Question

Question 5: Preparing a Statement of Cash Flows (Indirect Method) The following financial statements were issued by Hoskins Corporation for the fiscal year ended December

Question 5:

Preparing a Statement of Cash Flows (Indirect Method)

The following financial statements were issued by Hoskins Corporation for the fiscal year ended December 31, 2016. All amounts are in millions of U.S. dollars.

| Balance Sheets | |||

|---|---|---|---|

| December 31, 2015 | December 31, 2016 | ||

| Assets | |||

| Cash | $900 | $1,650 | |

| Accounts Receivable | 1,800 | 4,500 | |

| Inventory | 1,200 | 1,500 | |

| Prepaid Expenses | 1,200 | 450 | |

| Current Assets | 5,100 | 8,100 | |

| Property, Plant and Equipment at Cost | 18,600 | 18,300 | |

| Less Accumulated Depreciation | (6,300) | (5,250) | |

| Property, Plant and Equipment, Net | 12,300 | 13,050 | |

| Total Assets | $17,400 | $21,150 | |

| Liabilities and Shareholders Equity | |||

| Accounts Payable | $1,200 | $2,400 | |

| Income Tax Payable | 600 | 300 | |

| Short-Term Debt | 3,600 | 8,100 | |

| Current Liabilities | 5,400 | 10,800 | |

| Long-Term Debt | 3,000 | 0 | |

| Total Liabilities | 8,400 | 10,800 | |

| Contributed Capital | 2,400 | 2,400 | |

| Retained Earnings | 6,600 | 7,950 | |

| Total Shareholders Equity | 9,000 | 10,350 | |

| Total Liabilities and Shareholders Equity | $17,400 | $21,150 | |

| Income Statement | |||

|---|---|---|---|

| Fiscal year 2016 | |||

| Sales Revenues | $19,500 | ||

| Cost of Goods Sold | 10,200 | ||

| Gross Profit | 9,300 | ||

| Selling, General and Administrative Expenses | 4,350 | ||

| Depreciation Expense | 1,050 | ||

| Operating Income | 3,900 | ||

| Interest Expense | 1,050 | ||

| Income Before Income Tax Expense | 2,850 | ||

| Income Tax Expense | 750 | ||

| Net Income | $2,100 | ||

Additional information: 1. During fiscal year 2016, Hoskins Corporation acquired new equipment for $3,600 in cash. In addition, the company disposed of used equipment that had original cost of $3,900 and accumulated depreciation of $2,100, receiving $1,800 in cash from the buyer. 2. During fiscal year 2016, Hoskins Corporation arranged short-term bank financing and borrowed $4,500, using a portion of the cash to repay all of its outstanding long-term debt. 3. During fiscal year 2016, Hoskins Corporation engaged in no transactions involving its common stock, though it did declare and pay in cash a common stock dividend of $750.

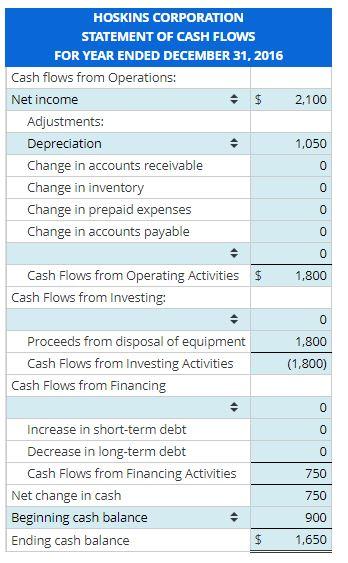

Prepare a statement of cash flows (all three sections) for Hoskins Corporations fiscal year 2016, using the indirect method for the cash from operations section.

Note: Use a negative sign with your answer to indicate a reduction in cash/cash outflow.

Please answer in same format as given photo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started