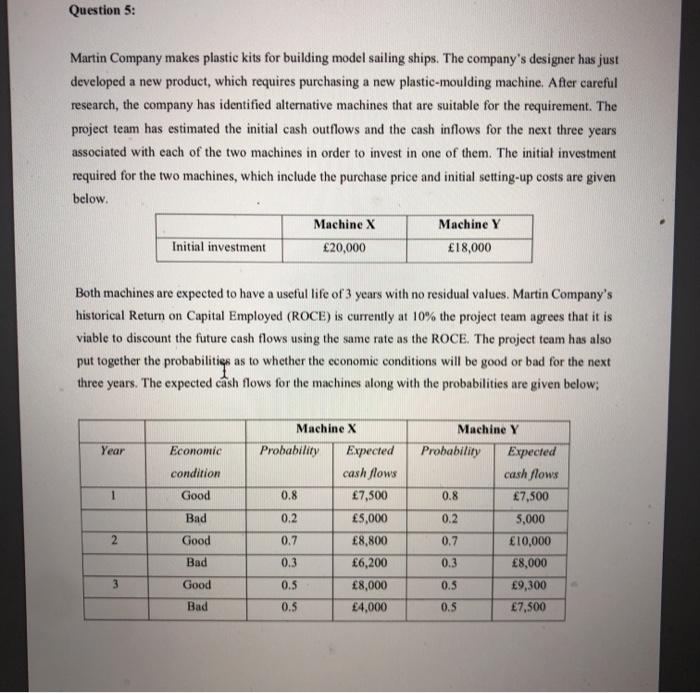

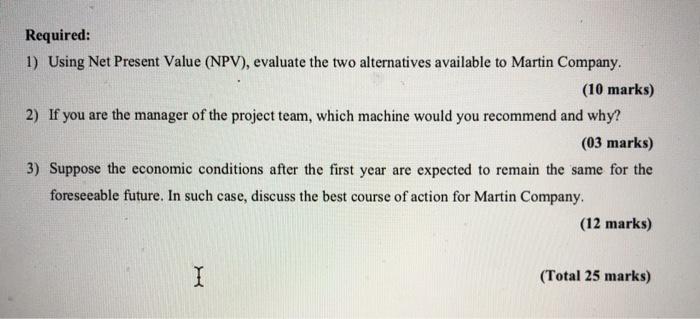

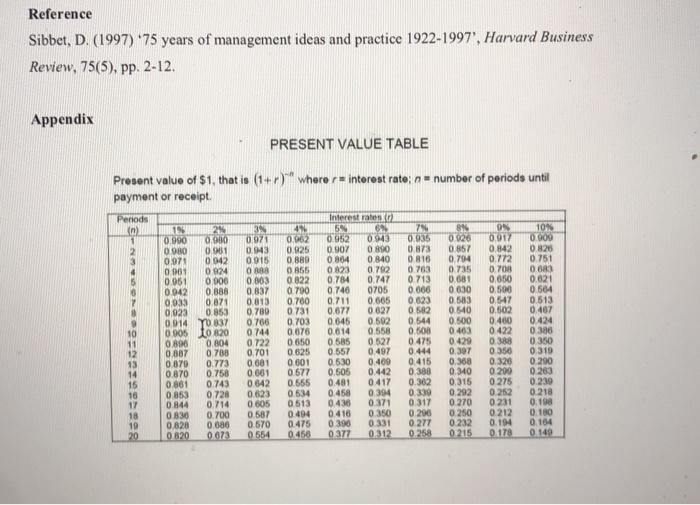

Question 5: Martin Company makes plastic kits for building model sailing ships. The company's designer has just developed a new product, which requires purchasing a new plastic-moulding machine. After careful research, the company has identified alternative machines that are suitable for the requirement. The project team has estimated the initial cash outflows and the cash inflows for the next three years associated with each of the two machines in order to invest in one of them. The initial investment required for the two machines, which include the purchase price and initial setting-up costs are given below. Machine X Machine Y Initial investment 20,000 18,000 Both machines are expected to have a useful life of 3 years with no residual values. Martin Company's historical Return on Capital Employed (ROCE) is currently at 10% the project team agrees that it is viable to discount the future cash flows using the same rate as the ROCE. The project team has also put together the probabilities as to whether the conomic conditions will be good or bad for the next three years. The expected cash flows for the machines along with the probabilities are given below; Year Economic condition Good 1 Bad Machine X Probability Expected cash flows 0.8 7,500 0.2 5,000 8.800 0.3 6,200 0.5 8,000 0.5 4,000 Machine Y Probability Expected cash flows 0.8 7,500 0.2 5,000 0.7 10,000 0.3 8,000 0.5 9,300 0.5 7,500 2 Good 0.7 Bad 3 Good Bad Required: 1) Using Net Present Value (NPV), evaluate the two alternatives available to Martin Company. (10 marks) 2) If you are the manager of the project team, which machine would you recommend and why? (03 marks) 3) Suppose the economic conditions after the first year are expected to remain the same for the foreseeable future. In such case, discuss the best course of action for Martin Company. (12 marks) I (Total 25 marks) Reference Sibbet, D. (1997) *75 years of management ideas and practice 1922-1997', Harvard Business Review, 75(5), pp. 2-12. Appendix PRESENT VALUE TABLE Present value of $1. that is (1+r)" where r- interest rate; n = number of periods until payment or receipt. Periods n 2 89 0 926 0.857 0.794 0.735 0.681 0.630 19 28 0.990 OXO 0980 0.96 0.97 0.042 0001 0924 0.051 0.000 0.042 0.888 0.033 0.071 0.023 0.853 0.914 70 837 090510 620 0.896 0.804 0.007 0708 0879 0.773 0.870 0.758 0.861 0.743 0.853 0.728 0.844 0.714 0830 0.700 0828 0.000 0.820 0073 3% 0971 0.943 0915 OR 0.803 0837 0.813 0780 0.766 0744 0.722 0.701 0.081 0.001 0842 0.623 0605 0.587 0.670 0554 41 0.262 0.825 0880 0855 0.822 0.700 0.700 0731 0.703 0.676 0650 0.625 0.001 0677 0.566 0534 0.513 0.494 0.475 0456 Interest rates 2 5 BA 6952 0943 0.907 0890 0 804 0.840 023 0.792 0.784 0.747 0.740 0705 0.711 0.665 0.677 0.627 0.645 0502 0.614 0.558 0585 0 527 0557 0.497 0.630 0409 0.605 0.442 0.481 0417 0.458 0.394 0436 0371 0418 0 350 0390 0 331 0377 0.312 7 0.035 0.873 0.816 0.763 0.713 0.006 0.623 0.582 0.544 0 500 0.475 0.444 0.415 0.388 0.362 0.330 0.317 0 200 0.277 0.258 ON 0.917 0842 0.772 0.700 0.650 0.500 0.547 0.502 0.400 0.422 0.388 0.350 0.326 0 290 0275 0.252 0.231 0.212 0.1944 0.178 10% 0.900 0826 0.751 0.83 0.621 0.564 0.513 0.407 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.104 0.149 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 11 13 14 15 10 17 18 19 20