Answered step by step

Verified Expert Solution

Question

1 Approved Answer

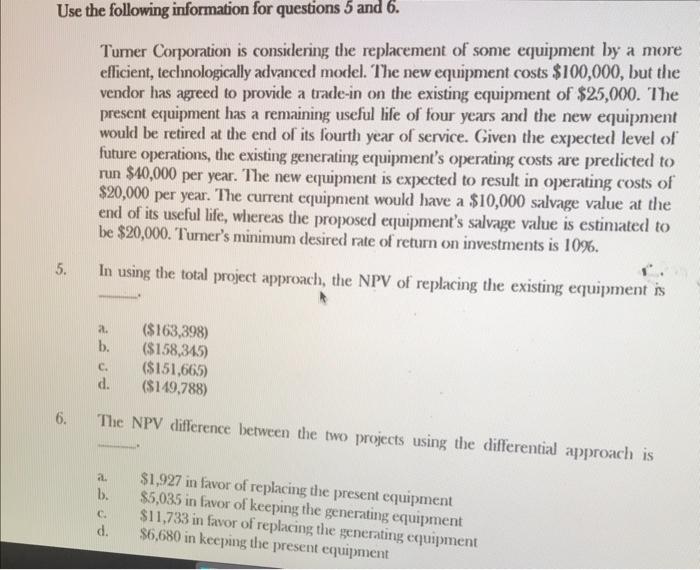

question 5. question 6. Tumer Corporation is considering the replacement of some equipment by a more efficient, technologically advanced model. The new equipment costs $100,000,

question 5.

Tumer Corporation is considering the replacement of some equipment by a more efficient, technologically advanced model. The new equipment costs $100,000, but the vendor has agreed to provide a trade-in on the existing equipment of $25,000. The present equipment has a remaining useful life of four years and the new equipment would be retired at the end of its fourth year of service. Given the expected level of future operations, the existing generating equipment's operating costs are predicted to run $10,000 per year. The new equipment is expected to result in operating costs of $20,000 per year. The current equipment would have a $10,000 salvage value at the end of its useful life, whereas the proposed equipment's salvage value is estimated to be $20,000. Turner's minimum desired rate of return on investments is 1096 . 5. In using the total project approach, the NPV of replacing the existing equipment is a. ($163,398) b. ($158,345) c. ($151,665) d. ($149,788) 6. The NPV difference between the two projects using the differential approach is a. \$1,927 in favor of replacing the present equipment b. $5,035 in favor of keeping the generating equipment c. \$11,733 in favor of replacing the generating equipment d. $6,680 in keeping the present equipment question 6.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started