Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 5 Mr Djanluo has been a customer of your branch for just two years. He is married with two young children who are not

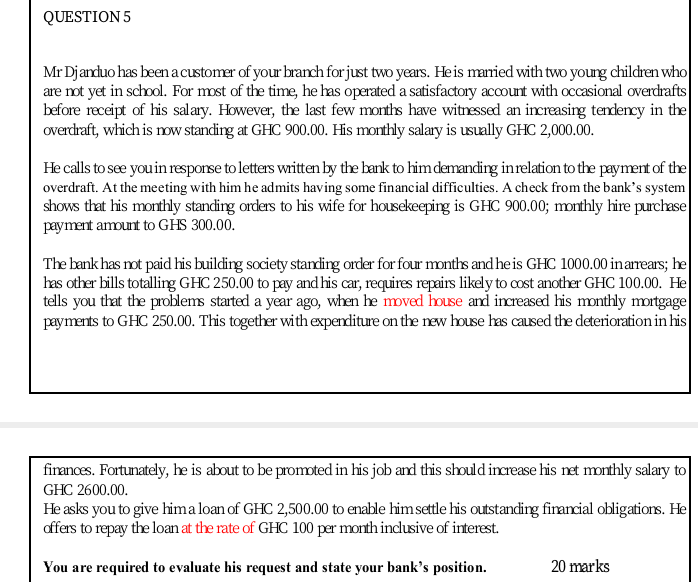

QUESTION 5 Mr Djanluo has been a customer of your branch for just two years. He is married with two young children who are not yet in school. For most of the time, he has operated a satisfactory account with occasional overdrafts before receipt of his salary. However, the last few months have witnessed an increasing tendency in the overdraft, which is now standing at GHC 900.00. His monthly salary is usually GHC 2,000.00. He calls to see you in response to letters written by the bank to him demanding in relation to the payment of the overdraft. At the meeting with him he admits having some financial difficulties. A check from the bank's system shows that his monthly standing orders to his wife for housekeeping is GHC 900.00; monthly hire purchase payment amount to GHS 300.00. The bank has not paid his building society standing order for four months and he is GHC 1000.00 in arrears; he has other bills totalling GHC 250.00 to pay and his car, requires repairs likely to cost another GHC 100.00. He tells you that the problems started a year ago, when he moved house and increased his monthly mortgage payments to GHC 250.00. This together with expenditure on the new house has caused the deterioration in his finances. Fortunately, he is about to be promoted in his job and this should increase his net monthly salary to GHC 2600.00 He asks you to give him a loan of GHC 2,500.00 to enable him settle his outstanding financial obligations. He offers to repay the loan at the rate of GHC 100 per month inclusive of interest. You are required to evaluate his request and state your bank's position. 20 marks QUESTION 5 Mr Djanluo has been a customer of your branch for just two years. He is married with two young children who are not yet in school. For most of the time, he has operated a satisfactory account with occasional overdrafts before receipt of his salary. However, the last few months have witnessed an increasing tendency in the overdraft, which is now standing at GHC 900.00. His monthly salary is usually GHC 2,000.00. He calls to see you in response to letters written by the bank to him demanding in relation to the payment of the overdraft. At the meeting with him he admits having some financial difficulties. A check from the bank's system shows that his monthly standing orders to his wife for housekeeping is GHC 900.00; monthly hire purchase payment amount to GHS 300.00. The bank has not paid his building society standing order for four months and he is GHC 1000.00 in arrears; he has other bills totalling GHC 250.00 to pay and his car, requires repairs likely to cost another GHC 100.00. He tells you that the problems started a year ago, when he moved house and increased his monthly mortgage payments to GHC 250.00. This together with expenditure on the new house has caused the deterioration in his finances. Fortunately, he is about to be promoted in his job and this should increase his net monthly salary to GHC 2600.00 He asks you to give him a loan of GHC 2,500.00 to enable him settle his outstanding financial obligations. He offers to repay the loan at the rate of GHC 100 per month inclusive of interest. You are required to evaluate his request and state your bank's position. 20 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started