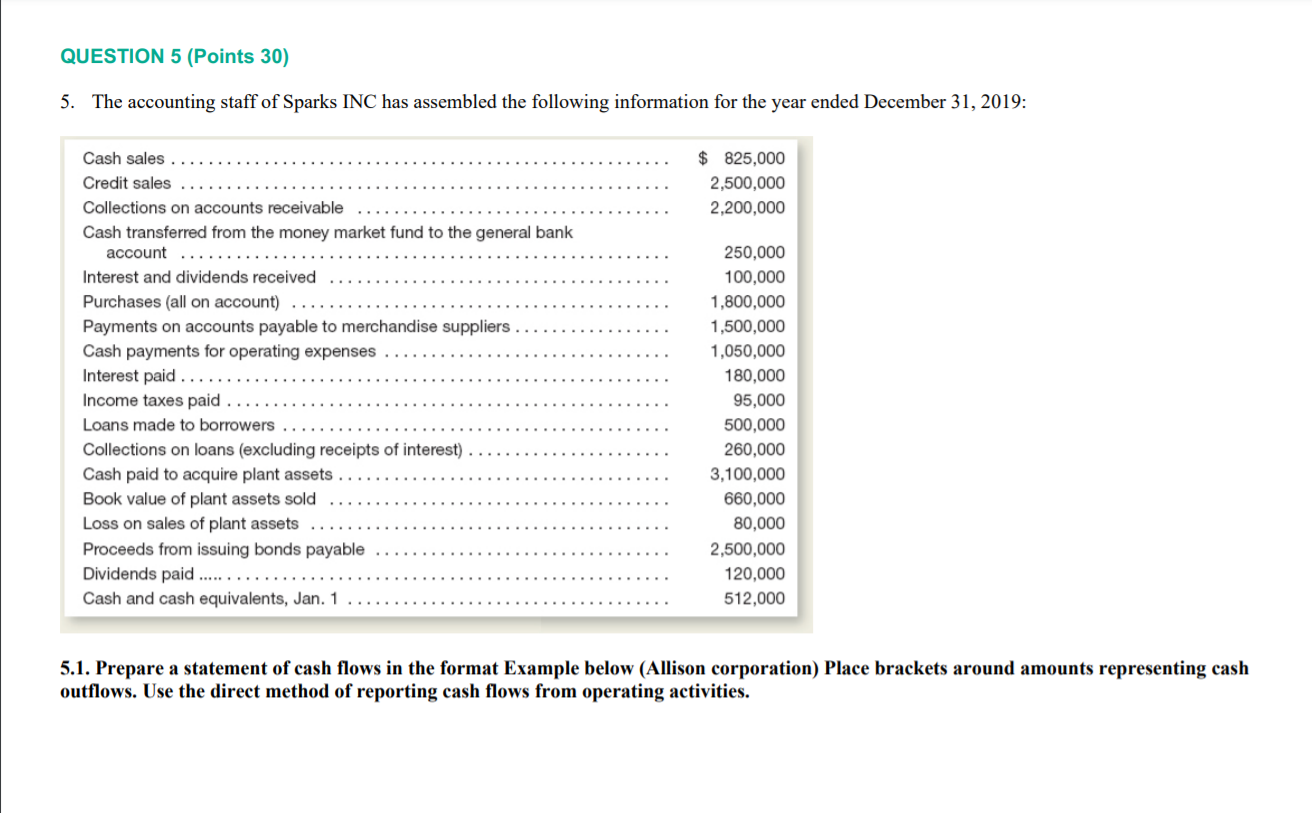

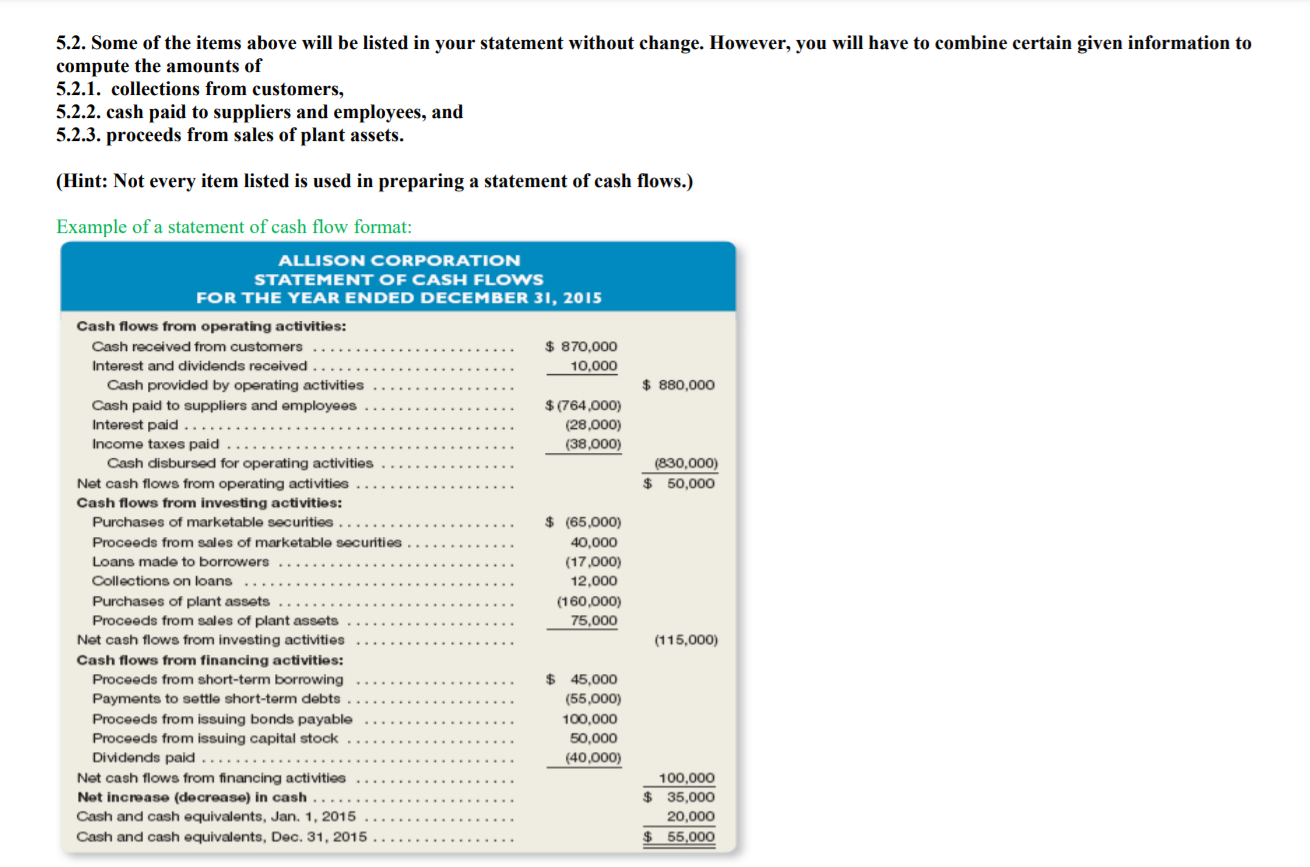

QUESTION 5 (Points 30) 5. The accounting staff of Sparks INC has assembled the following information for the year ended December 31, 2019: $ 825,000 2,500,000 2,200,000 Cash sales Credit sales Collections on accounts receivable Cash transferred from the money market fund to the general bank account Interest and dividends received Purchases (all on account) Payments on accounts payable to merchandise suppliers Cash payments for operating expenses Interest paid .. Income taxes paid Loans made to borrowers Collections on loans (excluding receipts of interest) Cash paid to acquire plant assets Book value of plant assets sold Loss on sales of plant assets Proceeds from issuing bonds payable Dividends paid ...... Cash and cash equivalents, Jan. 1 250,000 100,000 1,800,000 1,500,000 1,050,000 180,000 95,000 500,000 260,000 3,100,000 660,000 80,000 2,500,000 120,000 512,000 5.1. Prepare a statement of cash flows in the format Example below (Allison corporation) Place brackets around amounts representing cash outflows. Use the direct method of reporting cash flows from operating activities. 5.2. Some of the items above will be listed in your statement without change. However, you will have to combine certain given information to compute the amounts of 5.2.1. collections from customers, 5.2.2. cash paid to suppliers and employees, and 5.2.3. proceeds from sales of plant assets. (Hint: Not every item listed is used in preparing a statement of cash flows.) Example of a statement of cash flow format: $ 880,000 (830,000) $ 50,000 ALLISON CORPORATION STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2015 Cash flows from operating activities: Cash received from customers $ 870,000 Interest and dividends received 10.000 Cash provided by operating activities Cash paid to suppliers and employees $(764,000) Interest paid ... (28,000) Income taxes paid (38,000) Cash disbursed for operating activities Net cash flows from operating activities Cash flows from investing activities: Purchases of marketable securities $ (65,000) Proceeds from sales of marketable securities 40,000 Loans made to borrowers (17,000) Collections on loans 12.000 Purchases of plant assets (160,000) Proceeds from sales of plant assets 75,000 Net cash flows from investing activities Cash flows from financing activities: Proceeds from short-term borrowing $ 45,000 Payments to settle short-term debts (55,000) Proceeds from issuing bonds payable 100,000 Proceeds from issuing capital stock 50,000 Dividends paid .. (40,000) Net cash flows from financing activities Net increase (decrease) in cash Cash and cash equivalents, Jan. 1, 2015 Cash and cash equivalents, Dec. 31, 2015 (115,000) 100,000 $ 35,000 20.000 $ 55,000