Answered step by step

Verified Expert Solution

Question

1 Approved Answer

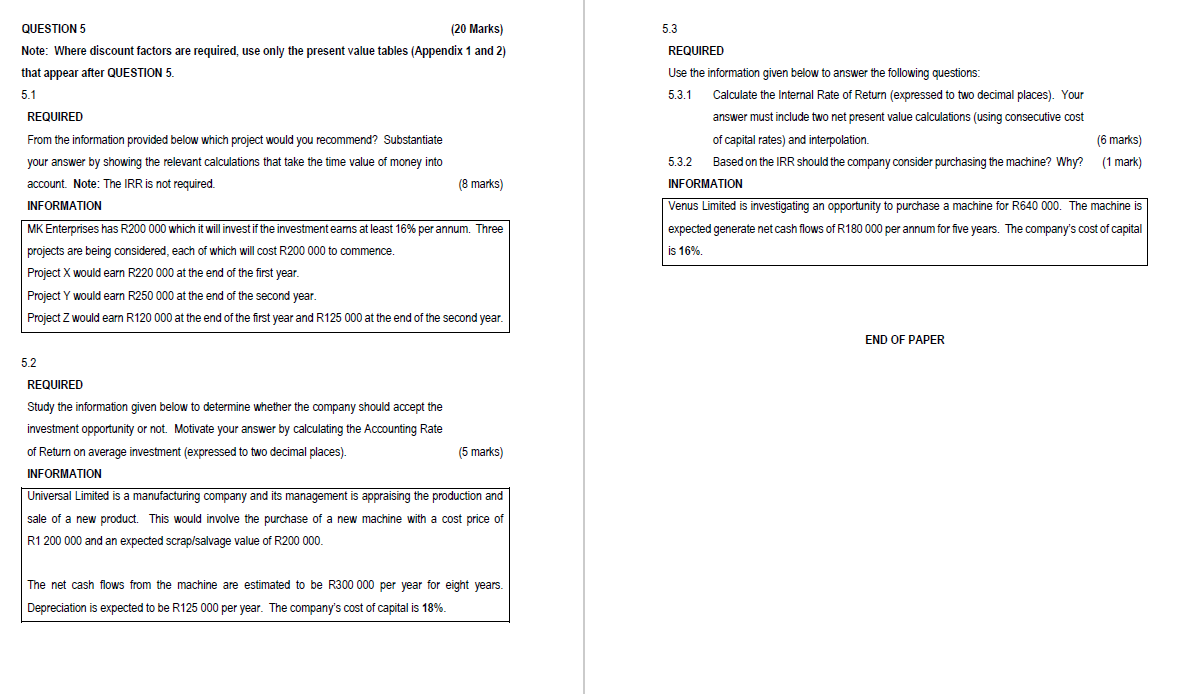

QUESTION 5 Note: Where discount factors are required, use only the present value tables ( Appendix 1 and 2 ) that appear after QUESTION 5

QUESTION

Note: Where discount factors are required, use only the present value tables Appendix and

that appear after QUESTION

REQUIRED

From the information provided below which project would you recommend? Substantiate

your answer by showing the relevant calculations that take the time value of money into

account. Note: The IRR is not required.

INFORMATION

MK Enterprises has R which it will invest if the investment earns at least per annum. Three

projects are being considered, each of which will cost R to commence.

Project would earn R at the end of the first year.

Project would earn R at the end of the second year.

Project would earn R at the end of the first year and R at the end of the second year.

REQUIRED

Study the information given below to determine whether the company should accept the

investment opportunity or not. Motivate your answer by calculating the Accounting Rate

of Return on average investment expressed to two decimal places

INFORMATION

Universal Limited is a manufacturing company and its management is appraising the production and

sale of a new product. This would involve the purchase of a new machine with a cost price of

R and an expected scrapsalvage value of R

The net cash flows from the machine are estimated to be R per year for eight years.

Depreciation is expected to be R per year. The company's cost of capital is

REQUIRED

Use the information given below to answer the following questions:

Calculate the Internal Rate of Return expressed to two decimal places Your

answer must include two net present value calculations using consecutive cost

of capital rates and interpolation.

Based on the IRR should the company consider purchasing the machine? Why?

INFORMATION

Venus Limited is investigating an opportunity to purchase a machine for R The machine is

expected generate net cash flows of per annum for five years. The company's cost of capital

is

END OF PAPER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started