Answered step by step

Verified Expert Solution

Question

1 Approved Answer

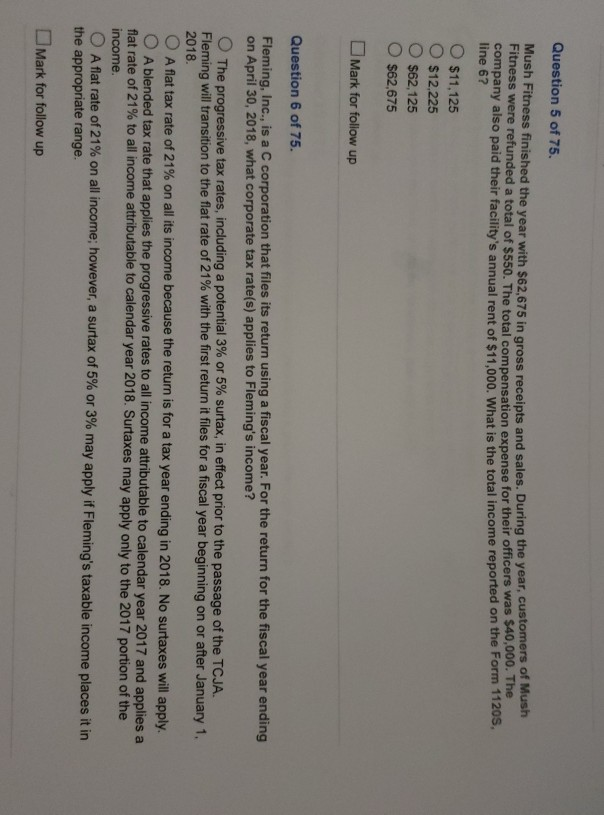

Question 5 of 75. Mush Fitness finished the year with $62,675 in gross receipts and sales. During the year, customers of Mush Fitness were refunded

Question 5 of 75. Mush Fitness finished the year with $62,675 in gross receipts and sales. During the year, customers of Mush Fitness were refunded a total of $550. The total compensation expense for their officers was $40,000. The company also paid their facility's annual rent of $11.000. What is the total income reported on the Form 11205, line 6? $11,125 $12,225 $62,125 $62,675 Mark for follow up Question 6 of 75. Fleming, Inc., is a C corporation that files its return using a fiscal year. For the return for the fiscal year ending on April 30, 2018, what corporate tax rate(s) applies to Fleming's income? The progressive tax rates, including a potential 3 % or 5 % surtax, in effect prior to the passage of the TCJA. Fleming will transition to the flat rate of 21% with the first return it files for a fiscal year beginning on or after January 1, 2018 A flat tax rate of 21% on all its income because the return is for a tax year ending in 2018. No surtaxes will apply. OA blended tax rate that applies the progressive rates to all income attributable to calendar year 2017 and applies a flat rate of 21% to all income attributable to calendar year 2018. Surtaxes may apply only to the 2017 portion of the income. OA flat rate of 21% on all income; however, a surtax of 5 % or 3% may apply if Fleming's taxable income places it in the appropriate range. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started